Earnings summaries and quarterly performance for Strategy.

Executive leadership at Strategy.

Board of directors at Strategy.

Brian Brooks

Independent Director

Carl Rickertsen

Independent Director

Gregg Winiarski

Independent Director

Jane Dietze

Independent Director

Jarrod Patten

Independent Director

Peter Briger

Independent Director

Stephen Graham

Independent Director

Research analysts who have asked questions during Strategy earnings calls.

Lance Vitanza

TD Cowen

3 questions for MSTR

Mark Palmer

The Benchmark Company, LLC

3 questions for MSTR

Andrew Harte

BTIG, LLC

2 questions for MSTR

Dan Hillary

Buck Global LLC

2 questions for MSTR

Larry Lepard

Equity Management Associates

2 questions for MSTR

Lyn Alden

Lyn Alden Investment Strategy

2 questions for MSTR

Pete Christiansen

Citi

2 questions for MSTR

Tom Lee

Fundstrat Global Advisors

2 questions for MSTR

Brian Dobson

Chardan Capital Markets

1 question for MSTR

Jeff Walton

Strive

1 question for MSTR

Lynn Alden

Independent Investor

1 question for MSTR

Preston Pysh

Investor's Podcast Network

1 question for MSTR

Samson Mow

JAN3

1 question for MSTR

Recent press releases and 8-K filings for MSTR.

