Earnings summaries and quarterly performance for Sony Group.

Research analysts who have asked questions during Sony Group earnings calls.

Junya Ayada

JPMorgan Chase & Co.

5 questions for SONY

Ryosuke Katsura

SMBC Nikko Securities Inc.

5 questions for SONY

Munakata san

Goldman Sachs

3 questions for SONY

Nakayama

Yomiuri Newspaper

3 questions for SONY

Okazaki san

Nomura Securities

3 questions for SONY

Yasuo Nakane

Mizuho Securities Co., Ltd.

3 questions for SONY

Ayada san

JPMorgan Securities

2 questions for SONY

Katsura san

SMBC Nikko Securities

2 questions for SONY

Mikio Hirakawa

Bank of America

2 questions for SONY

Minami Munakata

Goldman Sachs Group, Inc.

2 questions for SONY

Nakane san

Mizuho Securities

2 questions for SONY

Seno

Mainichi Shimbun

2 questions for SONY

Umegaki

Toyo Keizai

2 questions for SONY

Yamamoto

Free Press

2 questions for SONY

Yoshida

Nikkei

2 questions for SONY

Yoshihiko Nakane

Mizuho Securities Co., Ltd.

2 questions for SONY

Ayata

JPMorgan Chase & Co.

1 question for SONY

Ezawa

Citigroup Securities

1 question for SONY

Iwato san

Nikkei Business

1 question for SONY

Katsura

SMBC Nikko

1 question for SONY

Kota Ezawa

Citigroup Inc.

1 question for SONY

Masahiro Ono

Morgan Stanley

1 question for SONY

Mika Nishimura

Okasan Securities Co., Ltd.

1 question for SONY

Mikio Hirakawa

BofA Securities

1 question for SONY

Narisawa

Asahi Shimbun

1 question for SONY

Nishida san

Freelance

1 question for SONY

Nishikata

NHK (Japan Broadcasting Corporation)

1 question for SONY

Taku Umegaki

Toyo Keizai Inc.

1 question for SONY

Tanaka

The Asahi Shimbun Company

1 question for SONY

Tanno san

NHK

1 question for SONY

Taruno

NHK

1 question for SONY

Toda san

Yomiuri Shimbun

1 question for SONY

Yoshida san

Nikkei Inc.

1 question for SONY

Yukio Yoshida

Nikkei Inc.

1 question for SONY

Recent press releases and 8-K filings for SONY.

- Sony Group Corporation filed its Share Buyback Report for the period from January 1, 2026, to January 31, 2026.

- The share repurchase program approved on May 14, 2025, which authorized up to 250,000,000,000 Yen, was 100.00% utilized as of January 31, 2026, with 63,156,800 shares repurchased. This program concluded on October 27, 2025.

- For the program approved on November 11, 2025, Sony repurchased 4,971,600 shares totaling 19,656,086,859 Yen during January 2026. As of January 31, 2026, 50.00% of the maximum authorized amount of 100,000,000,000 Yen has been used, corresponding to 12,100,400 shares.

- As of January 31, 2026, the company held 186,469,367 shares in treasury.

