Earnings summaries and quarterly performance for Brookfield Asset Management.

Research analysts who have asked questions during Brookfield Asset Management earnings calls.

Alexander Blostein

Goldman Sachs

8 questions for BAM

Cherilyn Radbourne

TD Cowen

8 questions for BAM

Kenneth Worthington

JPMorgan Chase & Co.

8 questions for BAM

Craig Siegenthaler

Bank of America

6 questions for BAM

Mario Saric

Scotiabank

6 questions for BAM

Bart Dziarski

RBC Capital Markets

5 questions for BAM

Jaeme Gloyn

National Bank Financial

5 questions for BAM

Sohrab Movahedi

BMO Capital Markets

5 questions for BAM

Daniel Fannon

Jefferies Financial Group Inc.

4 questions for BAM

Michael Brown

Wells Fargo Securities

4 questions for BAM

Michael Cyprys

Morgan Stanley

4 questions for BAM

Crispin Love

Piper Sandler

3 questions for BAM

Dean Wilkinson

CIBC Capital Markets

3 questions for BAM

Ben Rubin

UBS

2 questions for BAM

Brian Bedell

Deutsche Bank

2 questions for BAM

Dan Fannon

Jefferies & Company Inc.

2 questions for BAM

Robert Kwan

RBC Capital Markets

2 questions for BAM

Barron Thomas

Morgan Stanley

1 question for BAM

Nikolaus Priebe

CIBC

1 question for BAM

Ritwik Roy

Jefferies

1 question for BAM

Vikram Gandhi

HSBC

1 question for BAM

Recent press releases and 8-K filings for BAM.

