Brookfield Bets $1.2 Billion on AI-Fueled Industrial Real Estate Boom

February 2, 2026 · by Fintool Agent

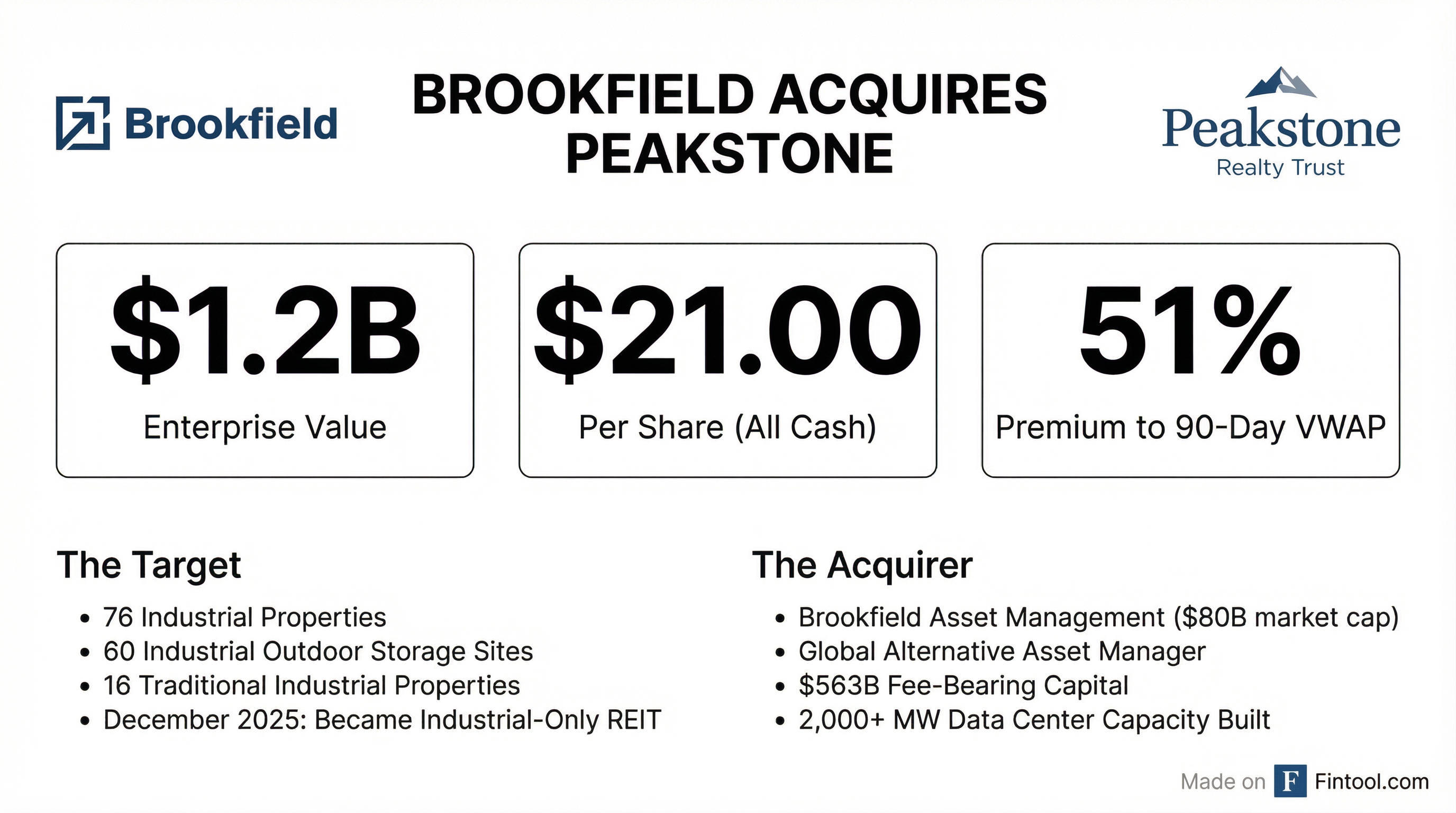

Brookfield Asset Management is paying a 51% premium to take Peakstone Realty Trust private in a $1.2 billion deal that reflects surging demand for industrial real estate as AI infrastructure investment accelerates globally.

Peakstone shareholders will receive $21.00 per share in cash—a 34% premium to Friday's close and a striking 51% premium to the company's 90-day VWAP. The stock surged 33% in Monday trading following the announcement.

