Earnings summaries and quarterly performance for GENCO SHIPPING & TRADING.

Executive leadership at GENCO SHIPPING & TRADING.

Board of directors at GENCO SHIPPING & TRADING.

Research analysts who have asked questions during GENCO SHIPPING & TRADING earnings calls.

Omar Nokta

Jefferies

6 questions for GNK

Liam Burke

B. Riley Financial

5 questions for GNK

Chris Robertson

Deutsche Bank

2 questions for GNK

Christopher Robertson

Deutsche Bank AG

2 questions for GNK

Poe Fratt

Alliance Global Partners

2 questions for GNK

Sharif Al-Mograbi

BTIG

2 questions for GNK

Sherif Elmaghrabi

BTIG

2 questions for GNK

Bendik Nyttingnes

Clarksons Securities AS

1 question for GNK

Ben Nolan

Stifel

1 question for GNK

Charles Fratt

Alliance Global Partners

1 question for GNK

Michael Mathison

Sidoti & Company, LLC

1 question for GNK

Recent press releases and 8-K filings for GNK.

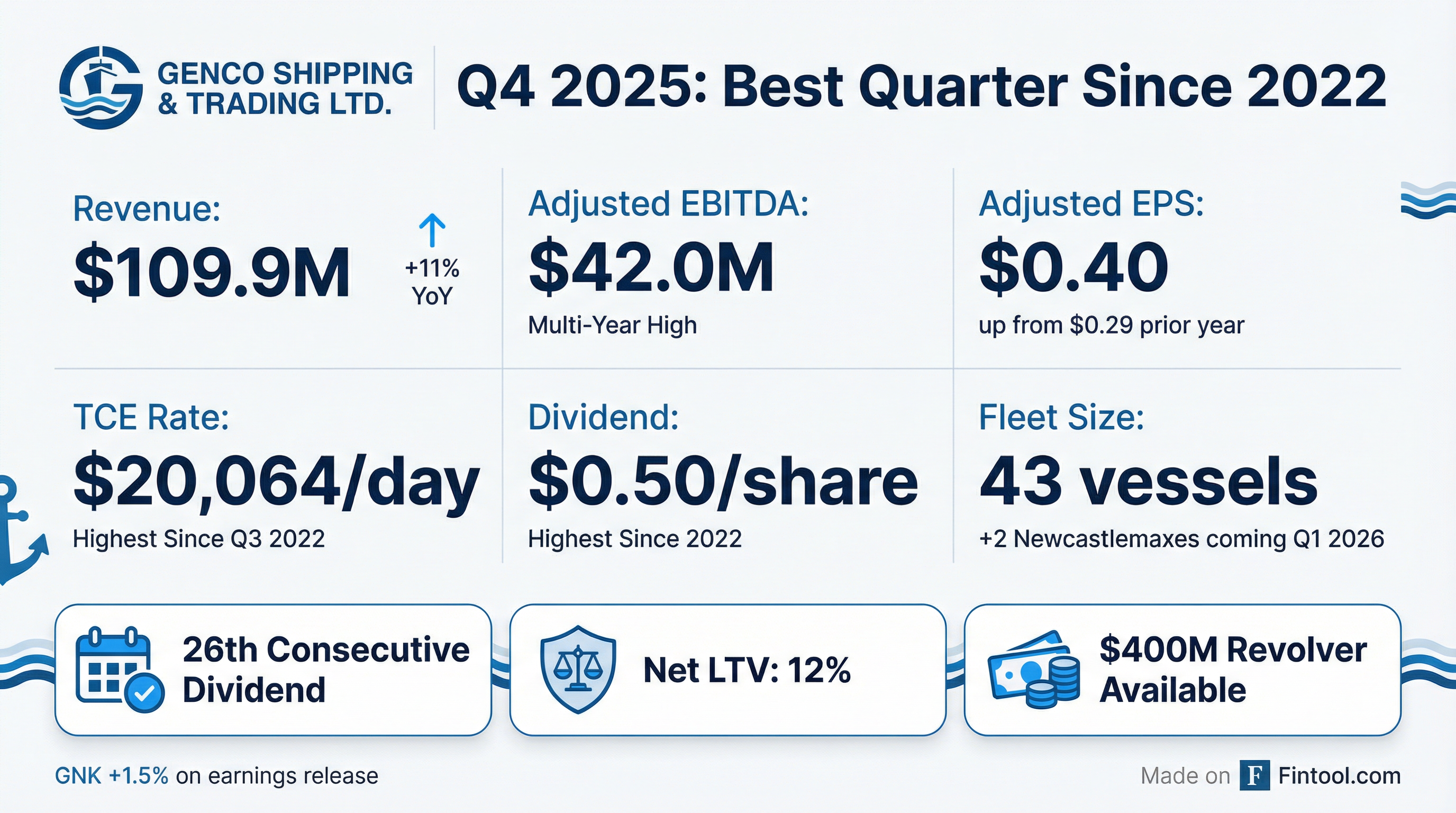

- Genco Shipping & Trading reported strong Q4 2025 financial results, with Net Income of $15.4 million , Adjusted EBITDA of $42.0 million , and Earnings per Share (EPS) of $0.35. Voyage Revenue for the quarter was $75.2 million , and the Time Charter Equivalent (TCE) was $20,064 per day.

- As of December 31, 2025, the company maintained a solid balance sheet with $55.5 million in Cash and Cash Equivalents and $200.0 million in Debt Outstanding.

- The fleet comprised 43 vessels at the end of Q4 2025 , achieving 99.1% fleet utilization. Genco also expanded its fleet by purchasing three ships in 2025, representing over $200 million in investments.

- The company declared a Q4 2025 dividend of $0.50 per share , marking its 26th consecutive quarterly dividend since Q3 2019.

- Genco Shipping & Trading Limited reported Q4 2025 adjusted net income of $17.3 million or $0.40 basic earnings per share and adjusted EBITDA of $42 million, representing a 94% increase from Q3 2025, with a TCE of $20,064 per day.

- The company declared a Q4 2025 dividend of $0.50 per share, which is its 26th consecutive dividend and the highest payout in three years.

- Genco concluded 2025 with $55.5 million in cash and $200 million in debt, maintaining $400 million of undrawn revolver availability.

