Clear Street Prices $1B IPO at ~$12B Valuation, Bringing Cloud-Native Prime Brokerage to Public Markets

February 4, 2026 · by Fintool Agent

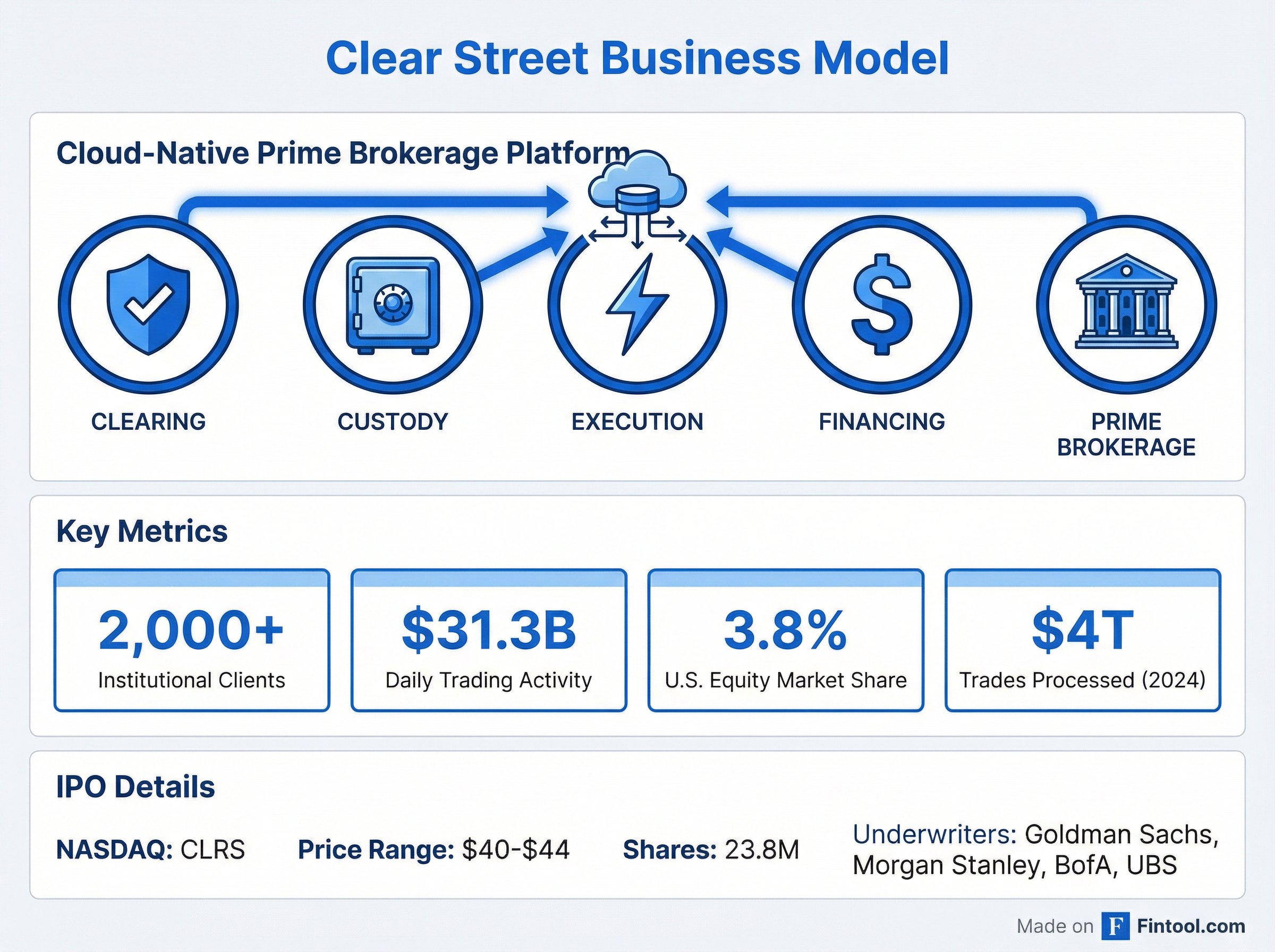

Clear Street Group Inc., the cloud-native fintech that's been quietly capturing market share from Wall Street's legacy prime brokers, is taking its next step: going public. The company filed an amended S-1 on Wednesday, pricing its IPO at $40 to $44 per share and seeking to raise up to $1.05 billion. At the top of the range, Clear Street would command a market valuation of nearly $12 billion .