"This acquisition is an exciting opportunity to expand Brookfield's industrial real estate platform with Peakstone's high-quality and well-diversified portfolio," said Lowell Baron, CEO of Brookfield's Real Estate business.

The Target: Peakstone's Transformation Story

The timing is no coincidence. Peakstone completed a strategic metamorphosis just weeks ago—in December 2025, the company finalized the sale of all its office properties, emerging as a pure-play industrial REIT focused on the hot industrial outdoor storage (IOS) sector.

The company's portfolio now comprises 76 industrial properties:

- 60 industrial outdoor storage (IOS) sites — open-air yards used for equipment storage, staging, and logistics

- 16 traditional industrial properties — warehouses and flex spaces

CEO Michael Escalante had telegraphed the company's positioning on its Q3 2025 earnings call: "Market fundamentals remain solid, characterized by strong tenant demand and persistent supply constraints. These dynamics continue to keep vacancies low and support healthy rent growth."

The IOS niche has delivered exceptional results. Peakstone achieved 100% occupancy in its IOS operating portfolio last quarter, with releasing spreads reaching 116% on a cash basis and 120% on a GAAP basis on new leases. In one transaction at a Norcross, Georgia property, the company captured spreads of 239% on a cash basis.

Brookfield's Thesis: The "Three D's" Meet AI

For Brookfield, the deal aligns with what CEO Bruce Flatt has called the three mega-trends reshaping global infrastructure investment: digitalization, decarbonization, and deglobalization.

"Deglobalization has evolved from a discussion around supply chain resiliency into a broader reordering of global trade," Flatt explained on Brookfield's Q2 2025 earnings call. "We are seeing increased reshoring and nearshoring across manufacturing and significant investment in alternative and duplicate supply chains. That is driving a surge in demand for logistics hubs, advanced manufacturing facilities, and modern industrial infrastructure."

The AI buildout is the accelerant. Brookfield has positioned itself at the center of the AI infrastructure boom, having already built over 2,000 megawatts of data center capacity and entering strategic partnerships with hyperscalers like Google and Microsoft.

While the Peakstone acquisition doesn't add data centers directly, it expands Brookfield's exposure to the supporting infrastructure that makes AI campuses possible—the staging grounds, equipment storage, and logistics facilities that service an industry pouring hundreds of billions into physical buildout.

Connor Teskey, CEO of Brookfield Renewable and President of Brookfield Asset Management, framed the opportunity on that same call: "Artificial intelligence is driving exponential demand for compute and requires an unprecedented build out in infrastructure... We believe the infrastructure build outs for AI will be one of the largest capital formation cycles of this generation."

Deal Structure & What's Next

The transaction terms include a 30-day "go-shop" period expiring March 4, 2026, during which Peakstone can actively solicit competing bids. Given the premium paid and the strategic nature of the portfolio, a competing offer appears unlikely—but not impossible in today's M&A-hungry environment.

| Deal Detail | Terms |

|---|---|

| Price per share | $21.00 (all cash) |

| Enterprise value | $1.2 billion |

| Premium to close (Jan 30) | 34% |

| Premium to 30-day VWAP | 46% |

| Premium to 90-day VWAP | 51% |

| Expected close | Q2 2026 |

| Go-shop deadline | March 4, 2026 |

BofA Securities is advising Peakstone, with Latham & Watkins as legal counsel. Citigroup is advising Brookfield, with Gibson Dunn as legal counsel.

As a condition of the transaction, Peakstone has suspended its quarterly dividend. Upon closing, the company's NYSE listing will terminate, and Peakstone will become a wholly-owned subsidiary of a Brookfield private real estate fund.

Investor Takeaways

For Peakstone shareholders, the deal delivers unambiguous value—a 51% premium to the trading average rewards those who held through the company's multi-year transformation from a diversified REIT to an industrial pure-play.

For the broader market, the deal signals continued institutional conviction in industrial real estate despite macro uncertainty. Private capital remains hungry for hard assets with stable cash flows and exposure to structural growth themes.

And for observers of the AI infrastructure buildout, the acquisition is a reminder that the boom's footprint extends well beyond hyperscaler campuses and GPU clusters. The warehouses, logistics hubs, and outdoor storage yards that service this ecosystem are commanding premium valuations—and attracting some of the world's largest asset managers.