Earnings summaries and quarterly performance for CUMMINS.

Executive leadership at CUMMINS.

Jennifer Rumsey

Chief Executive Officer

Amy Davis

Vice President and President – Accelera and Components

Jenny Bush

Vice President and President – Power Systems

Mark Smith

Chief Financial Officer

Srikanth Padmanabhan

Executive Vice President and President – Operations

Board of directors at CUMMINS.

Bruno Di Leo

Director

Carla Harris

Director

Daniel Fisher

Director

Gary Belske

Director

John Stone

Director

Karen Quintos

Director

Kimberly Nelson

Director

Matthew Tsien

Director

Robert Bernhard

Director

Thomas Lynch

Lead Independent Director

William Miller

Director

Research analysts who have asked questions during CUMMINS earnings calls.

Angel Castillo Malpica

Morgan Stanley

9 questions for CMI

David Raso

Evercore ISI

9 questions for CMI

Jamie Cook

Truist Securities

9 questions for CMI

Kyle Menges

Citigroup

9 questions for CMI

Steven Fisher

UBS

8 questions for CMI

Rob Wertheimer

Melius Research LLC

7 questions for CMI

Tami Zakaria

JPMorgan Chase & Co.

7 questions for CMI

Chad Dillard

AllianceBernstein

6 questions for CMI

Noah Kaye

Oppenheimer & Co. Inc.

6 questions for CMI

Jerry Revich

Goldman Sachs Group Inc.

5 questions for CMI

Tim Thein

Raymond James Financial

4 questions for CMI

Stephen Volkmann

Jefferies

3 questions for CMI

Timothy Thein

Raymond James

3 questions for CMI

Cole Bardawill

Wolfe Research, LLC

2 questions for CMI

Robert Wertheimer

Melius Research

2 questions for CMI

Avinatan Jaroslawicz

UBS

1 question for CMI

Charles Albert Dillard

Bernstein

1 question for CMI

Jeffrey Kauffman

Vertical Research Partners

1 question for CMI

Recent press releases and 8-K filings for CMI.

- Cummins expects strong, durable AI/data-center-driven power generation demand through the end of the decade, guiding scenario-based planning with guardrails to avoid overcapacity.

- To protect backlog pricing and margins, contracts include inflation and pricing adjusters and tariff surcharges, with hyperscaler orders representing concentrated but diversified demand.

- The company has doubled power generation capacity in recent years and will sanction further tranches only if they meet internal hurdle rates with clear payback timing and long-term demand visibility.

- Cummins will significantly reduce losses in its Accelera zero-emissions portfolio by scaling back hydrogen projects while maintaining battery and e-mobility investments for future growth.

- Organic and M&A investments are evaluated against 10- to 20-year profitable growth theses, exemplified by the Meritor acquisition’s delivered synergies and long-term powertrain expansion.

- Cummins expects durable AI/data center-driven demand for power generation through the next five years, using scenario-based guardrails for longer-term investments and has doubled power generation capacity.

- Backlog pricing and margin protection feature inflation adjusters, pricing adjusters, and tariff surcharges; the backlog is concentrated among major hyperscalers but includes a diversified long tail of customers.

- Cummins remains one of the few large diesel engine and tier-one genset suppliers globally—leveraging its engine, alternator, and radiator capabilities plus a global service network—and has seen no material market share loss to new entrants to date.

- The new X10/HELM platform will face initial margin compression due to launch costs, supply-chain immaturity, and higher warranty accruals, but is expected to achieve lifecycle margins in line with or above existing products post-2027.

- Cummins balances organic and inorganic investments with disciplined hurdle rates and a 10-20 year thesis, as evidenced by the Meritor acquisition and Accelera’s hydrogen portfolio restructuring to reduce losses while maintaining e-mobility positions.

- Cummins expects very strong AI/data-center driven power generation demand with visibility through 2030, and protects backlog margins via inflation, pricing, and tariff adjusters in customer contracts.

- The company has doubled power generation capacity, allocating organic investments based on internal hurdle rates and returns realization timelines, while reserving larger expansions for projects with 10–15 year demand visibility.

- Backlog arises mainly from major hyperscalers, though Cummins serves a broad customer base, using contract guardrails to mitigate margin erosion over multi-year deliveries.

- Despite new entrants in the diesel standby genset market, Cummins leverages its integrated engine, alternator, and radiator supply chain and global service network to defend market share.

- For its HELM platform, R&D spend rose by ~$150 million annually since 2023, peaking through early 2027 before trailing off if regulations remain stable; the EPA ’27 standard is expected at 35 mg NOx, with no extended warranty changes.

