Diana Shipping Doubles Down on Genco Bid at Capital Link Webinar, Signals Proxy Fight Readiness

January 29, 2026 · by Fintool Agent

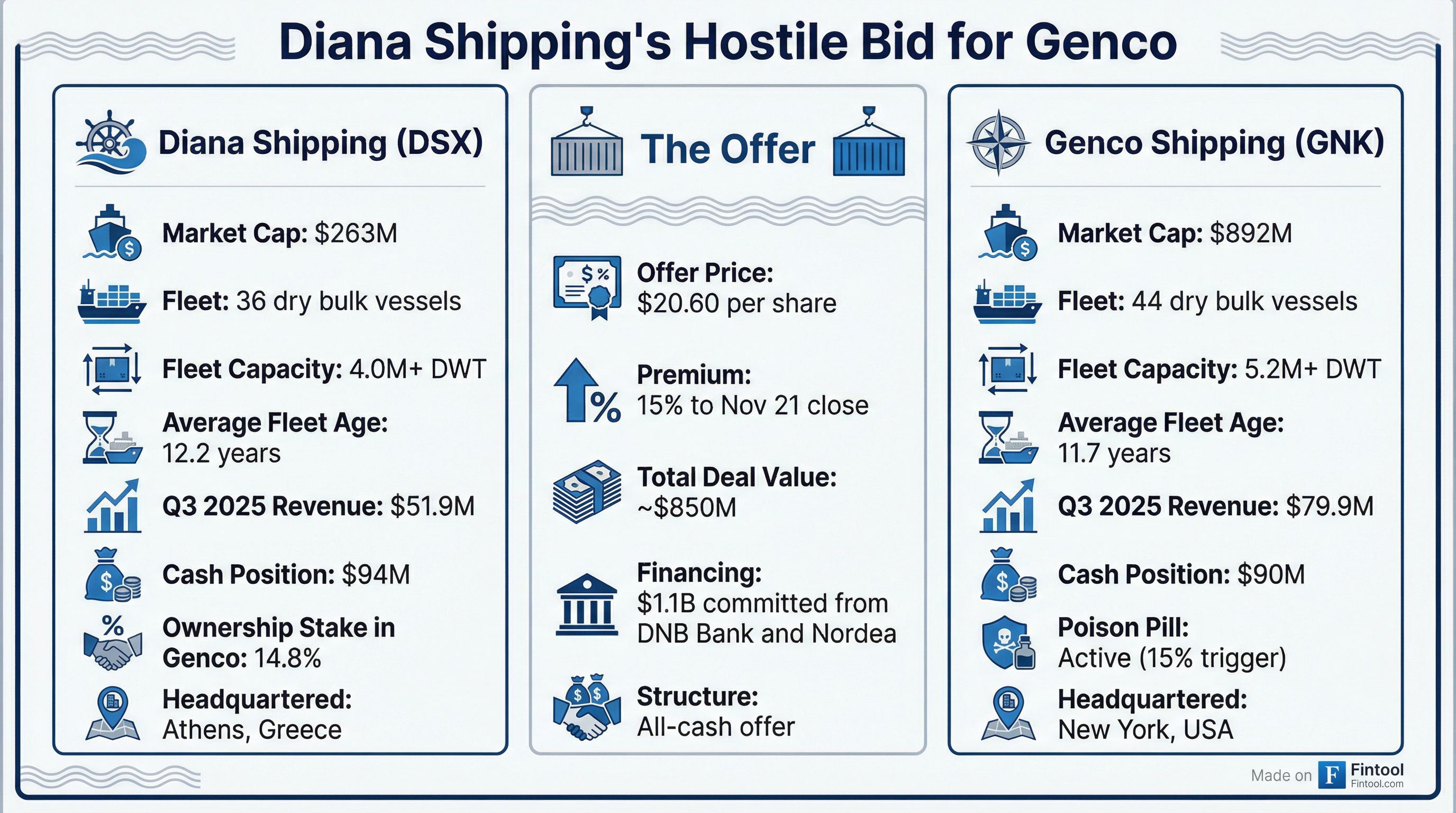

Diana Shipping+5.53% management took the offensive at today's Capital Link Corporate Presentation Series webinar, laying out the investment case for its hostile $20.60 per share bid for rival Genco Shipping & Trading+2.82% while telegraphing confidence in an upcoming proxy battle that could reshape the dry bulk shipping landscape.

