BOJ Watchers See 1% Rates by September as Weak Yen Forces Japan's Hand

January 15, 2026 · by Fintool Agent

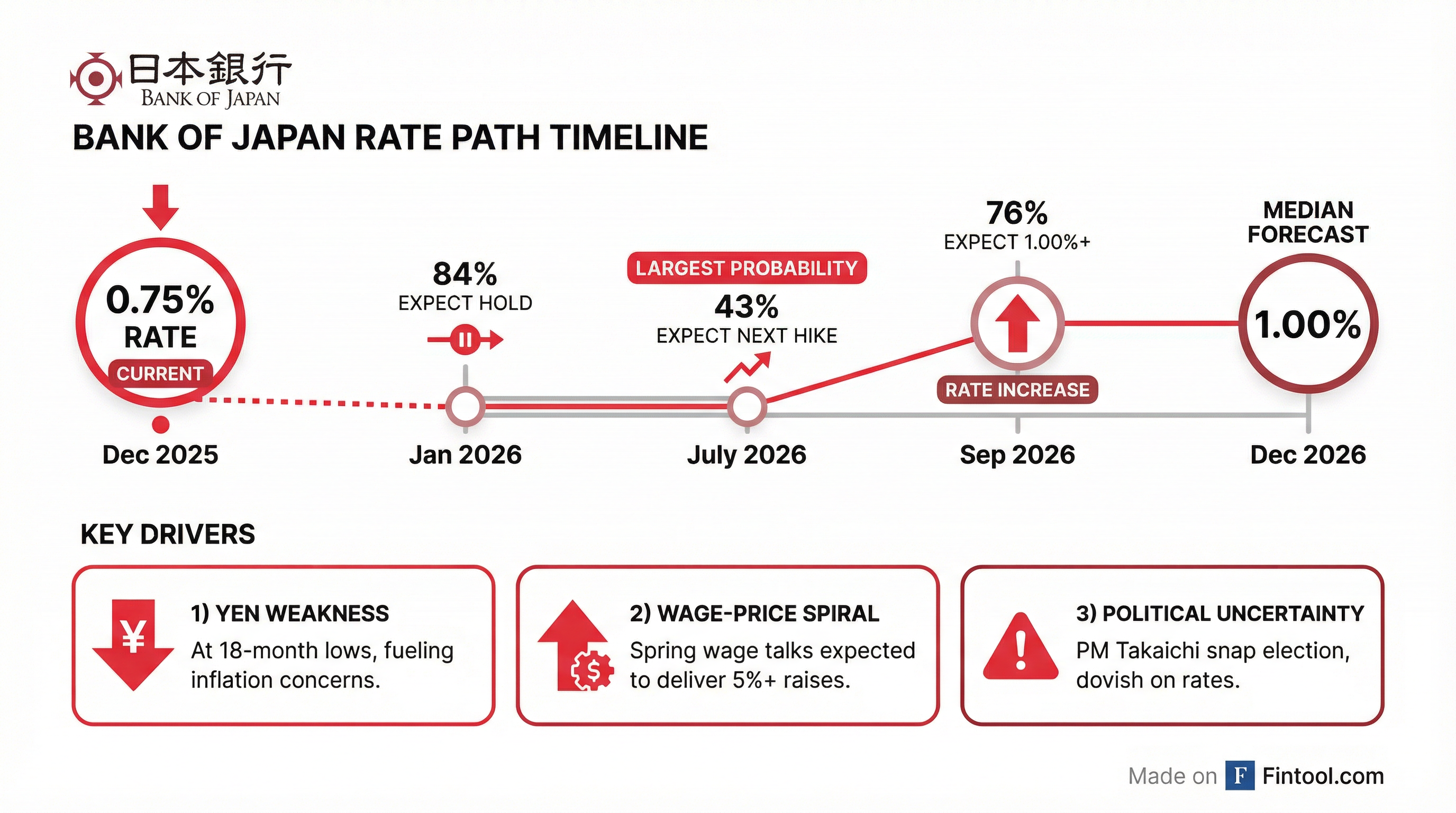

More than three-quarters of economists now expect the Bank of Japan+4.88% to push interest rates to 1% or higher by September—a pace that could accelerate if the yen's slide toward intervention territory persists.

