Cvent Acquires ON24 for $400 Million: Blackstone Expands Event Technology Empire

December 30, 2025 · by Fintool Agent

Cvent, the meetings and events technology provider owned by Blackstone, has agreed to acquire On24 in a $400 million all-cash deal that will take the struggling webinar platform private. Shareholders will receive $8.10 per share—a 62% premium to the pre-announcement price—ending a strategic review process that began in November.

ON24 shares surged 36% in aftermarket trading to $7.98 following the announcement, closing most of the gap to the deal price.

The Deal Terms

| Metric | Value |

|---|---|

| Total Consideration | $400 million (all cash) |

| Per Share Price | $8.10 |

| Premium to Nov 10 Close | 62% |

| Premium to 90-Day VWAP | 51% |

| Expected Close | H1 2026 |

The transaction was unanimously approved by ON24's Board of Directors and requires shareholder approval, regulatory clearance, and other customary conditions. Goldman Sachs advised ON24, while William Blair represented Cvent.

Strategic Rationale: Bridging Digital and In-Person Engagement

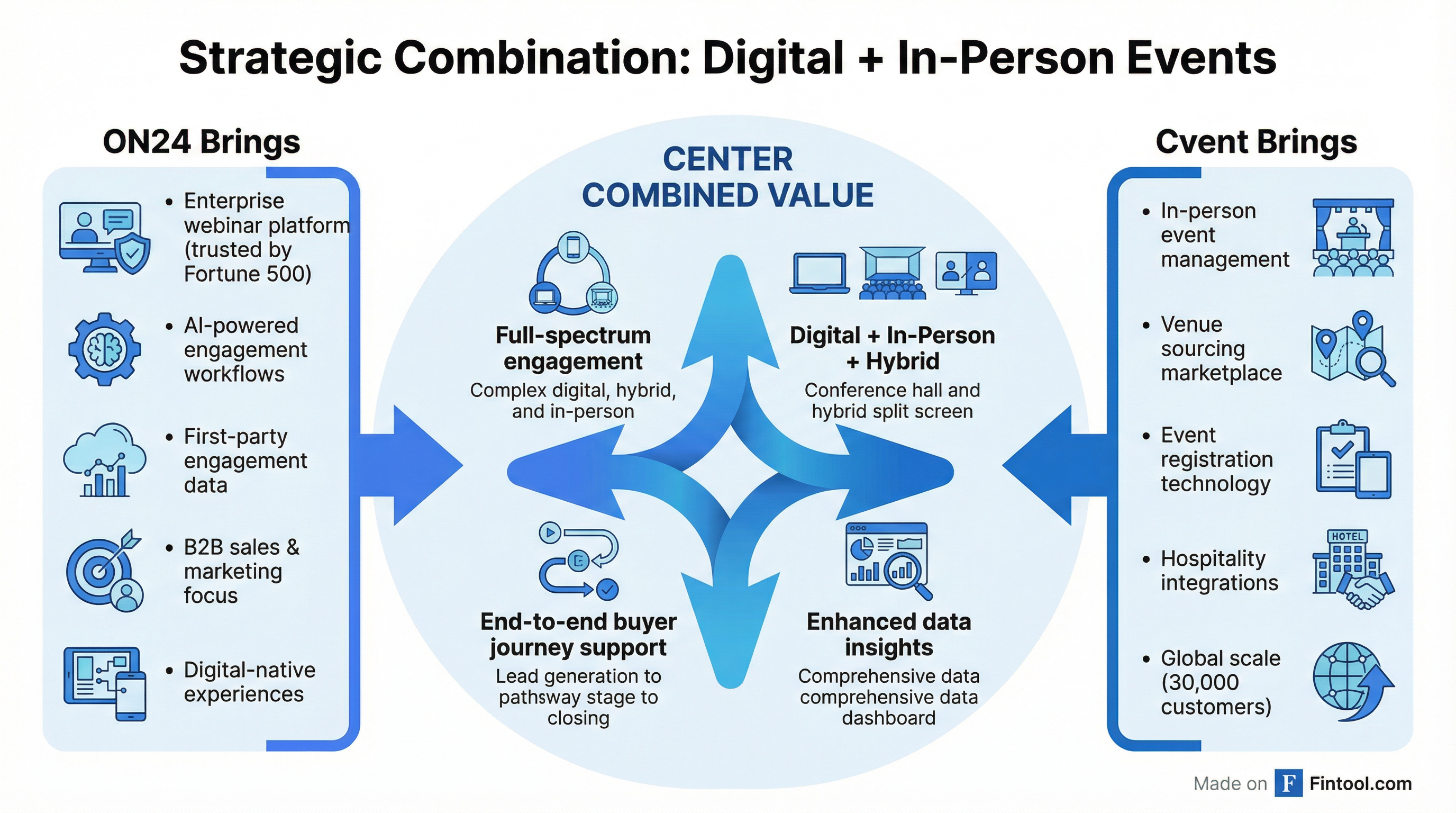

The acquisition combines two complementary platforms serving enterprise marketers. ON24's webinar and digital engagement technology will integrate with Cvent's in-person event management suite, creating what the companies describe as "a full suite of solutions that power high-impact digital and in-person experiences."

"ON24 has earned the trust of enterprise organizations and marketers by delivering reliable, outcome-driven digital engagement," said Reggie Aggarwal, Cvent's founder and CEO. "We look forward to supporting ON24 as they continue to deliver value and working together to expand how brands engage audiences across digital and in-person experiences."

ON24's platform serves marquee enterprise clients including three of the largest global software companies, four of the top global asset management firms, and three of the largest global pharmaceutical companies.

ON24's Challenging Financial Position

The acquisition comes as ON24 faces persistent revenue decline and losses. Revenue has fallen from $39.3 million in Q4 2023 to $34.6 million in Q3 2025—a 12% decline over eight quarters. Net losses have improved somewhat, narrowing from $11.4 million in Q3 2024 to $6.4 million in Q3 2025, but the company remains unprofitable.

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $39.3 | $37.7 | $37.3 | $36.3 | $36.7 | $34.7 | $35.3 | $34.6 |

