Earnings summaries and quarterly performance for MICROSOFT.

Executive leadership at MICROSOFT.

Satya Nadella

Chief Executive Officer

Amy Hood

Executive Vice President and Chief Financial Officer

Brad Smith

Vice Chair and President

Judson Althoff

Executive Vice President and CEO Microsoft Commercial

Takeshi Numoto

Executive Vice President and Chief Marketing Officer

Board of directors at MICROSOFT.

Carlos Rodriguez

Director

Catherine MacGregor

Director

Charles Scharf

Director

Emma Walmsley

Director

Hugh Johnston

Director

John David Rainey

Director

John Stanton

Director

Mark Mason

Director

Penny Pritzker

Director

Reid Hoffman

Director

Sandra Peterson

Lead Independent Director

Teri List

Director

Research analysts who have asked questions during MICROSOFT earnings calls.

Brent Thill

Jefferies

10 questions for MSFT

Karl Keirstead

UBS

10 questions for MSFT

Keith Weiss

Morgan Stanley

10 questions for MSFT

Mark Moerdler

Bernstein Research

10 questions for MSFT

Mark Murphy

JPMorgan Chase & Co.

6 questions for MSFT

Raimo Lenschow

Barclays

6 questions for MSFT

Brad Zelnick

Credit Suisse

5 questions for MSFT

Kash Rangan

Goldman Sachs

5 questions for MSFT

Michael Turrin

Wells Fargo

3 questions for MSFT

Kasthuri Rangan

Goldman Sachs

2 questions for MSFT

Aleksandr Zukin

Wolfe Research

1 question for MSFT

Bradley Sills

Bank of America

1 question for MSFT

Brad Reback

Stifel

1 question for MSFT

Brent Bracelin

Piper Sandler Companies

1 question for MSFT

Rishi Jaluria

RBC Capital Markets

1 question for MSFT

S. Kirk Materne

Evercore ISI

1 question for MSFT

Recent press releases and 8-K filings for MSFT.

- Microsoft has globally deployed Structured’s newly available AI-native Partner Marketing Execution Platform (PMEP) across its partner ecosystem to automate campaign creation and execution, driving higher engagement and pipeline growth.

- Structured’s PMEP uses generative and agentic AI to personalize content, enforce compliance, and orchestrate full-funnel campaigns across channels, supporting localization in 130+ languages.

- The integration of Azure OpenAI Service in Microsoft’s cloud validates the platform’s enterprise scale, with over 500,000 partners enabled for localized campaign execution and performance visibility.

- Structured maintains a 98% enterprise retention rate and powers channel marketing for global enterprises like IBM, Google, Zoom, Dell, and ServiceNow.

- JFTC raid: Japan’s Fair Trade Commission raided Microsoft Japan to investigate whether it steered customers toward Azure or imposed onerous conditions on rival clouds, potentially violating the Antimonopoly Act.

- Microsoft shares jumped about 2.5% to $398.72 (intraday range $390.21–$399.11) but remain down nearly 20% year-to-date in 2026.

- The probe adds to global scrutiny of cloud practices, with regulators in Britain, the EU, the U.S. and Brazil also examining major providers, highlighting rising regulatory risks for Big Tech’s AI and infrastructure investments.

- Japan’s cloud market, valued at $28.97 billion in 2025 and projected to reach $33.53 billion in 2026, is intensifying competition among Microsoft, Amazon and Google.

- Microsoft shares have tumbled roughly 28–29% since their October 2025 peak and are approaching their 200-week moving average, a historical rebound level.

