Sony Posts Record Profit, Raises Guidance — Stock Falls Anyway

February 5, 2026 · by Fintool Agent

Sony Group delivered its best third quarter ever — ¥515 billion in operating profit, up 22% year-over-year, on ¥3.71 trillion in sales — and raised its full-year outlook across the board. Yet the stock fell nearly 3%, extending a 26% decline since October as investors prioritize memory shortage risks and AI-related capital allocation over entertainment fundamentals.

CFO Lin Tao acknowledged the disconnect on the earnings call: "Memory concerns are one factor, and capital is flowing to AI-related stocks rather than entertainment. For us, what we can do is make our fundamentals even stronger."

The Numbers

| Metric | Q3 FY25 | vs. Prior Year | Full-Year Forecast (Revised) |

|---|---|---|---|

| Operating Profit | ¥515B | +22% | ¥1.54T (+8% from prior) |

| Sales | ¥3.71T | +1% | ¥12.3T (+3% from prior) |

| Net Income | ¥377.3B | +11% | ¥1.13T (+8% from prior) |

| Operating Cash Flow | — | — | ¥1.63T (+9% from prior) |

Both Q3 sales and operating profit set record highs for the period. Sony also expanded its share buyback authorization from ¥100 billion to ¥150 billion.

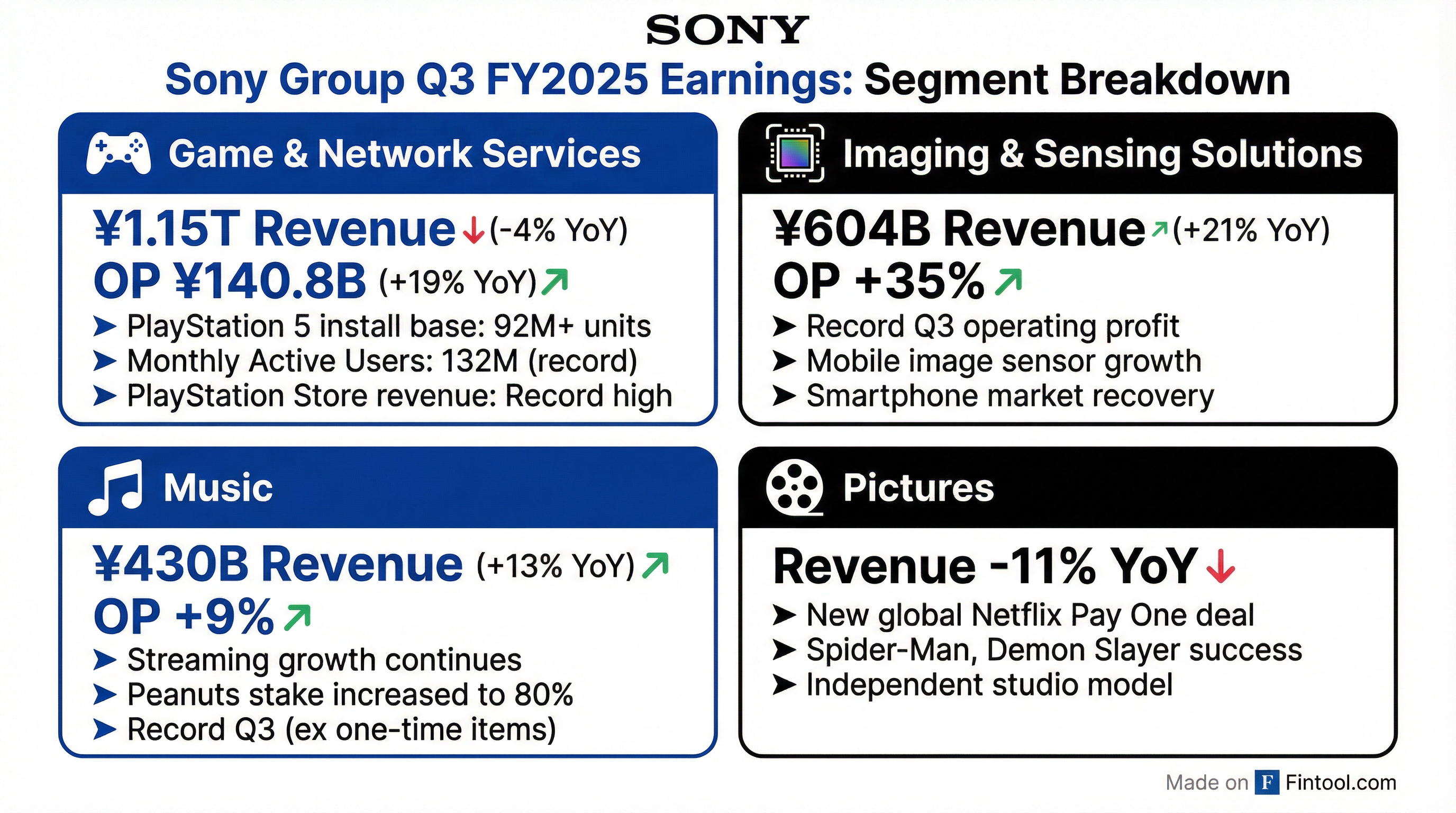

Segment Breakdown

Gaming (G&NS): Operating income rose 19% to ¥140.8 billion — a record for the quarter — despite PS5 hardware sales falling 16% to 8 million units. The key driver: PlayStation Network hit 132 million monthly active accounts (a record), while PlayStation Store and software revenue reached all-time highs. Sony is clearly shifting emphasis from hardware volume to monetizing its 92+ million install base.

"Given the stage of our console cycle, our hardware sales strategy can be adjusted flexibly," Tao said. "We intend to minimize the impact of increased memory cost by prioritizing monetization of the install base."

Image Sensors (I&SS): The standout performer with sales up 21% to ¥604 billion and operating profit surging 35% — both record highs. Recovery in the smartphone market and strong demand for larger, higher-resolution sensors drove the gains. Management upwardly revised segment forecasts and noted that high-end mobile sensors face relatively limited exposure to memory-driven production cuts.

Music: Operating income rose 9% to a record (excluding one-time items), driven by streaming growth and live event revenue. Sony will book a ¥45 billion valuation gain from increasing its stake in Peanuts Holdings to 80% for roughly $460 million.

Pictures: Revenue fell 11% as the quarter lacked a blockbuster comparable to last year's Venom: The Last Dance. However, Sony Pictures signed a landmark global Pay One licensing deal with Netflix for future theatrical films — an "industry-first" agreement that CFO Tao called "proof of SPE's excellent production capabilities."

The Memory Overhang