- Strategic fleet expansion includes the planned delivery of two 2020-built Newcastlemax vessels in March 2026, with $131 million in remaining CapEx to be funded primarily through an $80 million accordion feature on its credit facility, increasing pro forma borrowing capacity to $680 million.

- For Q1 2026, 80% of owned available days are fixed at approximately $18,000 per day, indicating a 50% year-over-year increase from Q1 2025 levels.

- Genco Shipping & Trading Limited reported strong Q4 2025 financial results, with EBITDA of $42 million and TCE of $20,064 per day, both the highest for the year. Net income was $15.4 million (or $0.35 basic EPS) and adjusted net income was $17.3 million (or $0.40 adjusted basic EPS).

- The company declared a Q4 2025 dividend of $0.50 per share, its highest payout in three years and the 26th consecutive quarterly dividend, based on 100% of operating cash flow less a voluntary reserve.

- Genco continued its fleet expansion by agreeing to purchase two 2020-built Newcastlemax vessels for delivery in March 2026, further increasing operating leverage, and maintained a strong balance sheet with an industry-low net loan to value of 12% at year-end 2025.

- For Q1 2026, the company estimates a strong start with a TCE of approximately $18,000 per day for 80% of owned available days, which is over 50% above Q1 2025 levels.

- The board rejected a non-binding proposal to acquire all outstanding shares of Genco, concluding it significantly undervalued the company.

- Genco Shipping & Trading reported strong Q4 2025 financial results, with adjusted EBITDA of $42 million and a TCE of $20,064 per day, marking the highest levels for the year.

- The company declared a Q4 dividend of $0.50 per share, its highest since Q4 2022 and a 233% increase over the Q3 2025 dividend, reflecting its comprehensive value strategy.

- Genco maintains a strong financial position with $55.5 million in cash and $400 million of undrawn revolver availability as of December 31, 2025, and plans to take delivery of two Newcastlemax vessels in March 2026.

- For Q1 2026, Genco has 80% of available days fixed at approximately $18,000 per day, projecting a year-over-year increase of over 50% in TCE.

- Genco Shipping & Trading Limited reported Q4 2025 net income of $15.4 million (or $0.35 basic and diluted EPS) and Adjusted EBITDA of $42.0 million, representing the highest levels since Q4 2022.

