Diana Shipping Launches Proxy Fight to Replace Genco's Entire Board After $580M Bid Rejection

January 16, 2026 · by Fintool Agent

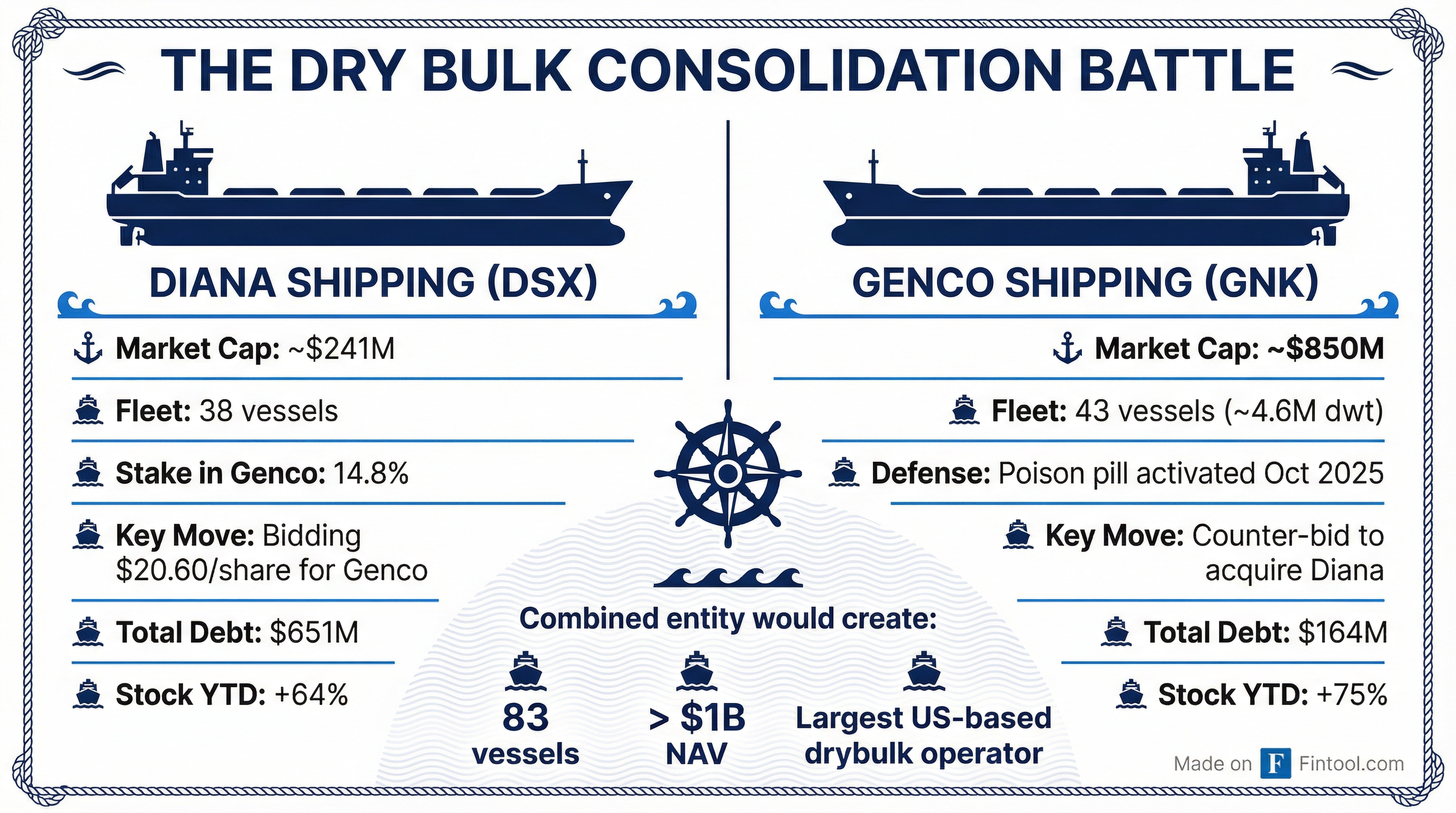

Diana Shipping+5.53% escalated its hostile bid for Genco Shipping & Trading+2.82% on Thursday, nominating six directors to replace the entire Genco board at the upcoming annual meeting—a move that will force shareholders to decide whether consolidation in the fragmented dry bulk shipping industry should come from Greece or New York.

The Athens-based company, which already owns 14.8% of Genco, made the announcement just three days after Genco's board unanimously rejected Diana's $20.60-per-share all-cash offer and countered with a proposal to flip the script: Genco would acquire Diana instead.

"The current Genco board has failed to engage constructively with Diana—its largest shareholder—and meaningfully evaluate an attractive premium acquisition proposal," Diana said in a statement announcing its slate of nominees.

Genco shares closed at $19.88 on Wednesday, up 36% over the past twelve months but still below Diana's $20.60 offer price.

The Offer That Launched a Corporate Battle

Diana's offer landed on November 24, 2025, proposing to pay $20.60 per share in cash for all outstanding Genco shares—representing a 23% premium to the 30-day and 90-day volume-weighted average prices at the time.

The bid came backed by a "highly confident" letter from DNB Bank and Nordea Bank for up to $1.1 billion in debt financing—though that commitment itself became a point of contention.

Genco took six weeks to respond, and when it did, the answer was blunt: No.

"The proposal fails to reflect the value of Genco's fleet, commercial operating platform, and strong balance sheet," the company stated, noting the offer was below both its net asset value and its 10-year high share price of $26.93. The board also raised concerns about "Diana Shipping's high leverage profile and the lack of committed financing for the transaction."

The Counter-Proposal: Genco's Reverse Takeover Gambit

Rather than negotiate, Genco's board authorized management to flip the tables entirely: the company would acquire Diana using a mix of cash and stock.

The logic, from Genco's perspective, has some merit. The New York-based shipper sports a stronger balance sheet—total debt of $164 million versus Diana's $651 million—and maintains its status as "the largest U.S. headquartered drybulk shipowner focused on the global transportation of commodities."

A Genco-led combination, the board argued, would give Diana shareholders "immediate cash value" while allowing them to participate in the upside of a combined company led by Genco management.

Diana's CEO, Semiramis Paliou, dismissed the counter as a "tactic to detract from the cash offer."

The company's response came via board nomination letters, not negotiation.

The Financial Tale of Two Shippers

| Metric | Diana Shipping+5.53% | Genco Shipping+2.82% |

|---|---|---|

| Market Cap | $241M | $850M |

| Fleet Size | 38 vessels | 43 vessels (4.6M dwt) |

| Total Debt (Q3 2025) | $651M | $164M |

| Cash (Q3 2025) | $94M | $90M |

| TTM Revenue | $219M | $331M |

| Stock YTD | +64% | +75% |

Values retrieved from S&P Global

The contrast in balance sheets is stark. Diana carries roughly four times the debt load despite being less than a third of Genco's market capitalization. Both companies have navigated challenging freight markets in 2025—Genco has been unprofitable through the first three quarters —but Genco enters any merger fight with significantly more financial flexibility.

The Poison Pill in the Room

Genco's board didn't wait for Diana's takeover attempt to prepare defenses. On October 1, 2025—nearly two months before Diana's offer arrived—the company adopted a limited-duration shareholder rights plan, commonly known as a "poison pill."

The plan triggers if any entity acquires 15% or more of Genco's common stock without board approval, entitling other shareholders to purchase additional shares at a discount and diluting the hostile acquirer's stake. It expires September 30, 2026—just in time for the proxy battle to play out.

Diana currently holds 14.8% of Genco, putting it just shy of the trigger threshold. The timing of Genco's poison pill adoption—before Diana's formal bid—suggests the company may have anticipated the hostile approach.

"The Rights Plan is designed to reduce the likelihood that any entity, person, or group would gain control of or significant influence over the Company through open-market accumulation or other tactics potentially disadvantaging the interests of all shareholders, without paying all shareholders an appropriate control premium," Genco stated when announcing the measure.

What Shareholders Will Decide

Diana has nominated six "highly qualified independent director candidates" with experience across dry bulk shipping, finance, mergers and acquisitions, and corporate governance.

The company will file a preliminary proxy statement with the SEC in the coming weeks, giving shareholders detailed information about the nominees and Diana's case for why change is needed.

If Diana wins the proxy contest and installs its slate, the new board would presumably be open to evaluating Diana's takeover proposal—or other strategic alternatives that maximize shareholder value.

Genco's Nominating and Corporate Governance Committee said it will review Diana's proposed nominees "according to standard processes and guidelines" and will make its formal recommendation in the company's own proxy statement.

The Consolidation Case

A combined Diana-Genco entity would own 83 dry bulk vessels with net asset value exceeding $1 billion, creating a significant player in the global commodity transportation market.

The dry bulk shipping industry remains highly fragmented, with dozens of small-to-mid-sized operators competing on thin margins as freight rates fluctuate with global trade flows. Scale can provide advantages in chartering negotiations, fleet utilization, and access to capital markets.

Diana has argued that its proposal "would benefit shareholders if the two companies combined their platforms, pushing for consolidation in the dry bulk carriers sector."

Genco counters that consolidation should happen—just under its own leadership.

What to Watch

The proxy filing timeline: Diana must submit its preliminary proxy statement to the SEC, likely within weeks, detailing its director nominees and case for change.

Annual meeting date: Genco has not yet scheduled its 2026 annual meeting, giving the board some flexibility in timing.

Shareholder response: Institutional investors holding significant stakes in both companies will likely be lobbied heavily. How they vote could determine whether dry bulk consolidation happens—and who leads it.

Financing commitments: Diana's "highly confident" letter may face scrutiny. Genco has already questioned whether the financing is truly committed.