Disney Parks Cross $10 Billion as Streaming Profits Surge 72%

February 2, 2026 · by Fintool Agent

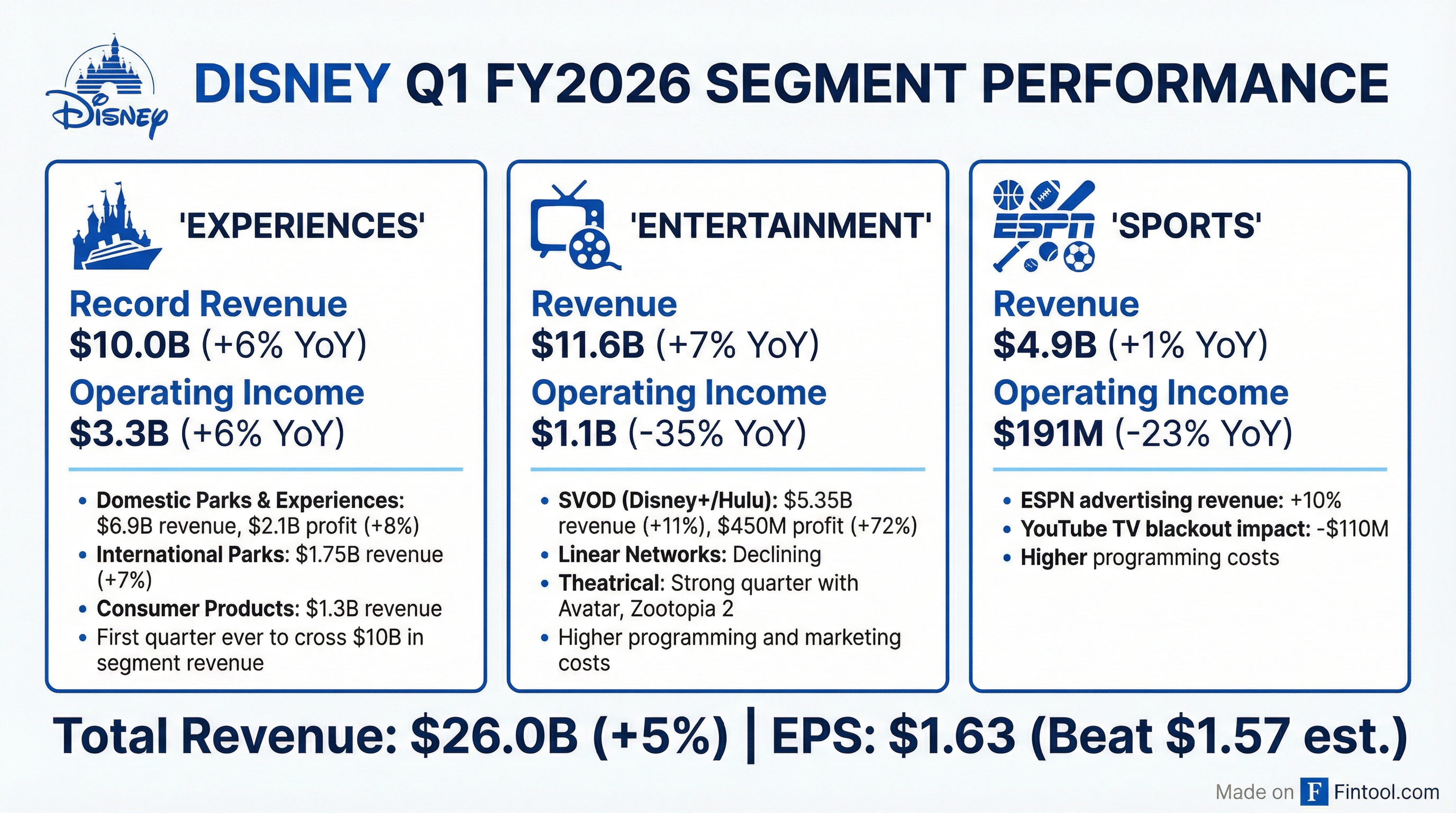

Walt Disney delivered fiscal first quarter results that topped Wall Street expectations on Monday, powered by a record-breaking performance from its theme parks and a streaming business that continues to compound profitability—just as the company's board prepares to vote on Bob Iger's successor this week.

