Chipotle's Executive Exodus: President and Top Lawyer Depart as Comps Slide

January 12, 2026 · by Fintool Agent

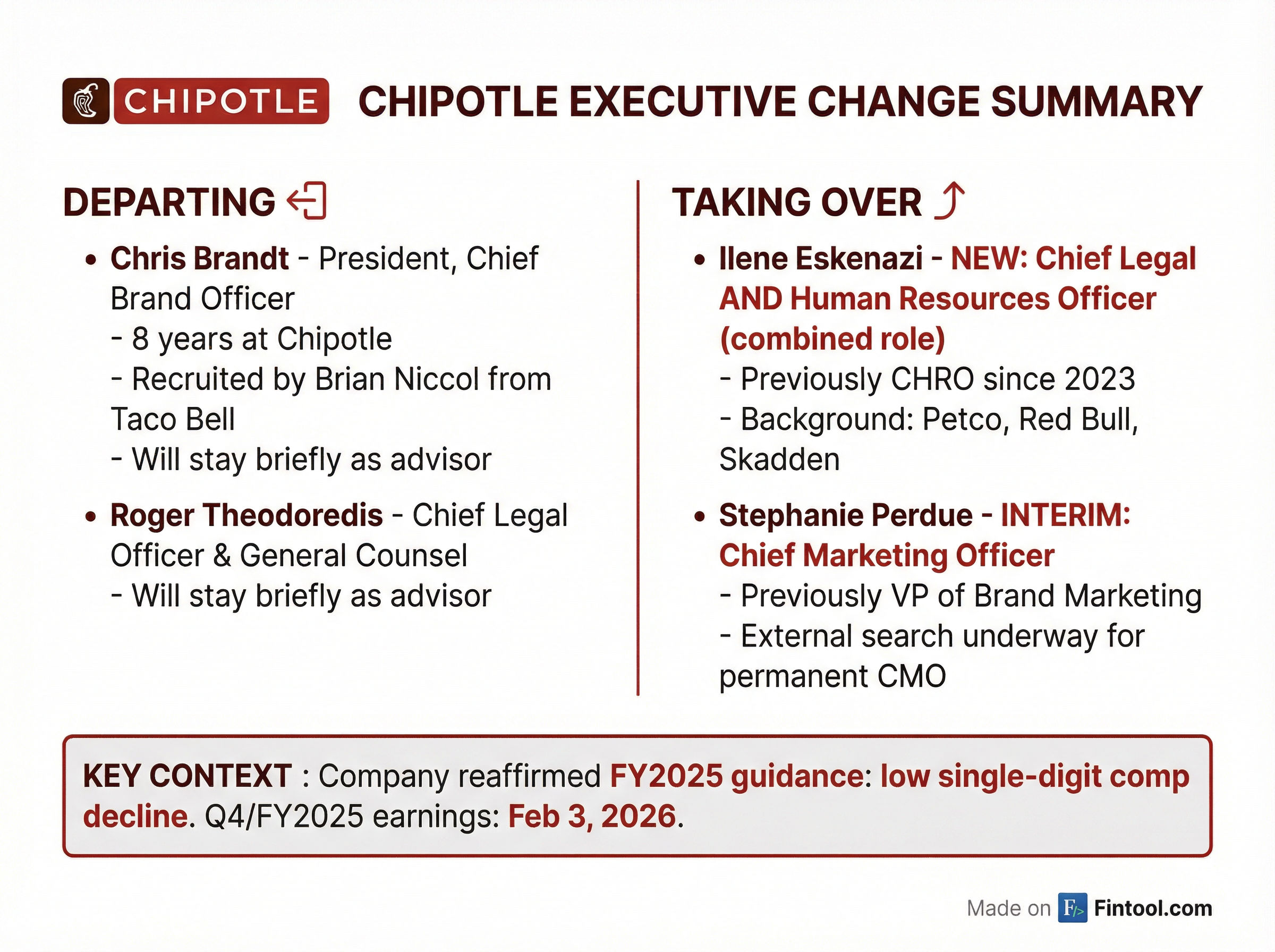

Chipotle Mexican Grill announced Sunday that President and Chief Brand Officer Chris Brandt and Chief Legal Officer Roger Theodoredis have departed, the latest shake-up at a company that has cycled through CEOs and now faces its first period of declining same-store sales in years.

The departures are effective immediately. Both executives will remain briefly as advisors to assist with succession.

