Chipotle Stock Tumbles After Flat 2026 Guidance Signals Prolonged Traffic Weakness

February 3, 2026 · by Fintool Agent

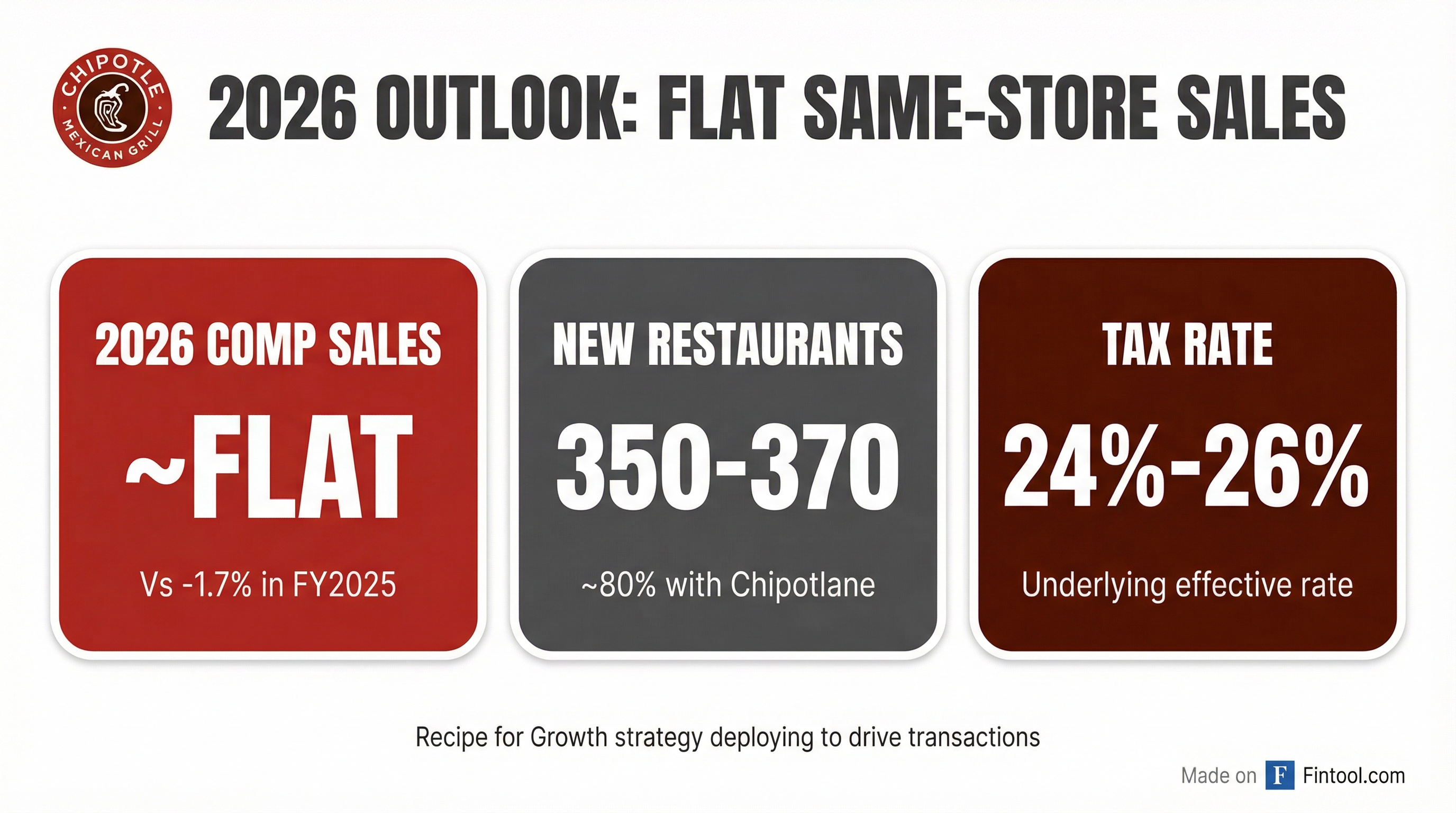

Chipotle Mexican Grill shares plunged approximately 7% in after-hours trading Tuesday after the fast-casual chain projected flat same-store sales for 2026—a sobering signal that the traffic weakness plaguing the burrito maker shows no signs of abating.

The company beat fourth-quarter earnings estimates, posting adjusted EPS of $0.25 versus the $0.24 consensus and revenue of $2.98 billion versus $2.96 billion expected. But the beat was overshadowed by management's muted outlook: comparable restaurant sales are expected to be "about flat" this year, following a 1.7% decline in fiscal 2025.

Shares closed the regular session at $39.17, up 1.7% on the day, before tumbling to approximately $36.34 in extended trading—a level that would mark a decline of roughly 33% from the stock's 52-week high of $59.

Fourth Consecutive Quarter of Traffic Declines

The Q4 results revealed the depth of Chipotle's consumer headwinds. Comparable restaurant sales fell 2.5% during the quarter, driven by a 3.2% drop in transactions partially offset by a 0.7% increase in average check. This marks the fourth consecutive quarter of traffic declines, a troubling pattern for a brand that built its premium positioning on operational excellence and customer loyalty.

"Against a dynamic consumer backdrop, we opened a record number of restaurants globally and grew Q4 and full year revenue," said CEO Scott Boatwright. The emphasis on restaurant openings rather than same-store performance reflects a strategic pivot: grow the base while waiting for macro conditions to improve.