The offering represents one of the largest fintech IPOs of the year, validating the thesis that modern technology can disrupt the creaking infrastructure that still powers much of Wall Street's plumbing.

The Numbers Behind the Buzz

Clear Street's financials tell a story of explosive growth:

| Metric | 9M 2025 | 9M 2024 | YoY Change |

|---|---|---|---|

| Revenue | $783.7M | $301.9M | +160% |

| Net Income | $157.2M | $20.7M | +659% |

For full-year 2024, the company reported revenue of $463.6 million (up 137% YoY) and net income of $89.1 million .

What Clear Street Actually Does

Founded in 2018, Clear Street built what it describes as "the first cloud-native, end-to-end capital markets platform powered by a single real-time ledger." Unlike legacy prime brokers running on decades-old infrastructure, Clear Street's platform was designed from scratch for the cloud era .

The platform offers:

- Clearing and custody for institutional investors

- Financing services with $17.2 billion in interest-bearing client balances

- Execution and trading across multiple asset classes

- Prime brokerage services for hedge funds and family offices

The numbers underscore the scale: Clear Street now supports over 2,000 institutional clients, processes $31.3 billion in daily trading activity, and clears approximately 3.8% of the U.S. equity market . In 2024 alone, the platform processed more than $4 trillion in trades across an average of 50 million transactions monthly.

Leadership With Pedigree

The company has assembled a leadership team that bridges technology and traditional finance. Co-founders Uriel Cohen (Executive Chairman), Chris Pento, and Sachin Kumar (CTO) launched the firm with a vision to build "the prime we need"—one that they, as former fund operators, would want to use themselves .

At the end of 2024, Ed Tilly took over as CEO. Tilly spent a decade running CBOE Global Markets, where he oversaw market cap growth from $2 billion to over $18 billion . His appointment signaled Clear Street's ambitions to compete at the highest levels of capital markets infrastructure.

"In a landscape dominated by legacy players, Chris had the vision to combine a cloud-native tech platform with non-bank prime-brokerage and a relentless customer-centric focus," Tilly said at his appointment. "That's a winning combination that we are repeating and scaling across markets, client types and geographies" .

IPO Structure and Underwriters

The offering is structured as follows:

| Detail | Value |

|---|---|

| Shares Offered | 23.8 million |

| Price Range | $40 - $44 |

| Target Raise | Up to $1.05B |

| Expected Valuation | $12B (at top) |

| Exchange | Nasdaq Global Select |

| Ticker | CLRS |

The underwriting syndicate features Wall Street's heavyweights: Goldman Sachs, Bank of America Securities, Morgan Stanley, and UBS Investment Bank—all of which compete with Clear Street in certain segments. Clear Street LLC is also serving as an underwriter, an unusual move that underscores the company's confidence in its own capabilities .

Following the IPO, Clear Street will have a dual-class share structure. Class B shares will carry ten votes per share compared to one vote for Class A, making the company a "controlled company" under Nasdaq rules. Clear Street Global Corp. will maintain majority voting control with approximately 88% of voting power .

Why This IPO Matters

Clear Street's public debut comes at a pivotal moment for capital markets infrastructure. Traditional prime brokers have struggled with aging technology stacks, capital constraints, and regulatory pressures that limit their ability to serve smaller hedge funds and emerging managers. Clear Street has positioned itself as the alternative.

"The primary problem is infrastructure," the company wrote in its founding manifesto. "Primes run on clearing and custody systems that are old and brittle. They increase costs and limit service capacity, creating insurmountable hurdles for a growing number of fund managers who no longer make the cut" .

The market appears receptive. Clear Street raised approximately $135.4 million through Series C preferred stock sales in December 2025 and January 2026, and its subsidiary issued $78.5 million in notes, bringing total outstanding debt to $300 million .

What to Watch

The IPO is expected to price next week. Key questions for investors include:

-

Can the growth sustain? 160% revenue growth is exceptional, but maintaining that trajectory as the company scales will be the challenge.

-

Competitive response: How will Goldman, Morgan Stanley, and other legacy primes react to a well-capitalized public competitor?

-

Profitability trajectory: With $157 million in net income through nine months of 2025, the company is already profitable—unusual for a high-growth fintech at IPO.

-

Market conditions: The software selloff gripping markets this week adds uncertainty, though Clear Street's core business is more infrastructure than software.

For a company founded just eight years ago, a ~$12 billion valuation and $1 billion capital raise represents a remarkable validation of the thesis that Wall Street's plumbing is ripe for disruption.