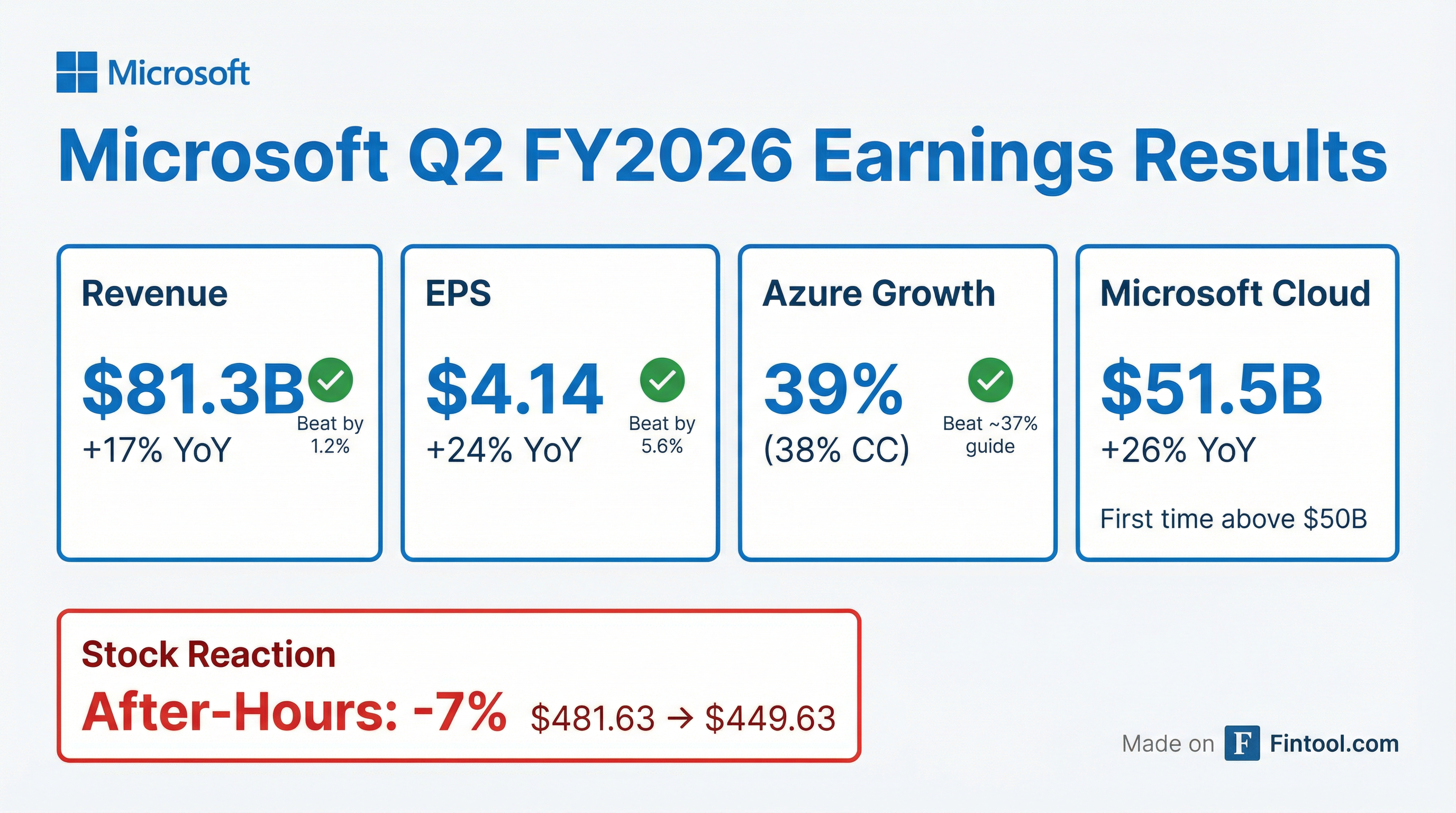

- Despite a fiscal Q2 beat with record revenue of $81 billion and EPS of $4.14, shares fell about 7% as investors reacted to slowing Azure growth and massive AI investment.

- Azure revenue growth slowed to 39%, trailing peer Google Cloud at 48%, while Microsoft’s forward P/E compressed to 21.4—the weakest among the top seven U.S. tech giants.

- The quarter’s $37.5 billion AI-related capex annualizes to over $150 billion, and the post-earnings selloff wiped out roughly $357 billion in market value in one day.

- Insider selling intensified, with CEO Satya Nadella offloading 149,205 shares (~$75.3 million) and Vice Chair Brad Smith selling 38,500 shares (~$19.97 million) over the past six months.

- Acquisition closed: Climb Global Solutions purchased interworks.cloud for approximately €8.0 million ($9.4 million), expanding its presence in Greece, Malta, Bulgaria and Cyprus.

- Financial impact: Interworks reported FY 2025 adjusted EBITDA of €901,000, up 86% from €485,000 in FY 2024; the transaction is expected to be accretive to earnings and adjusted EBITDA.

- Strategic benefits: Brings over 600 cloud reseller/MSP relationships and an experienced local team into Climb, enhancing cross-sell opportunities and support capabilities.

- Microsoft focus: Strengthens Climb’s Pan-European Microsoft CSP distribution strategy and compliance support across Southeastern Europe.

- Phil Spencer, Xbox head for 38 years, will retire effective Feb. 23 and stay on as an advisor through summer.