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $2.98B | $2.85B | +4.9% |

| Comparable Sales | -2.5% | +5.4% | — |

| Restaurant Traffic | -3.2% | +0.8% | — |

| Operating Margin | 14.1% | 14.6% | -50 bps |

| Restaurant-Level Margin | 23.4% | 24.8% | -140 bps |

| Diluted EPS | $0.25 | $0.24 | +4.2% |

Margin Pressure Mounts

Beyond the traffic challenges, margin pressure intensified. Restaurant-level operating margin—the key profitability metric for the unit economics model—fell 140 basis points to 23.4% in Q4, down from 24.8% a year earlier. For the full year, restaurant margins declined to 25.4% from 26.7%.

The culprit: labor costs that remain stubbornly elevated against a backdrop of declining volumes. Labor as a percentage of revenue rose to 25.5% in Q4, up from 25.2% in the prior year period, "primarily due to lower sales volumes and wage inflation."

Food costs showed modest improvement, declining to 30.2% from 30.4% thanks to menu price increases and lower dairy costs. But beef and chicken inflation, combined with tariffs enacted in 2025, partially offset these gains.

2026 Outlook: The Flat Guidance That Spooked Investors

The most concerning element of Tuesday's report was the 2026 outlook. Management guided for:

- Comparable sales: ~Flat (versus -1.7% in FY2025)

- New restaurant openings: 350-370 (including 10-15 international partner-operated locations)

- Chipotlane penetration: ~80% of new company-owned restaurants

- Effective tax rate: 24%-26%

Investors hoping for a return to mid-single-digit comparable growth—the level CEO Boatwright suggested was possible by mid-2026 during the Q3 call—were left disappointed. The flat guidance suggests the "dynamic consumer backdrop" isn't expected to meaningfully improve this year.

Recipe for Growth: Five Pillars for the Long Game

Chipotle unveiled its "Recipe for Growth" strategy, a five-pillar framework designed to position the company for success when macroeconomic headwinds subside:

- Operational & Culinary Excellence: Protect and strengthen the core through exceptional value delivery

- Menu Innovation & New Occasions: Evolve brand messaging and accelerate new menu items, including the recently launched high-protein "Build Your Own Chipotle" offerings

- Technology Modernization: Leverage AI and relaunch the Rewards program to elevate guest and team experiences

- Global Expansion: Scale with intention through company-owned and partner-operated markets in the Middle East, Mexico, Singapore, and South Korea

- Talent Cultivation: Prioritize speed and agility with the best talent in the industry

Long-term targets include average unit volumes exceeding $4 million, restaurant-level margins approaching 30%, and more than 7,000 North American restaurants. Currently, the company operates 4,042 company-owned restaurants with average unit volumes of $3.1 million and restaurant margins of 25.4%.

Record Buybacks Amid Stock Decline

With the stock under pressure, Chipotle has been aggressive on capital returns. The company repurchased $2.4 billion of stock during 2025 at an average price of $42.54—well above current levels. In Q4 alone, the company bought back $742 million at $34.14 per share.

As of December 31, $1.7 billion remained available under existing buyback authorizations. The balance sheet remains healthy with $1.3 billion in cash, cash equivalents, and investments and no debt.

Full Year 2025: Revenue Growth, Traffic Decline

For the full year, Chipotle posted revenue of $11.9 billion, up 5.4% from 2024, driven primarily by new restaurant openings. Same-store sales declined 1.7% for the year as transactions fell 2.9%, partially offset by a 1.2% increase in average check.

| Metric | FY 2025 | FY 2024 | Change |

|---|---|---|---|

| Revenue | $11.9B | $11.3B | +5.4% |

| Comparable Sales | -1.7% | +7.9% | — |

| New Restaurant Openings | 334 | 271 | +23% |

| Operating Margin | 16.2% | 16.9% | -70 bps |

| Restaurant-Level Margin | 25.4% | 26.7% | -130 bps |

| Diluted EPS | $1.14 | $1.11 | +2.7% |

Digital sales represented 36.7% of total food and beverage revenue for the year, reflecting the channel shift that accelerated during the pandemic.

What to Watch

The path to traffic recovery hinges on several factors:

High-efficiency equipment rollout: Approximately 350 restaurants currently have the new equipment package, with plans to expand to roughly 2,000 by year-end. These locations are showing higher guest satisfaction scores and "meaningful comp sales outperformance."

Menu innovation: The recently launched "protein cups" and high-protein menu are designed to create new occasions beyond lunch and dinner. Early results from the "Double Protein" promotion drove the company's highest digital sales day.

International expansion: The Middle East partnership nearly doubled its footprint in 2025 (from 3 to 14 locations), with plans to double again in 2026. New markets opening this year include Mexico, Singapore, and South Korea.

Consumer spending trends: As Boatwright noted, Chipotle has seen pullback from consumers "of all income cohorts, although low-income diners have made the most significant shift to their behavior."

The Bottom Line

Chipotle delivered a Q4 beat but failed to inspire confidence with its 2026 outlook. Flat same-store sales guidance suggests the traffic pressures that have weighed on the stock since mid-2024 are unlikely to reverse quickly. With shares now down roughly 33% from their 52-week high and trading at approximately 34x forward earnings, investors must weigh the strength of the "Recipe for Growth" strategy against the reality of a challenging consumer environment.

The company's record new restaurant openings, strong balance sheet, and aggressive buyback program provide some downside support. But until traffic returns to positive territory, Chipotle's premium valuation remains difficult to justify.

Related