Energy Fuels to Acquire ASM for $299M, Creating Western Rare Earth Champion

January 20, 2026 · by Fintool Agent

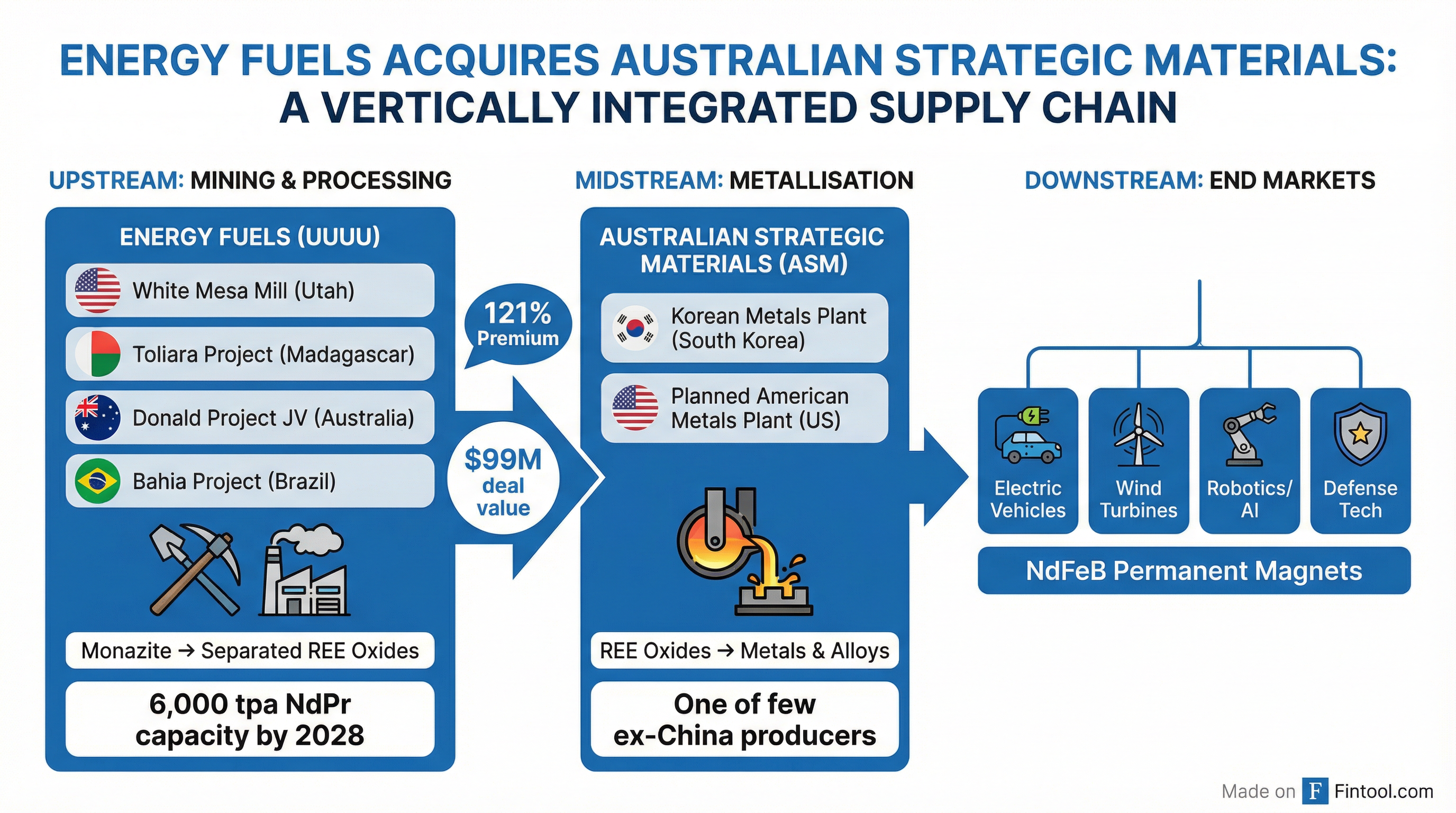

Energy Fuels is acquiring Australian Strategic Materials for US$299 million in an all-stock transaction that will create the largest fully integrated rare earth "mine-to-metal & alloy" producer outside China. The deal, announced Monday, values ASM at A$1.60 per share—a 121% premium to its prior close—and comes as Western nations scramble to reduce dependence on Chinese-controlled critical mineral supply chains.

Energy Fuels shares jumped 7.2% to $23.52 on the news, with aftermarket trading pushing the stock to $24.12, while ASM shares surged as much as 126% in Sydney.