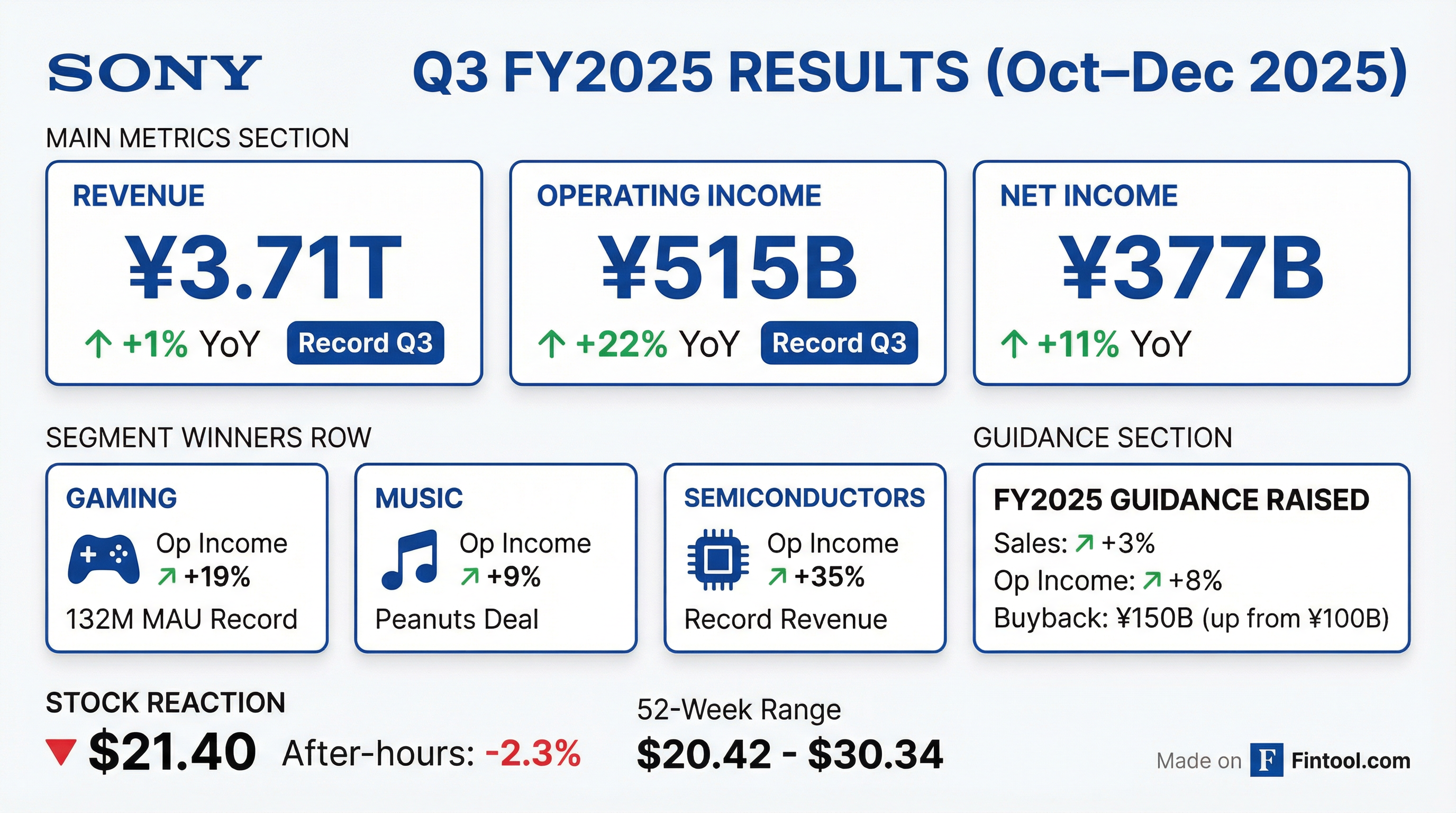

- Sony Group Corporation reported strong Q3 FY2025 results for continuing operations, with sales increasing 1% year-on-year to 3,713.7 billion Yen and operating income rising 22% to 515.0 billion Yen. Net income attributable to stockholders grew 11% to 377.3 billion Yen, with diluted EPS at 62.82 yen.

- The company has upwardly revised its FY2025 forecast for continuing operations, now projecting sales of 12,300 billion Yen (+3% from November forecast) and operating income of 1,540 billion Yen (+8% from November forecast).

- The FY2025 forecast for net income attributable to stockholders was also increased by 8% to 1,130 billion Yen, and operating cash flow by 9% to 1,630 billion Yen.

- Sony plans a total dividend per share of 25 yen for FY2025, representing a 5 yen increase year-on-year. These results and forecasts reflect the reclassification of the Financial Services business as a discontinued operation from Q1 FY25, with the equity method applied from Q3 FY25, following a partial spin-off of Sony Financial Group Inc..

- For the nine months ended December 31, 2025, continuing operations reported sales of 9,443,203 million Yen, an increase of 2.3% year-on-year, and operating income of 1,283,970 million Yen, up 21.0%. Net income attributable to Sony Group Corporation's stockholders from continuing operations was 947,776 million Yen, with basic EPS of 158.27 Yen.

- Due to the partial spin-off of Sony Financial Group Inc. (SFGI) effective October 1, 2025, the Financial Services business is classified as a discontinued operation. This resulted in a significant net loss from discontinued operations, leading to a consolidated net loss attributable to Sony Group Corporation's stockholders of 409,735 million Yen and a basic loss per share of 68.42 Yen for the nine months ended December 31, 2025.

- For the fiscal year ending March 31, 2026, Sony Group Corporation forecasts continuing operations sales of 12,300,000 million Yen (up 2.2%) and operating income of 1,540,000 million Yen (up 20.6%). Net income attributable to stockholders from continuing operations is projected to be 1,130,000 million Yen (up 5.9%).

- The full fiscal year 2026 forecast, including discontinued operations, anticipates a consolidated net loss attributable to Sony Group Corporation's stockholders of 230 billion yen.

- The company forecasts a total annual dividend per share of 25.00 Yen for the fiscal year ending March 31, 2026.

- Sony raised its fiscal-year operating profit forecast to ¥1.54 trillion after reporting a record third-quarter operating profit of ¥515 billion, an increase of 22%, on roughly ¥3.71 trillion in sales.

- The improvement was driven by gains in imaging and sensing, a stronger music business, and higher software and network-service revenue in gaming, despite PlayStation 5 unit sales falling 16% to 8 million.