The Brian Niccol Effect Fades

Brandt's exit is particularly notable: he was one of the original architects of Chipotle's turnaround, recruited in April 2018 from Taco Bell by then-new CEO Brian Niccol. When Niccol abruptly left for Starbucks in August 2024, the stock dropped 7.5% and the company scrambled to retain key executives with tens of millions in retention awards.

Brandt received $7 million in retention RSUs in August 2024 and saw his total compensation hit $14.1 million for the year—a 200% IPF (Individual Performance Factor) rating from the board for his marketing performance. His achievements included 70 billion social media impressions (61% YoY increase), record new restaurant openings, and successful limited-time menu launches like Chicken Al Pastor and Brisket.

Yet less than six months after those retention awards vested, he's out the door—raising questions about what changed.

Traffic Troubles

The timing suggests the departures may be connected to Chipotle's prolonged struggle to drive traffic. Q3 2025 comparable sales grew just 0.3%—entirely from price, with transactions down 0.8%. Q2 2025 was worse: comps fell 4.0%.

Management's full-year 2025 guidance calls for comparable restaurant sales to decline in the low-single digit range—a stark reversal from the mid-single-digit growth investors had grown accustomed to.

| Metric | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|

| Comp Sales | +6.0% | +5.4% | -0.4% | -4.0% | +0.3% |

| Revenue ($B) | $2.79 | $2.85 | $2.88 | $3.06 | $3.00 |

| EBITDA Margin | 20.5%* | 17.9%* | 20.3%* | 21.4%* | 19.1%* |

*Values retrieved from S&P Global

CEO Scott Boatwright, who took the helm after Niccol's departure, has been candid about the challenges. In Q1 2025, he noted that Brandt "has been asking for more marketing dollars for the 8 years I've been with this brand" and acknowledged "pretty material deficiencies" in guest experience—cleanliness at peak hours, friendliness, and customer recovery.

Leadership Restructuring Signals Cost Focus

The leadership restructuring reveals a cost-conscious approach:

- Ilene Eskenazi, previously Chief Human Resources Officer, now holds a combined Chief Legal and Human Resources Officer role—consolidating two C-suite positions into one.

- Stephanie Perdue, VP of Brand Marketing, becomes Interim CMO while Chipotle conducts an external search.

Eskenazi brings relevant dual experience from her prior role at Petco, where she held a joint Chief Legal and HR position. She also worked at Red Bull and Boardriders (Quiksilver) in similar combined capacities.

Guidance Reaffirmed—For Now

Despite the C-suite upheaval, Chipotle reaffirmed its 2025 guidance:

- Full-year comparable restaurant sales: decline in low-single digit range

- New restaurant openings: 315 to 345, with 80%+ featuring Chipotlanes

- Effective tax rate: 25% to 27%

CEO Boatwright struck a confident tone: "Our focus remains on the disciplined execution of our core strategies. We are reaffirming our full-year 2025 financial guidance that was issued in October and remain confident in our 2026 strategic plan."

Q4 and full-year 2025 results will be reported February 3, 2026.

Stock Reaction

CMG shares closed Monday at $40.34, essentially flat despite the news (the announcement came Sunday evening). The stock trades roughly 32% below its 52-week high of $59.57, reflecting the challenging comp environment.

| Metric | Value |

|---|---|

| Current Price | $40.34 |

| 52-Week High | $59.57 |

| 52-Week Low | $29.75 |

| Market Cap | $54B |

| 50-Day Avg | $34.48 |

| 200-Day Avg | $43.92 |

What to Watch

February 3 earnings call will be the first opportunity for investors to hear from management about:

- CMO search timeline and marketing strategy under interim leadership

- Traffic trajectory heading into 2026

- Cost structure implications of consolidated roles

- 2026 guidance and path back to positive comps

The external CMO search suggests the company isn't satisfied with promoting from within—a departure from Chipotle's typically strong internal bench (80% of promotions are historically internal).

The Bottom Line

Multiple C-suite departures less than 18 months after a disruptive CEO transition, combined with negative traffic and a combined legal/HR role, point to a company in cost-management mode. The burrito chain that once delivered consistent mid-to-high single-digit comp growth is now managing decline while searching for its next marketing leader externally.

The retention awards that were meant to stabilize leadership post-Niccol have largely vested. Now the question is whether Scott Boatwright's team can reverse traffic trends—or whether more departures are coming.

Related: