Coeur Mining and New Gold Shareholders Overwhelmingly Approve $7 Billion Merger, Creating North American Mining Powerhouse

January 28, 2026 · by Fintool Agent

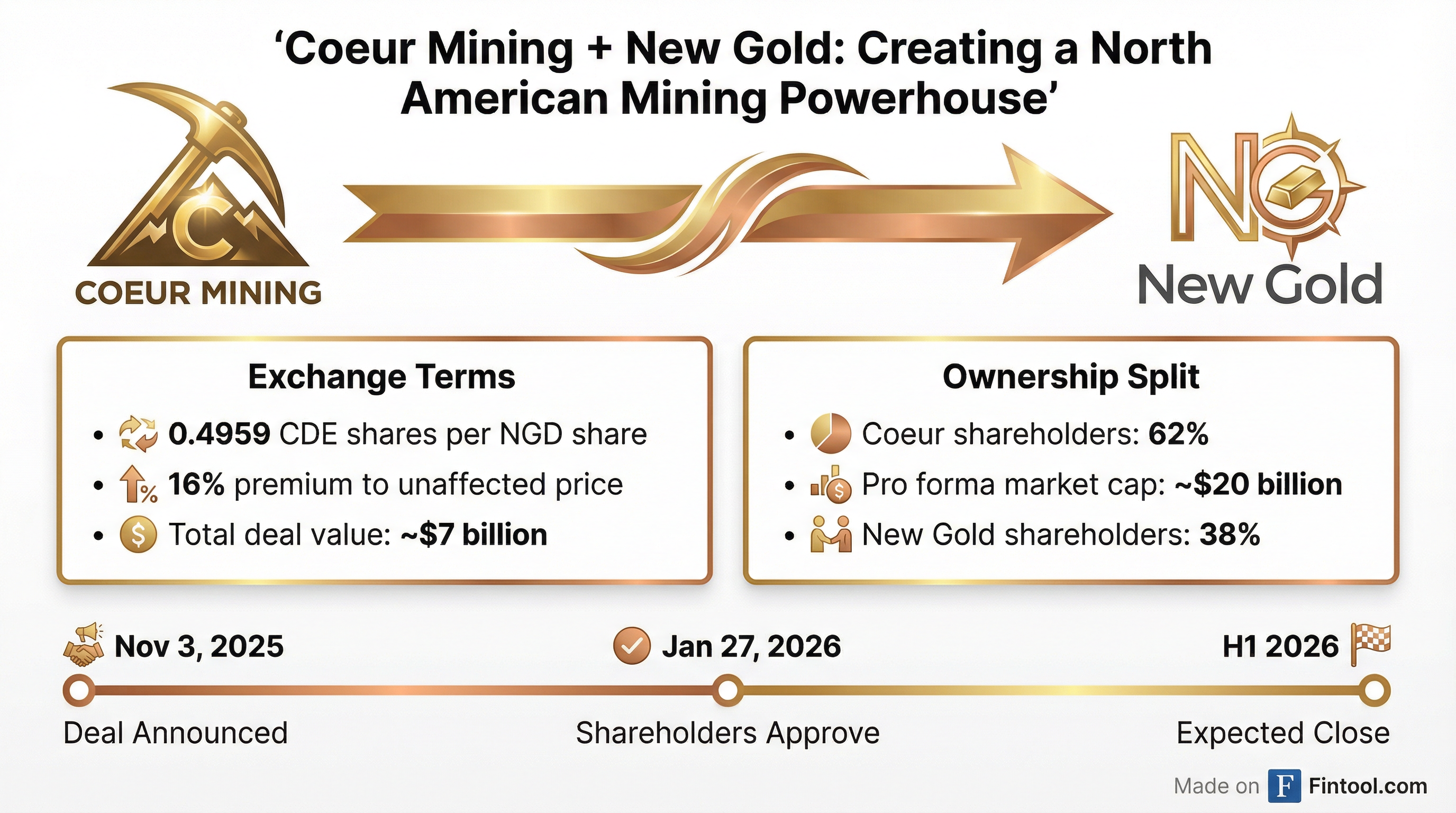

Shareholders of Coeur Mining and New Gold have given their overwhelming approval to a $7 billion all-stock merger that will create the largest pure-play North American precious metals producer—and they couldn't have picked a better time, with gold prices surging past $5,100 per ounce to all-time highs.

