Earnings summaries and quarterly performance for DEERE &.

Executive leadership at DEERE &.

John C. May

Chairman and Chief Executive Officer

Cory J. Reed

President, Lifecycle Solutions, Supply Management, and Customer Success

Deanna Kovar

President, Worldwide Agriculture & Turf Division: Production and Precision Ag (Americas and Australia)

Joshua A. Jepsen

Senior Vice President and Chief Financial Officer

Justin Rose

President, Worldwide Agriculture & Turf Division: Small Agriculture and Turf (Europe, Africa, and Asia)

Kellye L. Walker

Senior Vice President & Chief Legal Officer, Global Law Services & Regulatory Affairs

Rajesh Kalathur

President, John Deere Financial, and Chief Information Officer

Ryan D. Campbell

President, Worldwide Construction & Forestry and Power Systems

Board of directors at DEERE &.

Alan C. Heuberger

Director

Dmitri L. Stockton

Director

Gregory R. Page

Director

L. Neil Hunn

Director

Leanne G. Caret

Director

Michael O. Johanns

Director

R. Preston Feight

Director

Sheila G. Talton

Director

Sherry M. Smith

Lead Independent Director

Tamra A. Erwin

Director

Research analysts who have asked questions during DEERE & earnings calls.

David Raso

Evercore ISI

8 questions for DE

Jamie Cook

Truist Securities

8 questions for DE

Kristen Owen

Oppenheimer & Co. Inc.

7 questions for DE

Steven Fisher

UBS

6 questions for DE

Jerry Revich

Goldman Sachs Group Inc.

5 questions for DE

Tim Thein

Raymond James Financial

5 questions for DE

Stephen Volkmann

Jefferies

4 questions for DE

Tami Zakaria

JPMorgan Chase & Co.

4 questions for DE

Angel Castillo Malpica

Morgan Stanley

3 questions for DE

Chad Dillard

AllianceBernstein

3 questions for DE

Jairam Nathan

Daiwa Capital Markets

3 questions for DE

Robert Wertheimer

Melius Research

3 questions for DE

Angel Castillo

Morgan Stanley & Co. LLC

2 questions for DE

Charles Albert Edward Dillard

AllianceBernstein L.P.

2 questions for DE

Evan McCall

BMO Capital Markets

2 questions for DE

Kyle Menges

Citigroup

2 questions for DE

Mike Shlisky

D.A. Davidson

2 questions for DE

Sabahat Khan

RBC Capital Markets

2 questions for DE

Stephen Volkman

Jefferies Financial Group Inc.

2 questions for DE

Timothy Thein

Raymond James

2 questions for DE

Charles Albert Dillard

Bernstein

1 question for DE

Joel Jackson

BMO Capital Markets

1 question for DE

Kevin

Alliance Global Partners

1 question for DE

Mircea Dobre

Robert W. Baird & Co.

1 question for DE

Paddy Bogart

Melius Research LLC

1 question for DE

Recent press releases and 8-K filings for DE.

- Deere delivered FY 2025 net income of $5 billion on $45.7 billion in net sales, with equipment operations margins of 12.6% and diluted EPS of $18.50, reflecting structural margin improvements under its Smart Industrial model.

- The board’s director nominees were reelected, the advisory vote on executive compensation passed with 91.86% support, and ratification of Deloitte & Touche as auditor was approved with 94.71%; all three shareholder proposals on emissions ROI, written‐consent rights, and faith‐based BRGs were defeated, each receiving under 39% support.

- The company returned $2.9 billion to shareholders in 2025 through dividends and share repurchases.

- For FY 2026, Deere plans to invest 5–6% of sales in R&D and expects approximately $1.2 billion of direct tariff expense, though it will maintain guidance pending the timing and likelihood of refunds.

- Management confirmed it is not considering a stock split at this time but will continue to evaluate actions that enhance shareholder value.

- FY2025 net income of $5 billion on $45.7 billion in net sales; equipment operations margin of 12.6%, and $2.9 billion returned to shareholders via dividends and buybacks.

- Announced digital and autonomy momentum: 1 million connected machines, 500 million engaged acres, Harvest Settings Automation adoption > 90% on North American combines, and launch of autonomous 8RX/9RX tractors and a battery-powered tractor.

- FY2026 investment guidance: R&D spending to rise to 5–6% of sales; no stock split contemplated; tariff headwind estimated at $1.2 billion with guidance unchanged.

- Governance outcomes: all ten director nominees elected, advisory vote on executive compensation approved, Deloitte & Touche ratified as auditor; three shareholder proposals on emissions ROI, written consent, and faith-based BRGs were rejected.

- Deere reported $5 billion in net income on $45.7 billion in net sales, $18.50 diluted EPS, and a 12.6% equipment operating margin for FY 2025, and returned $2.9 billion to shareholders via dividends and buybacks.