The Strategic Logic: Closing China's Gap

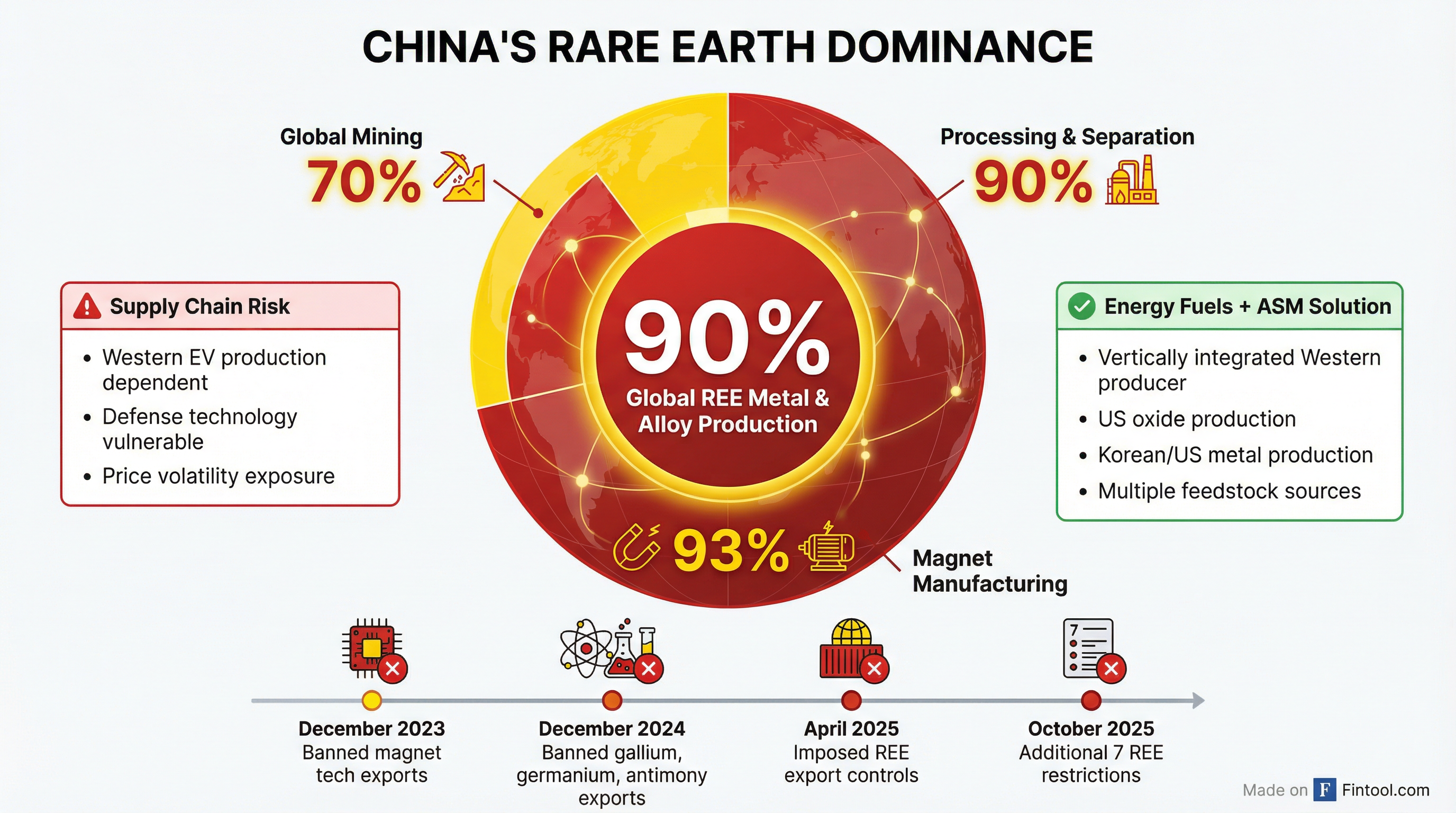

The transaction directly addresses a critical vulnerability in Western supply chains. China accounts for roughly 90% of global rare earth metal and alloy production, despite controlling "only" 70% of mining. This downstream processing dominance has given Beijing leverage that it has increasingly weaponized through export restrictions.

The deal combines three critical capabilities:

1. Upstream Oxide Production: Energy Fuels' White Mesa Mill in Utah is the only U.S. facility capable of separating monazite concentrates into both light and heavy rare earth oxides. The company recently completed its Phase 1 separation circuit producing commercial quantities of separated neodymium-praseodymium (NdPr) and is planning Phase 2 expansion to 5,000-6,000 tonnes per annum of NdPr capacity by 2028.

