Modelo Maker's Sales Slump as Hispanic Consumers Pull Back

January 7, 2026 · by Fintool Agent

Constellation Brands reported Q3 fiscal 2026 earnings that laid bare the ongoing challenge facing America's top imported beer company: the Hispanic consumers who propelled Modelo and Corona to dominance are cutting back on spending, and there's no clear end in sight.

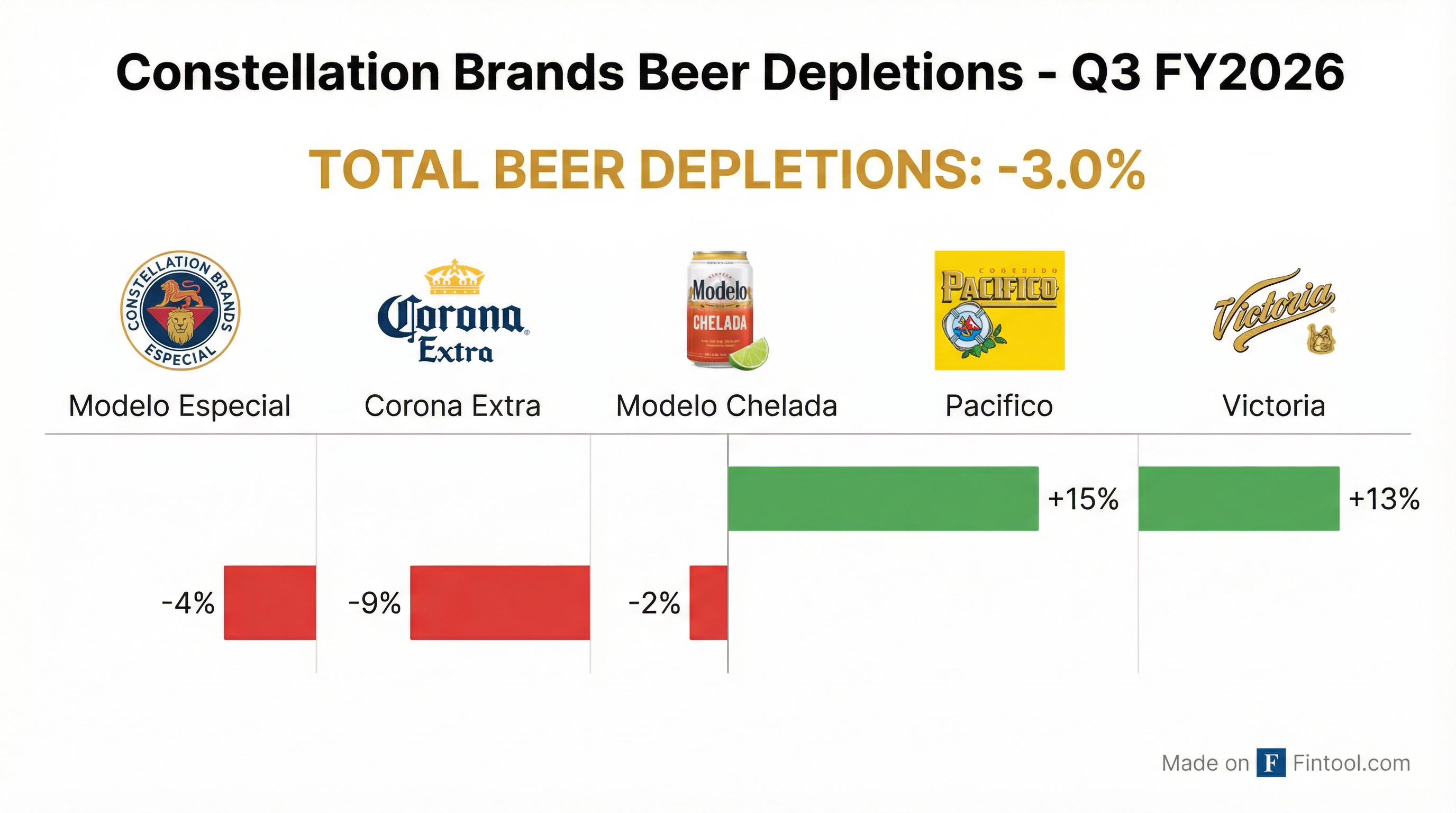

Net sales fell 10% to $2.22 billion, with beer depletions—a key measure of consumer demand—declining 3.0% . Modelo Especial, the brand that famously overtook Bud Light to become America's #1 selling beer in 2023, saw depletions fall approximately 4%, while Corona Extra plunged nearly 9% .

