Crane's Max Mitchell Steps Down After 181% Stock Return, COO Alcala Named CEO

January 26, 2026 · by Fintool Agent

Crane Company announced a planned CEO succession alongside record Q4 2025 results, with longtime CEO Max Mitchell handing the reins to COO Alex Alcala effective April 27, 2026. Mitchell, who has led Crane since 2014 and delivered a 181% stock return since the company's April 2023 separation, will remain as Executive Chairman.

The stock rose 2.7% to $209.77 in Monday's session following the announcement, with shares gaining further to $211 in after-hours trading.

The Mitchell Era: A Transformational Decade

Max Mitchell's tenure at Crane represents one of the more successful industrial CEO runs in recent memory. Since becoming CEO of the predecessor Crane Holdings in January 2014, Mitchell has orchestrated a fundamental transformation of the company's portfolio:

- Portfolio reshaping: Completed more than $2 billion in acquisitions and executed strategic divestitures, culminating in the April 2023 separation into Crane Company and Crane NXT

- Value creation: The company cites approximately $7.6 billion in equity value creation comparing December 2020 Crane Holdings to the combined post-separation companies as of December 2024 (+167%)

- Total shareholder return: Crane's 2024 TSR reached 106% versus 45% for the S&P MidCap 400 Capital Goods group

Since the separation, Crane stock has nearly tripled—from $74.68 at the April 3, 2023 open to $209.77 today, a 181% return in just 2.8 years (44% annualized).

Mitchell stated the transition was "well-planned and long-signaled," noting he had worked "side-by-side with Alex for more than a decade" and cannot think of "anyone better suited to continue Crane's strong forward momentum."

Alex Alcala: The Operator Turned CEO

Alex Alcala, 51, brings more than two decades of global industrial experience to the CEO role. His Crane career has been marked by consistent promotions and operational success:

| Period | Role | Key Accomplishments |

|---|---|---|

| 2013 | President, Crane Pumps & Systems | Joined Crane, drove substantial growth |

| 2014-2020 | President, Crane ChemPharma & Energy | Led segment expansion |

| 2020-2023 | SVP, Process Flow Technologies | Oversaw PFT + China, India, Middle East operations |

| 2023-2024 | EVP, Both Segments | Assumed full segment leadership |

| Dec 2024-Present | EVP & COO | Strategic and operational oversight |

| April 2026 | President & CEO | Incoming role |

Prior to Crane, Alcala held operations and strategic marketing positions at Eaton Corporation. His promotion to COO in December 2024 was explicitly described as positioning the company for "significant growth" and as "an example of our strong intellectual capital process focused on recognizing and promoting talent from within."

Alcala emphasized continuity in his statement: "I am committed to building on our legacy of performance and integrity, while leading Crane into its next phase of accelerated growth and value creation with rigorous operational and execution excellence as a given."

Record Q4 Caps Banner Year

The succession announcement accompanied Crane's strongest quarter ever:

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $581.0M | $544.1M | +6.8% |

| Core Sales Growth | — | — | +5.4% |

| Adjusted EPS | $1.53 | $1.26 | +21% |

| Operating Margin | 17.5% | 15.8% | +170bps |

| Adj. Operating Margin | 19.2% | 17.7% | +150bps |

Full-year 2025 results were equally impressive—adjusted EPS of $6.05 represented 24% growth over 2024, while revenue reached $2.31 billion (+8.2%).

Both business segments delivered record performance:

Aerospace & Advanced Technologies (renamed from Aerospace & Electronics):

- Q4 sales up 14.7% to $271.6M on 14.3% core growth

- Adjusted operating margin of 23.6%

- Backlog of $1.08B, up 25% year-over-year

Process Flow Technologies:

- Q4 sales flat at $309.4M (core down 1.5%, offset by FX and acquisitions)

