Earnings summaries and quarterly performance for CUMMINS.

Executive leadership at CUMMINS.

Jennifer Rumsey

Chief Executive Officer

Amy Davis

Vice President and President – Accelera and Components

Jenny Bush

Vice President and President – Power Systems

Mark Smith

Chief Financial Officer

Srikanth Padmanabhan

Executive Vice President and President – Operations

Board of directors at CUMMINS.

Bruno Di Leo

Director

Carla Harris

Director

Daniel Fisher

Director

Gary Belske

Director

John Stone

Director

Karen Quintos

Director

Kimberly Nelson

Director

Matthew Tsien

Director

Robert Bernhard

Director

Thomas Lynch

Lead Independent Director

William Miller

Director

Research analysts who have asked questions during CUMMINS earnings calls.

Angel Castillo Malpica

Morgan Stanley

9 questions for CMI

David Raso

Evercore ISI

9 questions for CMI

Jamie Cook

Truist Securities

9 questions for CMI

Kyle Menges

Citigroup

9 questions for CMI

Steven Fisher

UBS

8 questions for CMI

Rob Wertheimer

Melius Research LLC

7 questions for CMI

Tami Zakaria

JPMorgan Chase & Co.

7 questions for CMI

Chad Dillard

AllianceBernstein

6 questions for CMI

Noah Kaye

Oppenheimer & Co. Inc.

6 questions for CMI

Jerry Revich

Goldman Sachs Group Inc.

5 questions for CMI

Tim Thein

Raymond James Financial

4 questions for CMI

Stephen Volkmann

Jefferies

3 questions for CMI

Timothy Thein

Raymond James

3 questions for CMI

Cole Bardawill

Wolfe Research, LLC

2 questions for CMI

Robert Wertheimer

Melius Research

2 questions for CMI

Avinatan Jaroslawicz

UBS

1 question for CMI

Charles Albert Dillard

Bernstein

1 question for CMI

Jeffrey Kauffman

Vertical Research Partners

1 question for CMI

Recent press releases and 8-K filings for CMI.

