Bitcoin Slips Below $90K as ETF Outflows Hit Largest Level Since November

January 8, 2026 · by Fintool Agent

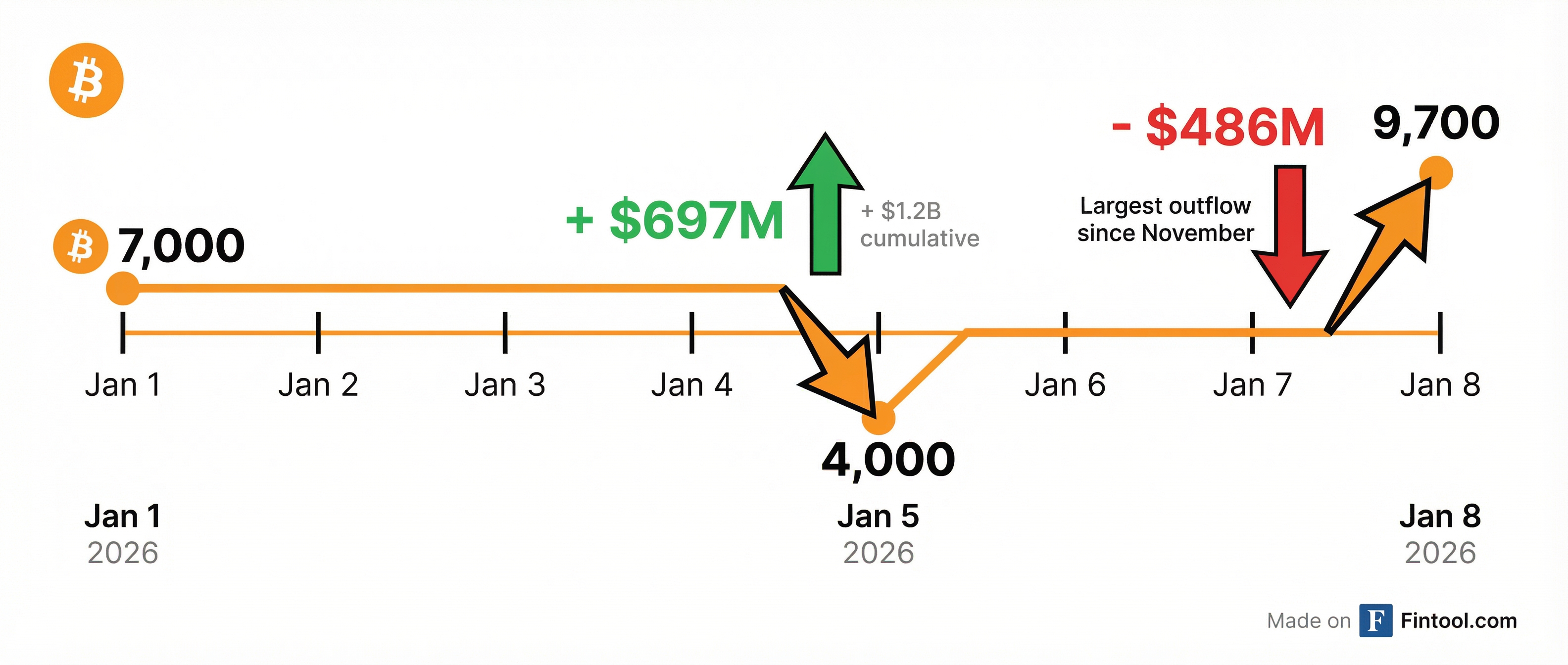

Bitcoin broke below $90,000 on Thursday as spot ETF outflows swelled to $486 million—the largest single-day withdrawal since November—erasing the early 2026 rally that had briefly pushed the cryptocurrency toward $95,000.

The reversal is stark: Just days ago, U.S. spot bitcoin ETFs recorded their strongest inflows in three months, pulling in $697 million on January 5 alone. Now, two consecutive days of outflows totaling over $700 million have shifted sentiment and dragged prices back to where they started the year.

The Rally That Wasn't

Bitcoin entered 2026 trading around $87,000 after a weak 2025—the worst-performing major asset class of the year, down approximately 6.3% according to K33 Research. The new year brought optimism: roughly $1.2 billion flowed into spot ETFs over the first two trading days.

