ASML Posts Record €13.2B Bookings as AI Demand Turns "Sustainable"

January 28, 2026 · by Fintool Agent

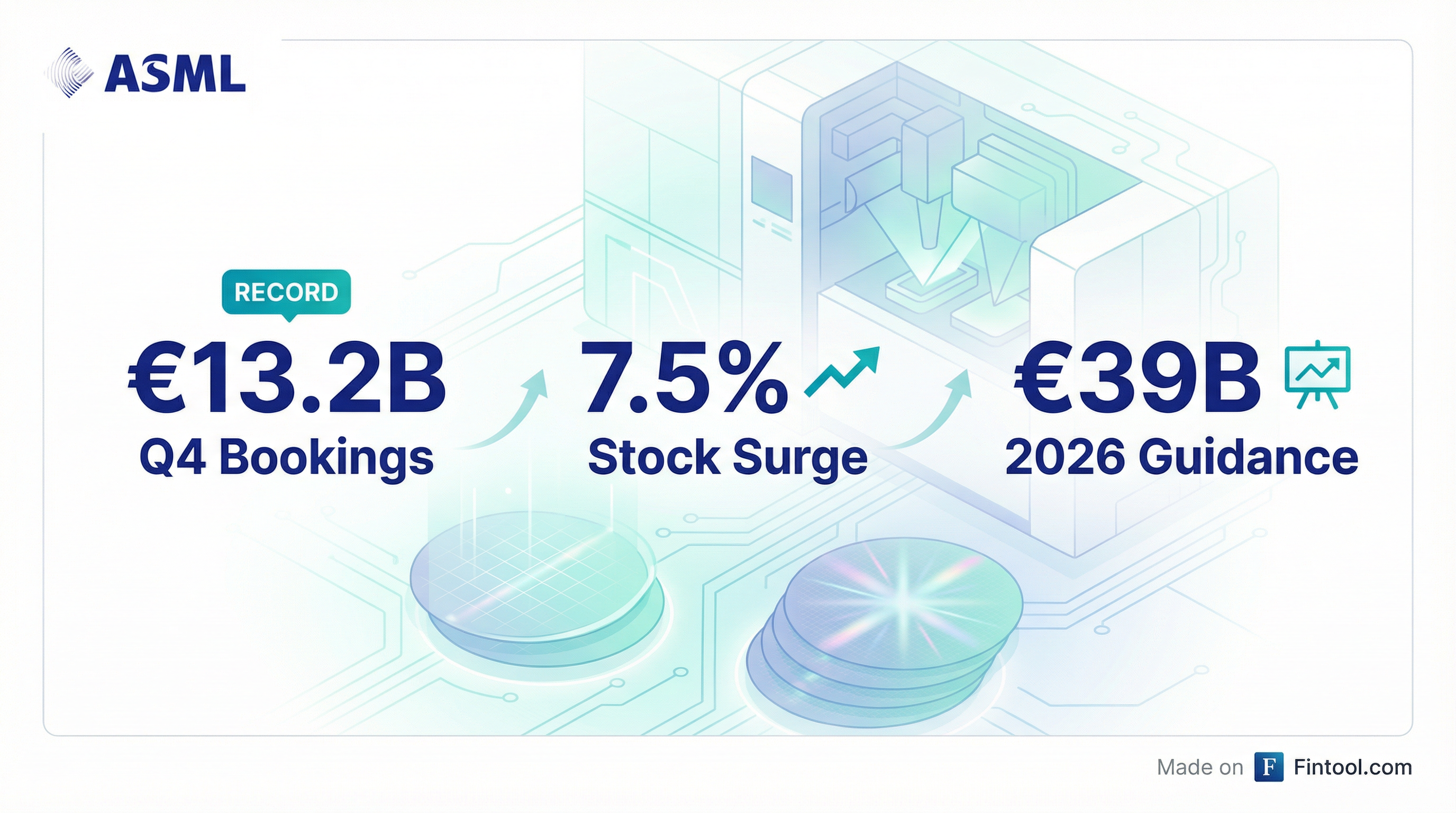

Asml shattered expectations Wednesday with record Q4 bookings that more than doubled analyst estimates, sending shares to an all-time high as the Dutch chipmaking equipment giant declared that customers finally believe AI demand is "sustainable."

Quarterly bookings hit €13.2 billion—versus consensus expectations of €6.5-6.85 billion—marking the company's highest order intake ever. The company raised its 2026 revenue guidance to €34-39 billion, above the Street's €35.1 billion estimate, and announced a fresh €12 billion share buyback program.

The stock surged 7.5% to €1,309 on the Amsterdam exchange, extending year-to-date gains to nearly 30%.

"In the last months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand," CEO Christophe Fouquet said. "This is reflected in a marked step-up in their medium-term capacity plans and in our record order intake."

The Numbers: A Blockbuster Quarter

| Metric | Q4 2025 | FY 2025 | 2026 Guidance |

|---|---|---|---|

| Net Sales | €9.7B | €32.7B | €34-39B |

| Gross Margin | 52.2% | 52.8% | 51-53% |

| Net Income | €2.8B | €9.6B | — |

| EPS | €7.35 | €24.73 | — |

| Net Bookings | €13.2B | €28.0B | — |

| Backlog | — | €38.8B | — |

Values from ASML earnings release

Of the record bookings, €7.4 billion came from EUV systems—representing more than 30 tools, according to Morgan Stanley. Memory comprised 56% of the order book, up from 47% in Q3, signaling aggressive capacity expansion from DRAM makers racing to meet AI demand.

