Byrna's COO Exits After 18 Months—No Severance, Stock at 52-Week Lows

January 30, 2026 · by Fintool Agent

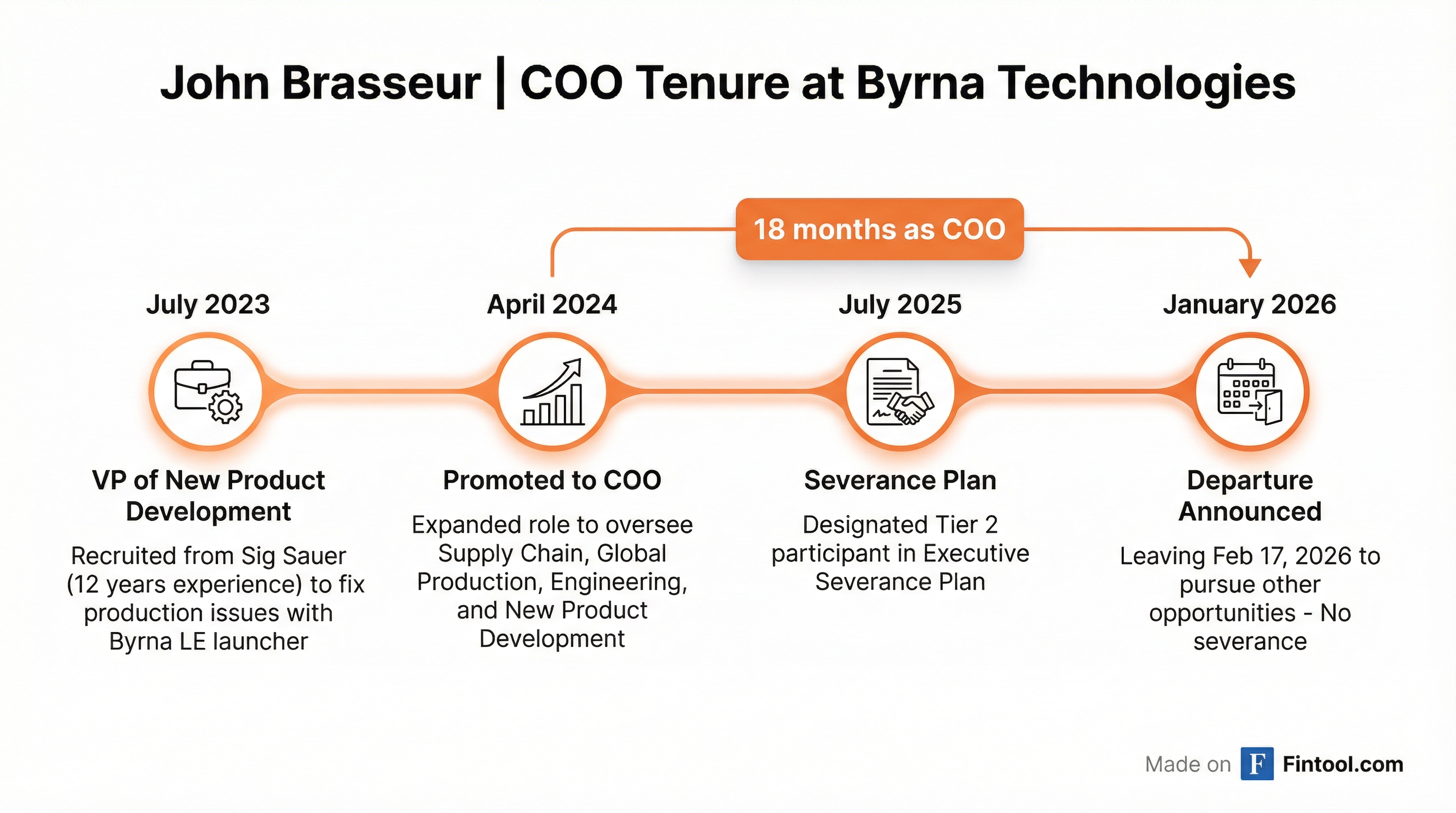

Byrna Technologies COO John Brasseur is leaving the less-lethal weapons maker after 18 months in the role, the company disclosed Thursday in an 8-K filing. His final day will be February 17, 2026—just 12 days after the company's scheduled Q4 2025 earnings call. Brasseur will receive no severance.

Shares fell 3.6% to $13.71 on the news, marking a fresh 52-week low. The stock has now declined 60% from its February 2025 peak of $34.19 and is down 18% year-to-date.

