Caterpillar Surges on Record Quarter as AI Data Centers Drive Power Demand

January 29, 2026 · by Fintool Agent

Caterpillar just proved that the AI infrastructure buildout extends far beyond semiconductor companies. The 100-year-old heavy equipment manufacturer reported Q4 2025 sales of $19.1 billion—an all-time quarterly record—crushing Wall Street expectations by 18% as data center operators scramble for power generation capacity to feed their AI ambitions.

Shares jumped 4% in premarket trading, extending CAT's remarkable 12-month run that has seen the stock nearly double.

The Power & Energy Story

The headline numbers tell a clear story: Caterpillar's Power & Energy segment has become an unlikely beneficiary of the AI revolution.

| Segment | Q4 2025 Revenue | YoY Growth | Sales to Users Growth |

|---|---|---|---|

| Power & Energy | $9.4B | +23% | +37% |

| Construction Industries | $6.9B | +15% | +11% |

| Resource Industries | $3.4B | +13% | -7% |

Power generation sales alone surged 44% year-over-year, "driven by strong demand for large gensets and turbines used in data center applications," CEO Joe Creed said on the earnings call.

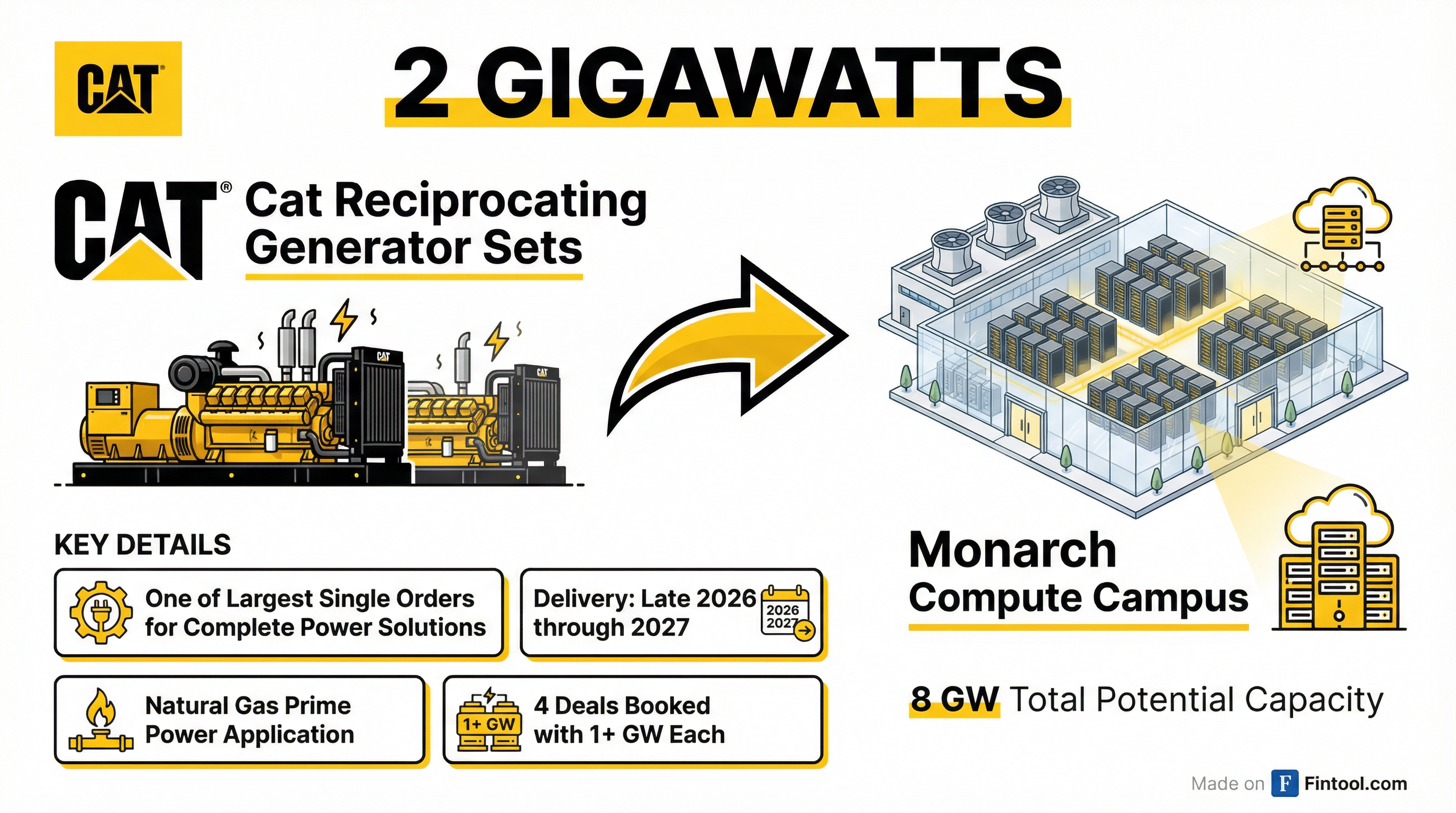

The Monarch Deal: 2 Gigawatts of Prime Power

The timing of Caterpillar's results couldn't be better. Just one day before the earnings release, the company announced a massive 2-gigawatt order from American Intelligence and Power Corporation for natural gas generator sets to power the Monarch Compute Campus—a data center project with a total potential of 8 gigawatts.

This represents "one of our largest single orders for complete power solutions," Creed noted. Deliveries will begin in late 2026 and continue through 2027.

The deal highlights a critical trend: Data center operators are increasingly turning to "prime power" solutions—bringing their own dedicated generation capacity rather than relying solely on the grid—to accelerate buildouts.

"We're starting to see orders for prime power trend higher as data center customers look for alternative power solutions to keep pace with their growth," Creed explained. "We've had 4 now prime power orders of greater than 1 gigawatt, and we've had a handful of other sizable orders that were less than 1 gigawatt."

Record Backlog Provides Multi-Year Visibility

Caterpillar's backlog tells an extraordinary story of demand momentum:

| Backlog Metric | Value |

|---|---|

| Total Backlog | $51 billion |

| YoY Increase | +71% ($21B higher) |

| Q4 Sequential Increase | +$11 billion |

| Expected 12-Month Deliveries | 62% |

"We are really excited... our backlog at $51 billion. That's 70% higher than year-end prior and $11 billion higher than where we finished the third quarter," Creed said.

The lower-than-typical near-term delivery percentage (62% vs. historical average) actually reflects strategic positioning. "We're working closely with our customers to schedule their orders in our factory to deliver when they need them in their project timing," Creed explained, noting that frame agreements include inflation escalators for orders stretching into 2027 and beyond.

Stock Performance

Caterpillar shares have been on a tear, driven by the Power & Energy tailwind:

The stock has risen approximately 74% over the past 12 months, significantly outperforming the broader industrial sector. Analysts have been raising targets—Jefferies recently boosted its price target to $750 from $700, maintaining a buy rating.

Full Year 2025: Highest Revenue in Company History

The quarterly results capped a historic year for the company:

| FY 2025 Metric | Value | YoY Change |

|---|---|---|

| Sales & Revenues | $67.6 billion* | +4% |

| Adjusted Operating Profit Margin | 17.2% | Within target range |

| Adjusted EPS | $19.06 | — |

| MP&E Free Cash Flow | $9.5 billion | Third consecutive year above $9B |

| Shareholder Returns | $7.9 billion | 84% of free cash flow |

*Values retrieved from S&P Global

"Our centennial year marked a significant milestone, and we achieved full year sales and revenues of $67.6 billion, the highest in Caterpillar's history," Creed declared.

The Tariff Headwind

Not everything is rosy. Caterpillar faces significant tariff headwinds that are compressing margins:

| Tariff Impact | 2025 Actual | 2026 Expected |

|---|---|---|

| Incremental Tariff Cost | $1.7 billion net | $2.6 billion |

| Q4 2025 Impact | $800 million | $800 million (Q1) |

| Margin Impact (CI segment) | 600 bps | — |

"Including the impact of tariffs, we expect margin to be near the bottom of the target range," CFO Andrew Bonfield acknowledged.

The company is taking mitigation actions including sourcing changes and cost controls, but emphasized that "going forward, it will become increasingly challenging to parse out and track whether cost control or price action is directly tied to tariff mitigation versus being taken in the normal course of business."

2026 Outlook

Management provided robust guidance for the year ahead:

- Sales Growth: Around top of 5-7% CAGR target range (~7% growth expected)

- Price Realization: ~2% of total sales

- CapEx: ~$3.5 billion (up from $3.1 billion in 2025)

- Adjusted Operating Margin: Near bottom of target range (including tariffs); top half excluding tariffs

"Our record backlog of $51 billion provides strong momentum to start the year," Creed said. "We're also starting to get multi-year visibility in Power & Energy as we work closely with our customers to schedule factory orders in line with their project timelines."

The company expects volume growth in all three primary segments, with Power & Energy delivering the strongest year-over-year rate of growth.

Why This Matters for Investors

Caterpillar's results illustrate a critical theme: The AI infrastructure buildout has second-order effects that extend far beyond obvious plays like Nvidia.

As hyperscalers and AI companies race to build compute capacity, they're running into physical constraints—namely, power. Data centers require enormous amounts of electricity, and grid infrastructure can't keep up. This has created an opportunity for companies like Caterpillar that can provide self-contained power solutions.

"We continue to stay close to our customers. I mean, we talk to hyperscalers and large data center customers weekly," Creed said.

The company is also expanding capacity to meet demand, with plans to double large engine capacity and more than double industrial gas turbine capacity by 2030. "We expect a big chunk of capacity, the first real big step up to come towards the end of this year and heading into 2027," Creed noted.

What to Watch

Near-term catalysts:

- Q1 2026 results (seasonal low point for sales)

- Capacity expansion milestones (late 2026 expected)

- Additional prime power deal announcements

- ConExpo industry show (BCP equipment unveilings)

Key risks:

- Tariff escalation ($2.6B headwind expected vs. $1.7B in 2025)

- Data center buildout slowdown

- Commodity price sensitivity in Resource Industries

- Capacity execution risk

Valuation check: At ~$651 per share, CAT trades at approximately 12x forward P/E on 2026 consensus estimates—a premium to historical averages but arguably justified given the structural data center tailwind.