Danaher Acquires Masimo for $9.9 Billion in Largest Medtech Deal of 2026

February 18, 2026 · by Fintool Agent

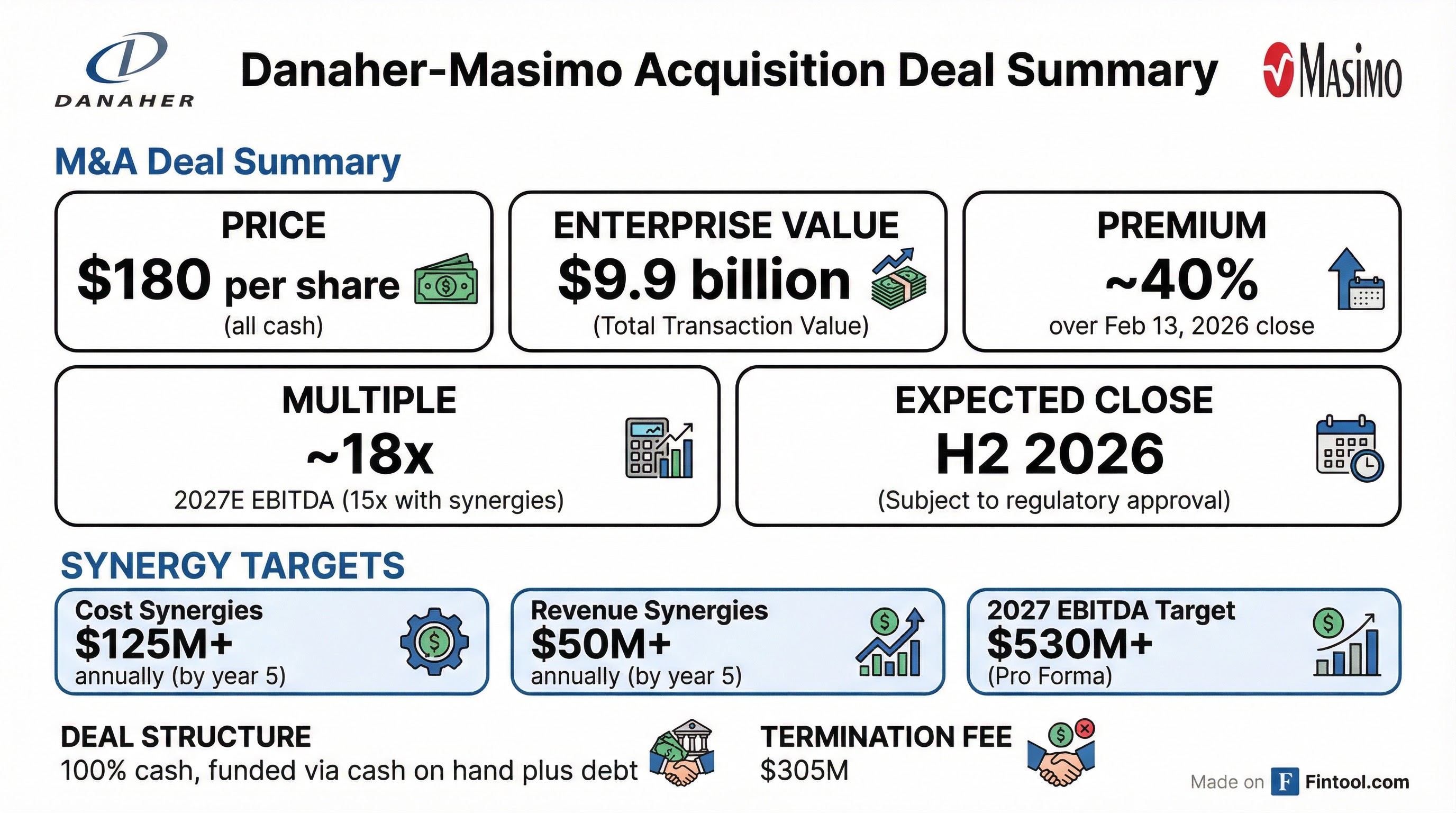

Danaher is acquiring pulse oximetry leader Masimo for $9.9 billion in an all-cash deal that marks the largest medtech acquisition of 2026 and caps a turbulent two-year transformation for the Irvine-based patient monitoring company.

The $180 per share offer represents a premium of roughly 40% over Masimo's closing price on February 13, 2026, valuing the company at approximately 18x estimated 2027 EBITDA—or 15x including the full benefit of expected synergies.

Masimo shares surged more than 34% in pre-market trading following the announcement, while Danaher stock fell approximately 6% as investors weighed integration risks and the premium paid.

Strategic Rationale: Completing the Diagnostics Portfolio

Danaher CEO Rainer M. Blair called Masimo "an exceptional strategic fit," highlighting the company's leadership in pulse oximetry and patient monitoring technology.

"We've followed this innovative company for many years and see it as an exceptional strategic fit for Danaher," Blair said. "Masimo is a leader in pulse oximetry and other patient monitoring solutions, which combined with its trusted brand and differentiated technology, will greatly strengthen our diagnostics franchise."

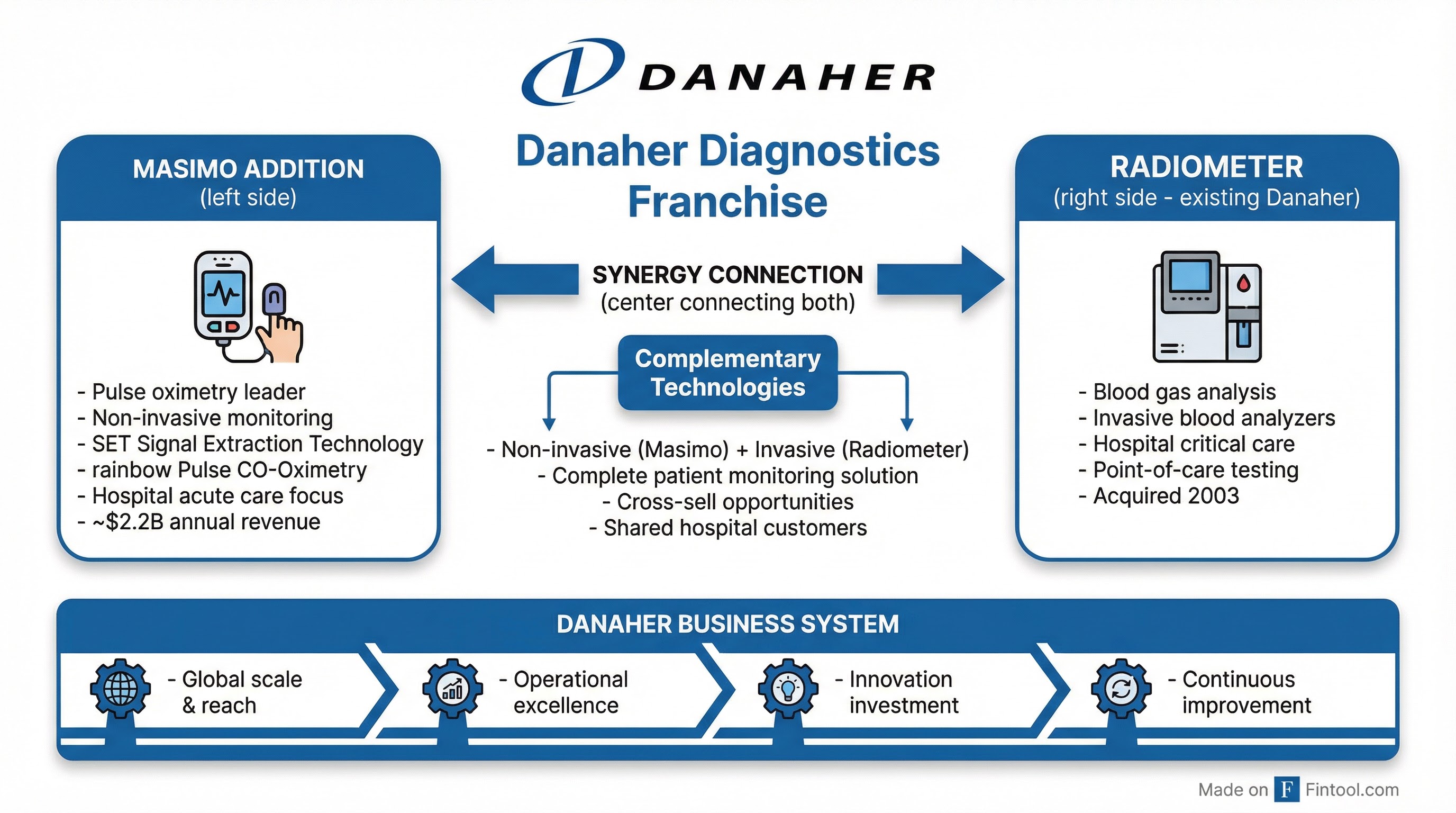

The acquisition brings powerful complementary capabilities to Danaher's existing diagnostics portfolio. Masimo's non-invasive monitoring technology pairs with Danaher's Radiometer blood gas analysis business, which focuses on invasive diagnostic testing—together creating a more complete patient monitoring solution for acute care settings.

