Earnings summaries and quarterly performance for Blackstone.

Research analysts who have asked questions during Blackstone earnings calls.

Craig Siegenthaler

Bank of America

8 questions for BX

Kenneth Worthington

JPMorgan Chase & Co.

8 questions for BX

Michael Cyprys

Morgan Stanley

8 questions for BX

Steven Chubak

Wolfe Research

8 questions for BX

Brian Bedell

Deutsche Bank

7 questions for BX

Glenn Schorr

Evercore ISI

7 questions for BX

Patrick Davitt

Autonomous Research

7 questions for BX

Alexander Blostein

Goldman Sachs

6 questions for BX

Arnaud Giblat

BNP Paribas

6 questions for BX

Brennan Hawken

UBS Group AG

6 questions for BX

Brian McKenna

Citizens JMP Securities

6 questions for BX

Ben Budish

Barclays PLC

5 questions for BX

Crispin Love

Piper Sandler

5 questions for BX

Dan Fannon

Jefferies & Company Inc.

5 questions for BX

Bill Katz

TD Securities

4 questions for BX

William Katz

TD Cowen

4 questions for BX

Benjamin Budish

Barclays PLC

3 questions for BX

Michael Brown

Wells Fargo Securities

3 questions for BX

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for BX

Daniel Fannon

Jefferies Financial Group Inc.

2 questions for BX

Kyle Voigt

Keefe, Bruyette & Woods

2 questions for BX

Mike Brown

UBS

2 questions for BX

Kaman Chung

Evercore ISI

1 question for BX

Recent press releases and 8-K filings for BX.

- Blackstone’s $82 billion Private Credit Fund (BCRED) saw redemption requests of $3.7 billion (7.9% of assets) and $2 billion in subscriptions, resulting in a $1.7 billion net outflow this quarter.

- To avoid forced selling, the firm raised the fund’s 5% redemption cap and, with employee participation, injected $400 million to fulfill all redemption requests.

- The episode is viewed as a liquidity stress test for the broader ~$2 trillion private-credit market but is considered tactical given BCRED’s size and continued gross inflows.

- Last year, BCRED generated $1.2 billion in fees, representing 13% of Blackstone’s total revenues, underscoring its profitability importance.

- 694 MW greenfield combined-cycle gas turbine power plant in Plaquemine, Louisiana, has commenced commercial operations.

- Facility is expected to generate enough electricity to power 500,000 homes annually and construction created over 400 local jobs.

- Project is the first hydrogen-capable advanced-class generator in MISO South, developed by Kindle Energy since 2021.

- Blackstone’s perpetual private equity strategy (BXPE) funds will acquire Champions Group, a leading residential services platform, from Odyssey Investment Partners.

- Champions Group operates 1,800 field technicians and serves 150,000 active members across HVAC, plumbing, and electrical services.

- Odyssey and management will retain a significant minority stake; terms undisclosed; transaction expected to close in H1 2026, subject to customary conditions.

- Blackstone intends to leverage its strategic and financial resources to accelerate growth and strengthen Champions Group’s market leadership in residential services.

- Funds managed by Blackstone’s perpetual private equity strategy have agreed to acquire Champions Group for roughly $2.5 billion, with closing expected in H1 2026, subject to approvals.

- Champions Group is a scaled residential services platform covering HVAC, plumbing, electrical, and related home repairs, operating with about 1,800 field technicians and 150,000 active members.

- Odyssey Investment Partners and Champions management will retain a significant minority stake post-transaction.

- Blackstone’s scale includes $1.242 trillion in assets under management and $906.2 billion in fee-earning assets as of September 2025; market cap ~$101.88 billion, with a three-year revenue decline of 14.9% and net margin of 24.3%.

- Blackstone is leading a $1.2 billion financing for AI cloud startup Neysa, committing up to $600 million in equity and backing a further $600 million in debt to secure a majority stake.

- The round values Neysa at around $1.4 billion, following prior funding of roughly $50 million.

- Proceeds will support deployment of more than 20,000 GPUs in India to build GPU-first sovereign compute and software tools for enterprises, government clients, and AI labs.

- Blackstone intends to leverage its global data-center platforms (QTS, AirTrunk, CoreWeave, and Firmus) to expand Neysa beyond India, anticipating India’s GPU capacity to grow from under 60,000 to over two million GPUs.