The global memory shortage — driven by insatiable AI data center demand siphoning HBM supply from consumer devices — has become Sony's most pressing near-term headwind.

Management said it has already secured "minimum quantities necessary" through next fiscal year's holiday season and is negotiating for additional supply. For PS5, which enters the latter half of its lifecycle with over 92 million units sold, Sony has flexibility:

"There are several or a wide range of choices or options that we can take," Tao noted, suggesting hardware strategy adjustments are possible.

For image sensors, the calculus is different. While low-end smartphone production may decline, Sony's focus on high-end sensors provides some insulation. "Since Sony's image sensors are primarily for the high-end market, at this time, we think the impact will be relatively small," Tao said.

Strategic Moves

Two structural transactions are reshaping Sony's portfolio:

-

TCL Joint Venture: Sony signed an MOU to form a joint venture with TCL for its home entertainment business (TVs and home audio). The deal combines Sony's brand and technology with TCL's cost structure and supply chain, targeting sustainable growth in a challenging segment. A definitive agreement is expected by March 31.

-

Financial Services Spinoff: The October deconsolidation of Sony Financial Services materially improved balance sheet metrics — equity attributable to stockholders rose to ¥8.16 trillion and the equity ratio improved to 51.4% from 23.2% at March 31, 2025.

Stock Disconnect

The market reaction underscores a broader theme: fundamentals aren't enough when capital rotates. Sony shares have fallen 26% since October despite three consecutive quarters of upward revisions. The stock trades at $21.31, well below its 52-week high of $30.34.

When asked about the muted stock response, Tao was philosophical: "We would look at the fundamentals to make them even stronger, and the profitability we would improve so that the portfolio can be optimized. Sony's long-term strategy — we believe in that so that the stock market would value our approach."

What to Watch

Near-term catalysts:

- Marathon launch (March 5): Bungie's live-service shooter, delayed multiple times, is Sony's next major first-party bet.

- Memory supply negotiations: Any clarity on cost pass-through or supply security for FY2027

- TCL JV closing: Expected by end of March; details on scope and financial impact pending

FY2027 setup: Management signaled confidence in the software lineup — Marvel's Wolverine and Saros are among titles planned for next fiscal year — while cautioning that memory cost impacts will become clearer at the next earnings release.

For investors, the question is whether Sony's record profitability and expanding recurring revenue base can eventually overcome the macro headwinds. At 6x forward earnings (implied), the market is skeptical.

Related: Sony Group