By January 5, bitcoin had rallied to $94,000—a 30-day high—as BlackRock's iShares Bitcoin Trust (IBIT) alone absorbed $372 million in fresh capital. Fidelity, Ark, Bitwise, and Invesco all posted positive inflows. The institutional bid appeared to be back.

Then the tide turned.

ETF Flow Breakdown: BlackRock Stands Alone

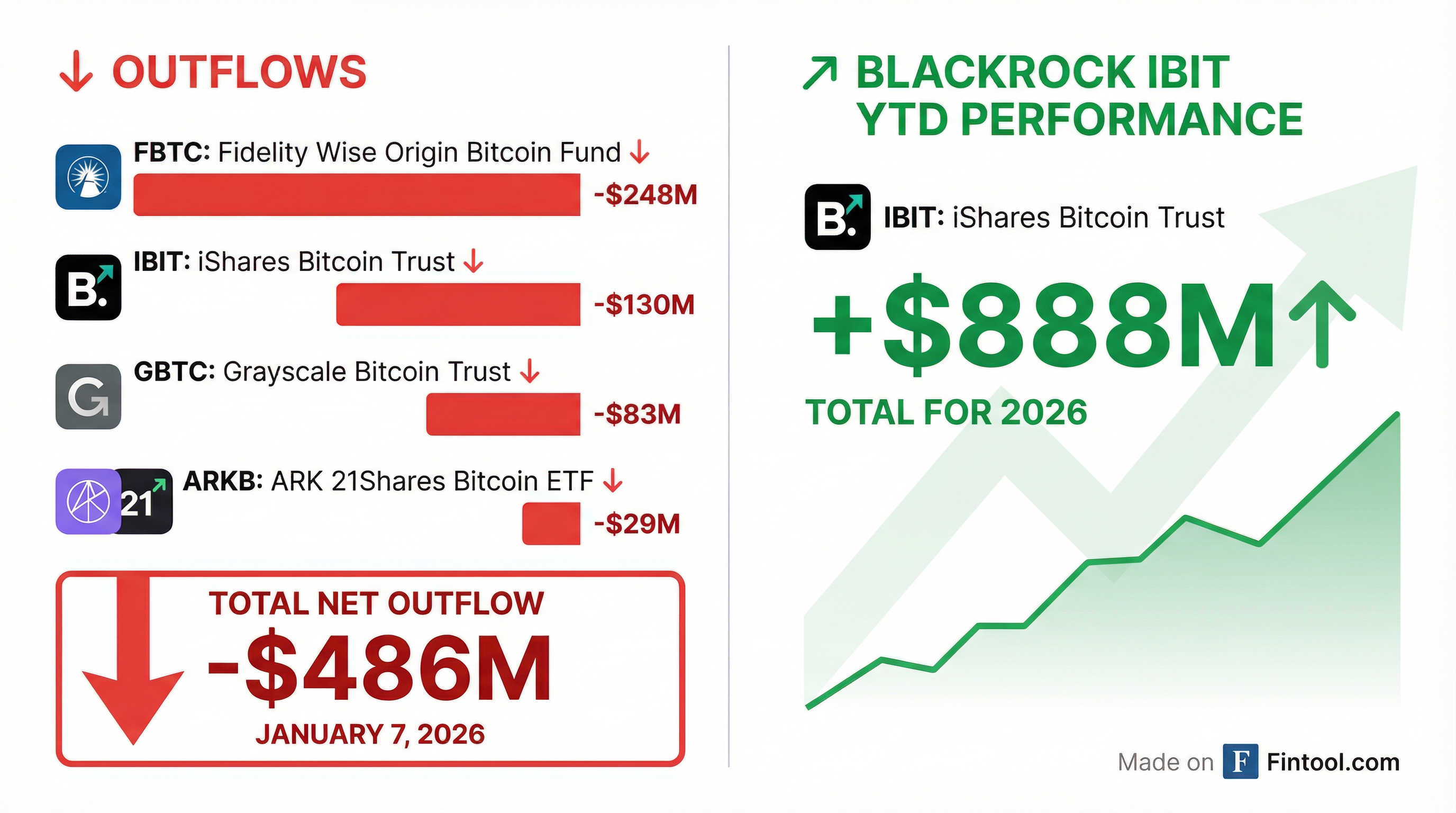

January 7's $486 million outflow was concentrated in the same names that had led the charge higher. Fidelity's Wise Origin Bitcoin Fund (FBTC) saw $248 million exit—the largest single-fund outflow of the day. Blackrock+0.15%'s IBIT lost $130 million. Grayscale's GBTC shed $83 million.

