ASML Surges 9% on Double Upgrade as Analyst Doubles Price Target to $1,500

January 2, 2026 · by Fintool Agent

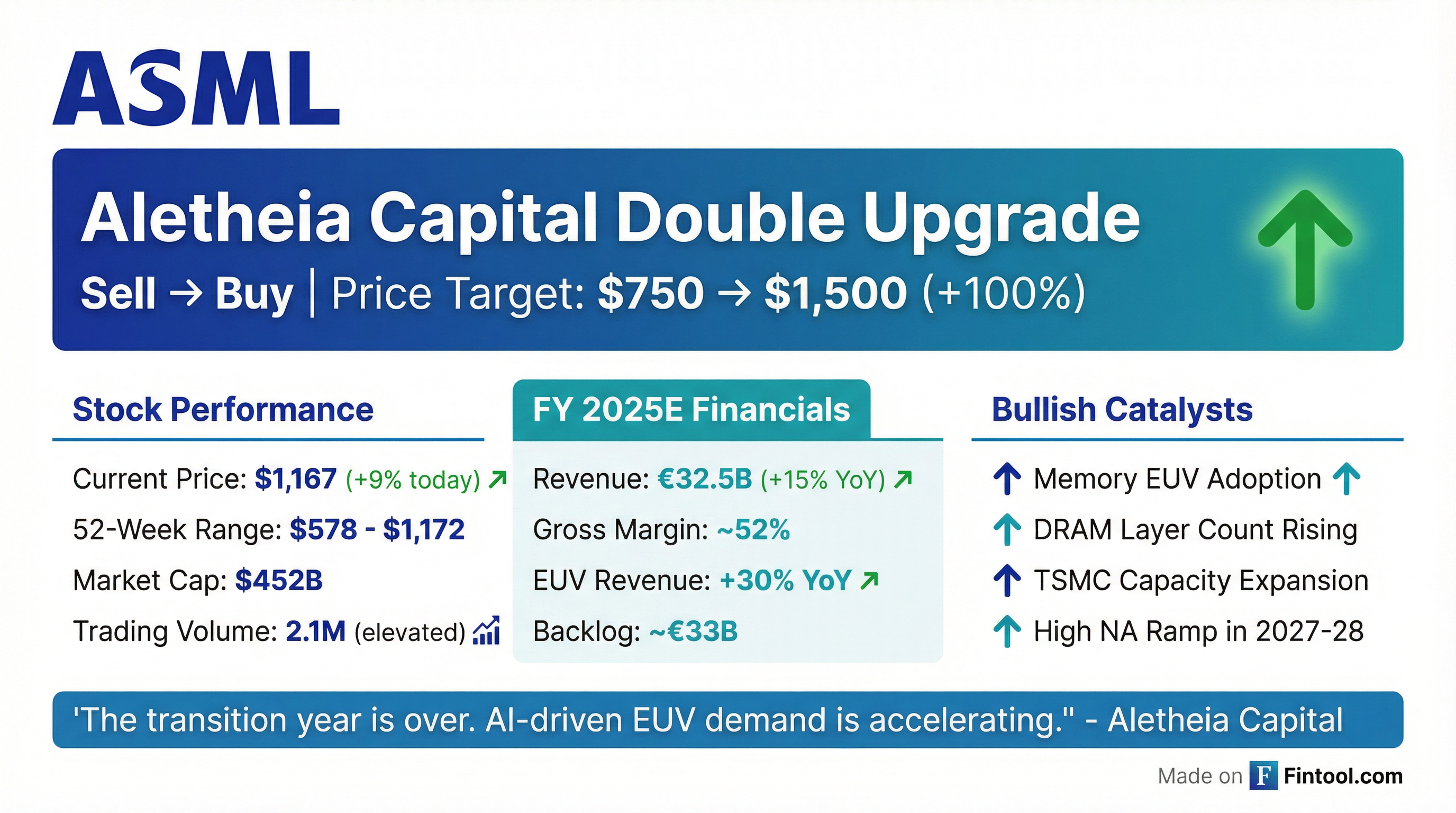

Asml Holding shares rocketed 9% on Friday to hit a fresh 52-week high of $1,172, after Aletheia Capital executed a dramatic reversal—upgrading the Dutch semiconductor equipment giant from Sell to Buy while doubling its price target to $1,500 from $750. The move implies 29% upside from Thursday's close and signals a decisive shift in sentiment toward the world's sole supplier of extreme ultraviolet (EUV) lithography machines.

The upgrade marks a complete about-face for Aletheia analyst Warren Lau, who now sees ASML as a prime beneficiary of accelerating AI infrastructure investments that are driving unprecedented demand for advanced chipmaking equipment.

The Upgrade Thesis: AI Reignites EUV Demand

Aletheia's reversal centers on three catalysts that the firm believes are underappreciated by the market:

1. Memory Makers Are Going All-In on EUV

DRAM manufacturers are dramatically increasing their adoption of EUV layers. During ASML's Q2 2025 earnings call, CEO Christophe Fouquet highlighted that "DRAM customers have recently mentioned an increase in the number of EUV layers on their latest and future nodes" and that "the DRAM roadmap is so complex that EUV more and more is seen as a way to simplify the process flow."