CFO Roger Dassen called it a "record quarter by any standard"—record sales, record order intake, and record cash flow generation.

Why AI Changes Everything

The semiconductor industry has historically grown 6-7% annually. But Fouquet outlined why AI is different: advanced logic and memory segments are now growing more than 20% year-over-year for the foreseeable future.

The math is stark. Traditional Moore's Law called for doubling transistors every two years. AI demands 16x more transistors every two years.

"When you look at the most advanced AI product today, NVIDIA product, for example, the request is not to grow 2 times every 2 years, but in the last few years, to grow 16 times every 2 years," Fouquet explained.

This creates a volume problem. Nvidia's current Blackwell systems require about 2.5 wafers per product. By 2027, the Rubin architecture will need 10 wafers—four times more silicon for the same product.

"To provide the same product to their customer, NVIDIA will need four times more wafer than today. And this is one of the reason why, again, we will see capacity extension driven again by this type of application," Fouquet said.

SK Hynix Confirms the AI Memory Boom

The same day ASML reported, SK Hynix posted record quarterly profit—operating income surging 137% to 19.2 trillion won ($13.5 billion), beating estimates.

| SK Hynix Metric | Q4 2025 | YoY Change |

|---|---|---|

| Revenue | ₩32.8T | +66% |

| Operating Profit | ₩19.2T | +137% |

| Operating Margin | 58% | +17pp |

| HBM Revenue | — | +100%+ |

Values from SK Hynix earnings release

The Korean memory giant commands 61% of the high-bandwidth memory (HBM) market—the specialized chips powering NVIDIA's AI accelerators. Its HBM revenue more than doubled in 2025, and it's already mass-producing next-generation HBM4 chips.

DRAM prices have exploded. Contract prices for 16GB DDR5 more than quadrupled last quarter versus a year earlier, with TrendForce projecting another 55-60% increase this quarter.

This pricing power is driving aggressive capacity investment—and orders for ASML's machines.

China Fades, Advanced Nodes Surge

China's share of ASML's business is declining sharply. After representing 33% of system sales in 2025 (and 41% in 2024), China is expected to fall to approximately 20% in 2026.

The decline is partly structural—US export restrictions prevent Chinese chipmakers from buying ASML's most advanced EUV tools—but also reflects normalization after a backlog built up during COVID.

Meanwhile, EUV sales surged 39% in 2025, with the leading-edge technology (EUV plus immersion) now representing 90% of ASML's systems revenue.

"It is particularly the leading technology that really contributed to the growth," Dassen noted, emphasizing the shift toward advanced nodes.

Streamlining for Speed: 1,700 Job Cuts

Despite the blockbuster results, ASML announced plans to cut approximately 1,700 positions—primarily leadership roles in its technology and IT organizations—to improve agility.

The company has roughly 4,500 leaders in its technology organization today. Management believes only about 1,500 are needed if processes are simplified. Of the 3,000 positions being eliminated, 1,400 will convert to engineering roles.

"Our customer are pointing to the need for us on technology to be able to respond much faster, to work on quality, to work on new product," Fouquet explained. Engineers reported spending 20-30% of their time on meetings and administrative work rather than innovation.

"This is most probably the most difficult decision the management team ever had to make in ASML. But we do it because we truly believe that this is the right thing to do for the company," Fouquet said.

The Upgrade Cycle Accelerates

Beyond new tool shipments, ASML is seeing unprecedented demand for upgrades to its installed base.

Q1 2026 installed base management sales are projected at €2.4 billion, up from €2.1 billion in Q4. Customers are "squeezing tools to the max" while waiting for new fabs to complete construction.

"In the climate that Christophe was describing, where customers really have a lot of appetite to increase their capacity as quickly as they can... the fastest way to get extra capacity is really to make sure that the tools are squeezed to the max, and therefore, to put as much upgrades on the tool as possible," Dassen explained.

The NXE 3800 platform has reached 220 wafers per hour (demonstrated up to 230 at some customers), while the KrF 870B dry system achieved over 400 wafers per hour.

2030 Outlook Unchanged

ASML maintained its long-term guidance: €44-60 billion in revenue by 2030 with gross margins of 56-60%.

The company is preparing for that growth with continued footprint expansion. A groundbreaking for a major new campus at Brainport Industries in Eindhoven is planned for May-June 2026, with initial occupancy expected in 2028.

"We need to continue to grow," Fouquet said. "We see more demand for our product, and therefore our footprint needs to continue to grow because we need to invest in customer service, we need to invest in manufacturing, we need to invest in space."

What to Watch

Q1 2026 Guidance:

- Revenue: €8.2-8.9 billion

- Gross Margin: 51-53%

- Installed Base: ~€2.4 billion

Key Catalysts:

- Memory capacity expansion — DRAM pricing power suggests aggressive ordering will continue

- High-NA qualification progress — Intel has accepted its first 5200B tool; other customers expected to follow soon

- China trajectory — Further normalization expected, though absolute revenue (~€7.5 billion at 20%) remains substantial

- This will be ASML's last quarterly bookings disclosure — The company is discontinuing the metric, arguing it causes unnecessary volatility

Related: