Blackstone Hits 'Escape Velocity' With Record $1.75 EPS and $71B Quarterly Inflows

January 29, 2026 · by Fintool Agent

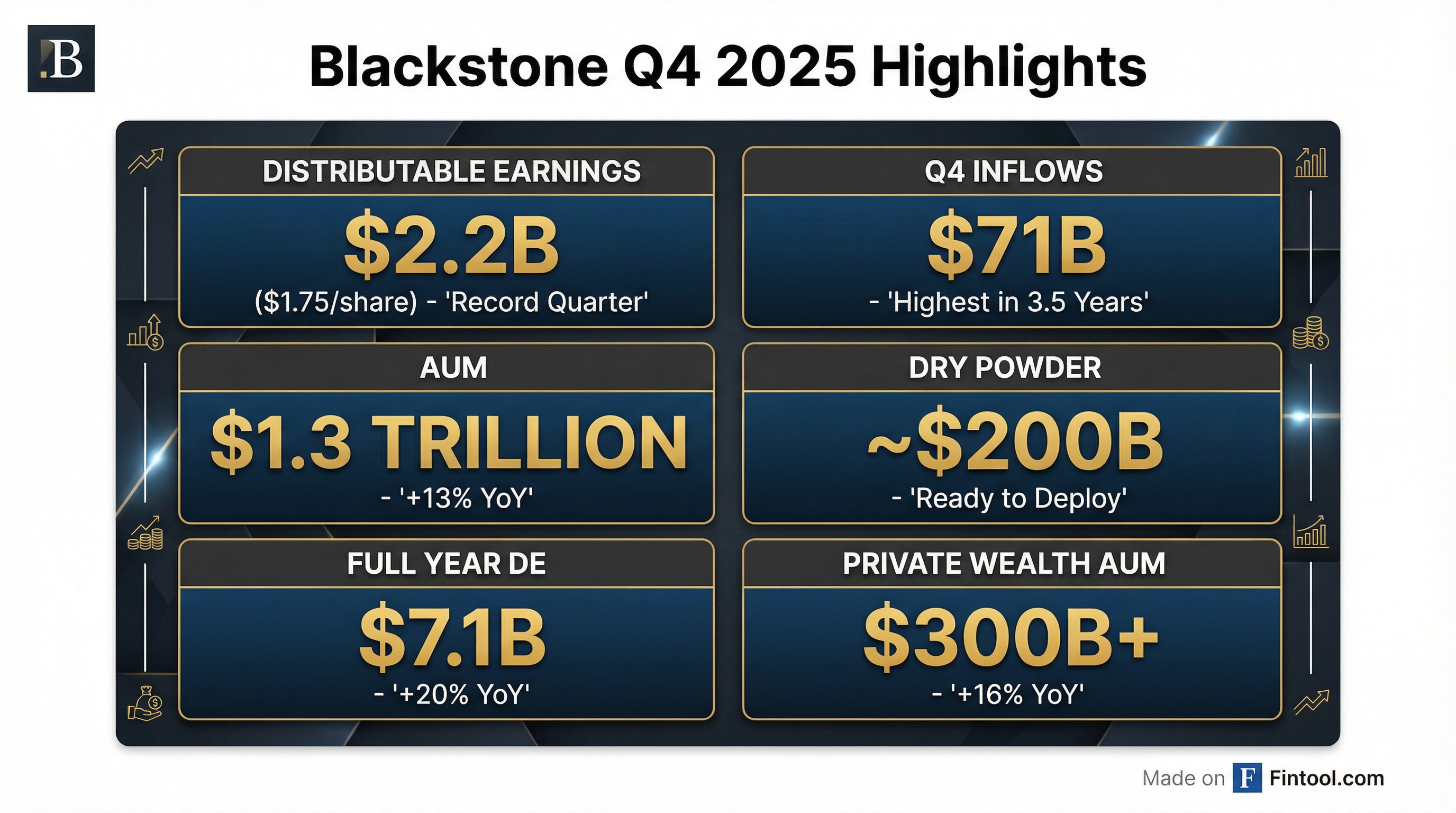

Blackstone just delivered the best quarter in its 40-year history. The world's largest alternative asset manager reported Q4 distributable earnings of $2.2 billion—$1.75 per share—while pulling in $71 billion of inflows, the highest quarterly haul in more than three years.

"The deal environment has reached escape velocity on the back of moderating cost of capital," President John Gray declared on Thursday's earnings call, framing the results as a turning point for private markets.

BX shares opened at $150.23 but retreated throughout the session, closing down 2.6% at $142.94—a likely case of "sell the news" after a 23% run since November lows.