Julie Sawyer Montgomery, Danaher's Executive Vice President for Diagnostics, emphasized the technological synergies: "Masimo's advanced sensor technology and AI-enabled monitoring bring powerful new capabilities to our diagnostics portfolio. Integrating these strengths into Danaher will create meaningful opportunities to innovate for clinicians and improve decision making in critical settings."

Financial Terms and Expected Returns

Danaher expects the acquisition to be accretive to adjusted diluted EPS by $0.15 to $0.20 in the first full year, ramping to approximately $0.70 by year five.

| Metric | Value |

|---|---|

| Price Per Share | $180 (all cash) |

| Enterprise Value | $9.9 billion |

| Premium to Feb 13 Close | 40% |

| Transaction Multiple | 18x 2027E EBITDA |

| Multiple with Synergies | 15x 2027E EBITDA |

| 2027E EBITDA | $530M+ |

| Cost Synergies (Year 5) | $125M+ annually |

| Revenue Synergies (Year 5) | $50M+ annually |

| Termination Fee | $305 million |

Masimo is expected to deliver high-single digit core revenue growth over the long-term, accelerating Danaher's Diagnostics segment growth profile.

Danaher plans to fund the acquisition using cash on hand and proceeds from debt financing. The company ended FY 2025 with $4.6 billion in cash and generated $6.4 billion in operating cash flow.

