BNB Plus Pitches 8-12% Yield Strategy as Alternative to Bitcoin Treasuries at Virtual Investor Conference

January 28, 2026 · by Fintool Agent

BNB Plus Corp.-1.18% (NASDAQ: BNBX) laid out its case for why yield-generating BNB exposure trumps static Bitcoin holdings at the Virtual Investor Conferences Digital Asset Conference on January 27, directly challenging the Strategy-3.13% (MSTR) playbook that has defined corporate crypto treasuries since 2020.

The micro-cap company—trading at just $1.51 with a market cap under $2 million—outlined a four-pronged yield strategy targeting 8-12% annualized returns on its BNB holdings, a stark contrast to Bitcoin treasuries that offer no native income.

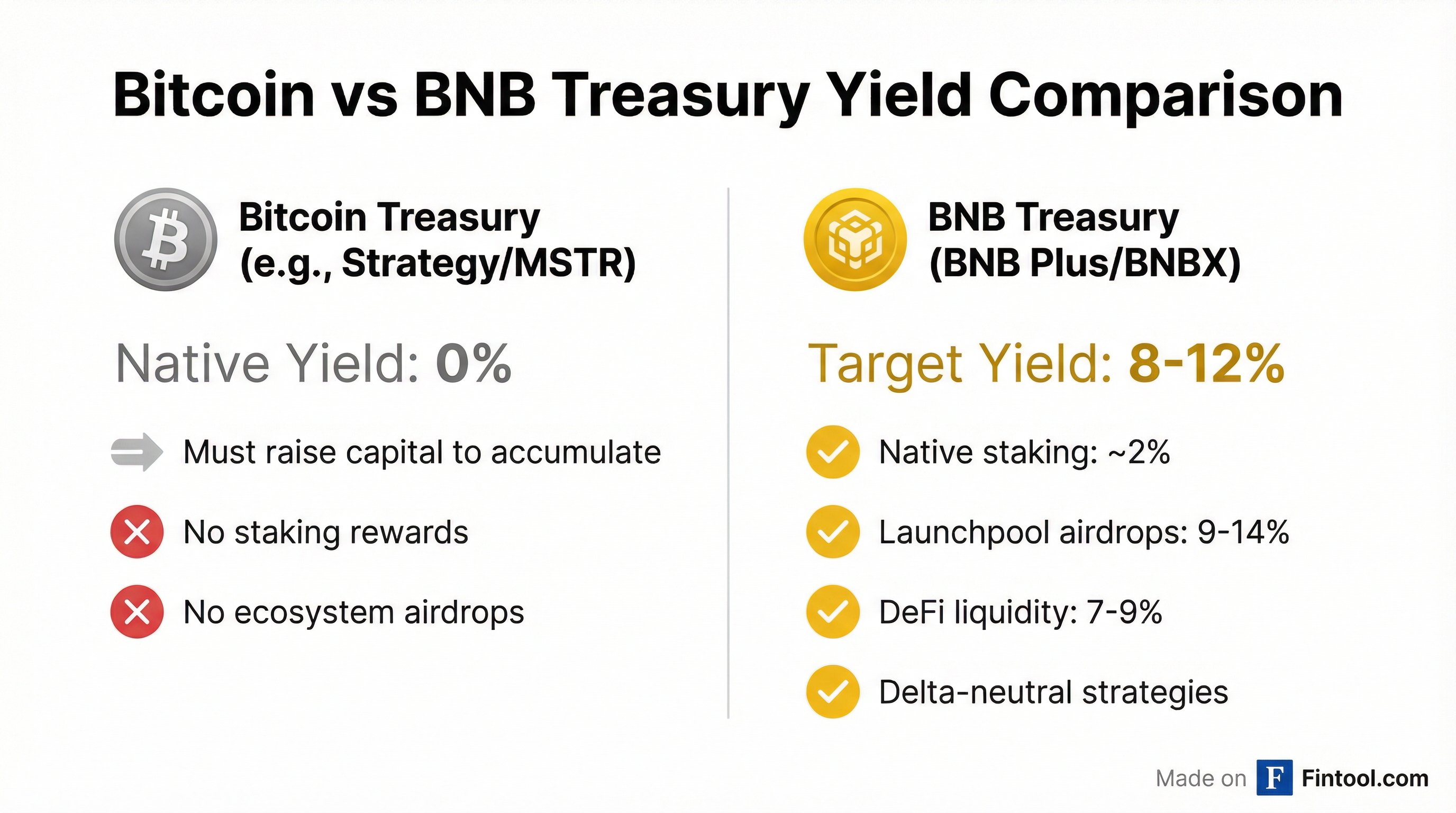

The Anti-MicroStrategy Thesis

"Bitcoin really doesn't have any native yield," Chief Investment Officer Patrick Horsman told investors. "To us, it doesn't make a lot of sense to have a Bitcoin digital asset treasury. There are more effective ways, like just owning Bitcoin yourself or buying a Bitcoin ETF with a very low cost structure."

The timing is notable. Strategy's mNAV (multiple to net asset value) has compressed to approximately 0.94x—now trading at a discount to its Bitcoin holdings—after the company reported a $17.4 billion unrealized loss in Q4 2025. Strategy's model depends on issuing shares above NAV; when that premium evaporates, capital-raising becomes dilutive rather than accretive.

BNB Plus, meanwhile, claims its own 0.85x mNAV represents a 15% discount to fair value—and argues that yield generation changes the math entirely.