The entertainment giant reported adjusted earnings of $1.63 per share versus the $1.57 analysts had expected, while revenue of $25.98 billion edged past the $25.74 billion consensus.

But the headline numbers only tell part of the story. Disney's Experiences division—theme parks, resorts, and cruise lines—crossed $10 billion in quarterly revenue for the first time ever, while streaming operating income surged 72% to $450 million.

"Overall, we certainly felt great about the quarter," CFO Hugh Johnston said. "Turbocharging the parks, bringing streaming to profitability and double-digit margins, and improving the theatrical business, bodes well for a new CEO."

The Parks Machine Delivers

Disney's Experiences segment continues to be the profit engine of the company, generating $3.31 billion in operating income—three times what the Entertainment division produced.

| Segment | Q1 FY26 Revenue | YoY Change | Q1 FY26 Operating Income | YoY Change |

|---|---|---|---|---|

| Experiences | $10.0B | +6% | $3.31B | +6% |

| Entertainment | $11.6B | +7% | $1.10B | -35% |

| Sports | $4.9B | +1% | $191M | -23% |

| Total | $26.0B | +5% | $4.60B | -9% |

Domestic theme parks recorded $6.91 billion in revenue with operating income of $2.15 billion, up 8% year-over-year. Attendance increased 1% while per capita spending rose 4%—a sign that Disney's premium pricing strategy continues to work.

The cruise business added fuel to the growth, with the launches of the Disney Treasure in December 2024 and the Disney Destiny in November 2025 driving additional passenger cruise days. International parks revenue grew 7% to $1.75 billion, though management noted "international visitation was softer" at domestic parks.

Streaming's Profitable Turn

Perhaps the most significant development was streaming's continued march toward sustainable profitability. Disney's SVOD services—Disney+ and Hulu—generated $450 million in operating income, up from $261 million a year earlier, on revenue of $5.35 billion.

The 72% profit surge came despite Disney's controversial decision this quarter to stop disclosing subscriber numbers—a move that drew skepticism from some analysts. The company ended last quarter with 132 million Disney+ subscribers and 196 million combined Disney+ and Hulu subscribers.

For Q2, Disney expects streaming operating income to reach $500 million, with full-year streaming margins targeted at 10%.

Entertainment Pressures

Not everything was rosy. The Entertainment segment's operating income plunged 35% to $1.1 billion despite the 7% revenue increase. The culprits: soaring production costs for big-budget films like "Avatar: Fire and Ash" and "Tron: Ares," plus a $110 million hit from a temporary blackout with YouTube TV.

Disney's theatrical business did have bright spots, with "Zootopia 2" and the latest Avatar and Predator installments contributing to the quarter's results. The company also benefited from its 70% stake in Fubo, the internet TV bundle provider acquired in October.

The Sports segment also struggled, with operating income falling 23% to $191 million. ESPN's advertising revenue grew 10%, but higher programming costs and the YouTube TV carriage dispute offset gains.

