CACI's $2.6B Bet on Space: Defense Giant's Largest Acquisition Ever Targets Intelligence Satellites

December 22, 2025 · by Fintool Agent

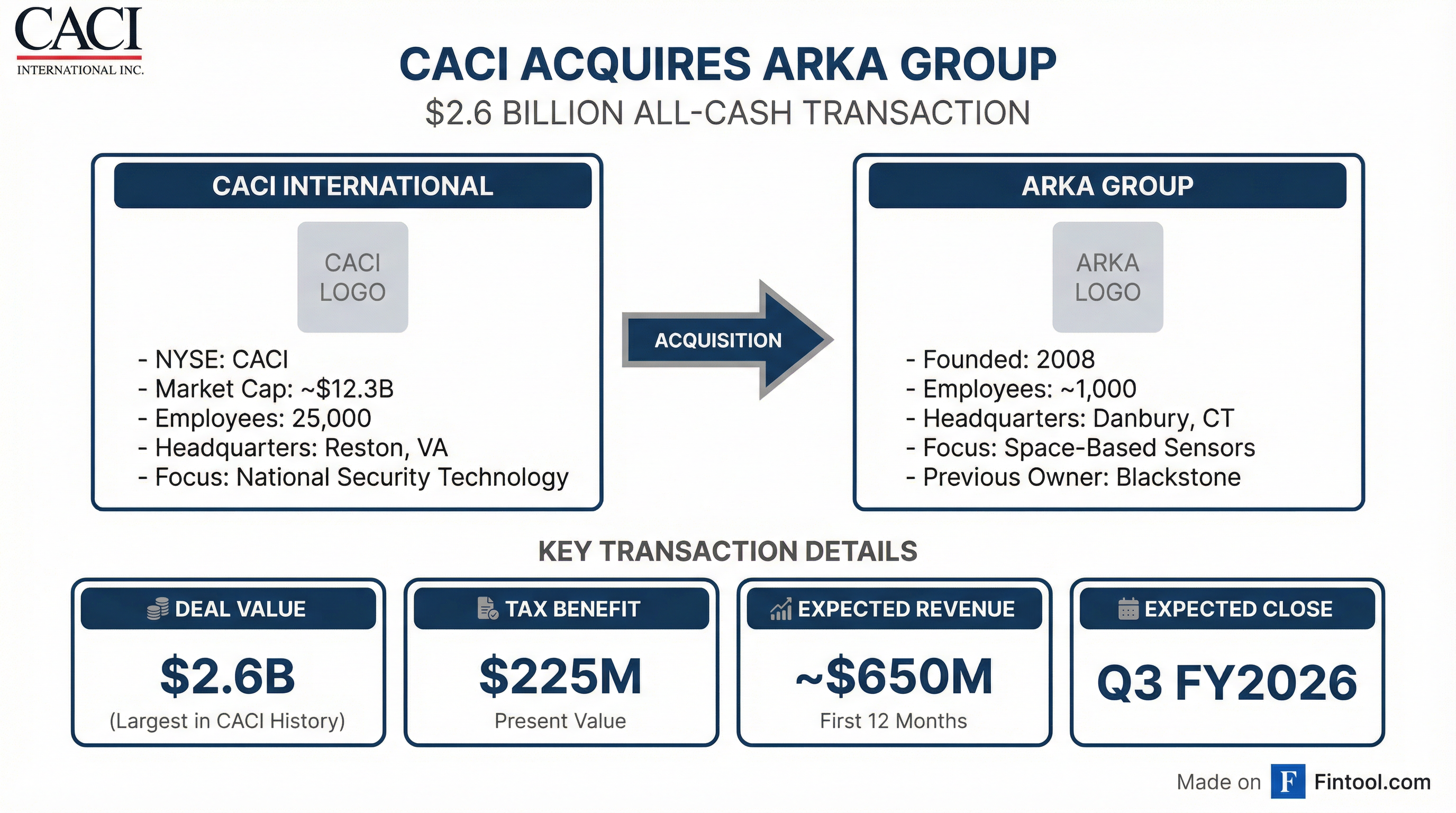

Caci International is making its biggest move yet. The Reston, Virginia-based defense contractor announced Monday it will acquire ARKA Group from Blackstone for $2.6 billion in cash—the largest deal in the company's 63-year history. The acquisition adds space-based sensor technology and classified intelligence capabilities at a time when the U.S. Space Force and intelligence community are rapidly expanding their orbital assets.

The deal represents approximately 21% of CACI's current market capitalization of $12.3 billion and positions the company to capture what management calls "significant future opportunities in the space domain."