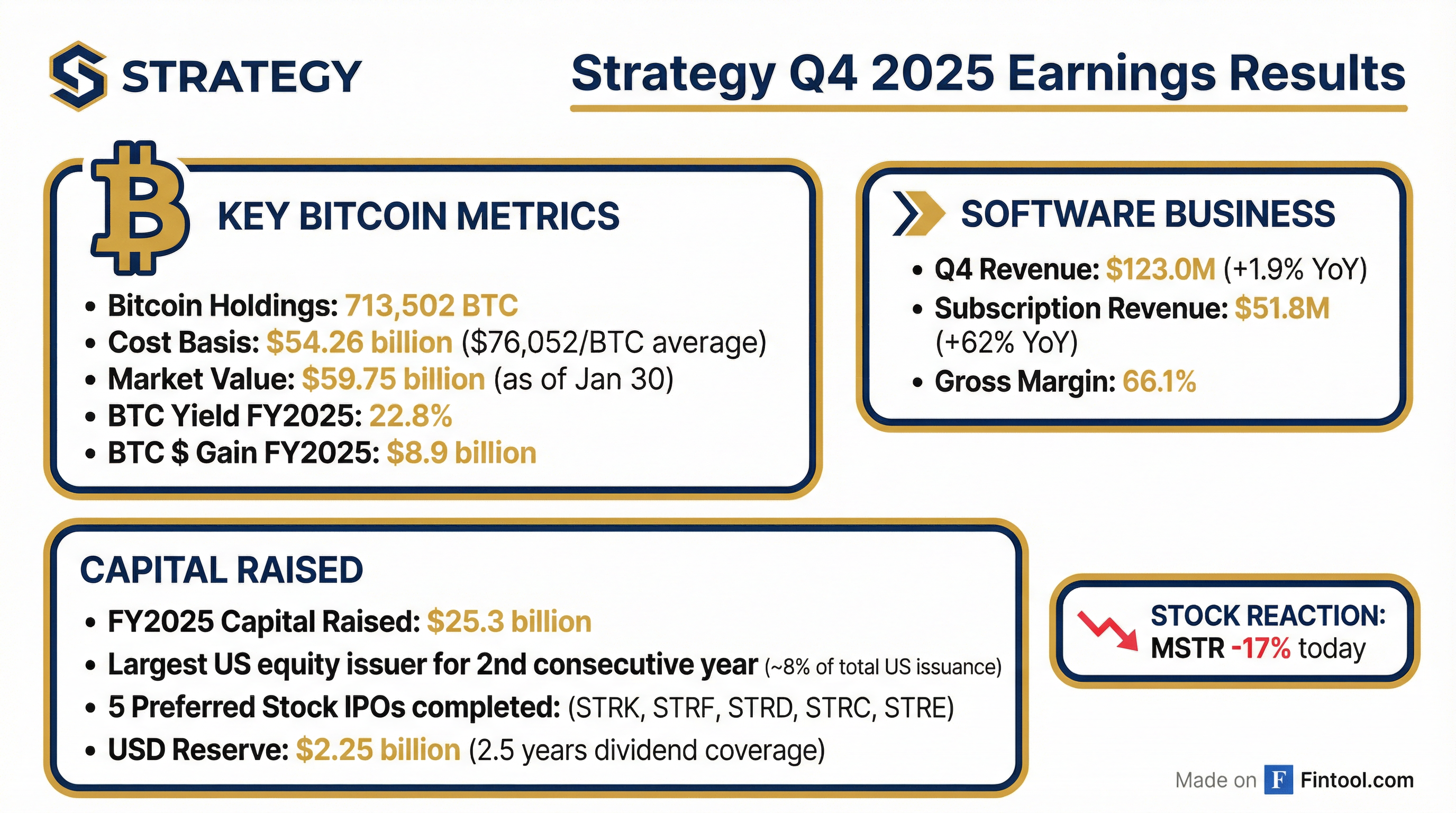

- Strategy reported a Q4 2025 operating loss of $17.4 billion and a net loss of $12.6 billion, primarily due to a decline in Bitcoin's fair value under mark-to-market accounting. For the full year 2025, the company recorded an operating loss of $5.4 billion and a net loss of $4.2 billion.

- The company concluded 2025 holding 713,502 Bitcoin on its balance sheet, reinforcing its position as the largest corporate holder of Bitcoin. During Q4 2025, Strategy purchased an additional 32,470 Bitcoin for approximately $3.1 billion.

- Strategy successfully raised over $25 billion in total capital during 2025, including $6.9 billion in preferred equity, and established a $2.25 billion cash reserve in Q4 to cover over 2.5 years of dividend obligations. Total equity, including preferred and common, rose to $51.1 billion at year-end 2025.

- Strategic milestones in 2025 included the adoption of fair value accounting, securing the first credit rating for a Bitcoin treasury company, and MSCI's confirmation of continued index eligibility for digital asset treasury companies. The company also launched five new digital credit instruments, such as "Stretch," to amplify common equity and increase Bitcoin per share.

- Strategy reported an operating loss of $17.4 billion and a net loss of $12.6 billion for Q4 2025, with full-year 2025 operating and net losses of $5.4 billion and $4.2 billion, respectively, primarily driven by the quarter-end decline in Bitcoin's fair value.

- The company ended 2025 with 713,502 Bitcoin on its balance sheet, representing approximately 3.4% of all Bitcoin, and purchased an additional 32,470 Bitcoin in Q4 for approximately $3.1 billion.

- Strategy successfully raised over $25 billion of total capital in 2025, including $6.9 billion in preferred equity, and increased its digital assets from $23.9 billion at the end of 2024 to $58.9 billion by the end of 2025.

- The company launched its digital credit product, Stretch, which offers an 11.25% effective yield paid monthly and is supported by a $2.25 billion USD cash reserve established in Q4, providing 2.5 years of dividend coverage.

- For the full year 2025, Strategy delivered a BTC Yield of 22.8%, resulting in a total BTC gain of 101,873 Bitcoin and a BTC dollar gain of $8.9 billion, reinforcing its commitment to increasing Bitcoin per share.

- Strategy ended 2025 with 713,502 Bitcoin on its balance sheet, representing approximately 3.4% of all Bitcoin, and purchased an additional 32,470 Bitcoin in Q4 for approximately $3.1 billion.

- For Q4 2025, the company reported an operating loss of $17.4 billion and a net loss of $12.6 billion, with full-year 2025 losses of $5.4 billion (operating) and $4.2 billion (net), primarily driven by the decline in Bitcoin's fair value.

- In 2025, Strategy successfully raised over $25 billion of total capital, increasing total equity to $51.1 billion, and established a $2.25 billion USD cash reserve in Q4, providing over 2.5 years of dividend coverage.

- Strategic milestones in 2025 included adopting fair value accounting, obtaining the first-ever credit rating for a Bitcoin treasury company, and MSCI confirming eligibility for inclusion in global market indices. The company also generated $477 million in annual revenue in 2025.

- Strategy Inc. reported a net loss of $12.4 billion, or $42.93 per common share on a diluted basis, for the fourth quarter of 2025, primarily due to an unrealized loss on digital assets of $17.4 billion. Total revenues for the quarter increased by 1.9% year-over-year to $123.0 million.

- As of February 1, 2026, the company held 713,502 bitcoins at a total cost of $54.26 billion, averaging $76,052 per bitcoin, with 41,002 bitcoins acquired in January 2026.

- In fiscal year 2025, Strategy Inc. raised $25.3 billion through capital markets activities, including five IPOs of preferred stock, to fund its Bitcoin treasury strategy.

- The company's Digital Credit instrument, STRC, reached an aggregate stated amount of $3.4 billion with a current dividend rate of 11.25%, supported by a $2.25 billion USD Reserve established in the fourth quarter of 2025.

- Strategy Inc. reported a net loss of $12.4 billion and an operating loss of $17.4 billion for the fourth quarter of 2025, primarily due to an unrealized loss on digital assets following the adoption of fair value accounting.

- As of February 1, 2026, the company holds 713,502 bitcoins at a total cost of $54.26 billion, or $76,052 per bitcoin.