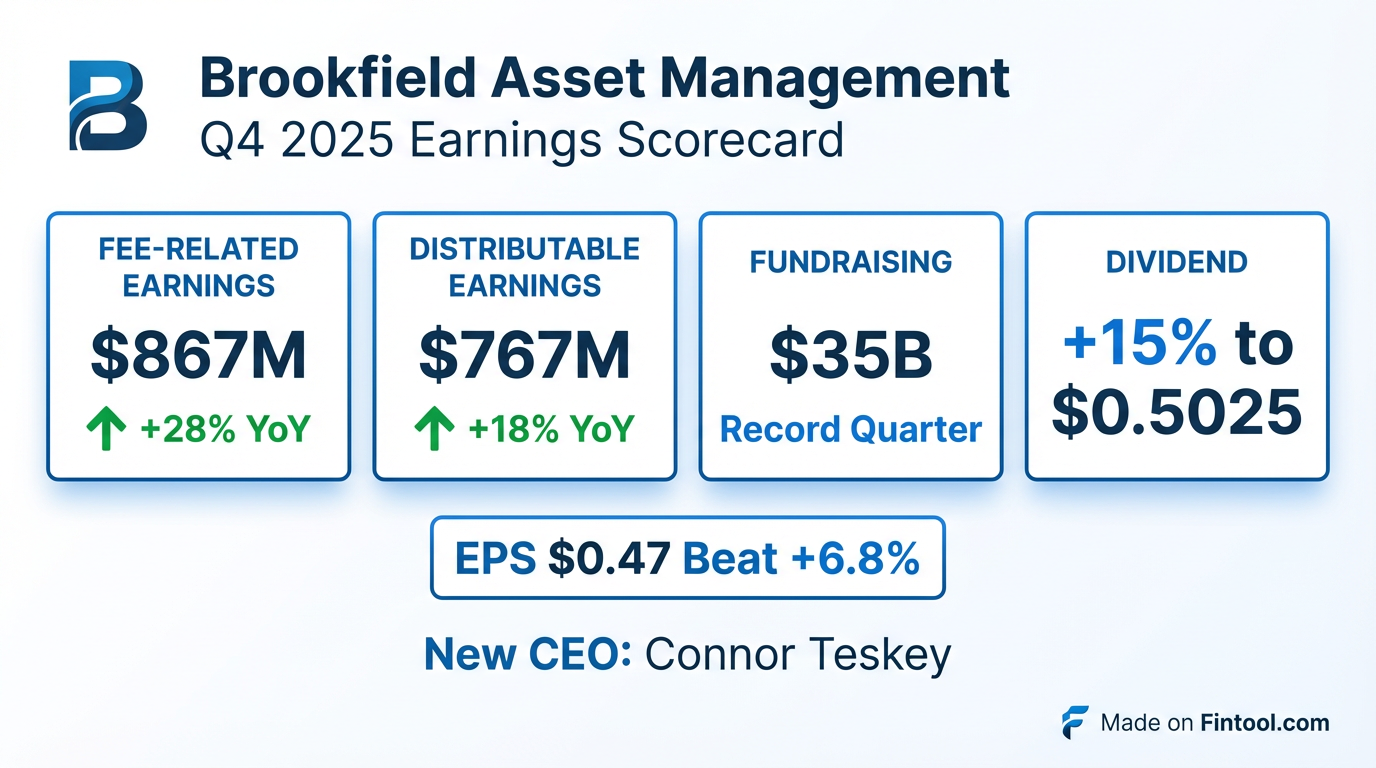

- Brookfield Asset Management (BAM) reported strong financial results for 2025, with fee-related earnings (FRE) reaching a record $3 billion, up 22% year-over-year, and distributable earnings (DE) increasing 14% to $2.7 billion. Fee-bearing capital grew 12% to over $600 billion.

- Conor Teskey has been appointed CEO of Brookfield Asset Management, with Bruce Flatt continuing as Chairman of the board and CEO of Brookfield Corporation.

- The company anticipates 2026 performance to be at or above its long-term growth targets (mid- to high teens for FRE), driven by strong fundraising momentum across infrastructure and private equity, and an expected $200 million of incremental annualized FRE from recent acquisitions and integrations.

- BAM launched a $100 billion global AI infrastructure program, anchored by an inaugural AI infrastructure fund with a $10 billion target that has already secured $5 billion in commitments.

- The board of directors increased the quarterly dividend by 15% to $0.50025 per share, or $2.01 per share on an annualized basis, payable on March 31, 2026.

- Brookfield Asset Management reported record fee-related earnings (FRE) of $3 billion for 2025, a 22% increase year-over-year, with distributable earnings (DE) reaching $2.7 billion, up 14%. For Q4 2025, FRE was $867 million ($0.53 per share) and DE was $767 million ($0.47 per share).

- The company raised $112 billion of capital and invested a record $66 billion in 2025, leading to a 12% increase in fee-bearing capital to over $600 billion. Q4 2025 was its strongest fundraising quarter ever, with $35 billion raised.

- Conor Teskey was appointed CEO of Brookfield Asset Management as part of a long-term succession process.

- The board of directors increased the quarterly dividend by 15% to $0.50025 per share, or $2.01 per share on an annualized basis.

- Brookfield launched a $100 billion global AI infrastructure program, anchored by an inaugural AI Infrastructure Fund with a $10 billion target, which already has $5 billion in commitments. The company expects 2026 to be a very strong year, exceeding long-term growth targets for FRE.

- Brookfield Asset Management (BAM) reported a strong 2025, with fee-related earnings (FRE) reaching a record $3 billion, up 22% year-over-year, and distributable earnings (DE) at $2.7 billion, an increase of 14%. Fee-bearing capital grew 12% to over $600 billion.

- The company raised $112 billion of capital and invested a record $66 billion in 2025, while monetizing $50 billion of equity. Q4 2025 marked the strongest fundraising quarter ever, with $35 billion raised across more than 50 strategies, including $23 billion in credit and $7 billion in infrastructure.

- BAM launched a $100 billion global AI infrastructure program, with its inaugural AI infrastructure fund securing $5 billion in commitments towards a $10 billion target. The company anticipates 2026 to be another record year for fundraising, particularly in infrastructure and private equity, expecting to meet or exceed its long-term target of mid-to-high teens annualized earnings growth.

- Conor Teskey has been appointed CEO of Brookfield Asset Management. The board of directors increased the quarterly dividend by 15% to $0.50025 per share, or $2.01 per share on an annualized basis, payable March 31, 2026.

- Connor Teskey has been appointed CEO of Brookfield Asset Management (BAM), succeeding Bruce Flatt, who will remain chair of BAM's board and CEO of parent Brookfield Corp.

- The appointment coincided with a record fundraising year in 2025 of approximately $112 billion, including $35 billion in the fourth quarter, and the firm raised its dividend.

- Teskey, who previously led the $4.8 billion acquisition of a 61% stake in Oaktree Capital Management, is expected to drive growth in areas such as digital infrastructure and credit.

- Brookfield Asset Management Ltd. reported record financial results for Q4 and FY 2025, with quarterly Fee-Related Earnings of $867 million (up 28% year-over-year) and quarterly Distributable Earnings of $767 million (up 18% year-over-year).