The stock closed down 1.8% to $140.49, extending a decline that has seen shares fall more than 50% from their 2022 highs.

The Hispanic Consumer Headwind

The numbers tell a stark story about economic anxiety among Hispanic Americans, who comprise roughly half of Constellation's consumer base .

CEO Bill Newlands painted a picture of a consumer in retreat. In the company's most recent earnings call, he noted that 80% of surveyed consumers—both Hispanic and non-Hispanic—express concern about the socioeconomic environment, with 70% specifically worried about their personal finances .

"We've got a consumer base that's pulling in a bit, and they are not engaging," Newlands said. "The results that you are seeing in high Hispanic zip code areas are significantly worse than what you see in the general market" .

California has been "the single biggest problem," according to Newlands, as construction jobs—the "4,000 calorie jobs" that historically correlate with beer consumption—haven't materialized as expected .

A Tale of Two Portfolios

While the flagship brands struggled, smaller Mexican imports are thriving. Pacifico grew depletions by over 15% and Victoria surged 13% —a glimmer suggesting that consumers trading down from premium products are staying within the Constellation portfolio rather than leaving entirely.

The company maintained that its Beer Business still ranked as the #3 dollar share gainer in tracked channels, with Modelo Especial and Corona Extra holding their #1 and #5 positions in dollar sales respectively . Four of the top 15 share-gaining brands in the entire U.S. beer category belong to Constellation.

| Metric | Q3 FY26 | Q3 FY25 | Change |

|---|---|---|---|

| Net Sales | $2,223M | $2,464M | -10% |

| Beer Net Sales | $2,010M | $2,032M | -1% |

| Beer Depletions | -- | -- | -3.0% |

| Reported EPS | $2.88 | $3.39 | -15% |

| Comparable EPS | $3.06 | $3.25 | -6% |

Guidance Holds, But Challenges Persist

Management affirmed full-year comparable EPS guidance of $11.30 to $11.60, while updating reported EPS to $9.72 to $10.02 . Beer net sales are now expected to decline 2% to 4% for the full fiscal year, with operating income falling 7% to 9% .

CFO Garth Hankinson emphasized capital allocation discipline: "Through the first three quarters of fiscal 2026, we returned nearly $1.4 billion to shareholders, maintained our investment-grade rating, and consistently met our ~3.0X comparable net leverage and ~30% dividend payout ratio targets" .

The company repurchased $824 million of shares year-to-date through December 2025 and declared a quarterly dividend of $1.02 per share .

Industry-Wide Weakness

Constellation isn't alone. The entire beer industry is under pressure, though the Hispanic consumer pullback hits imported Mexican beers disproportionately hard given their demographic concentration .

Recent Nielsen scanner data shows broad weakness across major brewers: Boston Beer volumes down 7%, Molson Coors down 11%, and Ab Inbev down 4% year-over-year .

| Company | Ticker | Price | Market Cap | YoY Volume Change |

|---|---|---|---|---|

| Constellation Brands | STZ | $140.49 | $24.8B* | -3% |

| Molson Coors | TAP | $45.94 | $9.3B* | -11% |

| Anheuser-Busch InBev | BUD | $63.14 | $123.3B* | -4% |

*Market cap values retrieved from S&P Global

The company's Wine and Spirits segment, now significantly smaller following divestitures of SVEDKA and mainstream wine brands, saw net sales plunge 51% to $213 million, though organic sales declined a more modest 7% .

What to Watch

The path forward hinges on macroeconomic improvement. Newlands expressed cautious optimism that volumes may have bottomed, but acknowledged "unprecedented volatility" in consumer behavior .

Management highlighted several strategic responses to the affordability squeeze:

- Repositioning Modelo Lite at lower price points to capture trading-down consumers

- Expanding price-pack architecture to offer entry points for financially constrained shoppers

- Continued investment in brewery capacity despite near-term headwinds, signaling confidence in long-term demand

"We're sitting in a good spot as the consumer turns around and gets more comfortable with where they are," Newlands said. "At the moment, there's just a tremendous amount of concern about socioeconomic issues really across the board" .

Related: Constellation Brands · Molson Coors · Anheuser-busch Inbev