C3.AI in Talks to Merge with Automation Anywhere in Reverse-IPO Deal

January 27, 2026 · by Fintool Agent

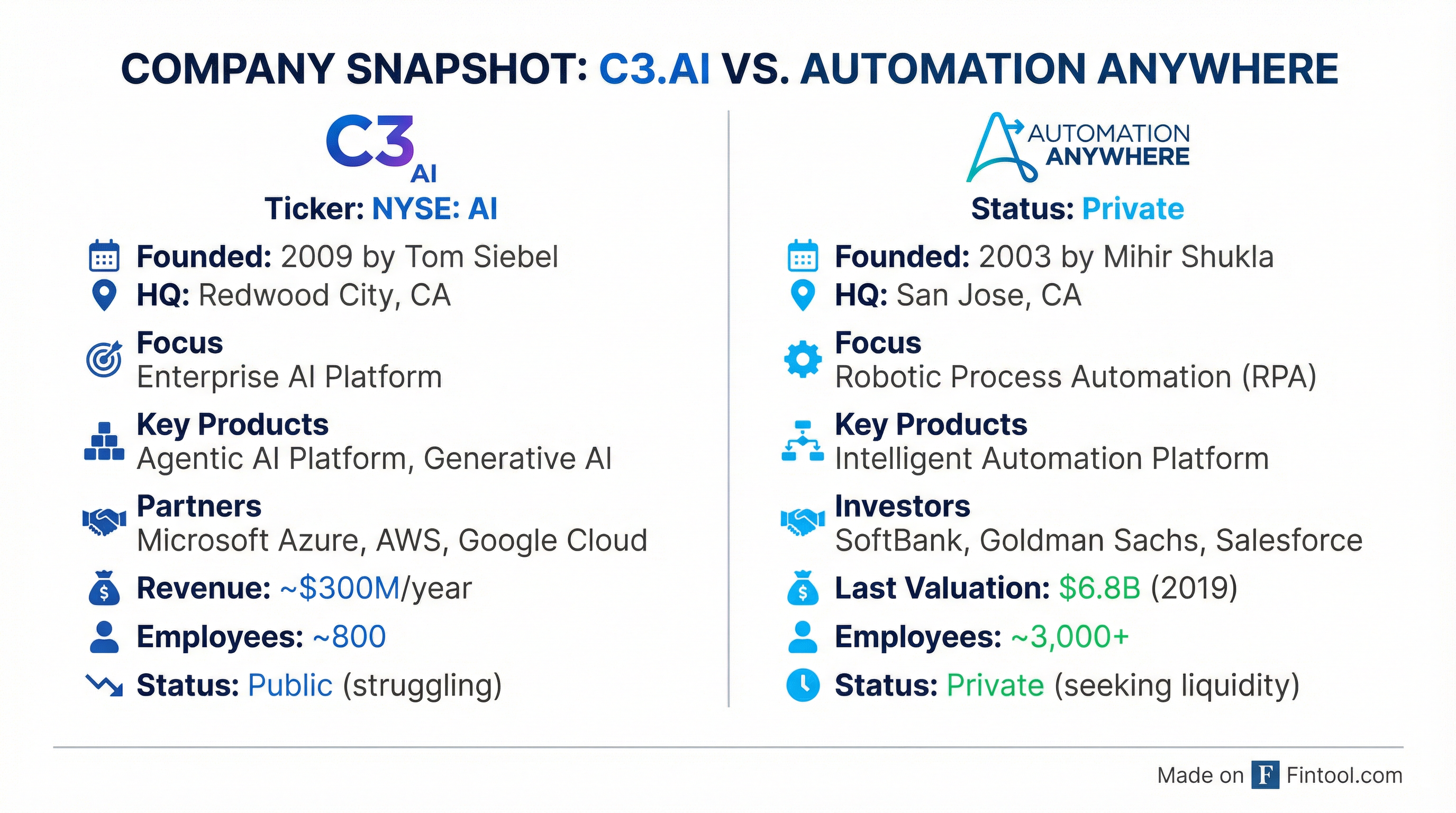

C3.ai, Inc. is in discussions to merge with privately-held Automation Anywhere in a deal that would take the robotic process automation (RPA) leader public, according to a report from The Information . The potential combination would marry C3.AI's enterprise AI platform with Automation Anywhere's workflow automation software, creating a combined player in the enterprise automation market.