- The spin-off of Sony's financial-services unit materially strengthened reported balance-sheet metrics, with equity attributable to Sony stockholders rising to ¥8.16 trillion and the equity ratio improving to 51.4%.

- Sony also expanded its share-buyback authorization and will book a valuation gain of approximately ¥45 billion from increasing its stake in Peanuts Holdings.

- Sony reported record-high Q3 FY25 (Q3 2026) sales of JPY 3,713.7 billion and operating income of JPY 515 billion, leading to an upward revision of its full-year FY25 sales forecast to JPY 12,300 billion and operating income forecast to JPY 1,540 billion.

- The I&SS segment achieved record Q3 sales and operating income, driven by increased volume and unit prices of mobile image sensors, resulting in an upward revision of its FY25 sales forecast to JPY 2,080 billion and operating income forecast to JPY 350 billion.

- In the G&NS segment, while Q3 hardware unit sales decreased, PlayStation Store software revenue reached a record high, and the PS5 cumulative selling units exceeded 92 million.

- Sony announced strategic moves including gaining 80% ownership of Peanuts Worldwide and signing an MOU with TCL for a joint venture in home entertainment, alongside increasing its share buyback facility by JPY 50 billion.

- Sony reported record-high Q3 FY2025 results, with sales increasing 1% to JPY 3,713.7 billion, operating income up 22% to JPY 515 billion, and net income up 11% to JPY 377.3 billion.

- The company upwardly revised its full-year FY2025 forecasts, projecting sales to reach JPY 12,300 billion (up 3%), operating income JPY 1,540 billion (up 8%), and net income JPY 1,130 billion (up 8%).

- Performance was notably strong in the I&SS segment, with Q3 sales increasing 21% and operating income 35% due to mobile image sensors, and the Music segment, which saw Q3 sales rise 13% and operating income 9%.

- Sony announced a strategic partnership with TCL to form a joint venture for its home entertainment business, encompassing TV and home audio, with a definitive agreement expected by the end of March.

- The company also expanded its share repurchase facility by JPY 50 billion, citing better-than-anticipated business results and cash flow.

- Sony Group reported record high Q3 FY 2025 sales of JPY 3,713.7 billion, operating income of JPY 515 billion, and net income of JPY 377.3 billion. This led to an upward revision of its full-year FY 2025 forecasts for sales (3% to JPY 12.3 trillion), operating income (8% to JPY 1.54 trillion), and net income (8% to JPY 1.13 trillion).

- The Game & Network Services (G&NS), Music, and Imaging & Sensing Solutions (I&SS) segments were key drivers, all achieving record high operating income for the quarter.

- The company increased its share repurchase facility from JPY 100 billion to JPY 150 billion.

- Strategic developments include gaining 80% ownership of Peanuts Worldwide and signing an MOU with TCL for a joint venture in its home entertainment business.

- PlayStation 5 (PS5) cumulative sales surpassed 92 million units, with a strategic focus on expanding software and network service revenue in the console's later lifecycle.

- Sony Music Group and Singapore’s sovereign-wealth fund GIC have established a joint venture to acquire music catalogs, with investment targets reported to be between over $1 billion and as much as $2–3 billion.

- Under the partnership, Sony will manage the acquired catalogs, overseeing distribution to streaming platforms and licensing for various media, while GIC will provide long-term capital and investment expertise. Sony Bank is also participating in this venture.

- This deal underscores the increasing institutional interest in music rights as a long-term asset class and is viewed by GIC as a strategic move to capitalize on streaming monetization, premiumization, and subscriber growth, especially in emerging markets.

- Sony Corporation, a wholly-owned subsidiary of Sony Group Corporation, has signed a memorandum of understanding with TCL Electronics Holdings Limited for a strategic partnership in the home entertainment field.

- The partnership intends to form a joint venture where TCL will hold 51% and Sony will hold 49% of the shares, assuming Sony's home entertainment business.

- This new company will handle the full process from product development to customer service for products including televisions and home audio equipment, with operations expected to commence in April 2027.

- Definitive binding agreements are targeted for execution by the end of March 2026, and the financial impact on Sony Group Corporation is currently under evaluation.

- Sony and TCL have signed a non-binding memorandum of understanding (MOU) to form a global joint venture for Sony’s television and home entertainment business.

- The proposed joint venture would see TCL owning 51% and Sony 49%, covering product development through manufacturing, sales, logistics, and customer service for TVs and home audio.

- The MOU includes an exclusivity clause preventing Sony from pursuing similar talks with other parties until the end of March 2026, with the aim to finalize definitive agreements by that time.

- Subject to agreements, regulatory approvals, and other conditions, the partners expect the joint venture to begin operations in April 2027.

Fintool News

In-depth analysis and coverage of Sony Group.

Quarterly earnings call transcripts for Sony Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more