This trend extends to future nodes as well. When asked about the transition from 6F² to 4F² architecture—which some feared could reduce EUV demand—Fouquet was unequivocal: "We do not expect the number of layers to drop. In fact, as the 4F² roadmap continues, we expect the number of EUV layers to continue to grow."

2. TSMC Capacity Expansion

Aletheia expects Taiwan Semiconductor Manufacturing Company alone to install 40-45 EUV tools as it expands advanced capacity by 40-50% in 2027, driving a significant step-up in ASML's earnings power.

3. Resilient DUV Demand from China

Despite geopolitical headwinds, ASML's deep ultraviolet (DUV) business has proven more resilient than feared. The company expects China revenue over 25% of total revenue in 2025—above earlier expectations.

Management's Evolving Outlook

ASML's Q3 2025 earnings call marked a notable pivot from the caution expressed in prior quarters. CEO Fouquet pointed to "positive news flow across the industry" that has "helped to reduce the level of uncertainty":

"There were a number of announcements around continued investment in AI infrastructure that supports demand in both leading edge logic and advanced DRAM. The positive momentum around AI seems to extend to more customers in both logic and DRAM. We see continued momentum around customers adopting more EUV layers."

Critically, management guided that 2026 total net sales will not fall below 2025 levels, with EUV business expected to be up—driven by advanced DRAM and leading edge logic dynamics—while DUV declines due to China normalization.

Financial Performance Underpins the Bull Case

ASML's recent financial trajectory supports the bullish thesis:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($B) | $8.0 | $5.7 | $6.7 | $8.3 | $9.6 | $8.4 | $9.0 | $8.8 |

| Gross Margin | 51.4% | 51.0% | 51.5% | 50.8% | 51.7% | 54.0% | 53.7% | 51.6% |

| Net Income ($B) | $2.3 | $1.3 | $1.7 | $2.3 | $2.8 | $2.6 | $2.7 | $2.5 |

*Values retrieved from S&P Global

Revenue has surged from $5.7 billion in Q1 2024 to $9.6 billion in Q4 2024, while gross margins have remained above 50%. Full-year 2025 revenue is guided at approximately €32.5 billion with ~52% gross margin—representing 15% growth year-over-year.

Looking ahead, consensus estimates project:

| Metric | FY 2024A | FY 2025E | FY 2026E |

|---|---|---|---|

| Revenue | $29.3B | $38.1B | $40.4B |

| EPS | $19.92 | $29.04 | $30.74 |

*Values retrieved from S&P Global

The China Question

One area of uncertainty remains: China. After contributing over 25% of revenue in 2024-2025, ASML expects China sales to "decline significantly" in 2026 as the market normalizes.

CFO Roger Dassen explained the dynamic: "For quite a while, we have been eating into our backlog... the China sales were very high because we've been eating into a substantial backlog. The underlying assumption is still that the sales level we currently see is very high in comparison to what we would think is a normalized level for the mainstream market."

However, this headwind is expected to be offset by strength in EUV demand from logic and memory customers outside China.

High NA: The Next Growth Frontier

ASML's High NA EUV systems—the most advanced lithography tools ever built—are progressing on schedule. SK Hynix has taken delivery of its first High NA system (EXE:5200), positioning the technology as "a critical enabler for future advanced DRAM devices."

Fouquet noted that customer qualification is proceeding well: "The more customers use the tool, the more they like it... The maturation level of the platform is well ahead of where low NA EUV was at the same stage in its introduction."

High volume manufacturing insertion is expected in 2027-2028, with High NA contributing meaningfully to gross margin improvement as volumes scale—though it will remain dilutive through 2030.

Consensus Catching Up

Aletheia is not alone in its optimism. According to InvestingPro data, 10 analysts have recently raised their earnings estimates for ASML. The average analyst price target stands at $1,208—still well below Aletheia's new $1,500 target but representing consensus expectations for continued upside.

What to Watch

January 2026: ASML will provide detailed 2026 guidance, including High NA shipment expectations and China revenue outlook. Management has repeatedly deferred specifics to this update.

Order Trends: Bookings of €5.4 billion in Q3 2025—including €3.6 billion of EUV—suggest healthy demand momentum. A meaningful portion of the €33 billion backlog extends beyond 2026, supporting longer-term visibility.

AI Infrastructure Announcements: As Fouquet noted, while major AI investment announcements "don't translate immediately into orders"—given ASML's long lead times—they create "a pretty positive backlog of opportunity for AI moving forward."

The Bottom Line

Aletheia's double upgrade crystallizes a shifting narrative: ASML's "transition year" appears over, and the company is positioned at the center of an AI-driven semiconductor supercycle. With sole control over EUV technology, expanding lithography intensity across both logic and memory, and High NA poised to extend its moat, ASML's position as the gatekeeper of Moore's Law remains unchallenged.

The stock's 9% surge—hitting an all-time high—suggests the market is beginning to price in this reality. At current levels, shares trade at roughly 38x forward earnings, a premium valuation that reflects ASML's monopoly position and secular growth tailwinds.

Related