- Blackstone injected $200 million into its Anthropic holding, lifting its total stake to about $1 billion and valuing the AI developer at roughly $350 billion.

- The fundraising round has exceeded its initial $10 billion target by more than double, and Blackstone had earlier joined a $13 billion round at a $183 billion valuation.

- Anthropic counts major tech firms Amazon and Alphabet among its backers.

- Following the new investment, Blackstone, which manages $1.242 trillion in assets, saw its share price climb approximately 1.7%.

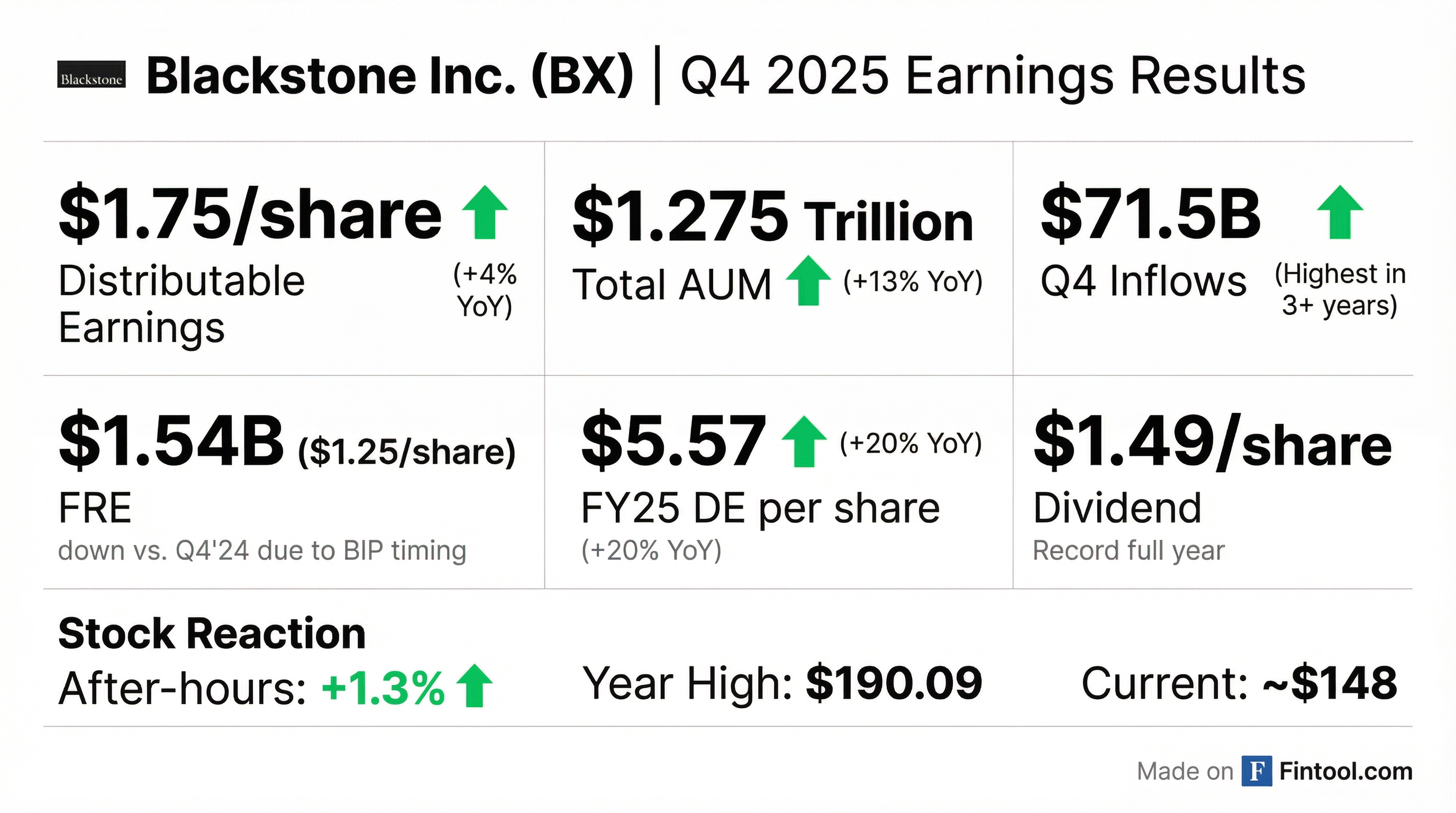

- $138 billion deployed in 2025 (a four-year high), including $42 billion in Q4, with continued focus on AI infrastructure, electrification, life sciences and private credit in 2026.