- In fiscal year 2025, Strategy Inc. raised $25.3 billion of capital, making it the largest US equity issuer, and completed five preferred stock IPOs, generating $5.5 billion in gross proceeds.

- The company's Digital Credit instrument, STRC, has scaled to an aggregate stated amount of $3.4 billion with a current dividend rate of 11.25%, supported by a $2.25 billion USD Reserve.

- Strategy reported a $12.4 billion net loss in Q4 2025, primarily due to $17.4 billion in mark-to-market unrealized losses on its Bitcoin holdings as the cryptocurrency's value declined.

- The company's GAAP EPS was -$42.93, and its shares plunged approximately 17% in a single day, though revenue saw a modest increase to $123 million.

- Despite the significant losses, Strategy continued to acquire Bitcoin, adding 41,002 BTC in January 2026, and highlighted its $2.25 billion USD Reserve and $25.3 billion raised in 2025 through capital programs.

- Analysts warned that the company's leverage and fair-value accounting, coupled with a prolonged Bitcoin downturn, could necessitate asset sales or strain its ability to raise fresh capital, especially after the company announced no new equity issuance or debt financing.

- Strategy Inc.'s bitcoin stake briefly fell below its average purchase price of roughly $76,000 per coin, resulting in approximately $900 million in unrealized losses.

- The company purchased an additional 855 BTC for about $75.3 million at an average price near $87,974 per coin, funded by at-the-market equity sales. This acquisition increased its total holdings to approximately 713,502 BTC at an aggregate cost of roughly $54.26 billion.

- Strategy declared a $0.9375 per-share dividend for February on its STRC preferred shares, payable on February 28 with a record date of February 15.

- The company retains more than $8 billion of remaining capacity under its at-the-market common stock program, alongside additional capacity from preferred stock offerings, to fund future purchases.

- Strategy (formerly MicroStrategy) acquired 22,305 BTC for approximately $2.13 billion at an average price of $95,284 per coin, bringing its total holdings to 709,715 BTC acquired for roughly $53.92 billion at an average cost of $75,979 per bitcoin as of January 19, 2026.

- The purchase was funded via at-the-market equity programs, generating approximately $2.13 billion from the sale of about 10.4 million MSTR Class A shares and issuances of STRC and STRK preferred stock.

- This acquisition represents Strategy’s largest weekly bitcoin purchase since late 2024, continuing its aggressive accumulation that now accounts for just over 3% of Bitcoin’s circulating supply.

- Analysts highlighted dilution and cash-flow tradeoffs, with TipRanks' AI analyst scoring MSTR as Neutral due to weak financial-statement quality and bearish technicals, even as some forecasts project materially larger 2026 bitcoin accumulation.

- Weekly distributions for various YieldMax® Option Income Strategy ETFs were announced.

- The record date for these distributions is January 8, 2026, with a payment date of January 9, 2026.

- The press release includes a table detailing the Distribution per Share and Distribution Rate for each ETF as of January 6, 2026. For instance, the YieldMax® MSTR Option Income Strategy ETF (MSTY) has a Distribution per Share of $0.3741 and a Distribution Rate of 64.23%.

- The 30-Day SEC Yield for these ETFs is reported as of December 31, 2025.

- All listed YieldMax® ETFs have a gross expense ratio of 0.99%.

- Strategy (formerly MicroStrategy) recently acquired 10,645 BTC for $980.3 million at an average price of $92,098 per coin, marking its second consecutive roughly $1 billion weekly purchase.

- The company's total Bitcoin holdings now stand at 671,268 BTC, acquired for a total of $50.33 billion (average cost $74,972), with the current market value estimated at $60 billion, representing approximately $10 billion in unrealized gains.

- This acquisition was primarily funded through its ATM equity program, raising $888.2 million from common-stock sales and additional proceeds from preferred-share offerings, totaling about $989 million in net proceeds.

- Despite a 41% year-to-date decline in MSTR shares and shareholder dilution concerns, management continues with large Bitcoin buys, while also pushing back against MSCI's proposed exclusion of bitcoin-treasury companies from indices.

Fintool News

In-depth analysis and coverage of Strategy.

Bitcoin Crashes Below $70K, Wiping Out Entire Trump Rally

Strategy's $54 Billion Bitcoin Bet Goes Underwater as Stock Hits 52-Week Low

Bitcoin Crashes to 15-Month Low, Erasing Trump-Era Gains as Bitwise CIO Declares 'Crypto Winter'

Strategy's $54 Billion Bitcoin Bet Goes Underwater as BTC Crashes Below Cost Basis

Strategy Deploys $2.1B in Largest Weekly Bitcoin Buy Since July, Holdings Surpass 709,000 BTC

Strategy Director Who Sold $10M at the Top Now Buying Back After 65% Crash

Quarterly earnings call transcripts for Strategy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more