- Asha Sharma, former CoreAI product lead, was appointed EVP and CEO of Microsoft Gaming reporting to Satya Nadella.

- The reorganization centralizes oversight of Xbox, Bethesda, Activision Blizzard and King under Sharma; Xbox president Sarah Bond is departing and Matt Booty is promoted to EVP and chief content officer.

- Microsoft's gaming division faced a 9–10% revenue decline in the December quarter, alongside impairment charges and weaker console sales amid Activision Blizzard integration.

- After achieving 100% renewable match for its electricity use, Microsoft will continue matching purchases as its AI-driven cloud operations grow.

- Contracted 40 GW of new clean power across 26 countries, with 19 GW already online—enough to power about 10 million U.S. homes.

- The portfolio is built from over 400 separate contracts with roughly 95 utilities and developers, scaling from its first 110 MW Texas wind deal in 2013.

- Its PPA-driven clean energy purchases have cut reported Scope 2 emissions by about 25 million tons since 2020.

- Plans include leaning more on carbon-free sources (e.g., a 2024 nuclear restart agreement) and investing $50 billion by 2030 to expand AI and data centers in the Global South.

- Microsoft and Ericsson will embed Ericsson Enterprise 5G Connect into Windows 11 to deliver AI- and cloud-analytics-powered, enterprise-grade 5G connectivity to PCs.

- The solution links Intune and Surface Copilot+ devices with Ericsson’s platform for automated eSIM switching and seamless handoffs across providers.

- On-device AI and continuous cloud monitoring enforce enterprise policies and optimize network quality, reducing manual setup and IT overhead.

- Validated on Surface devices and showcased at MWC Barcelona 2026 alongside CSP collaborators.

- Integration strengthens Windows 11’s role in corporate device management, enhancing Microsoft’s position against Apple, Google, and Samsung.

- The FTC has escalated its antitrust probe into Microsoft’s cloud and AI businesses, issuing civil investigative demands and detailed questionnaires to competitors and industry participants.

- Regulators are examining whether Microsoft leverages its dominance in Office and Windows and its OpenAI partnership to steer customers to Azure through bundling, licensing terms, exit fees, and hosting restrictions.

- Key focus areas include licensing practices, data portability, the bundling of AI tools like Copilot with Azure and Office, and exclusive cloud-hosting tied to Microsoft’s >$13 billion OpenAI investments.

- Despite the probe, Microsoft’s financial metrics—~$2.97 trillion market cap, P/E ~25, current ratio 1.39, debt/equity ~0.15, and Altman Z-Score 8.4—underscore its resilience amid regulatory scrutiny.

- Microsoft is accelerating development of its own frontier foundation models and building gigawatt-scale training infrastructure to reduce long-term dependence on OpenAI, despite maintaining a 27% stake and extended IP access through 2032.

- The company is also hosting third-party models (Anthropic’s Claude, Meta’s Llama, Mistral) on Azure to diversify its AI supplier risk and gain flexibility.

- Microsoft anticipates $140 billion in AI infrastructure capital expenditures to expand training compute and data capabilities.

- Investors have grown concerned about the scale of AI spending, with the stock down roughly 13% over the prior month on valuation risk worries.

- Simbian.ai achieved 15x customer growth over the last 12 months, solidifying its leadership in the AI SOC market.

- Its AI SOC platform processed over 1 million security incidents in the past year, enabling faster containment without increasing headcount.

- The company’s AI Agents autonomously triaged, investigated, and remediated up to 90% of alerts using its proprietary TrustedLLM™ and Context Lake™ architectures.

- In 2025, Simbian reached #1 in AI SOC ARR and expanded strategic partnerships, including an integration with Microsoft Sentinel and a distribution agreement with SoftBank for Japan.

Fintool News

In-depth analysis and coverage of MICROSOFT.

Microsoft Director John Stanton Bets $2M on MSFT—First Mega Insider Buy Since 2015

Phil Spencer Retires After 38 Years: Microsoft Gaming Gets AI-Era Leadership

ChatGPT Gets Ads Today as OpenAI-Anthropic Rivalry Turns Personal

Microsoft CTO Reveals $150K-Per-Year Coding Agent Costs as AI Demand Outpaces Supply

OpenAI Plans Q4 IPO in Race to Beat Anthropic to Public Markets

Microsoft Plunges 12%, Drags Software Stocks Into Bear Market as AI Spending Fears Mount

Quarterly earnings call transcripts for MICROSOFT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more