With Genco+2.82% shares trading at $20.64—essentially matching Diana's offer price—the market is signaling this fight is far from over.

Management Makes Its Case

Chief Operating Officer Ioannis Zafirakis led the presentation, flanked by the company's senior leadership team, in what amounted to a public investor relations campaign for the contested deal. The messaging was pointed: Diana has the financing, the industrial logic, and increasingly, shareholder support.

"We truly believe that the combined fleet and operating platform will enhance scale, flexibility, and operating leverage within the dry bulk sector," Zafirakis stated, walking investors through the timeline of rejected overtures and unanswered calls.

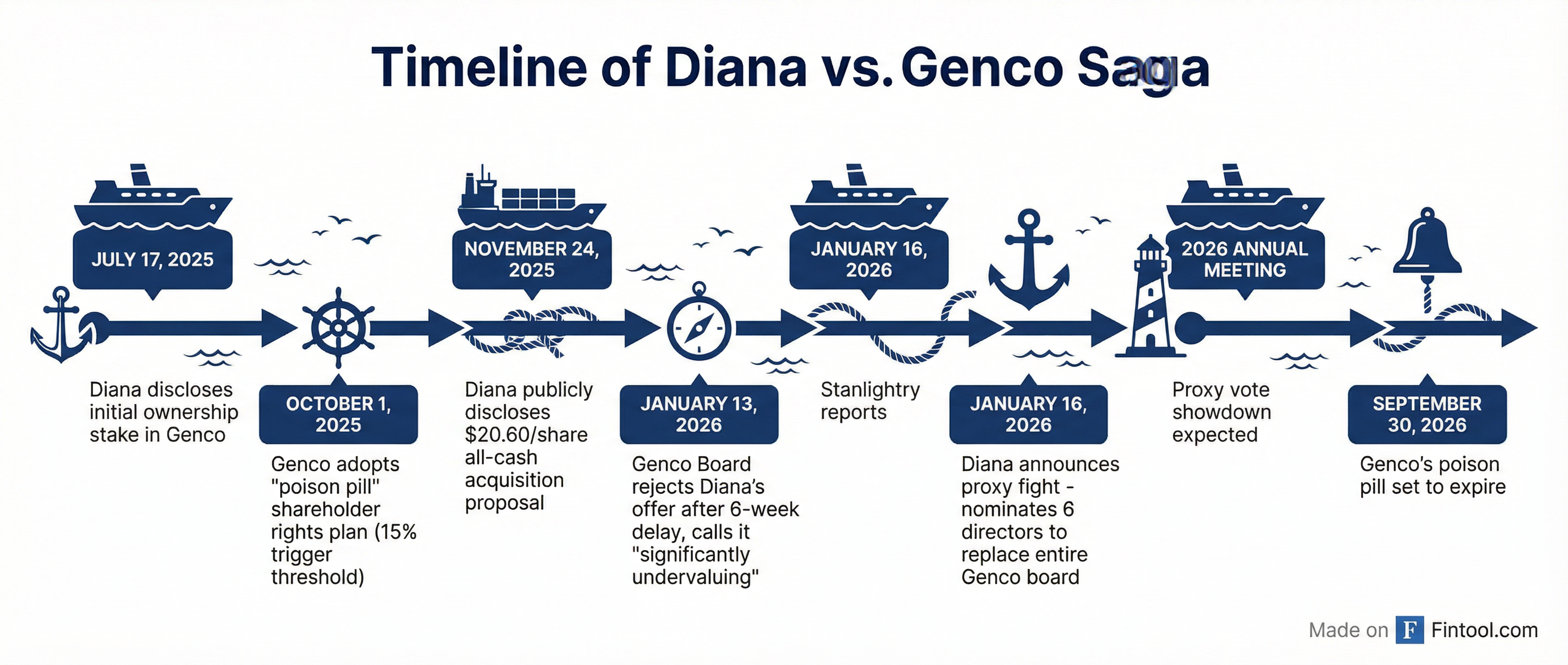

The frustration was palpable. Diana disclosed its acquisition proposal on November 24, 2025, offering what it characterized as attractive premiums across multiple metrics. Yet Genco's board took more than six weeks to respond—and when it did, the answer was a flat rejection without any engagement.

