Atmos Energy Shareholders Double Authorized Shares to 400 Million, Clearing Path for $26 Billion Infrastructure Push

February 4, 2026 · by Fintool Agent

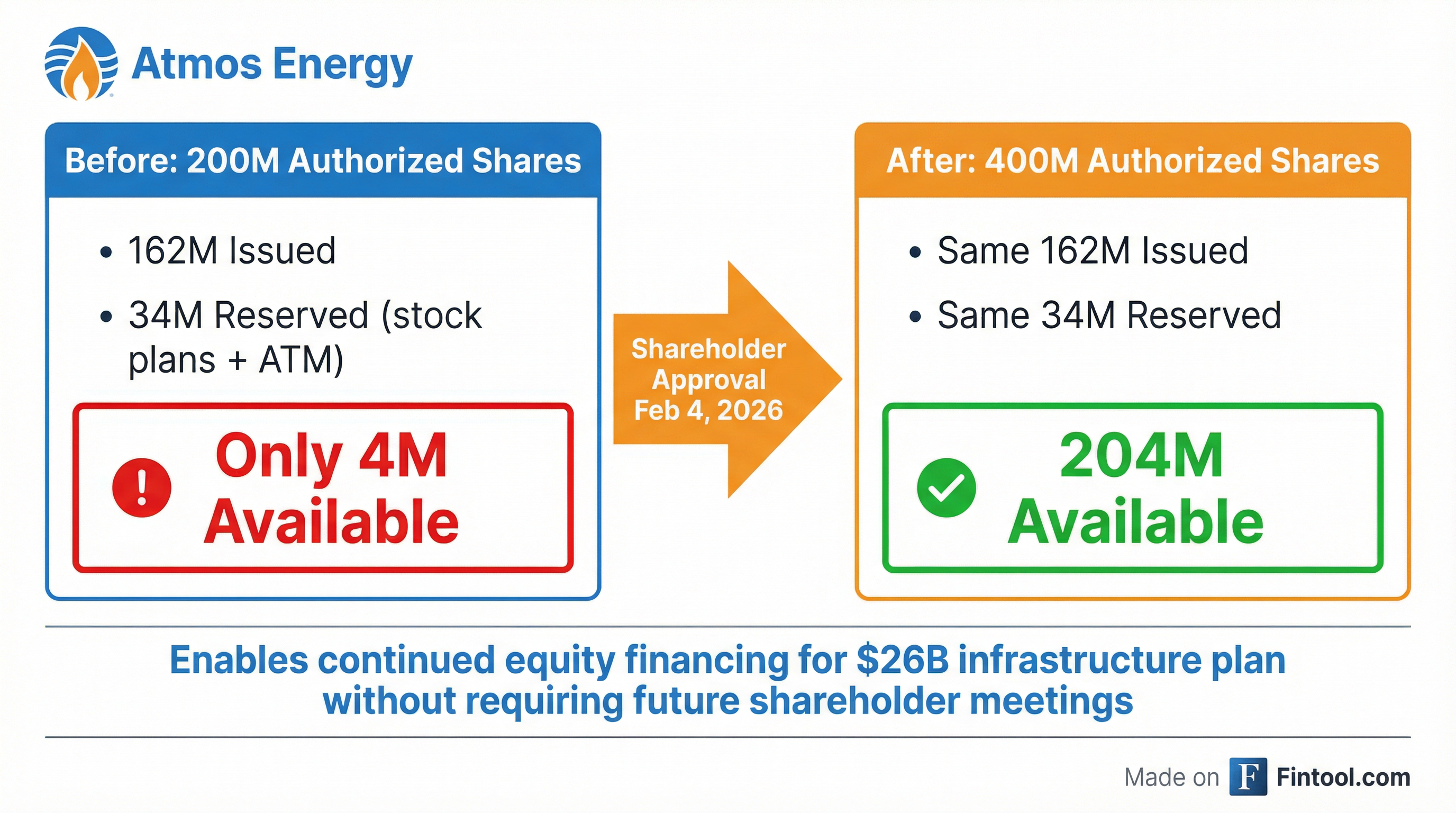

Atmos Energy shareholders approved a doubling of authorized common stock from 200 million to 400 million shares at the company's virtual annual meeting today, eliminating a critical bottleneck that had left the nation's largest pure-play natural gas utility with just 4 million shares available to fund its ambitious capital program.

The stock rose 2.1% to $172.41 on above-average volume, extending gains that began after the company reported Q1 FY2026 earnings and affirmed full-year guidance of $8.15-$8.35 EPS.

Why the Share Authorization Matters

The math was stark: of 200 million previously authorized shares, approximately 162 million were already issued and 34 million were reserved for stock plans and the company's at-the-market (ATM) equity offering program. That left just 4 million shares—roughly 2% of authorized capital—to fund what management describes as a $26 billion five-year infrastructure investment plan.

The ATM program is central to Atmos Energy's financing strategy. Rather than dilutive secondary offerings, ATM programs allow utilities to sell shares gradually at prevailing market prices, reducing execution risk and price impact. But the program requires authorized shares to draw upon.