The Strategic Rationale

ARKA isn't just another defense contractor. Headquartered in Danbury, Connecticut, the company traces its lineage to the earliest days of the U.S. space program and has built deep expertise in space-based sensing—the ability to collect and process intelligence data from satellites orbiting Earth.

"The acquisition of ARKA represents a significant step forward in our space strategy," said John Mengucci, CACI's President and CEO. "They bring deep experience and proven performance as a best-in-class provider of national security space and defense capabilities."

The timing is strategic. Space has become the new frontier in defense technology, with rising geopolitical tensions driving unprecedented investment in satellite surveillance, communications, and early warning systems. CACI already provides land, air, and sea-based sensors—ARKA's space-based capabilities complete the picture.

What ARKA Brings to the Table

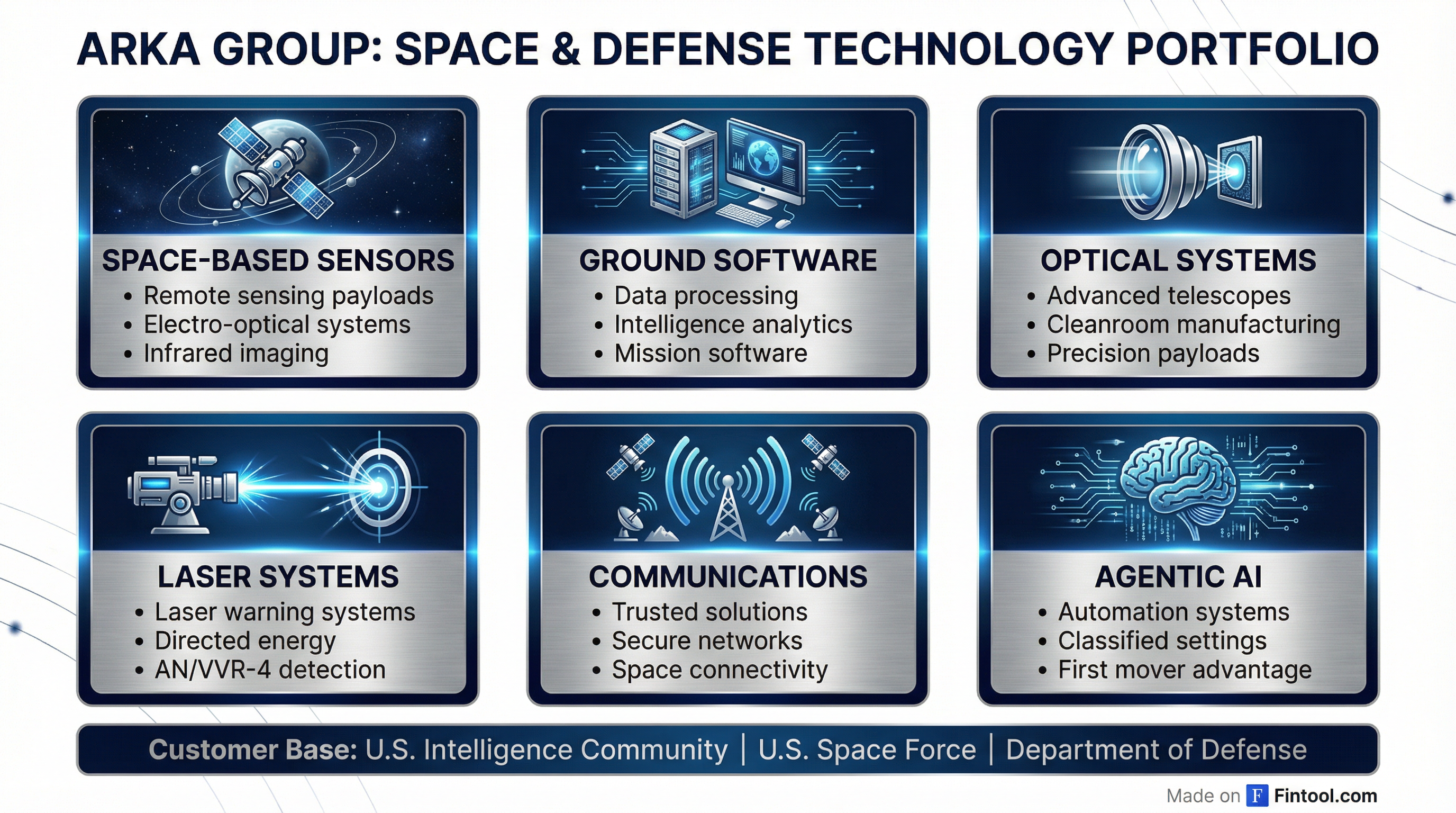

ARKA employs approximately 1,000 people, including 315 software engineers focused on advanced optics and space/defense work. The company's technology portfolio spans:

- Remote sensing payloads for intelligence satellites

- Electro-optical/infrared optical systems for imaging

- Sensor data processing tools leveraging AI

- Laser warning systems, including the AN/VVR-4 detection system

- Directed energy components for emerging weapons platforms

What makes ARKA particularly valuable: the company has positioned itself as a "first mover in operationalizing agentic AI for automation in classified settings"—a capability increasingly critical as intelligence agencies struggle to process the massive data streams from proliferating satellite constellations.

