US Investors Sue South Korea Over Coupang 'Discrimination,' Seek Tariffs and Trade Sanctions

January 22, 2026 · by Fintool Agent

Two of Silicon Valley's most prominent venture capital firms have taken the extraordinary step of filing arbitration claims against South Korea—accusing Seoul of mounting a discriminatory campaign against Coupang that has destroyed billions of dollars in shareholder value.

Greenoaks Capital Partners and Altimeter Capital notified the South Korean government Thursday of their intent to bring claims under the US-Korea Free Trade Agreement (KORUS), while simultaneously petitioning the Office of the US Trade Representative to investigate Seoul's actions and impose "appropriate trade remedies, potentially including tariffs and other sanctions."

The move could escalate a corporate data breach crisis into a full-blown trade dispute between two long-standing allies—testing the durability of the KORUS agreement at a moment when the Trump administration is already reshaping America's trade relationships.

The Investor Case

Greenoaks and Altimeter, which together hold more than $1.5 billion in Coupang equity, allege that South Korea's response to the company's November 2025 data breach has "far exceeded" scrutiny imposed on domestic Korean and Chinese competitors.

"More than a dozen government bodies were mobilized over several weeks," the investors stated in their filings, "including law enforcement, tax, labor, financial, media, customs, land use, and national intelligence agencies—many with no role in data or cybersecurity matters."

Among the government actions the investors cite:

- Repeated raids on Coupang offices by South Korean police

- A 150-member National Tax Service task force and 86-member police task force focused solely on investigating the company

- Pressure on the national pension fund to divest its Coupang holdings

- Blocked commercial agreements unrelated to the data breach

- Criminal referrals for company executives who are US nationals, including founder Bom Kim and Chief Administrative Officer Harold Rogers

Perhaps most damning, the investors point to public statements by Korean Prime Minister Kim Min-seok, who urged regulators to approach enforcement against Coupang "with the same determination used to wipe out mafias."

Timeline of the Crisis

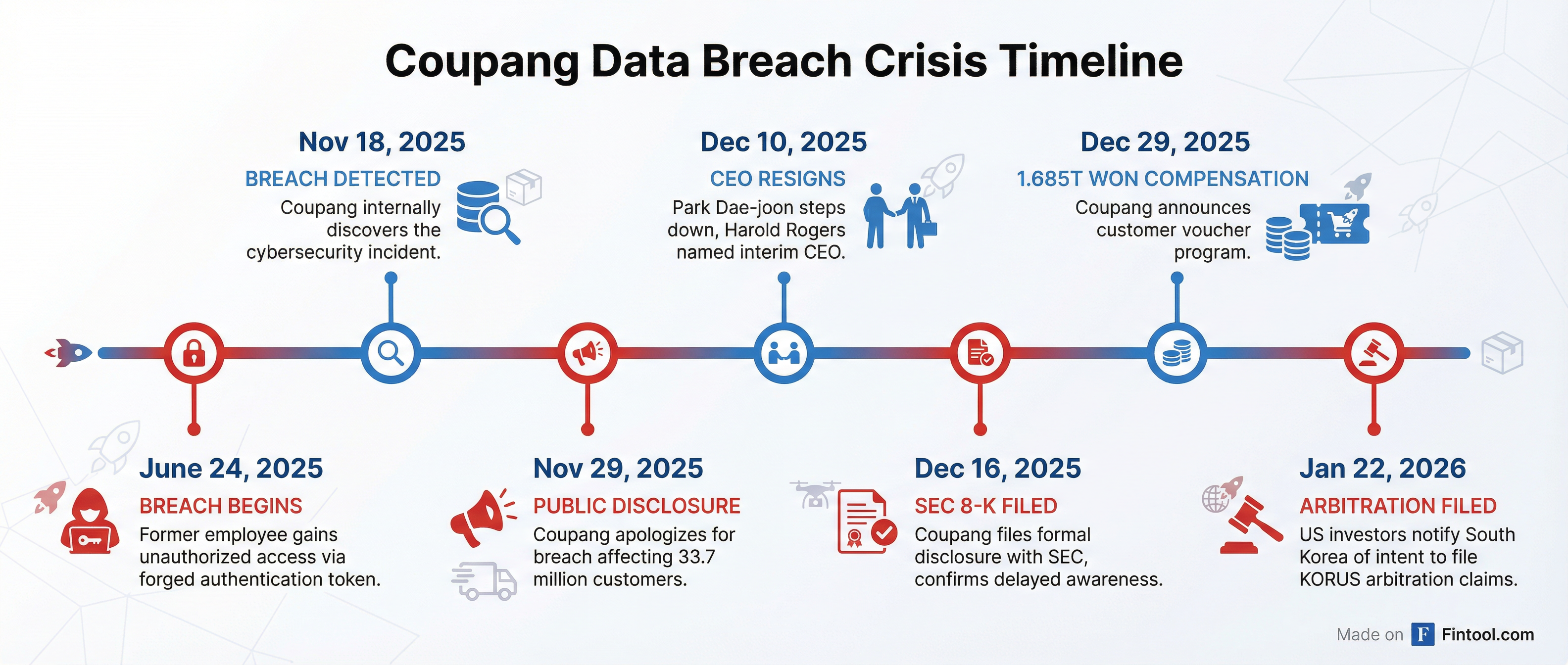

The dispute traces back to June 2025, when a former Coupang employee—described as a Chinese national who had worked in authentication management—allegedly used a forged token and retained access credentials to gain unauthorized access to customer data.