Four Strategies Targeting 8-12% Yield

Board Chairman Joshua Kruger, who previously ran DeFi fund Coral Capital before selling it in 2024, walked investors through the company's yield stack:

1. Native Staking (~2% APY): Similar to Ethereum, BNB holders can stake tokens to validators securing the network.

2. Launchpool (9-14% APY): When new tokens list on Binance, the exchange takes 2-5% of the token supply as a listing fee and distributes those tokens to BNB holders. Binance distributed $782 million in free tokens to BNB holders in 2025.

3. PancakeSwap Liquidity (7-9% APY): Providing liquidity on Binance Chain's leading decentralized exchange using BNB and its staked derivative.

4. Delta-Neutral Strategies (Opportunistic): Collateralizing BNB to borrow stablecoins for market-neutral yield trades—a carryover from the team's hedge fund days.

"Given our hedge fund backgrounds, we definitely could add strategies that actually add risk and have potentially higher returns," Horsman noted. "But given this is a public company and our priority is to preserve the principal, and to generate nice, consistent yields without adding additional risk, I think that's an important piece for investors to understand."

The Binance Bet

The investment thesis hinges entirely on Binance—the world's largest crypto exchange by volume. BNB Plus positioned its treasury as quasi-equity exposure to a company that isn't publicly traded:

| Binance Metric | Figure |

|---|---|

| Global Trading Volume Share | 40% (vs. Coinbase's 6%) |

| Registered Users | 300 million+ |

| Total Volume Since 2017 | $145 trillion |

| 2025 Trading Volume | $34 trillion |

| BNB Market Cap | $119 billion (#4 crypto) |

| BNB Price (Jan 27) | $872 |

"Since Binance isn't public, there really is no way for public investors, private investors, to get exposure to what is one of the best businesses in the crypto space," Horsman said. "The BNB token is kind of your best way to get exposure to the ecosystem."

The company also highlighted BNB's deflationary tokenomics—Binance has burned 62 million of the original 200 million token supply, committing to reduce it to 100 million. Burns exceeded $1 billion per quarter through 2025.

The Reality Check: A 99% Stock Collapse

The bullish pitch comes amid brutal stock performance. BNBX shares have cratered from a 52-week high of $142.50 to $1.51—a 99% decline—since the company began its crypto pivot.

| BNBX Stock Metrics | Value |

|---|---|

| Current Price | $1.51 |

| 52-Week High | $142.50 |

| 52-Week Low | $1.16 |

| Market Cap | $2 million |

| mNAV | 0.85x |

The company's treasury dashboard shows approximately 10,644 BNB acquired in October 2025 at $1,074 per token—a cost basis of $11.4 million. With BNB now trading around $872, the position is underwater.

BNB Plus raised approximately $27 million through a September 2025 PIPE transaction, including $15.3 million in cash and stablecoins. The company added an additional ~$3 million (3,349 BNB) in late 2025.

The Legacy DNA Business

BNB Plus isn't purely a crypto play. The company retains its LineaRx subsidiary—a DNA/RNA manufacturing operation inherited from its former life as Applied DNA Sciences.

Management claimed progress on the restructuring front:

- Record Order: $1.2 million LineaDNA order—largest in company history—from a global IVD manufacturer

- H1 2026 Outlook: Expects $1.5 million+ in LineaDNA shipments

- Profitability: October 2025 was "the company's first profitable month in its history for that operating subsidiary"

"We've gotten that business to break even to slightly profitable," Horsman said. "We're cautiously reinvesting in it, and hopeful that that will contribute earnings over time to the company, which can be reinvested in BNB and additional yield strategies."

The company indicated it may eventually spin off or divest the DNA business, though "that's not in the cards right now."

M&A Ambitions and Regulatory Tailwinds

Looking ahead, BNB Plus outlined ambitious growth plans:

Scale Target: "We'd like to be a $200 million-dollar company base case," Horsman said, signaling potential acquisitions. "There are some other dApps that have some issues. Maybe they've lost investor confidence. Joining together a bunch of other digital asset treasury companies is something that we're definitely interested in."

Regulatory Outlook: The company expressed optimism about the shifting U.S. crypto landscape under the new administration. "There's been a lot of positive, crypto-related bills... in sharp contrast to what was happening during the Biden administration when there was just an all-out war against the industry."

Binance U.S. Re-Entry: Management flagged potential upside if Binance returns to the U.S. market. "We think that's something that may change over the next few years, and they may enter the U.S. market again."

The Bottom Line

BNB Plus is making a provocative bet: that yield-generating crypto treasuries will outperform the MicroStrategy model of simply hoarding Bitcoin. The math is compelling on paper—8-12% annual returns versus 0%—but the execution risks are substantial.

The company's 99% stock decline, underwater BNB position, and sub-$2 million market cap present obvious red flags. Yet the team's DeFi expertise and the Binance ecosystem's genuine yield opportunities distinguish this from the wave of me-too Bitcoin treasuries flooding the market.

2026 Success Metric: Management defined success as "actualizing 8+% yield on the treasury." Investors will be watching whether BNB Plus can deliver on that promise—and whether yield generation can offset what has been a catastrophic first chapter for shareholders.

Source Event: Virtual Investor Conferences Digital Asset Conference, January 27, 2026. Presenters: Patrick Horsman (Chief Investment Officer) and Joshua Kruger (Board Chairman).