"Our business is capital intensive, requiring significant resources to fund operating expenses and capital project expenditures," the company stated in its proxy filing. "Approval of this amendment by shareholders will enable us to take timely advantage of market conditions and other opportunities that may become available to us without the expense and delay of arranging a special meeting of shareholders in the future."

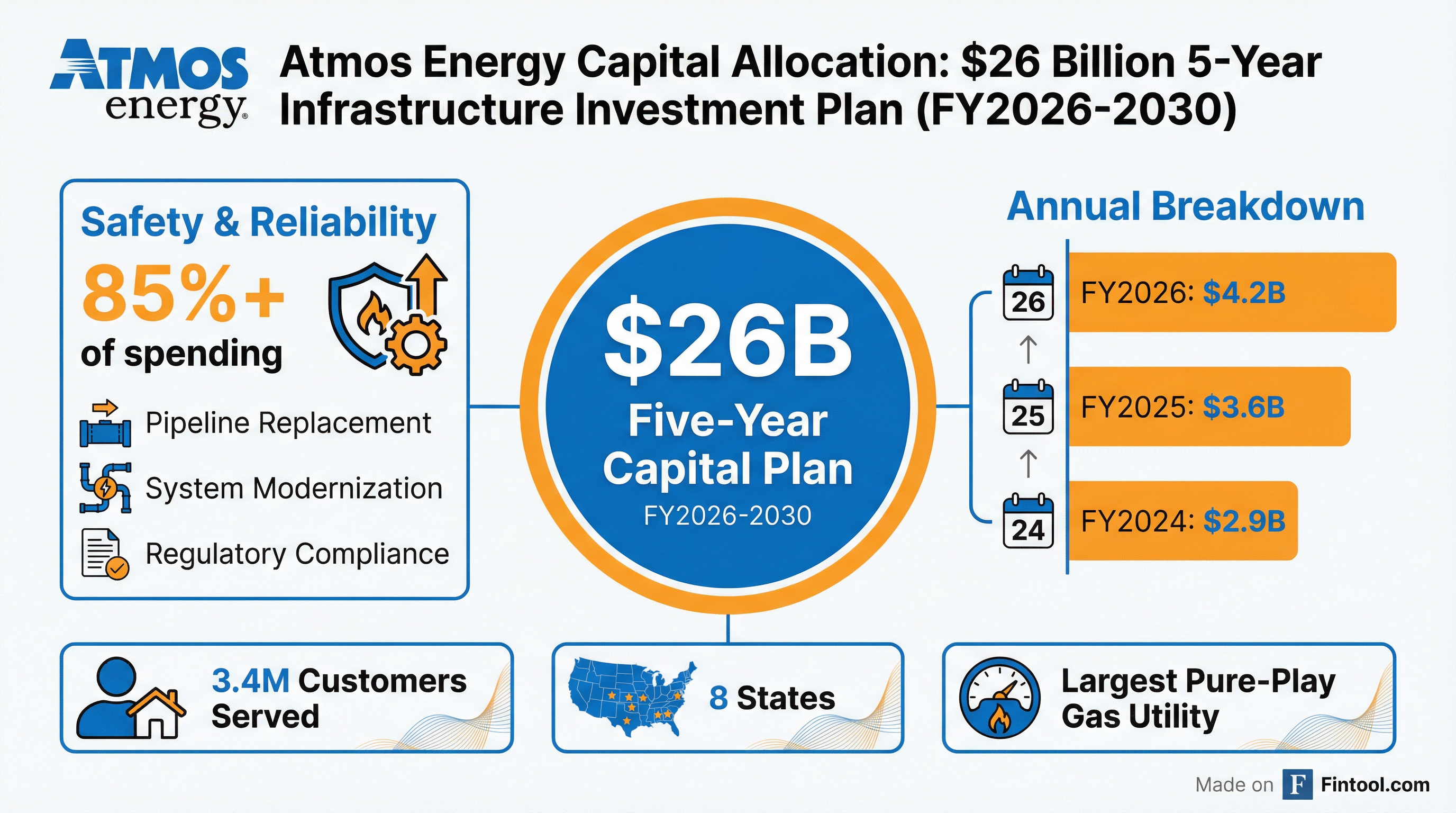

The $26 Billion Infrastructure Bet

The share authorization clears the way for continued funding of one of the most aggressive infrastructure programs in the utility sector. Between fiscal years 2026 and 2030, Atmos plans to invest approximately $26 billion, with more than 80% dedicated to safety and reliability spending.

The trajectory is accelerating:

| Fiscal Year | Capital Expenditures | YoY Change |

|---|---|---|

| FY 2023 | $2.8 billion | — |

| FY 2024 | $2.9 billion | +4% |

| FY 2025 | $3.6 billion | +24% |

| FY 2026E | $4.2 billion | +17% |

Q1 FY2026 capital expenditures of $1.0 billion were invested primarily in pipeline replacement and system modernization, with over 85% focused on safety and reliability.

The spending is funded through a combination of operating cash flow, debt issuance, and equity financing. As of December 31, 2025, Atmos maintained $4.6 billion in total liquidity, including $367 million in cash, $1.1 billion in equity forward commitments, and $3.1 billion in undrawn credit facilities.