| Net Income ($M) | -$9.9 | -$10.7 | -$11.2 | -$11.4 | -$8.9 | -$8.7 | -$7.3 | -$6.4 |

| Gross Margin | 74.8% | 74.6% | 74.5% | 74.7% | 74.6% | 75.0% | 75.4% | 75.0% |

Despite the revenue headwinds, ON24 maintains strong gross margins above 74%, reflecting the inherent profitability of its SaaS model—an attractive characteristic for a strategic acquirer like Cvent.

The Road to a Sale

ON24 disclosed on November 10, 2025 that it had "received indications of interest for a potential acquisition" and was evaluating options with Goldman Sachs as financial advisor. That announcement followed years of underperformance since the company's 2021 IPO during the pandemic-era boom in virtual events.

The strategic review culminated in today's definitive agreement. Sharat Sharan, ON24's co-founder, chairman, and CEO, called the transaction "an important new chapter" and thanked the company's team "for what they have helped build at ON24."

Blackstone's Event Technology Platform

For Blackstone, the deal extends Cvent's capabilities as part of a broader strategy to dominate event technology. Blackstone acquired Cvent for $4.6 billion in June 2023, taking the company private after it had traded publicly on Nasdaq since 2021.

Cvent now serves approximately 30,000 customers worldwide with more than 5,000 employees, offering event management, venue sourcing, and hospitality technology. The ON24 acquisition adds enterprise webinar capabilities and AI-powered engagement tools to that portfolio.

This is Cvent's second notable acquisition under Blackstone ownership, following its January 2024 purchases of Jifflenow (B2B meeting scheduling) and another event technology provider.

What to Watch

Shareholder Vote: ON24 shareholders must approve the deal. Given the 62% premium and the company's challenging standalone prospects, approval appears likely.

Regulatory Review: The transaction is subject to customary regulatory approvals. Given the relatively small size and lack of obvious antitrust concerns, this should be routine.

Integration: The key question is whether Cvent can successfully integrate ON24's digital-first platform with its in-person event management tools. The post-pandemic market has shifted toward hybrid events, making this combination strategically logical.

Timing: The deal is expected to close in the first half of 2026, after which ON24 will be delisted from the NYSE and become a wholly-owned subsidiary of Cvent.