Cboe COO Chris Isaacson to Retire After Leading Technology Transformation; Stock at 52-Week Highs

January 26, 2026 · by Fintool Agent

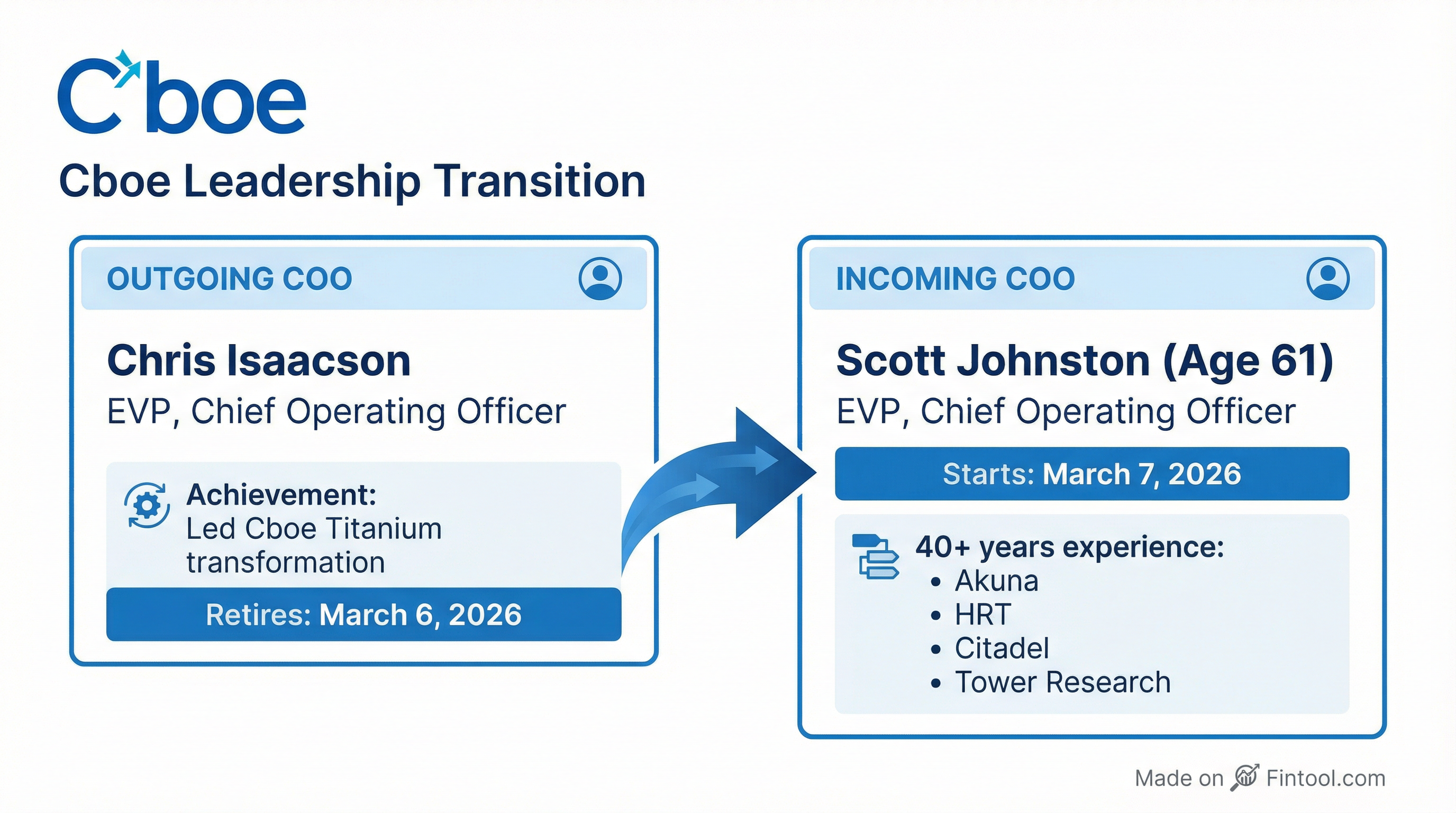

Cboe Global Markets announced today that Chief Operating Officer Chris Isaacson will retire effective March 6, 2026, capping a tenure that saw the world's largest derivatives exchange network transform its technology infrastructure and deliver a 131% stock return since early 2020 .

The announcement comes as CBOE trades near 52-week highs of $278.50, up over 40% in the past year, with the company just completing its sixth consecutive record-breaking year for options trading volume.

The Succession: A Trading Firm Veteran Takes the Helm

Scott Johnston, 61, will join Cboe on February 17, 2026, and assume the COO role on March 7 . Johnston brings over 40 years of industry experience spanning the trading firm ecosystem:

| Period | Role | Company |

|---|---|---|

| Spring 2025 - Present | Chief Operating Officer | Akuna Capital |

| Aug 2021 - Jun 2024 | Head, Operations Management | Hudson River Trading |

| Jun 2018 - Aug 2020 | Chief Administrative Officer/COO | Citadel Investment Group |

| May 2009 - Oct 2016 | Partner & COO | Tower Research Capital |

| Prior | Various Roles | CME Group, UBS |

His compensation package reflects the role's strategic importance :

| Component | Value |

|---|---|

| Base Salary | $550,000 |

| Target Bonus | 130% of base (prorated for 2026) |

| Annual LTI | $2.735M (time- and performance-based) |

| Sign-On Equity | $1.0M (3-year cliff vest) |

| Cash Sign-On Bonus | $627,200 |

Isaacson's Legacy: Technology Transformation

Isaacson's departure comes at a high-water mark for Cboe's operational capabilities. Under his leadership, the exchange completed a multi-year migration of all global equities and derivatives markets onto the unified "Cboe Titanium" technology platform .

Key operational achievements during his tenure:

- 99.9%+ platform uptime across all 27 global platforms in 2024, with 25 achieving 100% uptime

- 100 billion+ quotes and orders daily processed across Cboe's four U.S. options exchanges

- New options access architecture rolled out to improve market quality and data access

- Dedicated Cores service launched to enhance trading consistency for customers

"Chris has played a pivotal role in guiding Cboe through an incredible period of transformation and growth," said CEO Craig Donohue. "Under his leadership, Cboe transformed its technology and operations, paving the way for continued innovation and establishing Cboe as a benchmark for technology excellence in the industry" .

Stock Performance Under Isaacson

The stock hit a 52-week high of $278.50 on January 22, 2026—just days before this announcement. Key metrics:

| Metric | Value |

|---|---|

| Current Price | $276.59 |

| 52-Week High | $278.50 (Jan 22, 2026) |

| 52-Week Low | $197.10 (Jan 23, 2025) |

| 1-Year Return | +40.7% |

| Total Return Since Jan 2020 | +131.2% |

| Market Cap | $29.0B |

Financial Trajectory

Cboe's financial performance has strengthened consistently during Isaacson's operational tenure:

| Metric | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|---|

| Revenue | $3.43B | $3.49B | $3.96B | $3.77B | $4.09B |

| Net Income | $468M | $529M | $235M | $761M | $765M |

| Diluted EPS | $4.27 | $4.92 | $2.19 | $7.13 | $7.21 |

| EBITDA Margin | 25.3%* | 28.0%* | 28.4% | 31.8% | 31.9%* |

*Values retrieved from S&P Global

Record Options Volume: The Tailwind Behind the Numbers

Isaacson departs as Cboe reported its sixth consecutive record year for options trading in 2025:

- Total options volume: 4.6 billion contracts (ADV of 18.4 million)

- SPX options: 970.6 million contracts (ADV of 3.9 million)

- 0DTE SPX options: 59% of total SPX volume (ADV of 2.3 million)

- VIX options: 215.6 million contracts (ADV of 862,000)

The explosion in retail options trading, particularly through platforms like Robinhood, has been a key driver. As David Howson noted in the Q4 2024 earnings call, the Robinhood rollout "exceeded our expectations in two ways. First, that it's been quicker than we expected and second, that the uptake has been greater than we had expected" .

Transition Details: Consulting Through Year-End

The 8-K filing reveals the structured transition plan :

Isaacson's departure terms:

- Continues as full-time employee through March 6, 2026

- Will provide consulting services through December 31, 2026

- Consulting fee: $541,666 (paid monthly)

- Retains pro-rata portions of outstanding RSUs and PSUs based on service through consulting period

- Eligible for 2025 STI (bonus) payment based on performance

The retirement was described as voluntary, "not due to any disagreement with the Company concerning the Company's operations, policies or practices" .

Broader Leadership Reshuffle

The announcement comes with additional executive changes :

| Name | New Role | Notes |

|---|---|---|

| Heidi Fischer | EVP, Global Head of Equities and Spot Markets | Joining from TMX Group; 25+ years experience |

| Alex Dalley | SVP, Head of European Equities | Promoted; pending regulatory approval |

| Jon Weinberg | SVP, Global Head of FX and Off-Exchange Trading | Expanded role |

| Natan Tiefenbrun | Departing | Former President, Europe & Global Head of Cash Equities |

Cboe is also implementing a regional office leadership structure: Tim Lipscomb (Kansas City), Fischer (New York), Dalley and Weinberg (London), and Vikesh Patel (Amsterdam).

Insider Activity

Isaacson's recent Form 4 filings show routine equity transactions:

| Date | Type | Shares | Price |

|---|---|---|---|

| Sep 2, 2025 | Sale | 5,000 | $236.66 |

| Jul 15, 2025 | RSU Award | 940 | $0.00 |

| Jun 9, 2025 | Sale | 5,000 | $221.37 |

| Feb 19, 2025 | Option Exercise | 6,742 | $210.25 |

The 8-K outlines Isaacson's outstanding equity treatment upon retirement, with maximum pro-rata vesting of certain RSUs and PSUs based on his continued service through the consulting period .

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected early February) — consensus estimates: Revenue $662M, EPS $2.95*

- Johnston's start date (February 17) and formal COO transition (March 7)

- Strategic portfolio review — Cboe announced in Q3 2025 plans to sell Cboe Australia and Cboe Canada, discontinue corporate listings efforts

Technology initiatives:

- Continued Cboe Titanium investment and international rollout

- 24x5 U.S. equities trading expansion (pending regulatory approval)

- AI center of excellence and data platform development

*Consensus estimates from S&P Global

The Bottom Line

This is a textbook succession at a company firing on all cylinders. Isaacson leaves having delivered transformative technology improvements, record trading volumes, and a stock that has more than doubled. Johnston's deep trading firm pedigree—spanning Akuna, HRT, Citadel, and Tower Research—positions him to maintain operational excellence while potentially bringing fresh perspectives on serving the high-frequency trading community that drives much of Cboe's volume.

The 10-month overlap through consulting arrangements should minimize execution risk. With the stock at all-time highs and 2025 consensus pointing to continued growth, the market appears comfortable that Cboe's momentum will carry through the transition.

Related Companies: Cboe Global Markets