- The Smart Industrial model continues to drive adoption, with over 1 million connected machines, 500 million engaged acres, and a doubling of highly engaged acres in three years, now extended to turf, construction, and road-building segments.

- Key product and technology launches included autonomous 8RX/9RX tractors, retrofit autonomy kits, the F9 1000 forage harvester, a fully battery-powered tractor, JDLink Boost (8,000+ orders), and Harvest Settings Automation with >90% North American combine adoption.

- For FY 2026, Deere forecasts R&D spending of 5–6% of sales, faces an estimated $1.2 billion in direct tariff expenses, and is not considering a stock split at this time.

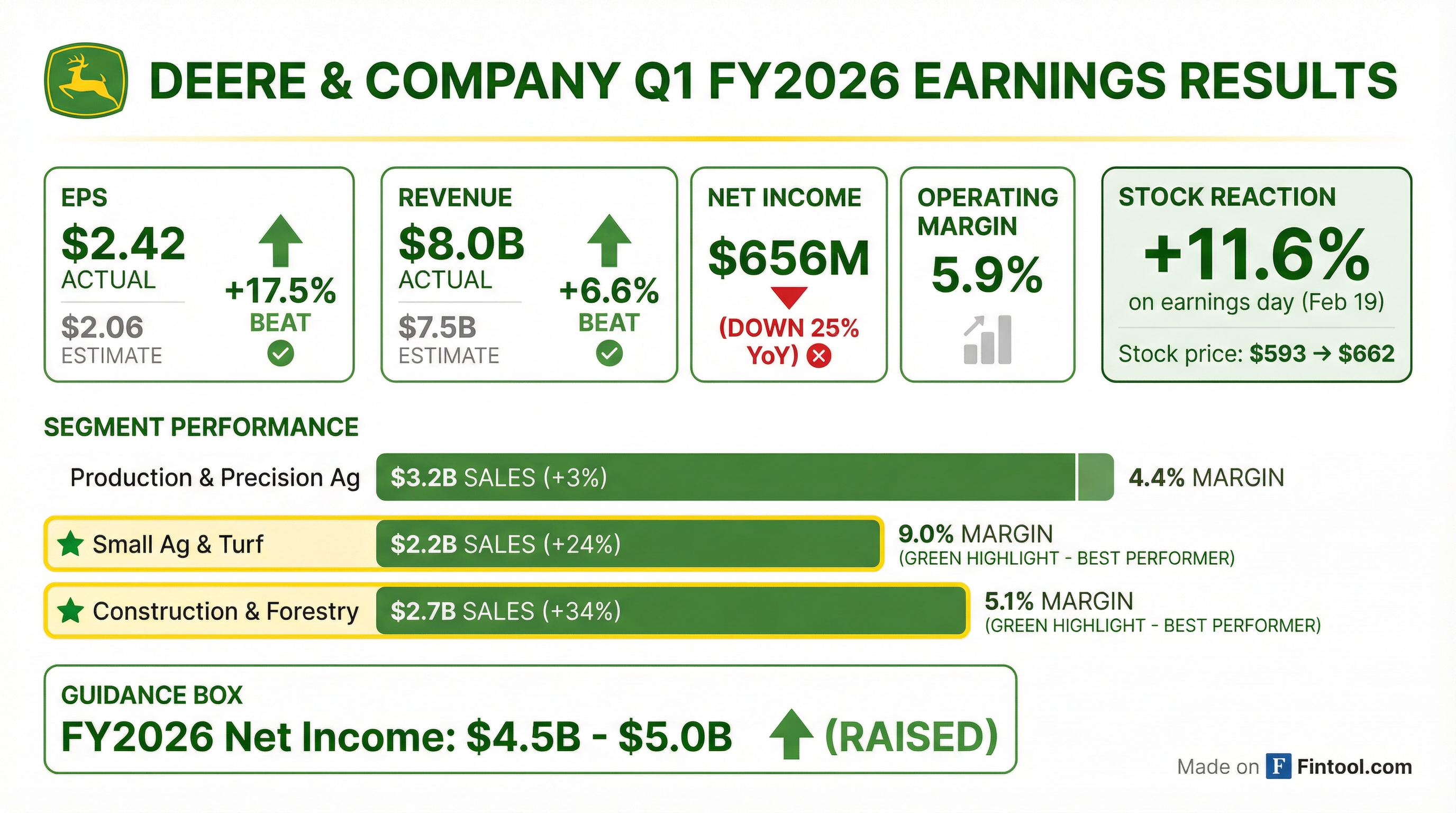

- Deere’s Q1 net sales and revenues rose 13% to $9.611 billion, with equipment operations net sales up 18% to $8.001 billion; net income attributable to Deere & Company was $656 million or $2.42 per diluted share.