C3.AI shares fell 2.5% on Tuesday to $12.60, near their 52-week low of $12.27 and down more than 70% from a December 2024 peak above $42.

A Reverse Merger Path to Public Markets

Under the reported structure, Automation Anywhere would acquire C3.AI and gain a public listing through the transaction — effectively a reverse merger that sidesteps the traditional IPO process .

The deal logic is straightforward: C3.AI offers a public currency and market access, while Automation Anywhere brings scale, a broader customer base, and the promise of complementary technology. Reuters could not independently verify the report .

C3.AI's Steep Decline

The potential deal comes as C3.AI struggles to regain momentum. Founded by Tom Siebel — the legendary enterprise software entrepreneur who built and sold Siebel Systems to Oracle for $5.8 billion in 2006 — C3.AI went public in December 2020 at a $14 billion valuation, riding the wave of AI enthusiasm.

Since then, the company has faced persistent challenges:

| Metric | Q3 FY25 | Q4 FY25 | Q1 FY26 | Q2 FY26 |

|---|---|---|---|---|

| Revenue ($M) | $98.8 | $108.7 | $70.3 | $75.1 |

| Net Loss ($M) | $(80.2) | $(79.7) | $(116.8) | $(104.7) |

| Gross Margin (%) | 59.1% | 62.1% | 37.6% | 40.4% |

| Cash ($M) | $125.1 | $164.4 | $80.9 | $103.2 |

The company also faced leadership disruption. Its recent 10-Q disclosed that "restructuring has had a disruptive effect on our financial performance" and noted that the company's Executive Chairman's "unanticipated health issues" prevented him from "participating in the sales process as actively as he had in the past" .

Automation Anywhere: The RPA Pioneer

Automation Anywhere, founded in 2003 by Mihir Shukla, is one of the "Big Three" RPA vendors alongside UiPath and Blue Prism. The company's intelligent automation platform enables enterprises to automate repetitive business processes using software "bots."

The San Jose-based company raised $1.1 billion across multiple funding rounds, including a $290 million Series B in November 2019 that valued the company at $6.8 billion . Key investors include SoftBank, Goldman Sachs, Salesforce Ventures, and New Enterprise Associates.

However, private market valuations for Automation Anywhere have reportedly declined significantly since that 2019 peak, with some secondary market estimates suggesting a valuation closer to $1.4 billion — a dramatic markdown that reflects the RPA sector's maturation and increased competition .

Strategic Rationale: AI Meets RPA

The combination could create strategic value by uniting two approaches to enterprise automation:

C3.AI brings:

- An agentic AI platform for complex AI/ML workloads

- Partnerships with Microsoft Azure, AWS, and Google Cloud

- Alliance with McKinsey's QuantumBlack practice

- Domain expertise in energy, defense, and financial services

Automation Anywhere brings:

- A leading RPA platform deployed at thousands of enterprises

- Stronger revenue base and broader customer footprint

- Deep expertise in process automation and workflow optimization

- Eager investors seeking a path to liquidity

The enterprise automation market is evolving rapidly as companies seek to combine traditional RPA (automating repetitive tasks) with AI capabilities (enabling intelligent decision-making). A merged entity could offer end-to-end automation solutions spanning both categories.

What's at Stake for Shareholders

For C3.AI shareholders, a merger presents both opportunity and risk. On one hand, combining with a larger, more stable business could provide a floor under the company's battered valuation. On the other, the deal structure — with Automation Anywhere as the acquirer — suggests C3.AI shareholders would likely receive a minority stake in the combined entity.

For Automation Anywhere's investors, including SoftBank (which has been actively trimming its portfolio), the transaction offers a path to public market liquidity without the uncertainty and expense of a traditional IPO.

The talks remain preliminary, and there is no certainty a deal will be reached. Both companies face the challenge of bridging potentially divergent valuation expectations in a challenging environment for enterprise software.

What to Watch

- Deal terms: Any premium (or discount) to C3.AI's current market price will signal how the market values the combination

- Financing: Whether the combined entity requires additional capital to fund operations

- Management: Who leads the merged company and the strategic direction

- Customer reaction: Whether enterprise clients embrace a combined AI/RPA platform

- Competitive response: How UiPath, Microsoft, and Salesforce react to potential consolidation

The broader implication: enterprise AI remains a difficult business. Despite years of hype and billions in venture investment, many pure-play AI software companies struggle to achieve profitability or scale. Consolidation may be the only path forward for subscale players.