The Numbers That Matter

| Metric | Q4 2025 | YoY Change |

|---|---|---|

| Distributable Earnings | $2.2B ($1.75/share) | Record |

| GAAP Net Income | $2.0B | +44% |

| Quarterly Inflows | $71B | Highest in 3.5 years |

| Assets Under Management | $1.3T | +13% |

| FRE Margin | Record | +100bps |

| Net Realizations | $957M | +59% |

Full-year 2025 distributable earnings grew 20% to $7.1 billion ($5.57 per share), beating the Street's $5.35 estimate. Fee-related earnings rose 9% to $5.7 billion, and management fees climbed 12% to $8 billion—all records.

"It Feels Like 2013, 2014"

CEO Steve Schwarzman and President John Gray painted a picture of an M&A and IPO market finally thawing after four years of hibernation.

The proof: Blackstone's $7.2 billion Medline IPO in Q4—the largest since 2021 and the largest sponsor-backed IPO in history. Shares traded up 40% on day one.

"It feels like 2013, 2014, where you had that four or five-year hibernation period, the markets reopened, and we took a bunch of companies public. That's the way it feels today," Gray told analysts.

The firm now has "one of the largest IPO pipelines in our history"—a diverse mix across sectors and geographies, primarily concentrated in corporate private equity and energy/electricity themes.

The AI Infrastructure Play

Blackstone's data center and power investments continue to be the firm's crown jewels. QTS, its data center platform, was the single largest driver of returns in both the infrastructure (BIP) and real estate (BREIT) portfolios.

Key performance highlights:

- Infrastructure appreciated 24% for the full year, led by digital and energy assets

- BIP (co-mingled infrastructure strategy) has generated 18% net returns annually since inception 7 years ago

- BREIT returned 8.1% in 2025, nearly 3x the public REIT index

"The historic pace of investment taking place in the U.S. to facilitate the development of artificial intelligence... is the key driver of economic growth today and is creating an enormous need for capital solutions," Schwarzman said.

The firm deployed $138 billion across all strategies in 2025—the highest in four years—and holds nearly $200 billion in dry powder ready to deploy.

Credit: The Quiet Giant

Blackstone's credit platform hit $520 billion in AUM—up 15% YoY—with $140 billion of inflows in 2025 alone.

The firm is betting big on investment-grade private credit, which it sees as in the "earliest stages" of a secular shift. That business alone grew 30% to $130 billion.

"Corporate investment-grade bond spreads are at their tightest level since 1998," Gray explained. "We can bring our insurance clients an extra 180 basis points... that obviously motivates them."

Direct lending performance remains strong: realized losses were just 11 basis points over the last 12 months, with high single-digit EBITDA growth at borrower companies.

Private Wealth: The $300B Channel

Individual investors continue to pile in. Private wealth AUM grew 16% to more than $300 billion—up threefold in five years.

| Product | Q4 Gross Sales | Key Stat |

|---|---|---|

| BCRED (Direct Lending) | $3.3B | 10% net returns since inception |

| BXPE (Private Equity) | Growing | 17% net returns since inception |

| BX Infra | $4B AUM | Launched 1 year ago |

| BREIT (Real Estate) | Recovering | Best net flows in 3+ years in Dec |

Management expects 2026 to be their "busiest year yet" for product launches, with new offerings in the hedge fund space and continued innovation across channels.

What to Watch

Near-term catalysts:

-

IPO pipeline execution – "One of the largest in our history" should drive realizations through 2026, with activity "building as we move through the year"

-

Management fee ramp – Five new PE drawdown funds targeting $50B+ in aggregate will begin earning fees by year-end, with full-year contribution in 2027

-

Real estate recovery – Construction starts are at 12-year lows in both logistics and multifamily. "Real estate has plenty of room to run," Gray said

-

401(k) market – DOL rules facilitating alts in retirement plans could drive "very significant" long-term capital, though meaningful flows likely in 2027

Risks:

- BCRED redemptions ticked up amid "headline noise," though gross inflows exceeded $800M/month in Dec and Jan

- Real estate appreciation was muted (+1.5% for 2025) as life sciences office and UK student housing lagged

The Flywheel Accelerates

Schwarzman framed the opportunity simply: "The structural tailwinds driving the alternative sector, and in particular Blackstone, are accelerating."

The math supports it. With $71 billion in quarterly inflows, $1.3 trillion in AUM generating recurring management fees, and a deal market finally reopening, the firm's earnings power has multiple vectors of growth:

- Fee-related earnings from AUM growth and new fund launches

- Carried interest as realizations accelerate via IPOs and M&A

- Transaction fees from deploying nearly $200B in dry powder

Management's 2026 outlook: margin stability "with the potential for upside," stronger realizations "particularly in the back half," and multiple new products launching in private wealth.

"We think the future has been world normalized," Gray concluded. "Cost of capital comes down. You have what's happening in the AI world, economy growing faster, productivity picking up... We think that will really get this flywheel going."