- Adjusted operating margin expanded to 22.0% from 20.3%

- Orders remained "sluggish," management adopting "cautious view" of 2026

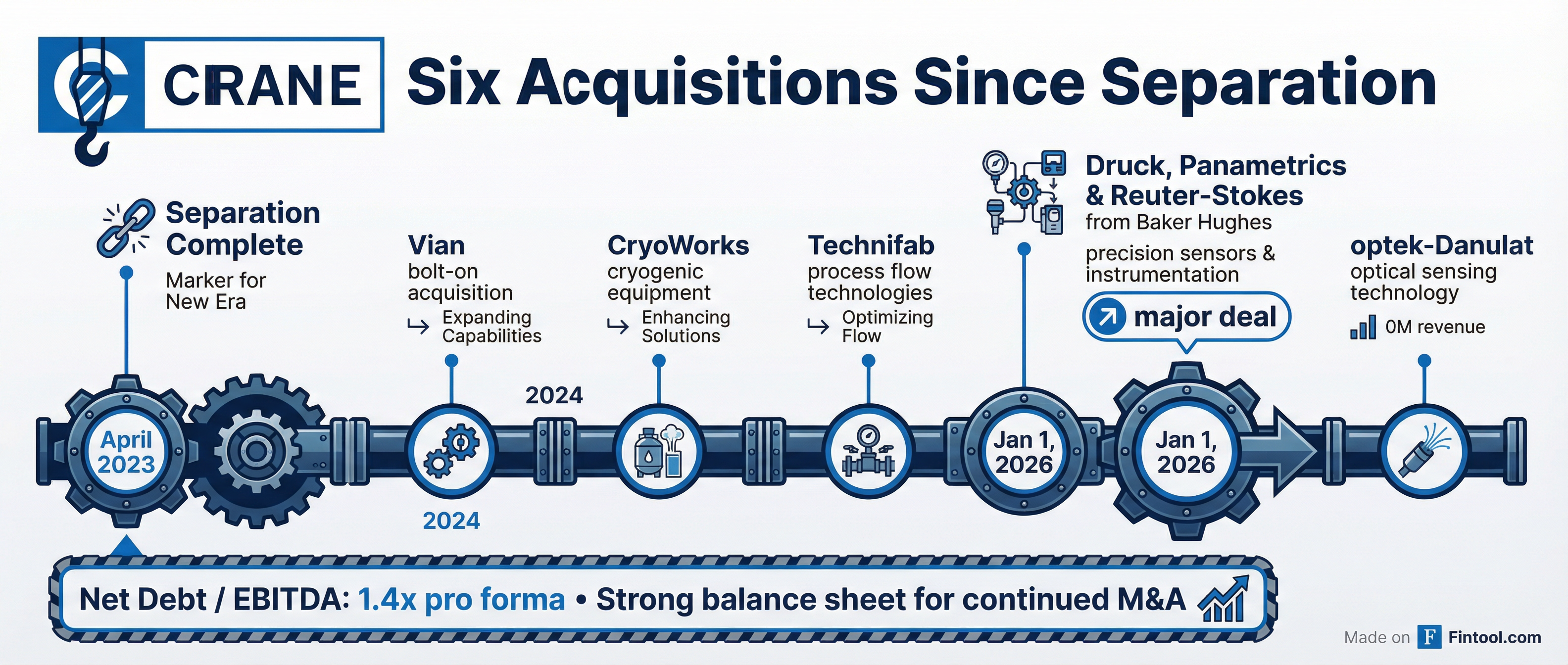

Aggressive M&A Continues

Mitchell and Alcala wasted no time deploying capital in 2026. The company closed two significant transactions on January 1:

Druck, Panametrics & Reuter-Stokes (from Baker Hughes): A precision sensors and instrumentation business that will be housed in the renamed Aerospace & Advanced Technologies segment. This deal—funded through $1.15B in borrowings under a September 2025 credit facility—represents Crane's largest acquisition since separation.

optek-Danulat: A German provider of inline process control optical measurement solutions for biopharma and pharmaceutical markets. The business generated $40 million in 2025 sales and complements Crane's instrumentation business within Process Flow Technologies.

These deals bring Crane's total to six acquisitions since separation, with net debt / adjusted EBITDA remaining manageable at just 1.4x pro forma. CFO Rich Maue noted the company has "significant financial flexibility for further capital deployment" and continues to pursue a "very robust acquisition pipeline."

2026 Outlook: 10% EPS Growth on Acquisitions

Crane initiated 2026 guidance that reflects both organic momentum and deal contributions:

| Metric | 2026 Guidance | Commentary |

|---|---|---|

| Adjusted EPS | $6.55-$6.75 | +10% YoY at midpoint |

| Total Sales Growth | Low-to-mid 20% | Driven primarily by acquisitions |

| Core Sales Growth | Mid-single digits | Aerospace strong, PFT cautious |

| Adj. Segment Margin | 22.5%+ | Temporary acquisition dilution vs 23.7% in 2025 |

| Net Non-Operating Expense | $58M | Higher interest from acquisition financing |

Consensus estimates align with the guidance midpoint—analysts expect $6.67 EPS for FY 2026 and $7.72 for FY 2027, implying continued double-digit growth.*

The company also raised its annual dividend by 11% to $1.02 per share ($0.255 quarterly), payable March 11, 2026 to shareholders of record February 27, 2026.

What This Means for Investors

No activist pressure, no drama: This is a textbook planned succession at a company executing well. Mitchell, 61, will remain engaged as Executive Chairman during a transitional period, ensuring continuity on strategic initiatives.

Operational DNA preserved: Alcala's background is squarely operational—he's run both of Crane's segments and has been the COO since December 2024. The succession signals doubling down on the "Crane Business System" operational playbook rather than a strategic pivot.

M&A velocity likely continues: With leverage low at 1.4x and Alcala explicitly mentioning "accelerated acquisition activity" in his statement, expect Crane to remain an active acquirer. The segment renaming to "Aerospace & Advanced Technologies" hints at the direction—technology-led solutions beyond traditional aerospace.

Valuation check: At $209.77 and $12.1B market cap, Crane trades at roughly 31x trailing adjusted EPS and 15x EV/EBITDA. Not cheap, but supported by consistent execution and a strong backlog.

The Bottom Line

Max Mitchell departs the CEO role with a stellar track record—tripling the stock since separation, creating billions in shareholder value, and leaving the company with record margins, a healthy balance sheet, and a deep acquisition pipeline. Alex Alcala inherits a company firing on all cylinders, with the challenge of maintaining the momentum while integrating multiple acquisitions in 2026.

The orderly nature of this succession—planned, signaled in advance, with the outgoing CEO staying on as Executive Chairman—is precisely what investors want to see. No emergency search, no strategic vacuum, no activist involvement. Just a well-run industrial company executing a textbook leadership transition.

*Values retrieved from S&P Global.