At Coeur's special stockholder meeting on January 27, 2026, two critical proposals passed with decisive majorities. The charter amendment to increase authorized shares from 900 million to 1.3 billion received 96.75% approval, while the stock issuance proposal to New Gold shareholders passed with 97.12% support.

New Gold shareholders were even more emphatic, voting 99.22% in favor of the arrangement at their separate meeting.

A Transformational Deal at the Perfect Moment

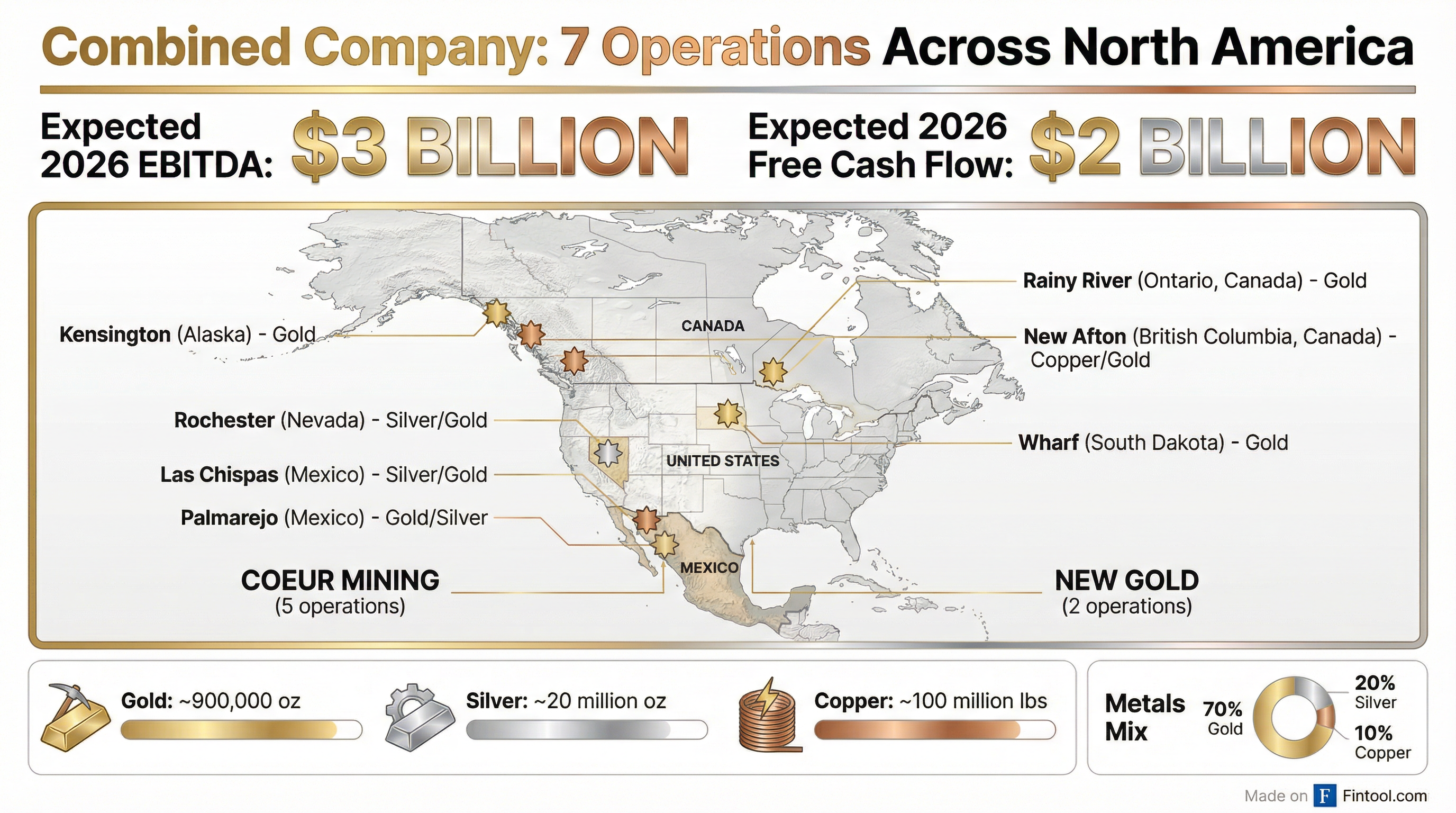

The combination brings together Coeur's five U.S. and Mexican operations with New Gold's two Canadian mines—Rainy River in Ontario and New Afton in British Columbia—creating a seven-asset portfolio spanning the continent.

"This transaction provides clear and compelling benefits for New Gold and Coeur shareholders by bringing together two companies with similar cultures to create a stronger, more resilient, and larger scale precious metals mining company," said Mitchell J. Krebs, Coeur's Chairman, President and CEO, at the special meeting.

The timing couldn't be more fortuitous. Gold has surged 64% in 2025—its biggest annual gain since 1979—and has already climbed another 18% this year, driven by safe-haven demand amid geopolitical tensions, central bank buying, and a weakening dollar. Analysts at Deutsche Bank, Goldman Sachs, and Bank of America now see gold reaching $5,400-$6,000 per ounce by year-end.

Financial Firepower: $3 Billion EBITDA, $2 Billion Free Cash Flow

The combined company is expected to generate approximately $3 billion of EBITDA and $2 billion of free cash flow in 2026—a dramatic acceleration from Coeur's standalone trajectory.

| Metric | Coeur FY 2023 | Coeur Est. 2025 | Combined 2026E |

|---|---|---|---|

| EBITDA | $142M | $1.0B | $3.0B |

| Free Cash Flow | -$297M | $550M | $2.0B |

| Operations | 5 | 5 | 7 |

Source: Company projections

The financial transformation is stark. Just two years ago, Coeur was burning cash. Now the combined entity will rank among the most cash-generative gold producers in the sector.