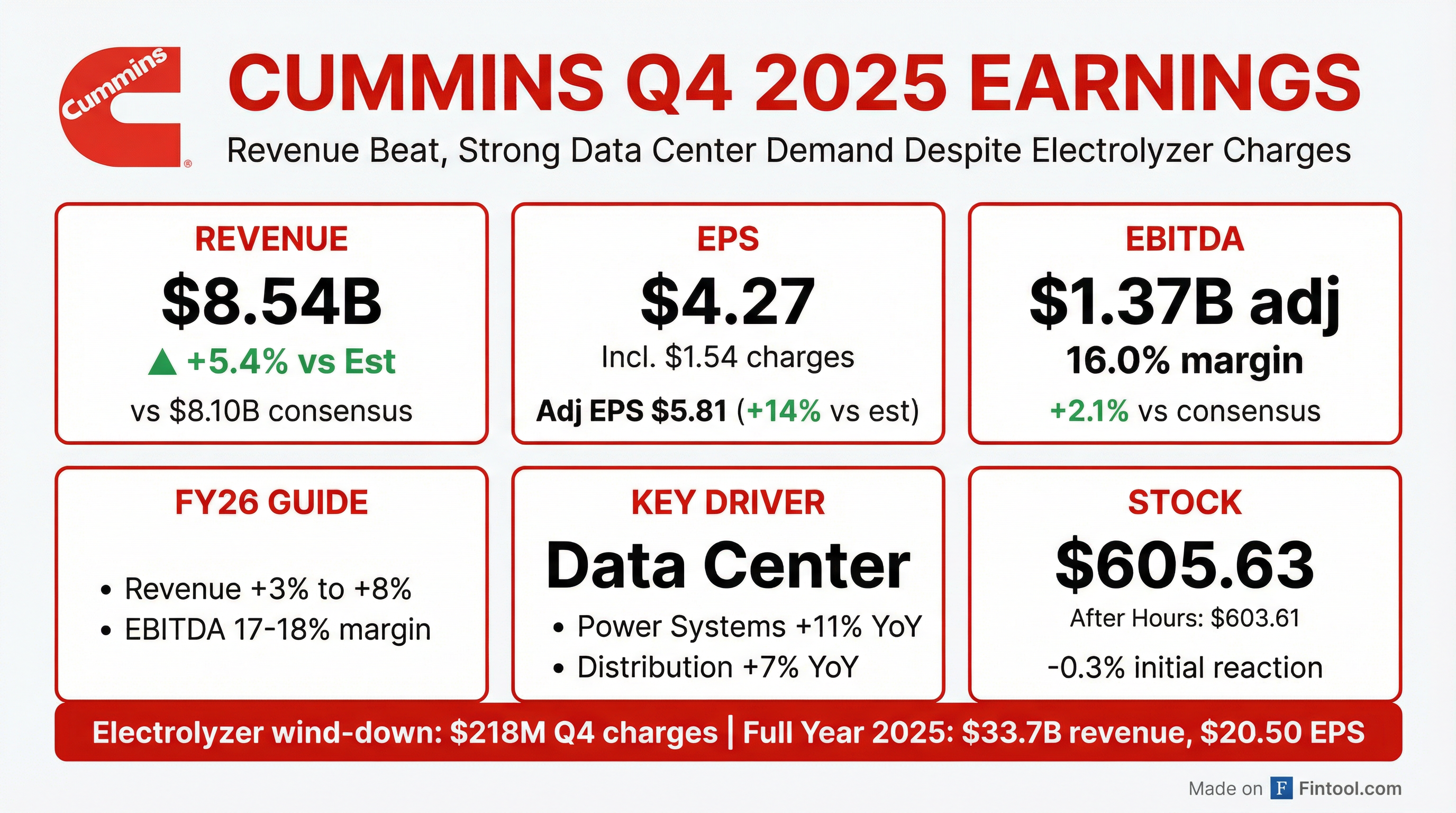

- Q4 revenue of $8.5 billion, up 1% year-over-year; Q4 EBITDA $1.2 billion (13.5%), or $1.4 billion (16%) excluding $218 million of Accelera charges.

- 2025 revenue of $33.7 billion, down 1%; EBITDA $5.4 billion (16%), or $5.8 billion (17.4%) ex-$458 million of Accelera charges; record full-year segment EBITDA margins in Power Systems at 22.7% and Distribution at 14.6%.

- 2026 guidance calls for revenue growth of 3–8% and an EBITDA margin of 17–18%.

- Q4 operating cash flow was $1.5 billion; full-year 2025 capital expenditures were $1.2 billion; dividends totaled $1.1 billion.

- Q4 revenue of $8.5 billion (+1% year-over-year) and EBITDA of $1.2 billion (13.5% of sales); excluding $218 million in accelerate segment charges, EBITDA was $1.4 billion (16%).

- 2025 full-year revenues of $33.7 billion (-1%) and EBITDA of $5.4 billion (16%); excluding one-time charges, EBITDA was $5.8 billion (17.4%).

- Record segment margins in power systems (22.7% of sales, +430 bps) and distribution (14.6% of sales, +250 bps) driven by data center demand and operational efficiency.

- 2026 guidance: revenues expected to increase 3%–8% and EBITDA margin to be 17%–18%, with continued North America truck market weakness in H1 and strong power generation and aftermarket demand.

- Q4 2025 revenues were $8.5 billion, up 1% year-over-year, with reported EBITDA of $1.2 billion (13.5% of sales); excluding $218 million of electrolyzer-related charges, adjusted EBITDA was $1.4 billion (16%).

- Full-year 2025 revenues of $33.7 billion declined 1%; EBITDA of $5.4 billion (16.0%) included $458 million of accelerate segment charges, while adjusted EBITDA reached a record $5.8 billion (17.4%).

- For 2026, Cummins forecasts revenues to grow 3%–8% and EBITDA margins of 17%–18%, with anticipated first-half weakness in North America truck markets and continued strength in power generation.

- Fourth quarter revenues were $8.5 billion, with GAAP net income of $593 million, or $4.27 per diluted share.

- Q4 EBITDA was 13.5% of sales, including $218 million of charges related to its electrolyzer business in Accelera.

- Full-year 2025 revenues totaled $33.7 billion, GAAP net income was $2.8 billion (or $20.50 EPS), and EBITDA was 16.0% of sales.

- For 2026, Cummins expects revenues to grow 3%–8% and EBITDA to be 17.0%–18.0% of sales.