The Departure

The 8-K states Brasseur notified the company on January 29, 2026 of his decision to depart "to pursue other professional opportunities." Notably, Byrna emphasized the departure "was not the result of any disagreement with the Company on any matter relating to the Company's operations, policies, or practices."

What makes this departure unusual: Brasseur will receive no severance or compensatory payments beyond earned wages and standard amounts due. This is notable because just six months ago, in July 2025, Brasseur was designated a Tier 2 participant in Byrna's Executive Severance Plan alongside CFO Laurilee Kearnes and Chief Revenue Officer Luan Pham.

The standard 8-K boilerplate language—no disagreement, pursuing other opportunities—reveals little about the actual circumstances. But the timing and terms raise questions.

Brasseur's Track Record

Byrna recruited Brasseur in July 2023 specifically to fix a crisis. The company had botched the rollout of its new Byrna LE launcher, facing "unforeseen production problems and quality control issues" from out-of-spec components that forced a production halt.

CEO Bryan Ganz publicly disclosed the severity at the time: "Not only was this a black eye for the company, it had a material negative impact on sales." The company terminated its VP of New Product Development and demoted the CTO (who later resigned).

Brasseur was brought in as the fix. His credentials: 12 years at Sig Sauer, a leading firearms manufacturer, most recently as VP of Product Management. Within nine months, he was promoted to COO in April 2024 and given broad authority over supply chain, global production, engineering, and new product development.

The turnaround seemed to work. Under his tenure, Byrna:

- Successfully relaunched the Byrna LE and launched the new Byrna Compact Launcher

- Scaled production to support 35% year-over-year revenue growth

- Opened a new ammunition manufacturing facility in Fort Wayne, Indiana

- Implemented a proprietary shop floor management system that "virtually eliminated labor and overhead variances"

Brasseur also showed personal conviction: SEC filings show he made an open market purchase of 728 shares in April 2025—a modest amount, but insider buying is typically viewed as a bullish signal.

Financial Context

Despite the stock's collapse, Byrna's underlying business has shown improvement:

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $16.7 | $20.3 | $20.9 | $28.0* | $26.2 | $28.5 | $28.2 |

| Net Income ($M) | $0.0 | $2.1 | $1.0 | $9.7* | $1.7 | $2.4 | $2.2 |

| Gross Margin | 57.9% | 62.0% | 62.4% | 62.8% | 60.8% | 61.6% | 60.1% |

*Values retrieved from S&P Global

Revenue has grown from $16.7 million in Q1 2024 to over $28 million in recent quarters—a nearly 70% increase. The company has guided for 35-40% full-year revenue growth for fiscal 2025.

So why the stock collapse? Part of the answer lies with short sellers.

The Bonitas Shadow

In October 2024, short seller Bonitas Research published a detailed report questioning Byrna's sales channels, dealer network claims, and growth sustainability. The report alleged Byrna's "Premier Dealer" count was overstated and that some "Authorized Dealers" included a car wash, tea shop, and barbershop with minimal retail presence.

The stock fell 15% on the report's release and has never recovered. Bonitas declared it was short BYRN and believed "its stock is going lower."

While Byrna has continued posting growth numbers that would seem to contradict the short thesis, the stock remains under pressure. The short interest, combined with broader market rotation away from small-caps, has kept shares depressed despite operational progress.

What to Watch

Earnings Call on February 5: Byrna reports Q4 results in six days. Expect analysts to press management on:

- Who is taking over Brasseur's operational responsibilities

- Whether the departure signals any production or supply chain concerns

- The status of new product launches (value-oriented launcher, connected safety platform) that Brasseur was overseeing

Succession Plan: The company has not announced a replacement. Brasseur's purview was extensive—supply chain, production, engineering, new product development. CEO Bryan Ganz may absorb some duties, but a $312 million market cap company losing its COO right before a major product cycle creates execution risk.

Severance Optics: The no-severance departure, despite being in the severance plan, suggests either a quick exit negotiation or circumstances that preclude severance. Watch for any subsequent filings that might clarify.

The Bottom Line

Byrna's operational turnaround narrative just lost its chief architect—and the timing couldn't be worse. The stock sits at 52-week lows, short sellers remain active, and the company is days away from reporting results on a quarter that CEO Ganz has called "exceptionally high order volume."

For investors, the question is whether Brasseur's departure reflects personal career decisions or something more concerning about Byrna's operational trajectory. The boilerplate language in the 8-K offers no clarity. The February 5 earnings call will be the first opportunity to get answers.

Related