Both stocks have rallied sharply since the November 3, 2025 announcement. Coeur shares have climbed 49% from $17.17 to $25.62, while New Gold has surged 71% from $7.34 to $12.57—propelled by both deal enthusiasm and the broader gold rally.

Combined Production: 70% Gold, 20% Silver, 10% Copper

Under the terms of the arrangement, New Gold shareholders will receive 0.4959 Coeur common shares for each New Gold share—a 16% premium to New Gold's unaffected share price on October 31, 2025. Upon closing, existing Coeur stockholders will own approximately 62% and New Gold shareholders 38% of the combined company.

The combined company will produce approximately 1.25 million gold equivalent ounces annually, including:

- Gold: ~900,000 ounces

- Silver: ~20 million ounces

- Copper: ~100 million pounds

The metals mix shifts to roughly 70% gold, 20% silver, and 10% copper—up from Coeur's historically silver-weighted profile.

What's Next: BC Court Approval and H1 2026 Close

While both shareholder votes have passed, the transaction still requires final approval from the Supreme Court of British Columbia, along with remaining regulatory clearances and TSX listing approval for Coeur shares.

The deal includes substantial protections. Break fees of $414 million and $255 million apply to Coeur and New Gold respectively if either party terminates under certain circumstances. The outside date is May 15, 2026, with automatic extension to August 15, 2026 if only regulatory approvals remain outstanding.

Upon closing:

- New Gold shares will be delisted from the TSX and NYSE American

- Coeur will seek a new listing on the Toronto Stock Exchange

- Patrick Godin, New Gold's CEO, and another New Gold director will join Coeur's board

- The combined company will operate from New Gold's Toronto office while maintaining Coeur's Chicago headquarters

Coeur Mining shares closed at $25.62 on January 28, up modestly in after-hours trading. New Gold finished at $12.57—trading almost exactly at the implied deal value of $12.70 based on the exchange ratio.

Related: Coeur Mining · New Gold