The divergence between IBIT and its competitors has been a defining feature of 2026. Despite the outflows, BlackRock's fund has accumulated $888 million in net inflows year-to-date—suggesting a flight to quality as investors consolidate positions in the lowest-fee, highest-liquidity product.

| ETF | Provider | Jan 7 Flow | YTD Flows |

|---|---|---|---|

| FBTC | Fidelity | -$248M | -$500M+ |

| IBIT | BlackRock | -$130M | +$888M |

| GBTC | Grayscale | -$83M | -$150M+ |

| ARKB | Ark & 21Shares | -$29M | -$60M+ |

Crypto Miners Feel the Pain

The pullback has rippled through crypto-adjacent equities. Mining stocks, which offer leveraged exposure to bitcoin's price, have retreated from recent highs.

| Company | Ticker | Price | Day Change | 52-Week Range |

|---|---|---|---|---|

| Coinbase+13.00% | COIN | $243.44 | -0.5% | $147 - $349 |

| Microstrategy+26.11% | MSTR | $310.50 | -2.1% | $101 - $543 |

| Mara Holdings+22.44% | MARA | $10.38 | +4.6% | $6.19 - $29.60 |

| Riot Platforms+19.82% | RIOT | $15.11 | -1.1% | $6.19 - $23.94 |

Microstrategy+26.11%, which holds over 440,000 bitcoin on its balance sheet, is particularly exposed. The company's stock is down more than 40% from its November 2025 high of $543, though it remains up significantly from its 52-week low.

What Analysts Are Saying

Despite the outflows, analysts are not sounding alarms.

"BTC ETF outflows look more like post-inflow normalization than risk-off," said Vincent Liu, CIO of Kronos Research. "Institutions are rebalancing exposure, not exiting conviction. One day of ETF outflows doesn't outweigh the broader trend of sustained institutional allocation."

Paul Howard, senior director at Wincent, sees further downside as possible but not catastrophic: "The next natural step for BTC is likely a break below $91,000 to fill the CME gap. Current conditions are choppy, favoring short-term trading rather than sustained directional bets."

Nick Ruck, director of LVRG Research, described the pullback as "normal profit-taking and portfolio rebalancing."

Historical Context: Outflows as Buying Signals?

Since spot bitcoin ETFs launched in the U.S. in January 2024, extended periods of net outflows have often aligned with local market bottoms—based on 30-day moving average data from Glassnode:

- August 2024: Yen carry trade unwind drove bitcoin to roughly $49,000

- April 2025: Tariff concerns marked a local low near $76,000

If that pattern holds, the current outflow cluster could signal accumulation opportunity rather than the start of a deeper decline. The Coinbase premium index—a measure of U.S. institutional demand—has climbed back toward neutral, suggesting conditions are "no longer consistent with capitulation."

What to Watch

Fed signals: The Congressional Budget Office expects the Federal Reserve to cut rates in 2026, with the fed funds rate settling around 3.4% by 2028. Easier monetary policy has historically supported risk assets, including crypto.

CME gap: Traders are watching the $80,000-$85,000 range where a CME futures gap remains unfilled. A move to fill this gap would represent an additional 10%+ decline from current levels.

ETF flow momentum: Whether the outflows continue or reverse will be the key signal. A return to net inflows could stabilize prices; continued redemptions could accelerate the decline.

Altcoin rotation: Notably, spot Ethereum ETFs saw $114.7 million in net inflows on January 7, even as bitcoin funds bled. XRP and Solana ETFs also posted positive flows, suggesting some capital may be rotating within crypto rather than exiting entirely.

Related: Coinbase+13.00% · Microstrategy+26.11% · Mara Holdings+22.44% · Riot Platforms+19.82% · Blackrock+0.15% · Fidelity+1.07%