- Cummins plans to launch three HELM fuel-agnostic engine platforms ahead of EPA 2027, reflecting investments made over the past 4–5 years to boost power density and fuel efficiency.

- The company continues investing in zero-emissions technologies (battery electric, E-axles) but says heavy-duty BE truck economics remain challenging without regulatory support, while closely monitoring competition from Tesla Semi.

- In its power generation segment, Cummins has doubled data center backup genset capacity via line and supply-chain optimizations in the US, UK, China, and India, with order backlog secured through 2027 and early discussions for 2028 volumes.

- Tariff surcharges are expected to dilute FY 2026 margins by about 50 bps, chiefly hitting the engine and distribution segments; potential Section 232 rebates for engines are under negotiation but mechanics remain unclear.

- At its May 2026 Investor Day, Cummins will update its 2030 financial ambitions, covering margin trajectory, capital allocation, and growth priorities for both engine platforms and power data centers.

- HELM next-gen engine platforms: Cummins has invested over four to five years to launch three new HELM engine platforms for EPA 2027, focusing on power density, fuel efficiency and fuel-agnostic capability.

- Zero-emission tech portfolio: The company continues balancing investment pace in battery electric and e-axles amid shifting regulations and views Tesla as a credible—but cost-intensive—competitor in heavy-duty trucks.

- EPA 2027 regulation impact: Confident in meeting the 35 mg NOₓ standard, Cummins anticipates an ≈$10,000 average selling price uplift per truck—≈2⁄3 in engines and 1⁄3 in components—driving multi-year margin accretion.

- R&D investment trajectory: Engine & components R&D rose by $150 million annually since 2023 for platform development, remaining elevated through H1 2027 before tapering in H2 2027 absent new regulatory changes.

- Power Gen/datacenter growth: AI-driven demand has prompted Cummins to double current capacity via internal optimizations; further brownfield or new expansions are under evaluation, with details to be shared at the May 2026 Investor Day.

- Cummins is launching three new HELM engine platforms to meet EPA 2027 standards, offering improved power density, fuel efficiency, and fuel-agnostic capabilities for diesel and alternative fuels.

- The company continues significant investments in zero-emission technologies (battery electric powertrains, E-axles) while pacing spending and viewing Tesla as a formidable but economically constrained competitor without regulatory support.

- In China, over 20% of heavy-duty truck sales shifted to battery electric in 2025 due to government mandates; Cummins focuses on E-axle systems (not batteries) to compete and gather operational insights in this market.

- Cummins has doubled its power generation capacity through manufacturing optimizations in the U.S., U.K., China, and India to serve surging AI-driven data center demand, with backlog secured through 2027 and early 2028 order discussions underway.

- Tariff surcharges are diluting margins by ~50 bps, prompting Cummins to pursue Section 232 engine and truck rebate mechanisms while investing in IT consolidation in distribution; a full 2030 margin and capital allocation update is planned for its May investor day.

- Net sales of $447 million in Q4 and $1,764 million for FY 2025; adjusted EPS of $0.66 in Q4 and $2.73 for the full year

- Adjusted EBITDA of $85 million (19.1% margin) in Q4 and $354 million (20.0% margin) for the year

- 2026 guidance: revenue of $1.945–2.015 billion and adjusted EPS of $2.75–3.00

- Completed Koch Filter acquisition on January 7, 2026, establishing an Industrial Solutions segment

- Returned $78 million to investors in 2025 (stock repurchases of $61 million and dividends of $17 million); $69 million remains under the $150 million repurchase program

- Cummins’ Board of Directors declared a quarterly common stock cash dividend of $2.00 per share.

- The dividend is payable on March 5, 2026 to shareholders of record as of February 20, 2026.