The Numbers Behind the Bid

Diana's offer represents:

| Metric | Premium |

|---|---|

| November 21, 2025 closing price | 15% |

| July 17, 2025 closing price (initial stake disclosure) | 21% |

| 30-day and 90-day VWAP to November 21 | 23% |

Critically, the company emphasized the certainty of execution. A "highly confident letter" from DNB Bank and Nordea Bank provides up to $1.1 billion in committed financing—enough to cover the full purchase price, refinance Genco's existing debt, and pay transaction expenses.

Proxy Fight Looms

Having been rebuffed at the negotiating table, Diana announced on January 16 its intention to nominate six independent directors to replace Genco's entire board at the upcoming annual meeting.

"On the 16th of January, we announced our intention to nominate a slate of six highly qualified independent directors for election to the Genco board of directors at its upcoming 2026 annual meeting of shareholders," Zafirakis confirmed. "We truly believe that these nominees, if elected, will be open to explore strategic alternatives in order to maximize the value for the shareholders of Genco."

The stakes are high. Genco adopted a shareholder rights plan (poison pill) on October 1, 2025, which triggers at 15% ownership—Diana currently holds 14.8%. But that plan expires September 30, 2026, creating a potential window for Diana's campaign.

Operating From Strength

Diana used the presentation to showcase its operational discipline. The company has secured $154.4 million in contracted revenues covering 71% of remaining ownership days for 2026, with an additional $14.5 million (6% of days) locked in for 2027.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $57.1* | $54.9* | $54.7* | $51.9* |

| Net Income ($M) | $9.7* | $3.0* | $4.5* | $7.2* |

| Cash ($M) | $125* | $132* | $65* | $94* |

| Total Debt ($M) | $638* | $624* | $611* | $651* |

*Values retrieved from S&P Global

The company's average daily time charter rate for the remainder of 2026 stands at approximately $17,700 per day, comfortably above its cash break-even of roughly $16,800 per day—which accounts for operating expenses, debt service, dry-docking provisions, and preferred dividends.

"We have managed to have basically no maturities of debt, any kind of debt, before 2029," Zafirakis noted, highlighting the company's conservative balance sheet management.

Genco's Counter-Proposal

Notably, Genco's board didn't just reject Diana's offer—it floated a reverse merger concept where Genco would acquire Diana. But Diana dismissed this as a delay tactic lacking substance.

"The Genco Board put forth a suggestion for Genco to acquire Diana... however, it does not include any details on price or premium, amount of cash or stock consideration, or any other basic financial terms necessary to be properly evaluated," management stated in January. "Diana believes this 'proposal' is merely a tactic that serves no serious purpose other than to dismiss and detract from Diana's attractive offer."

For context, Genco has posted losses in three consecutive quarters, with Q3 2025 net income at negative $1.1 million despite generating $79.9 million in revenue.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $99.2 | $71.3 | $80.9 | $79.9 |

| Net Income ($M) | $12.7 | ($11.9) | ($6.8) | ($1.1) |

| Cash ($M) | $43.7 | $30.2 | $35.4 | $90.0 |

Market Outlook: Cautiously Optimistic

Chief Commercial Officer Dave van der Linden provided color on dry bulk fundamentals. After a "tale of two halves" in 2025—with weakness early in the year followed by a strong recovery—2026 has started "historically strong on all sizes."

Key demand drivers remain supportive:

- Iron ore and bauxite shipments backing Capesize rates

- Long-haul grain movements supporting mid-size vessels

- Ton-mile increases more important than headline volumes

Supply growth has stayed controlled at roughly 11% order book-to-fleet ratio, with scrapping at near-historical lows. However, van der Linden cautioned about geopolitical wildcards: "We're witnessing really unprecedented uncertainties regarding policies, tariffs, penalties, retaliations, all of which can highly influence the dry bulk market either way at any given moment."

Diana continues to avoid the Red Sea and Black Sea regions due to ongoing hostilities.

What to Watch

The battle lines are drawn. Diana has the financing, a 14.8% toehold, and six board nominees ready to go. Genco has its poison pill defense—but it expires in September.

Key catalysts ahead:

- Genco's proxy statement filing — Will reveal board's defense strategy and any sweetened alternatives

- 2026 Annual Meeting date — The proxy vote battleground

- September 30, 2026 — Poison pill expiration date

- Q4 earnings — Both companies report in February; operational performance could sway undecided shareholders

With GNK trading at $20.64—essentially at Diana's offer price—shareholders appear to be betting on deal completion. But between the poison pill, Genco's reverse-merger gambit, and the uncertainty of proxy fights, the path forward remains anything but certain.

Related Companies: