Earnings summaries and quarterly performance for CATERPILLAR.

Executive leadership at CATERPILLAR.

Board of directors at CATERPILLAR.

Research analysts who have asked questions during CATERPILLAR earnings calls.

David Raso

Evercore ISI

6 questions for CAT

Jamie Cook

Truist Securities

6 questions for CAT

Kristen Owen

Oppenheimer & Co. Inc.

6 questions for CAT

Michael Feniger

Bank of America

6 questions for CAT

Tami Zakaria

JPMorgan Chase & Co.

6 questions for CAT

Jerry Revich

Goldman Sachs Group Inc.

5 questions for CAT

Mircea Dobre

Robert W. Baird & Co.

5 questions for CAT

Kyle Menges

Citigroup

4 questions for CAT

Angel Castillo Malpica

Morgan Stanley

3 questions for CAT

Chad Dillard

AllianceBernstein

3 questions for CAT

Robert Wertheimer

Melius Research

3 questions for CAT

Rob Wertheimer

Melius Research LLC

3 questions for CAT

Stephen Volkmann

Jefferies

3 questions for CAT

Steven Fisher

UBS

3 questions for CAT

Charles Albert Dillard

Bernstein

2 questions for CAT

Timothy Thein

Raymond James

2 questions for CAT

Jairam Nathan

Daiwa Capital Markets

1 question for CAT

Recent press releases and 8-K filings for CAT.

- ElevenEs ha completato la prima chiusura del suo round di Serie B con il sostegno di Caterpillar Venture Capital Inc.

- Il capitale finanzierà le fasi iniziali dell’infrastruttura e dell’attrezzatura di una mega-fabbrica da 1 GWh di celle per batterie LFP, con avvio previsto a febbraio 2026

- Al round ha partecipato anche un’affiliata di BST (HK) Ltd., trading house di materie prime con sede a Hong Kong

- Caterpillar’s strategy centers on growing operating profit after capital charge (OPACC), which has increased 4.1× since 2020, and on achieving 5–7% average annual sales growth through 2030 (4% achieved in 2025; Construction end-user sales +5% in a down market).

- The company raised its operating margin target range to 15–25% (from 10–22%) and lifted the top-end sales goal to $100 billion (from $72 billion); CapEx is set to double over the next five years, peaking near $3.5 billion (<5% of revenues) in 2026–27.

- Over the past three years, Caterpillar generated >$9 billion of free cash flow (highest average in the S&P 500 industrials) and returned ~84% of FCF in 2025 via dividends (7% increase) and buybacks; the dividend has risen for 32 consecutive years with high single-digit growth expected to 2030.

- To support growth, the company is investing in production capacity—large-engine capacity +1.25× and Solar Turbines +2×—with new capacity coming online in 2027 for engines and 2028 for Solar.

- Reiterated definition of winning as growing absolute OPACC dollars with sales and revenue CAGR target of 5 – 7% to 2030 and raising the OPACC upper target from $72 billion to $100 billion.

- Maintained operating margin guidance of 15 – 25% (implying ~31% pull-through), with ~$3.5 billion CapEx in 2026 and plans to increase digital and technology investment 2.5× by 2030.

- Generated >$9 billion of free cash flow over the past three years (highest in the S&P 500 Industrials), returned 84% of 2025 FCF to shareholders, marked 32 consecutive years of dividend increases, and repurchased shares at an average of $226 reducing share count 21% since 2019.

- Announced capacity expansions: 1.25× increase for large engines (used in power gen, oil & gas, mining) and 2× for Solar Turbines—including the new 38 MW Titan 350 model—with major capacity additions coming online in 2027–2028.

- Highlighted a broad portfolio across Construction Industries, Resource Industries, and Power & Energy, with 5% end-user sales growth in CI despite a down market, and leveraging automation, connectivity, and services to reduce cyclicality.

- Caterpillar reaffirmed its focus on growing OPACC (Operating Profit After Capital Charge) dollars to $100 billion, with sales and revenues targeting a 5–7% CAGR to 2030 and operating margins of 15–25%.

- Free cash flow generation remains strong, with over $9 billion generated in the last three years, 84% of 2025 free cash flow returned to shareholders, 32 consecutive years of dividend increases, and a 21% reduction in share count since 2019.

- The company plans $3.5 billion of CapEx in 2026 (under 5% of revenues), will increase digital and technology investment 2.5× by 2030, expand large-engine capacity by 1.25×, and double Solar Turbines output (online by 2027–28).

- Broad segment demand continues: end-user construction sales grew 5% in a down market, Power & Energy backlog includes a 1 GW AIP data-center order, and dealer inventories remain at a healthy 3–4 months of supply.

- Caterpillar Inc. acquired RPMGlobal Holdings Limited, an Australian mining software company.

- The deal enhances Caterpillar’s portfolio of data-driven mining technology and software solutions to improve mine site planning and operations.

- Caterpillar announced the agreement in October 2025 and closed the acquisition in February 2026; RPMGlobal will continue under its existing brand.

- RPMGlobal, headquartered in Brisbane, offers nearly 50 years of mining software expertise across 125 countries.

- Pronto introduced a tiered AHS portfolio—Pronto AHS Vision, VLR, and VLR 360—tailored to quarry through ultra-class mining environments.

- The Vision-Only AHS has already hauled over 2 million tons in under eight months at Heidelberg Materials’ Lake Bridgeport quarry.

- Pronto AHS VLR combines camera semantics with long-range Lidar and radar for fail-operational, all-weather performance, while VLR 360 adds a 360° sensor array for complex, congested operations.

- All editions are OEM-agnostic, capable of retrofitting platforms including the Komatsu 980 and Caterpillar 798.

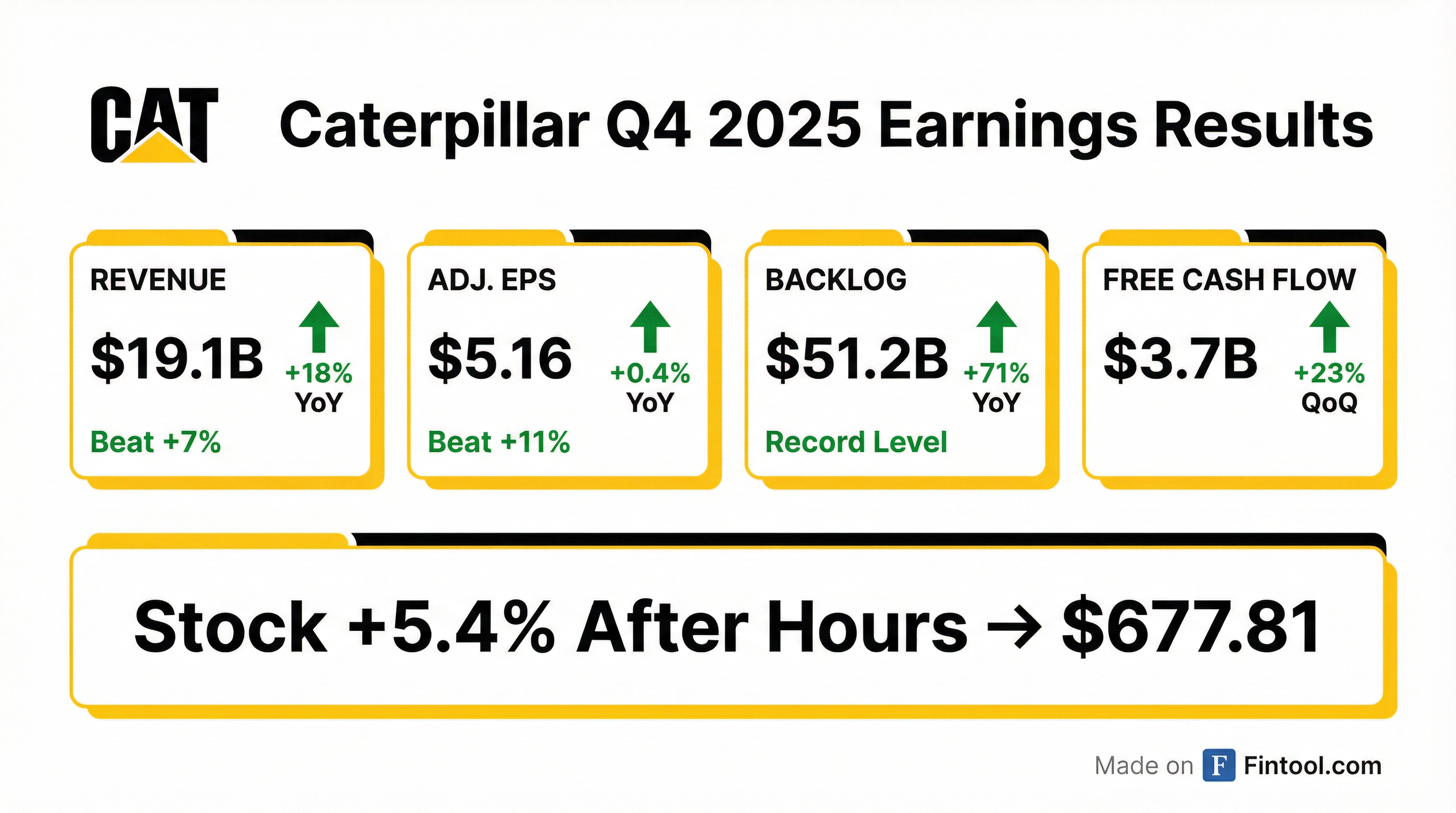

- Q4 revenue of $19.1 billion and adjusted EPS of $5.16, topping estimates; power & energy sales rose 37%, with $9.4 billion in power revenues.

- Full-year revenue of $67.6 billion; operating profit down ~15% to $11.2 billion, adjusted operating profit down ~14% to $11.6 billion; full-year adjusted EPS of $19.06, a ~13% YoY decline.

- Order backlog surged by $11.3 billion QoQ to a record $51.2 billion, signaling robust demand.

- Projects $2.6 billion in tariff costs for 2026 (including $800 million in Q1), exerting margin pressure.

- Q4 2025 sales & revenues were $19.1 B, up 18% year-over-year.

- Q4 2025 operating profit was $2.7 B, down 9% YoY; adjusted operating profit was $3.0 B, flat YoY with a 15.6% margin.

- Q4 2025 MP&E free cash flow reached $3.7 B, up from $3.0 B in Q4 2024.

- Backlog hit a record $51 B, up 71% YoY.

- 2026 guidance targets sales growth around the top end of a 5–7% CAGR, adjusted operating margin near the bottom of the annual range, and slightly lower MP&E free cash flow than 2025.

- Q4 record sales and revenues of $19.1 billion (up 18% YoY); adjusted operating margin 15.6%; adjusted EPS $5.16; Q4 MP&E-free cash flow $3.7 billion.

- Full-year 2025 sales and revenues of $67.6 billion (+4% YoY); adjusted operating margin 17.2%; adjusted EPS $19.06; generated $9.5 billion MP&E-free cash flow; backlog of $51 billion (+71% YoY); returned $7.9 billion to shareholders via repurchases and dividends.

- Q4 end-market performance: Construction Industries sales to users +11%; Resource Industries ‑7%; Power & Energy +37%, led by power generation and oil & gas demand.

- 2026 outlook: anticipate sales & revenues growth near the top of the 5–7% CAGR target; adjusted operating margin to exceed 2025 but remain near the lower end of the target range including ~$800 million of tariffs; capital expenditures ~$3.5 billion; MP&E-free cash flow slightly below 2025.

- Record full-year sales and revenues of $67.6 billion, up 4% year-over-year, and all-time Q4 revenue of $19.1 billion; backlog reached a record $51 billion, up 71% versus prior year.

- Adjusted operating profit margin was 15.6% in Q4 and 17.2% for FY 2025; adjusted EPS of $5.16 for the quarter and $19.06 for the full year.

- Generated $9.5 billion of MP&E free cash flow in 2025 and returned $7.9 billion to shareholders via $5.2 billion of share repurchases and $2.7 billion of dividends.

- 2026 outlook: anticipate sales growth at the top end of 5–7% CAGR, ~2% price realization, adjusted margin above 2025 but near the bottom of the target range including $2.6 billion of incremental tariffs, CapEx ~$3.5 billion, and slightly lower free cash flow, underpinned by strong backlog.

Fintool News

In-depth analysis and coverage of CATERPILLAR.

Dow Jones Crosses 50,000 for First Time in 129-Year History

US Manufacturing Returns to Expansion for First Time in 12 Months as New Orders Surge

Caterpillar Surges on Record Quarter as AI Data Centers Drive Power Demand

Caterpillar Surges on Record Quarter as AI Data Centers Drive Power Demand

US Manufacturing Ends 2025 at 14-Month Low as Tariffs Bite

Quarterly earnings call transcripts for CATERPILLAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more