- Q4 revenue of $8.5 billion, GAAP net income of $593 million (6.9% of sales) and diluted EPS of $4.27, including $218 million of charges ($1.54 per share) related to the Electrolyzer business.

- Full-year 2025 revenue of $33.7 billion, GAAP net income of $2.8 billion (8.4% of sales) and diluted EPS of $20.50, including $458 million of Electrolyzer charges ($3.28 per share).

- Q4 sales rose 1% year-over-year, with North America down 2% and international up 5%.

- 2026 outlook calls for revenue growth of 3–8% and EBITDA margins of 17.0–18.0%.

- The Hydrogen IC Engine Market is valued at USD 35.33 Billion in 2025 and is forecast to expand at a 22.76% CAGR to USD 274.38 Billion by 2035.

- Decarbonization mandates and demand for low-carbon heavy-duty power solutions are driving adoption of hydrogen ICEs, which leverage existing internal combustion engine infrastructure to reduce transition costs.

- In 2025, hydrogen-only engines held a 61% market share, while dual-fuel engines are the fastest-growing segment over 2026–2035.

- North America leads with a 36.47% revenue share in 2025, and the Asia Pacific region is the fastest-growth market at a 26.29% CAGR through 2035.

- In April 2025, Cummins launched H2 ICE turbochargers for heavy-duty on-highway applications, securing a Euro VII-compliant engine supply contract with a major European OEM.

- Q3 2025 revenue of $8.3 billion, a slight year-over-year decline but above Wall Street estimates, driven by strong backup power and data center demand.

- Adjusted EPS of $5.59 vs. consensus $4.81, reflecting resilience despite non-cash impairment charges in the Accelera segment.

- Power Systems revenue up 18%, Distribution 7%, and Accelera 10% year-over-year in the quarter.

- Quarterly dividend raised to $2.00 per share, marking the 16th consecutive annual increase.

- Paused full-year guidance amid regulatory uncertainty, planning an update in February 2026.

- Revenues of $8.3 billion in Q3 2025, down 2% year-over-year; EBITDA of $1.2 billion (14.3% of sales), or $1.4 billion (17.2%) excluding $240 million non-cash Accelera charges

- North America on-highway truck demand remains weak: heavy-duty unit sales down 38% and medium-duty down 55% year-over-year, with Q4 on-highway engine shipments expected to decline a further 15%

- Record power systems revenues of $2.0 billion (+18%) with a 22.9% EBITDA margin, and distribution revenues of $3.2 billion (+7%) with a 15.5% margin

- Strategic actions include a collaboration with Komatsu on hybrid mining powertrains and a review of the electrolyzer business following weaker green hydrogen demand

- Engine segment faces margin pressure from product changeovers, higher engineering costs, and lower volumes; management expects Q4 performance to be similar to Q3 levels as pressures bottom out.

- Power Systems achieved ~50% incremental margins in Q3 on a $200 million capacity expansion and record orders; further investments planned, but margin improvement will plateau.

- Data center business generated $2.6 billion revenue in 2024 (split evenly between PSBU and DBU) and is projected to grow 30–35% in 2025; capacity doubling for large engines is concluding and potential expansions into prime power and natural gas engines are under review.

- Accelera segment recorded non-cash impairment charges in Q3, mainly goodwill write-downs; electrolyzers account for less than half of losses, and cost-reduction measures are underway.

- E-mobility (primarily U.S. bus applications) has transitioned from negative to stable gross margins, while regulatory uncertainty for 2027 product launches persists and discussions with the EPA continue.

- Sales of $8.3 B, down 2% YoY, driven by weaker North America truck demand, with EBITDA of $1.2 B (14.3% of sales) and $1.4 B (17.2% excl. $240 M electrolyzer charges)

- Heavy-duty engine sales fell 38% to 16 k units and medium-duty fell 55% to 17 k; North America power generation revenues rose 27% and international revenues increased 2%

- China revenues of $1.7 B, up 16%, and India revenues of $713 M, up 3%, supported by data-center and domestic market strength

- Tariff costs rose in Q3; Cummins is nearing full recovery of earlier tariffs but remains net negative, and expects a further 15% drop in on-highway engine shipments in Q4

- Accelera segment took $240 M non-cash charges on electrolyzer assets amid reduced incentives and slower market development, triggering a strategic review

Quarterly earnings call transcripts for CUMMINS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more