Masimo's Turbulent Journey to Exit

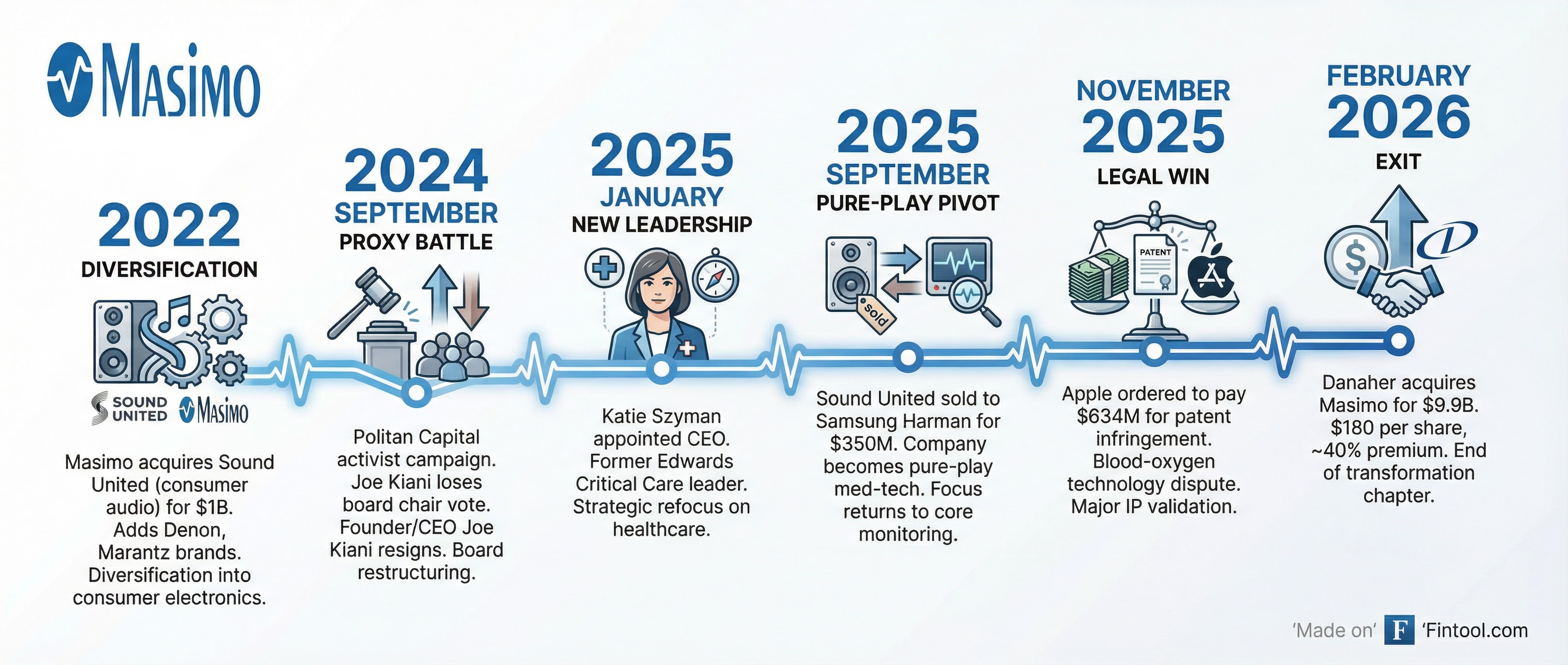

The acquisition caps a transformative two years for Masimo that saw the company undergo a proxy battle, leadership change, and strategic pivot back to its healthcare roots.

In September 2024, founder and CEO Joe Kiani lost a proxy battle against activist investor Politan Capital Management and subsequently resigned after losing his board chair position. Katie Szyman, formerly of Edwards Critical Care, was appointed CEO in early 2025.

Under Szyman's leadership, Masimo divested its consumer audio business—which included the Denon and Marantz brands acquired via Sound United in 2022—to Samsung's Harman for $350 million in September 2025, refocusing the company as a pure-play medical technology firm.

The company also scored a significant legal victory in November 2025, when a federal jury ordered Apple to pay Masimo $634 million for infringing pulse oximetry patents—validating the company's core intellectual property.

Politan Capital, which led the proxy battle and now holds approximately 4.6 million Masimo shares, has entered into a voting agreement to support the transaction.

Market Reaction: Premium Price Raises Integration Questions

The divergent stock reactions reflect the market's assessment of deal risk. Masimo shares traded near the $180 deal price, reflecting confidence in deal completion, while Danaher's 6% decline signals investor concerns about the premium paid and integration execution.

BTIG analysts noted that with Masimo shares down roughly 30% over the prior year and its "market leadership in the patient monitoring duopoly," acquisition interest was unsurprising. They added that Danaher's existing Radiometer business—which incorporates Masimo SET technology into some monitors—creates natural integration opportunities.

Deal Structure and Path to Close

The transaction requires Masimo shareholder approval and is subject to Hart-Scott-Rodino antitrust clearance along with certain foreign regulatory approvals. The merger agreement includes a go-shop provision allowing Masimo to consider superior proposals, with a $305 million termination fee if the company pursues an alternative transaction.

Closing is expected in the second half of 2026, with an outside date of November 16, 2026—automatically extended to February 16, 2027 if regulatory conditions remain the only outstanding items.

Upon completion, Masimo will operate as a standalone business unit within Danaher's Diagnostics segment, joining Radiometer, Leica Biosystems, Cepheid, and Beckman Coulter Diagnostics.

What to Watch

Regulatory Review: The combination of two significant players in patient monitoring technology may draw antitrust scrutiny, though the companies operate in largely complementary areas (non-invasive vs. invasive diagnostics).

Integration Execution: Danaher's track record with the Danaher Business System will be tested as it works to achieve the aggressive synergy targets while maintaining Masimo's innovation culture.

Competing Bids: The go-shop period and Masimo's strong market position could attract alternative bidders, though the 40% premium and Politan's support make this less likely.

Related: Danaher Corporation | Masimo Corporation