- The Board of Directors declared a quarterly dividend of $0.5025 per share, representing a 15% increase, payable on March 31, 2026.

- Connor Teskey was appointed Chief Executive Officer of BAM, effective February 3, 2026, with Bruce Flatt continuing as Chair of the Board.

- The company achieved record fundraising of $35 billion in Q4 2025 and $112 billion for the full year 2025, increasing its fee-bearing capital to over $600 billion.

- Strategic developments include the launch of a $100 billion global AI infrastructure program and the planned acquisition of the remaining 26% of Oaktree for approximately $3.0 billion, expected to close in the first half of 2026.

- Brookfield Asset Management (BAM) reported record financial results for the quarter and year ended December 31, 2025, with quarterly Fee-Related Earnings of $867 million, up 28% year-over-year, and quarterly Distributable Earnings of $767 million, up 18% year-over-year.

- The company announced a 15% increase in its quarterly dividend to $0.5025 per share, payable on March 31, 2026.

- Connor Teskey was appointed CEO of Brookfield Asset Management, with Bruce Flatt continuing as Chair of the Board.

- BAM achieved record fundraising of $35 billion in Q4 2025 and $112 billion for the full year 2025, growing fee-bearing capital to $603 billion. Strategic initiatives include launching a $100 billion global AI infrastructure program and the acquisition of the final 26% of Oaktree.

- Brookfield Asset Management Ltd. has renewed its normal course issuer bid, providing the option to purchase up to 36,946,177 Class A Limited Voting Shares, which represents approximately 10% of the public float of its outstanding Class A Shares.

- The period for this renewed normal course issuer bid will extend from January 13, 2026, to January 12, 2027.

- As of December 31, 2025, the company had 1,637,941,906 Class A Shares issued and outstanding, with a public float of 369,461,770 shares.

- Under the prior normal course issuer bid, which commenced on January 13, 2025, Brookfield Asset Management purchased 6,548,561 Class A Shares as of December 31, 2025, at a weighted average price of US$54.14.

- All Class A Shares acquired under the new bid will be cancelled or purchased by a non-independent trustee for long-term incentive plans.

- Brookfield Asset Management has renewed its normal course issuer bid, providing the option to purchase up to 36,946,177 Class A Limited Voting Shares, representing approximately 10% of the public float.

- The new share buyback program will be active from January 13, 2026, to January 12, 2027.

- As of December 31, 2025, the public float of Class A Shares totaled 369,461,770.

- Under the prior bid, which commenced on January 13, 2025, the company had purchased 6,548,561 Class A Shares at a weighted average price of US$54.14 as of December 31, 2025.

- The renewal allows the company to acquire Class A Shares in alignment with its investment and capital allocation strategies, with all purchased shares to be cancelled or used for long-term incentive plans.

- Brookfield Asset Management Ltd. published its 2026 Investment Outlook on December 16, 2025, identifying the current period as one of the most significant investment periods in decades, driven by accelerating global economic forces and a structural, multi-decade cycle.

- The outlook highlights a "once-in-a-generation investment supercycle" in infrastructure, fueled by digitalization, decarbonization, and deglobalization, with explosive demand for digital infrastructure and power due to AI adoption.

- In renewable power and transition, global electricity demand is accelerating faster than supply, necessitating an "any-and-all" approach to energy, including renewables, storage, nuclear, and natural gas.

- For private equity, value creation is shifting towards operational excellence and business transformation, while real estate markets are normalizing, creating opportunities for selective, operationally focused investors.

- Brookfield's CEO, Bruce Flatt, highlighted the company's diversified business model across real estate, infrastructure, renewables, credit, and private equity, which contributes to its strong resiliency.

- The company achieved significant fundraising, raising $120 billion in 2024 and $100 billion in 2025, with expectations for larger fundraising in 2026 as major funds enter the market.

- AI infrastructure is a key focus, described as a multi-trillion-dollar capital formation cycle, with Brookfield aiming to manage $100 billion in AI infrastructure assets over a 15-year buildout period.

- Brookfield invested $110 billion in 2025 across its various businesses and realized over $75 billion in sales year-to-date through Q3 2025, with a projected $75-$100 billion in monetizations for 2026.

- The insurance business (BWS) is rapidly expanding, with assets projected to grow from $25 billion five years ago to almost $200 billion shortly, and a long-term goal of $500 billion, leveraging Brookfield Asset Management's investment capabilities.

Fintool News

In-depth analysis and coverage of Brookfield Asset Management.

Quarterly earnings call transcripts for Brookfield Asset Management.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more