- The company declared a $0.50 per share dividend for Q4 2025, marking its 26th consecutive quarterly dividend and the highest dividend since Q4 2022, payable on or about March 18, 2026.

- Average daily fleet-wide TCE for Q4 2025 was $20,064 per day, the highest since Q3 2022.

- Genco expanded its fleet by taking delivery of a Capesize vessel in October 2025 and agreed to acquire two Newcastlemax vessels expected in March 2026, while also upsizing its borrowing capacity by $80 million.

- The company maintained a strong liquidity position of $455.5 million at December 31, 2025, including $55.5 million in cash and $400.0 million in undrawn revolver availability.

- Genco Shipping & Trading Limited declared a Q4 2025 dividend of $0.50 per share, marking its highest dividend since 2022 and the 26th consecutive quarterly dividend.

- For Q4 2025, the company reported net income of $15.4 million, Adjusted EBITDA of $42.0 million, and voyage revenues of $109.9 million, with the Adjusted EBITDA and average daily fleet-wide TCE of $20,064 per day being the highest since Q4 2022 and Q3 2022, respectively.

- The company is expanding its fleet with the expected delivery of two Newcastlemax vessels in March 2026 and has upsized its borrowing capacity by $80 million.

- For the full year ended December 31, 2025, Genco reported a net loss of $4.4 million and Adjusted EBITDA of $85.9 million.

- Genco Shipping & Trading's Board unanimously rejected Diana Shipping's unsolicited $20.60-per-share cash proposal to acquire the shares Diana does not already own.

- The board stated the offer materially undervalues the company, failing to reflect its modern fleet, cash-flow, net asset value, and an appropriate control premium, also citing significant execution risk and lack of committed financing.

- Diana, holding a 14.6–14.8% stake in Genco, affirmed its offer is supported by $1.1 billion of financing and remains willing to negotiate despite disappointment.

- Genco indicated openness to discussions on alternative transaction structures, including the possibility of Genco acquiring Diana.

- The companies dispute historic price benchmarks: Genco notes the offer is significantly lower than its 10-year share price high of $26.93, while Diana argues it is in line with a $20.84 10-year high when adjusted for dividends.

- Genco Shipping & Trading Limited (GNK) announced an estimated time charter equivalent (TCE) rate of approximately $20,000 per day for the fourth quarter of 2025, covering about 95% of its owned available days.

- The company projects approximately 3,830 owned fleet-wide available days for the fourth quarter of 2025.

- Eight Capesize vessels are expected to complete voyages in December 2025, becoming available for new fixtures in a strong freight rate environment, with four anticipated to ballast to the Atlantic basin.

- Genco Shipping & Trading Limited reported a net loss attributable to Genco Shipping & Trading Limited of $(1.053) million and basic earnings per share of $(0.02) for Q3 2025, with revenues totaling $79.921 million.

- The company's Adjusted EBITDA for Q3 2025 was $21.695 million , and the total Time Charter Equivalent (TCE) rate was $15,959.

- A dividend of $0.15 per share was declared for Q3 2025.

- As of Q3 2025, debt outstanding was $100 million , and cash (including restricted cash) stood at $89.951 million.

- For Q4 2025, the estimated cash flow breakeven rate (excluding drydocking capex) is approximately $9,000 , with no mandatory debt repayments scheduled.

- Genco Shipping & Trading Limited reported a net loss of $1.1 million and an adjusted net loss of $0.01 per share for Q3 2025, with Adjusted EBITDA totaling $21.7 million, representing a 52% increase from Q2.

- The company declared a Q3 2025 dividend of $0.15 per share and projects a strong Q4, with 72% of owned available days fixed at approximately $20,000 per day fleet-wide, significantly exceeding the estimated $10,000 per day cash flow break-even rate.

- Since 2021, Genco has invested $347 million in modern vessels, distributed $264 million in dividends, and reduced debt by $279 million, bringing the total debt outstanding to $170 million.

- Genco completed 90% of its 2025 dry docking schedule by the start of Q4 and acquired a 2020-built Capesize vessel in October, which is the fourth high-specification Capesize vessel acquired since Q4 2023.

- A poison pill was adopted in early October in response to a shareholder accumulating a nearly 15% position, structured to be shareholder-friendly for less than a year.

Quarterly earnings call transcripts for GENCO SHIPPING & TRADING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more