Coupang detected the breach internally on November 18, 2025, but did not disclose it publicly until November 29—a delay that has become central to securities litigation against the company.

The breach affected approximately 33.7 million customer accounts, making it the largest data leak in South Korean history. Compromised information included names, phone numbers, delivery addresses, and email addresses—though payment credentials were reportedly not exposed.

CEO Park Dae-joon resigned on December 10, with Harold Rogers—Coupang's General Counsel and a US citizen—stepping in as interim CEO of the Korean e-commerce unit.

On December 29, Coupang announced a customer compensation program worth 1.685 trillion won ($1.2 billion), distributing 50,000 won in purchase vouchers to each of the 33.7 million affected accounts.

Market Impact

The fallout has been devastating for shareholders. Coupang shares have plunged 37.6% since the breach was disclosed, erasing approximately $22.6 billion in market capitalization.

| Metric | Before Breach (Nov 28) | Current (Jan 22) | Change |

|---|---|---|---|

| Stock Price | $31.98 | $19.95 | -37.6% |

| Market Cap | $60B | $37.4B | -$22.6B |

Greenoaks holds over $1.4 billion of Coupang stock, representing 17.3% of its portfolio according to its latest 13-F filing. Altimeter's position is valued at approximately $210-340 million.

"These losses have been borne directly by US shareholders—including individual investors and institutional funds holding the retirement savings of millions of American workers," the investors stated in their filings.

Financial Position

Despite the turmoil, Coupang's underlying business remains substantial. The company generated $7.1 billion in revenue in Q3 2025—up 17% year-over-year—and holds $7.2 billion in cash.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $6.05 | $6.09 | $6.51 | $7.08 |

| Net Income ($M) | $156 | $107 | $32 | $95 |

| Cash ($B) | $5.88 | $6.11 | $6.80 | $7.23 |

The company generates approximately 90% of its revenue from South Korea, giving Seoul substantial leverage over its operations.

Political Connections

The timing and participants lend the dispute added political significance.

Greenoaks founder Neil Mehta sits on Coupang's board of directors, though he says he brought the action independent of the company.

Altimeter founder Brad Gerstner led the initiative that became "Trump Accounts"—the viral campaign encouraging Americans to set up brokerage accounts in the president's name. Former acting White House Chief of Staff Mick Mulvaney this week wrote an op-ed in the Washington Examiner arguing that South Korea is "targeting" US companies.

Coupang itself was founded by Korean American entrepreneur Kim Bom-suk (also known as Bom Kim), and the company is headquartered in Seattle—making it legally an American firm despite its Korean operations.

The Legal Path Forward

The filings trigger two parallel tracks:

KORUS Arbitration: The notice to South Korea begins a 90-day "cooling-off" period, during which the government can either "engage in self-correction" or proceed to formal arbitration. If Seoul doesn't address the investors' concerns, a tribunal would ultimately decide whether Korean actions violated the trade agreement's protections for American investors.

Section 301 Investigation: The petition to USTR starts a 45-day clock for the trade office to decide whether to launch a formal investigation under Section 301 of the Trade Act—the same provision used to impose tariffs on China during the first Trump administration. A formal probe could open public comment periods, hearings, and potentially lead to tariffs or sanctions on South Korean goods.

Seoul's Response

South Korea's Trade Minister Yeo Han-koo has pushed back, saying the government is not discriminating against Coupang and that US officials have "misunderstandings."

Presidential spokesperson Cheong Wa Dae stated that the ongoing investigation should not be interpreted as part of a broader trade issue, arguing that the case involves an "unprecedented" scale of personal data leakage and that investigations are "in line with applicable laws."

The data breach remains the largest in South Korean history, and public sentiment has strongly favored aggressive enforcement. But the investors argue that the response has gone beyond enforcement into a coordinated campaign to destroy an American company that was taking market share from domestic and Chinese competitors.

What to Watch

USTR Decision (Within 45 Days): Whether the trade office decides to launch a formal Section 301 investigation will signal how seriously the Trump administration views the case—and could influence settlement discussions.

South Korea's Response: Seoul must decide whether to negotiate during the cooling-off period or defend its actions in arbitration. The government faces pressure from both sides—domestic public opinion demanding accountability for the breach, and diplomatic interests in maintaining strong US relations.

Other Investors: Greenoaks and Altimeter may not be alone for long. The legal framework they've established could encourage other institutional holders—including sovereign wealth funds and pension managers—to join the action.

Coupang Earnings (February 2026): The company's next quarterly report will be the first to fully reflect the impact of both the data breach and the government crackdown on its Korean operations.

This case represents an unprecedented use of trade law by venture capital investors—and could set a significant precedent for how American firms with overseas operations are protected under free trade agreements.