- $239 billion of inflows in 2025 (+40% YoY), led by institutional (+50%), individual (+50%) and insurance (+20%); drawdown fundraising in 2026 is expected to surpass 2025 levels.

- Base management fees grew mid-teens across three of four segments in Q4 2025; fee-earning AUM up 14% in open-ended strategies (BXMA) and strong transaction fee outlook underpin multi-year fee-related earnings growth.

- Applying AI in operations (e.g., coding, cybersecurity, legal review, valuations) to boost efficiency by 30–100%; holds 7% of AUM in software while investing in AI infrastructure and application companies to capitalize on the AI revolution.

- Strong portfolio performance: corporate private equity revenue grew 9% in Q4 and QTS data center leasing expanded 50% in 2025, reflecting robust macro and AI-driven trends.

- Record investment and fundraising: deployed $138 billion in 2025 (including $42 billion in Q4) and generated $239 billion of inflows, up 40% year-over-year.

- 2026 financial outlook: expects mid-teens growth in base management fees across most segments, driven by new drawdown funds totaling over $50 billion, private wealth expansion, and continued momentum in credit and BXMA strategies.

- Private credit and real estate strength: maintains a $520 billion credit platform with 16% fee-related earnings growth and 37% distributable earnings growth in 2025; real estate fundamentals improving with BREIT net inflows of 8.1%.

- Blackstone sees a healthy macro backdrop with 9% Q4 revenue growth in its corporate PE portfolio, stable margins, and anticipates AI-driven productivity gains; its U.S. data center platform QTS grew leasing 50% in 2025.

- Deployed a record $138 bn in investments in 2025—incl. 8 public-to-private deals, record credit and secondaries activity—with focus on AI/data centers, power and electrification (31 investments, $10 bn equity), life sciences, private credit, and Asia expansion.

- Achieved $239 bn of fundraising inflows in 2025 (+40% YoY), driven by institutional (+50%), individual (+50%), and insurance (+20%) channels, and expects 2026 drawdown fundraising to exceed 2025 levels.

- Projects multi-year financial strength: mid-teens base management fee growth in three segments in Q4; launching 5 new PE drawdown funds totalling $50 bn+ in 2026; and foresees ramping dispositions and incentive-fee crystallizations in 2027.

- Private wealth AUM surpassed $300 bn, leveraging partnerships (Wellington/Vanguard, L&G, Empower), rolling out ERISA-compatible CITs (BREIT, private equity) for retirement, and expanding distribution in key markets (Japan, Canada, Australia, Korea).

- Anthropic signed a full-building lease for the 466,000 sq ft 300 Howard and 18,000 sq ft 342 Howard in San Francisco from a DivcoWest–Blackstone Real Estate JV, marking one of the city’s largest office commitments.

- The lease anchors Anthropic’s expansion into AI Alley, underscoring AI-driven demand and contributing to downtown San Francisco’s revitalization.

- Anthropic, with over 1,300 Bay Area employees, will consolidate its local footprint previously split across two nearby buildings.

- Blackstone Real Estate highlights its long-term commitment to San Francisco, citing the AI revolution as a key driver of office utilization and demand.

Fintool News

In-depth analysis and coverage of Blackstone.

Blackstone and J&J Strike First-Ever Co-Funding Deal for AML Drug

Blackstone Bets $2.5 Billion on AI-Resistant Home Services with Champions Group Buy

Blackstone CFO Defends Software Credit Exposure at Bank of America Conference, Shares Jump 2.6%

Blackstone Leads $10 Billion AI Data Center Loan to Australia's Firmus

Blackstone Hits 'Escape Velocity' With Record $1.75 EPS and $71B Quarterly Inflows

Blackstone Weighs $5B+ Sale of Beacon Offshore, Signaling End of PE Energy Era

Quarterly earnings call transcripts for Blackstone.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more