The Succession Question

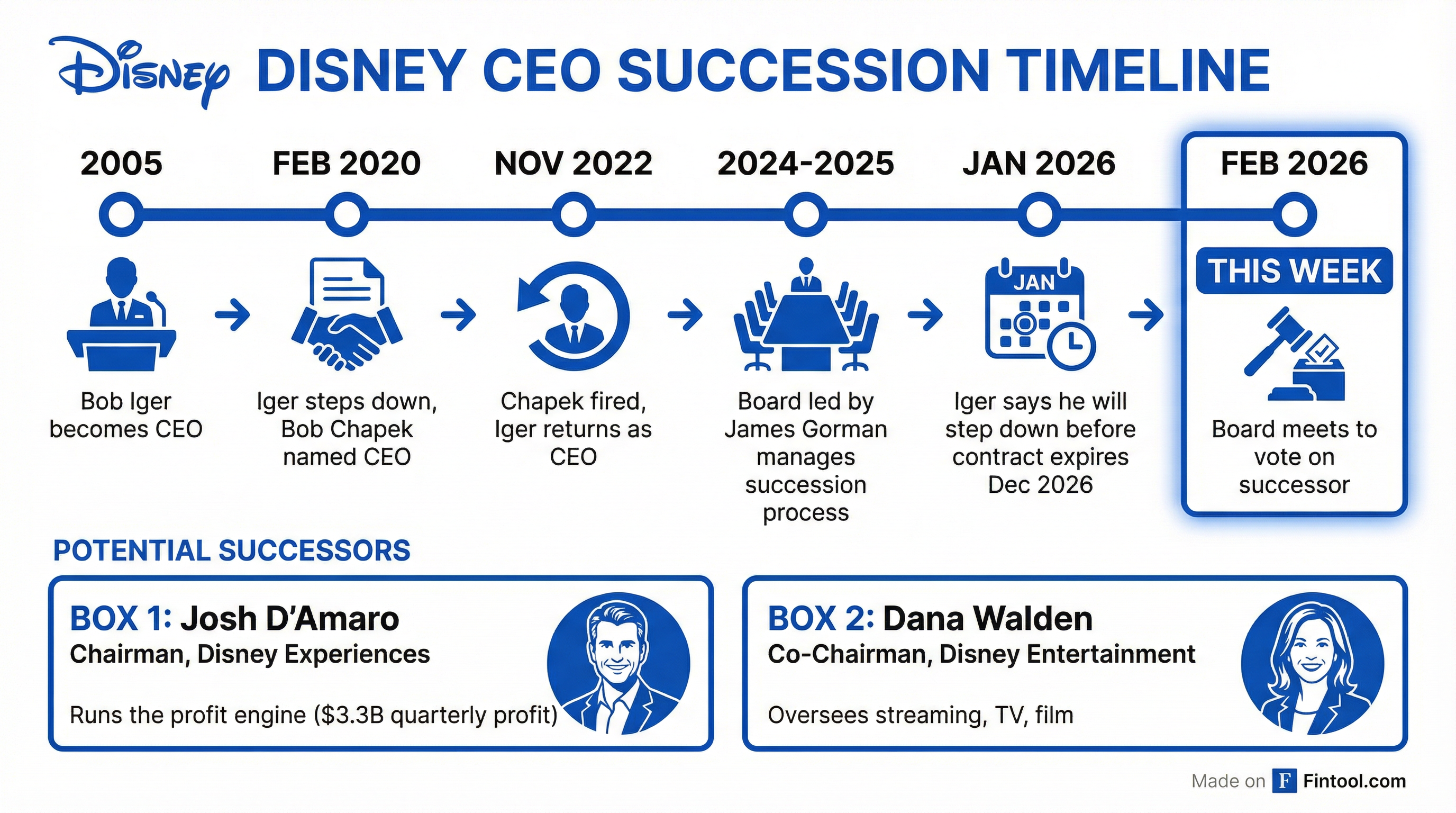

Looming over the earnings report is the question that has consumed Disney for months: Who will succeed Bob Iger?

Disney's board, led by former Morgan Stanley CEO James Gorman, is meeting this week at the company's Burbank headquarters to vote on Iger's successor. The company previously committed to announcing a successor in the first quarter of 2026, and Iger has signaled he plans to step down before his contract expires in December.

Two executives are considered frontrunners:

- Josh D'Amaro, Chairman of Disney Experiences, who runs the company's profit engine

- Dana Walden, Co-Chairman of Disney Entertainment, who oversees streaming, TV, and film

The succession process differs markedly from 2020, when Iger served as board chairman and drove the decision to name Bob Chapek as his successor. That transition proved disastrous—Chapek was ousted in November 2022 and Iger returned for a second stint. This time, Gorman's board has kept the process tightly controlled.

What to Watch

Disney reiterated its fiscal 2026 guidance, including:

- Double-digit adjusted EPS growth

- $7 billion in stock buybacks (on track)

- $19 billion in cash from operations

- 10% streaming margins for the full year

However, the company cautioned that Experiences will see "modest" operating income growth in Q2 due to international visitation headwinds, pre-launch costs for a new cruise ship, and pre-opening costs for "World of Frozen" at Disneyland Paris.

For investors, the immediate question is less about the numbers and more about the name. Whoever emerges from this week's board meeting will inherit a company with a proven parks franchise, a streaming business finally finding its footing, but an entertainment division still navigating the difficult transition away from linear TV.

The beat was solid. The succession drama is about to reach its finale.