- All segments delivered strong growth: Small Ag & Turf net sales increased 24% to $2.168 billion, and Construction & Forestry net sales rose 34% to $2.67 billion year-over-year.

- For FY 2026, Deere projects mid-single-digit net sales growth for equipment operations, raised its net income forecast to $4.5 billion–$5 billion, and maintains segment targets of 11%–13% operating margin for Production & Precision Ag and 13.5%–15% for Small Ag & Turf (with ~15% sales growth).

- Returned nearly $750 million to shareholders via dividends and share repurchases in Q1 2026.

- Equipment Operations sales were mixed by segment in 1Q 2026: Production & Precision Ag down 13%, Small Ag & Turf up 24%, and Construction & Forestry up 134% year-on-year.

- Financial Services net income rose to $244 million in 1Q 2026 from $230 million a year earlier.

- Deere reaffirmed its FY 2026 guidance: net income of $4.5–5.0 billion, effective tax rate 25–27%, and net operating cash flow $4.5–5.5 billion; capital expenditures are forecast at ~$1.4 billion.

- Deere & Company reported Q1 2026 net sales of $9.611 billion (+13% YoY) and equipment operations sales of $8.001 billion (+18% YoY), achieving a 5.9% operating margin and net income of $656 million ($2.42 EPS).

- Management projects mid-single-digit net sales growth for equipment operations in FY2026 and raised segment guidance: Small Ag & Turf net sales +15% (margin 13.5–15%) and Construction & Forestry net sales +5%.

- Strong inventory and order trends, with North American used combine inventories ~15% below the March 2024 peak and robust order books across large ag, turf, and C&F, offering visibility into Q4 2026.

- Strategic initiatives include the acquisition of Tenna to expand C&F digital solutions, unveiling Deere-designed 20-ton excavators, and returning nearly $750 million to shareholders via dividends and share repurchases.

- Deere posted 13% YoY net sales growth to $9.611 B, with equipment operations net sales up 18%, net income of $656 M ($2.42 per diluted share) and an equipment operations operating margin of 5.9% in Q1 2026.

- All core segments delivered higher sales: Production & Precision Ag net sales +3% (4.4% operating margin), Small Ag & Turf +24% (9% margin), and Construction & Forestry +34% (5.1% margin).

- Full-year 2026 guidance raised: equipment operations net sales now expected to grow mid-single digits; Small Ag & Turf net sales +15% (13.5–15% margin); Construction & Forestry net sales +15% (9–11% margin); consolidated net income of $4.5–5.0 B; operating cash flow of $4.5–5.5 B; effective tax rate 25–27%.

- Order books strengthened and used inventory reduced: North American large tractor used inventories down over 10% from peaks with rolling order visibility into Q4; early order activity remains robust in Small Ag & Turf and Construction.

- Net income of $656 million (down 25% YoY) and EPS of $2.42 for the quarter ended February 1, 2026, versus $869 million ($3.19/share) in Q1 2025.

- Worldwide net sales and revenues rose 13% to $9,611 million (net sales of $8,001 million) in Q1 2026.

- Deere noted shipments ahead of plan and strengthening order books across its diverse segments and geographies.

- Fiscal 2026 net income guidance range raised to $4.5 billion–$5.0 billion.

- Q1 net sales rose 13% to $9.611 billion; net income was $656 million ($2.42/share)

- Full-year net income guidance increased to $4.5 billion–$5.0 billion, with expected mid-single-digit sales growth

- Construction & Forestry sales jumped 34% and operating profit more than doubled to $137 million; Small Agriculture & Turf sales climbed 24% with $196 million profit

- Flags risks from higher tariffs and warranty expenses amid a weak large-ag market; views 2026 as a potential cycle bottom

- Deere & Company reported Q1 net income of $656 million (down from $869 million) and $2.42 EPS on net sales of $8.001 billion, as worldwide net sales and revenues rose 13% to $9.611 billion.

- The company raised fiscal 2026 net income guidance to $4.5 billion–$5.0 billion, citing resilience across diverse customer segments and geographies.

- Production & Precision Agriculture segment net sales grew 3% to $3.163 billion, while operating profit declined 59% to $139 million due to higher tariffs, unfavorable mix, and warranty expenses.

- Small Agriculture & Turf sales increased 24% to $2.168 billion, with operating profit up 58% to $196 million, driven by higher volumes, mix, and price realization.

- Financial Services net income rose 6% to $244 million, reflecting favorable financing spreads and a lower provision for credit losses.

Fintool News

In-depth analysis and coverage of DEERE &.

Quarterly earnings call transcripts for DEERE &.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more