ARKA's recent $85 million expansion added modern cleanrooms for telescopes and payloads, signaling serious investment in manufacturing capacity. Government contracts in 2024 alone included a $136 million U.S. Army contract for laser detecting systems and a $95 million Defense Logistics Agency contract.

Deal Economics

| Metric | Value |

|---|---|

| Purchase Price | $2.6 billion (all cash) |

| Tax Benefit (PV) | $225 million |

| Expected Revenue Contribution | $650 million (first 12 months) |

| Expected Close | Q3 FY2026 (by June 2026) |

| Financing | Cash on hand + $1.3B bridge loan from Wells Fargo |

CACI expects ARKA to contribute approximately $650 million in revenue during the first twelve months after closing. More than half of ARKA's revenue is "non-disclosed"—a reflection of the classified nature of its intelligence community work.

The deal includes a significant tax benefit with a present value of $225 million, which partially offsets the premium being paid. CACI plans to fund the acquisition through a combination of cash on hand, borrowings under its revolving credit facility, and a committed $1.3 billion senior secured bridge loan from Wells Fargo.

CACI's Financial Position

CACI enters this acquisition from a position of strength. Recent quarterly performance shows steady revenue growth and disciplined cash flow generation:

| Metric | Q1 FY2026 | Q4 FY2025 | Q3 FY2025 | Q2 FY2025 |

|---|---|---|---|---|

| Revenue | $2.29B | $2.30B | $2.17B | $2.10B |

| Net Income | $125M | $158M | $112M | $110M |

| Total Debt | $3.20B | $3.34B | $3.48B | $3.44B |

| Cash | $133M | $106M | $224M | $176M |

The company has been running annual revenues approaching $9 billion with approximately 25,000 employees. CACI's existing debt load of roughly $3.2 billion will increase significantly with this acquisition, but the steady cash flow generation and expected $650 million in additional revenue should support the leverage.

The Acquisition Track Record

This deal caps an aggressive M&A streak for CACI. In the past three fiscal years alone, the company has completed seven acquisitions:

The standout was October 2024's $1.3 billion acquisition of Azure Summit Technology, which expanded CACI's software-defined offerings and specialized technologies. The ARKA deal is nearly double that size and signals management's conviction that space-based capabilities are critical to the company's future.

Blackstone's Exit

For Blackstone, this marks a successful exit from a 2019 investment through its Tactical Opportunities platform. The private equity giant made a follow-on investment in 2020, and the ARKA portfolio grew through a series of acquisitions including AMERGINT Technologies, Danbury Mission Technologies, and Maxar's radar and sensor technology group.

"Our aligned mission-focused cultures and deep engineering roots create a strong foundation for future innovation and growth," said Andreas Nonnenmacher, ARKA's President and CEO.

Why Space, Why Now

The deal comes amid what Reuters describes as "surging demand for defense and intelligence contracts, driven by rising geopolitical tensions, increased military spending by the United States and its allies, and greater investment in space, cyber and advanced surveillance capabilities."

With an estimated 10,000+ satellites now in orbit—many owned by state actors including the U.S., China, and Russia—space-based intelligence has become essential for tracking global threats and monitoring borders in real-time. The proliferation of satellite constellations requires advanced processing capabilities to turn raw data into actionable intelligence.

CACI's management specifically cited the "Golden Dome initiative" and expanding U.S. Space Force constellations as growth drivers. The company is already positioned on multiple Space Force programs, including Tranche zero, one, two, and three terminals for satellite communications.

What to Watch

Regulatory approvals: The transaction requires standard regulatory clearances given the classified nature of ARKA's work. CACI expects to close by the end of June 2026.

Integration execution: CACI has a track record of successful integration (Azure Summit, Applied Insight), but ARKA's scale and complexity will test the team. The company plans to retain ARKA's Danbury operations and more than 500 employees.

Leverage management: Pro-forma debt will rise significantly. Investors will watch for evidence that ARKA's cash flows can support the increased interest burden.

Revenue synergies: Management is betting that ARKA's space-based sensors, combined with CACI's land, air, and sea capabilities, will create cross-selling opportunities across the combined customer base.