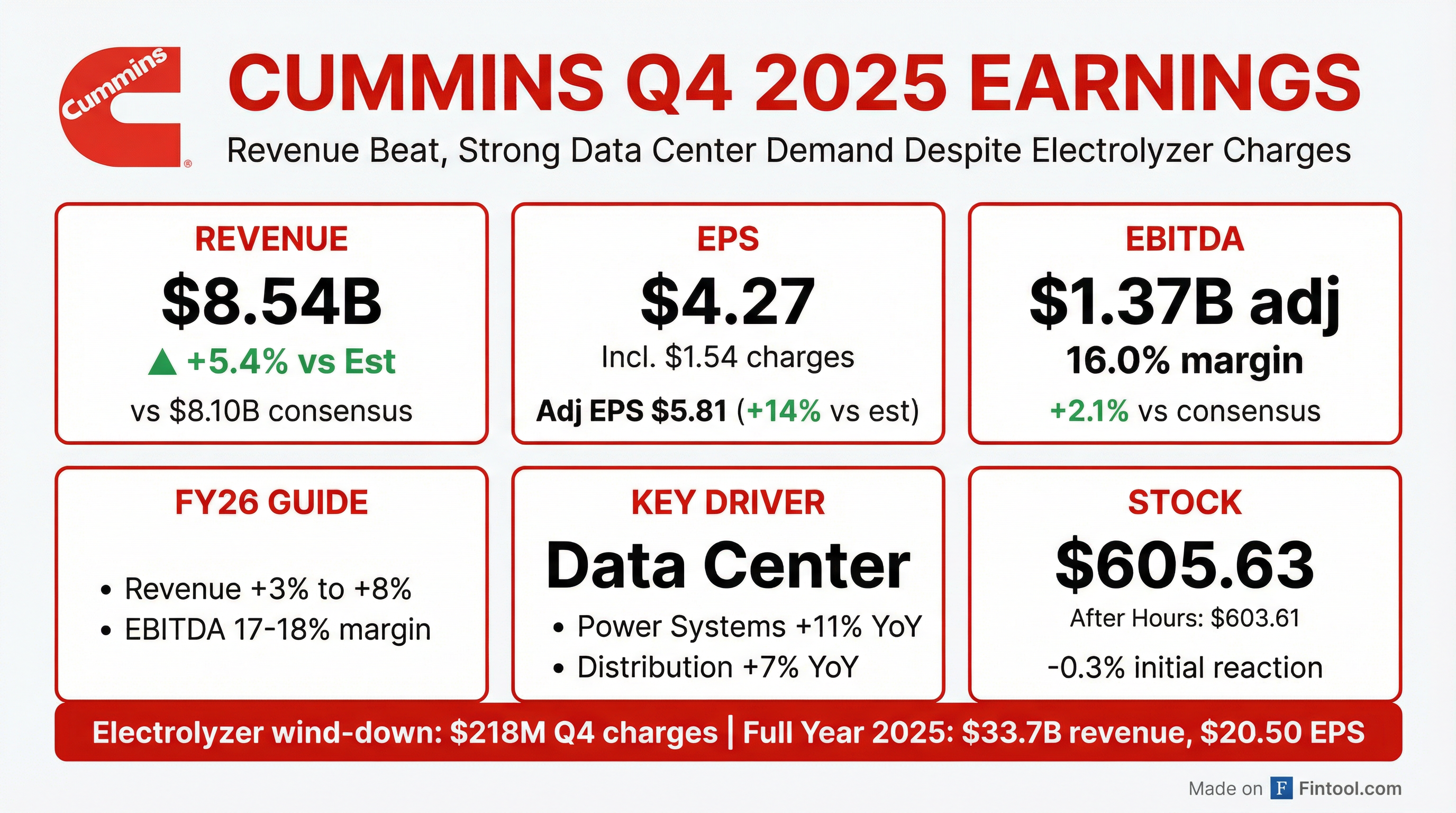

- In 2025, Cummins earned $2.8 billion in net income on $33.7 billion in sales.

- Q4 revenue of $8.5 billion, up 1% year-over-year; Q4 EBITDA $1.2 billion (13.5%), or $1.4 billion (16%) excluding $218 million of Accelera charges.

- 2025 revenue of $33.7 billion, down 1%; EBITDA $5.4 billion (16%), or $5.8 billion (17.4%) ex-$458 million of Accelera charges; record full-year segment EBITDA margins in Power Systems at 22.7% and Distribution at 14.6%.

- 2026 guidance calls for revenue growth of 3–8% and an EBITDA margin of 17–18%.

- Q4 operating cash flow was $1.5 billion; full-year 2025 capital expenditures were $1.2 billion; dividends totaled $1.1 billion.

- Q4 revenue of $8.5 billion (+1% year-over-year) and EBITDA of $1.2 billion (13.5% of sales); excluding $218 million in accelerate segment charges, EBITDA was $1.4 billion (16%).

- 2025 full-year revenues of $33.7 billion (-1%) and EBITDA of $5.4 billion (16%); excluding one-time charges, EBITDA was $5.8 billion (17.4%).

- Record segment margins in power systems (22.7% of sales, +430 bps) and distribution (14.6% of sales, +250 bps) driven by data center demand and operational efficiency.

- 2026 guidance: revenues expected to increase 3%–8% and EBITDA margin to be 17%–18%, with continued North America truck market weakness in H1 and strong power generation and aftermarket demand.

Quarterly earnings call transcripts for CUMMINS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more