The findings, from a Reuters poll of 67 economists, mark a sharp shift in sentiment. Just weeks after the BOJ raised its benchmark rate to 0.75% in December—the highest level in three decades—markets are already pricing in faster tightening. July is now the top choice for the next hike, with 43% of respondents pointing to that meeting.

The Yen Problem

Despite December's rate increase, the Japanese yen continues to weaken. The Invesco CurrencyShares Japanese Yen Trust (FXY+0.02%) has fallen 7.3% since October and hit an 18-month low this week following news that Prime Minister Sanae Takaichi will call a snap election next month.

BOJ officials are paying increasing attention to the yen's potential impact on inflation, according to sources familiar with the matter. While the central bank has no preset course for borrowing costs, the weak currency could prompt policymakers to bring forward subsequent rate hikes.

"The danger today, given recent FX price action as rate expectations strengthened, was that there would not be enough in this hike to halt yen selling," said Derek Halpenny, head of research at MUFG. "Intervention risks over the quieter Christmas period are becoming a more realistic prospect."

Banks Surge on Rate Hike Expectations

While the weak yen creates headaches for policymakers, Japanese banks are celebrating. Mitsubishi Ufj Financial Group+4.88% has surged 19% since October, with the stock gaining another 19.5% since the December rate hike alone. Nomura Holdings+5.68% has been an even bigger winner, rallying 31.5% over the same period.

| Stock | Since Oct 1 | Since Dec BOJ Hike |

|---|---|---|

| MUFG | +19.0% | +19.5% |

| Nomura (NMR) | +31.5% | +14.4% |

| Toyota (TM) | +21.1% | +7.5% |

| Sony (SONY) | -16.1% | -6.9% |

| Yen (FXY) | -7.3% | -1.9% |

The divergence tells the story of Japan's rate normalization: banks thrive on higher net interest margins, while exporters like Sony+4.80% face margin pressure from the weaker currency's inflationary effects.

Political Uncertainty Clouds the Path

Prime Minister Takaichi's decision to call a snap election adds another layer of complexity. Known as a fiscal and monetary dove, Takaichi rattled markets immediately after taking office in October by saying she had control over the direction of monetary policy and stressed her preference for low interest rates.

Some of Takaichi's advisers have repeatedly warned against the danger of additional interest rate increases, creating tension between the government's preferences and the BOJ's inflation mandate.

Former BOJ Executive Director Momma Kazuo offered a nuanced view: "The BOJ is adjusting interest rates solely because the norm—the socially accepted expectation for inflation—has shifted. Since the BOJ's primary mandate is price stability, it has to raise rates when prices go up, even if the economy is sluggish."

What to Watch

January 23 Meeting: All but two of 67 economists expect the BOJ to hold rates steady at its upcoming meeting. The focus will be on the quarterly Outlook Report for signals about how policymakers view inflationary pressures from the yen's recent weakness.

Spring Wage Negotiations: Japan's annual "shuntō" wage talks begin in February. Companies delivered the most generous raises in three decades last year, and BOJ officials are closely watching whether this trend continues. Strong wage growth would support the case for continued rate normalization.

Terminal Rate: The median forecast for where rates ultimately settle is 1.5%, up from 1.0% in polls taken a year ago. Some economists now see rates reaching 2.0%—a level Japan hasn't seen since the 1990s.

Investment Implications

For global portfolios, the BOJ's tightening path has significant implications:

Currency Exposure: The rate differential between Japan and the U.S. remains wide, keeping downward pressure on the yen. However, any hawkish surprise from the BOJ could trigger sharp yen rallies, as seen during past intervention episodes.

Carry Trade Dynamics: Japan has long served as a funding currency for carry trades. As Japanese rates rise, these positions become less attractive, potentially triggering unwinds that could ripple through global markets.

Equity Allocation: Japanese banks offer a direct play on rate normalization, while export-heavy sectors face margin headwinds from inflation. The Nikkei 225 hit record highs earlier this month despite these cross-currents, supported by corporate governance reforms and strong earnings.

A slight majority of economists (14 of 27 polled) said there was "neither high nor low" risk of the BOJ falling "behind the curve" in taming inflation. But with consumer prices above the 2% target for nearly four years now, pressure to normalize policy continues to build.

Related: MUFG Company Profile+4.88% · Nomura Holdings Profile+5.68% · Toyota Motor Profile+2.96% · Sony Group Profile+4.80%