Q1 Results and Full-Year Outlook

The shareholder meeting followed the company's Q1 FY2026 earnings report, which showed continued momentum:

| Metric | Q1 FY2026 | Q1 FY2025 | Change |

|---|---|---|---|

| Net Income | $403.0 million | $351.9 million | +15% |

| Diluted EPS | $2.44 | $2.23 | +9% |

| Operating Cash Flow | $308.1 million | $282.0 million | +9% |

| Equity Capitalization | 59.9% | — | — |

The 15% year-over-year increase in net income largely reflects positive rate outcomes driven by safety and reliability spending. Additionally, results benefited from $35.2 million related to Texas legislation that became effective during Q3 FY2025 regarding infrastructure spending.

Management affirmed FY2026 guidance of $8.15-$8.35 per diluted share, representing 9-12% growth over FY2025's $7.46 EPS.

Dividend Increase Signals Confidence

The board declared a quarterly dividend of $1.00 per share, representing an indicated annual dividend of $4.00—a 14.9% increase over fiscal 2025. This marks the company's 169th consecutive quarterly dividend.

At the current stock price, the dividend yield stands at approximately 2.3%, competitive for the utility sector while leaving ample room for retained earnings to fund the capital program.

| Metric | Value |

|---|---|

| Annual Dividend | $4.00 |

| Dividend Yield | 2.3% |

| Payout Ratio (FY26E) | 48-49% |

| Consecutive Dividends | 169 quarters |

Other Meeting Business

Beyond the share authorization, shareholders approved several governance changes:

- Director Elections: All 12 nominees were elected to one-year terms, including Chairman Kim Cocklin and CEO Kevin Akers

- Say-on-Pay: Advisory approval of FY2025 executive compensation passed by majority vote

- Auditor Ratification: Ernst & Young LLP approved as independent auditor for FY2026

- Plurality Voting: Amendment adopted to use plurality voting in contested director elections, avoiding potential "failed election" scenarios

- Officer Liability Limits: Updated provisions limiting officer liability as permitted by Texas and Virginia law

- Indemnification Clarifications: Technical updates to indemnification provisions

The plurality voting amendment is notable—it ensures that in a contested election where nominees exceed board seats, the candidates with the most votes win regardless of whether they achieve a majority. This protects against activist scenarios where shareholders vote against all candidates.

What to Watch

Regulatory Execution: Atmos implemented $122.5 million in annualized regulatory outcomes during Q1, with an additional $34.0 million in rate cases pending. The company's ability to recover capital investments through timely rate adjustments remains the key driver of earnings growth.

Equity Issuance: With 204 million shares now available versus only 4 million previously, watch for ATM activity to accelerate. As of December 31, 2025, approximately $1.1 billion in equity forward commitments were outstanding.

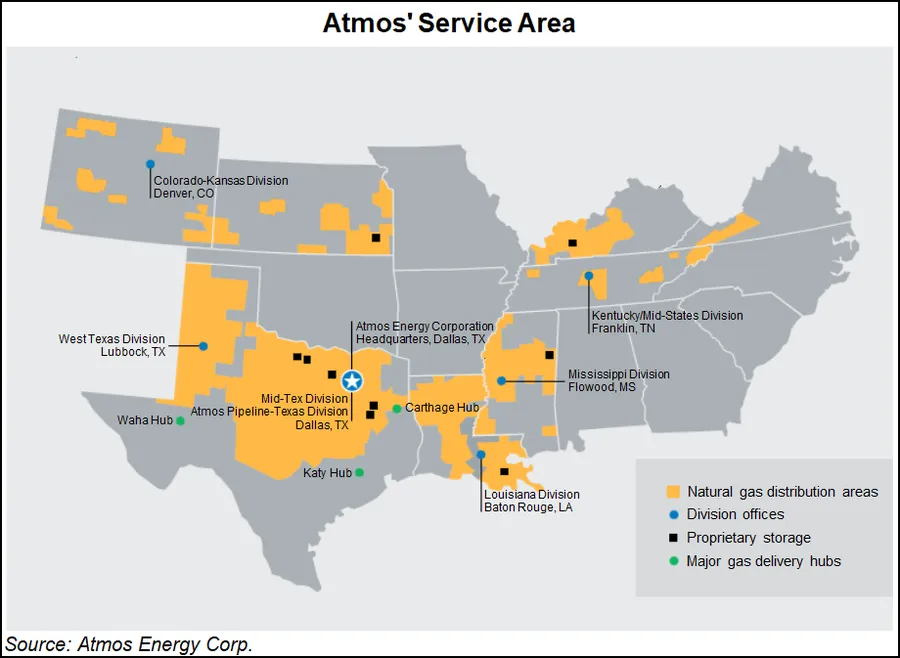

Texas Concentration: Two-thirds of Atmos's earnings derive from Texas, where the company operates both distribution and pipeline assets. Population growth in the state supports customer additions but also demands continued infrastructure investment.

Related: Atmos Energy Company Profile