2. Midstream Metallisation: ASM operates the Korean Metals Plant (KMP) in the Ochang Foreign Investment Zone—one of the only facilities outside China currently producing rare earth metals and alloys, including NdPr, dysprosium (Dy), and terbium (Tb) metals as well as NdFeB and DyFe alloys.

3. U.S. Metal Capacity: ASM's planned American Metals Plant (AMP) provides Energy Fuels with a de-risked path to construct a domestic metals and alloys facility capable of producing 2,000 tonnes per annum of alloy, leveraging proven technology from the Korean plant.

Why Now: China's Tightening Grip

The urgency behind this deal becomes clear when examining China's escalating export restrictions over the past two years:

- December 2023: China banned exports of technology to manufacture rare earth magnets

- December 2024: Extended bans to gallium, germanium, and antimony with defense applications

- February 2025: Expanded export licensing to tungsten, indium, bismuth, tellurium, and molybdenum

- April 2025: Imposed export controls on seven heavy rare earth elements and certain magnet materials

- October 2025: Additional restrictions on rare earth elements with immediate licensing requirements

"We are now locked in a new kind of Cold War, a race of mutually assured economic destruction, fought not with weapons but with supply chains," said Jim Litinsky, CEO of MP Materials, the largest U.S. rare earth miner. "Self-sufficiency, allied resilience, and national industrial champions are no longer optional. They are the front lines of security."

MP Materials itself ceased shipments of rare earth concentrate to China in July 2025 after Beijing's retaliatory tariffs and export controls.

Deal Structure and Financials

Under the scheme of arrangement, ASM shareholders will receive:

- 0.053 Energy Fuels shares for each ASM share (implied value A$1.47)

- Up to A$0.13 cash per share as a special dividend

Post-closing, ASM shareholders will own approximately 5.8% of Energy Fuels' outstanding shares. The transaction has received unanimous board approval from ASM, including support from Non-Executive Chair Ian Gandel, who controls approximately 13.6% of ASM shares.

Energy Fuels enters the deal from a position of financial strength:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $39.9 | $16.9 | $4.2 | $17.7 |

| Cash ($M) | $38.6 | $73.0 | $71.5 | $94.0 |

| Total Debt | $0 | $0 | $0 | $0 |

The company operates with zero debt and has been building cash reserves despite operating losses as it ramps up rare earth production—a capital-intensive business that has generated negative EBITDA as the company invests in Phase 2 expansion.

What Energy Fuels Gets

Beyond the immediate metallisation capabilities, the acquisition brings significant development assets:

Dubbo Project (NSW, Australia): A well-known rare earth deposit that could position the combined company as a unique mine-to-metals integrated producer. ASM is updating its feasibility study to focus initially on rare earths only.

Intellectual Property: ASM's proprietary metallisation technology enables production of high-purity rare earth metals that meet specifications for permanent magnet manufacturers—knowledge that can be replicated at the planned U.S. facility.

Customer Relationships: ASM has signed supply agreements with magnet makers including USA Rare Earth and Neo Performance Materials, providing Energy Fuels with established market access.

"Energy Fuels is moving quickly to capture accretive opportunities, differentiate the company among our peers, and ultimately provide unique value to customers in the ex-China rare earth supply chain," said CEO Mark Chalmers.

The Competitive Landscape

The deal reshapes competitive dynamics among Western rare earth players:

| Company | Market Cap | Focus | Key Assets |

|---|---|---|---|

| MP Materials | $12.1B | Mining, Separation, Magnets | Mountain Pass Mine (CA), Fort Worth Magnet Plant |

| Energy Fuels + ASM | $5.9B | Mining through Metals/Alloys | White Mesa Mill (UT), Korean Metals Plant, Toliara, Dubbo |

| USA Rare Earth | $2.3B | Magnets, Separation | Round Top Mountain (TX), Magna Facility (OK) |

MP Materials has built the most vertically integrated operation in the U.S. but ceased Chinese concentrate shipments, creating near-term financial pressure. Its CEO warned that most rare earth projects being promoted "simply will not work at virtually any price" due to uneconomic grades.

USA Rare Earth is ramping magnet production while securing supply through agreements with ASM—agreements that Energy Fuels would inherit.

What to Watch

H1 2026: Shareholder vote and expected deal closing, subject to Australian court approval and regulatory conditions.

2026: Phase 2 capacity expansion at the Korean Metals Plant to 3,600 tonnes per annum of NdFeB alloy.

2028: Energy Fuels' Phase 2 rare earth separation circuit completion at White Mesa, targeting 5,000-6,000 tpa NdPr capacity.

Policy: The Trump administration's critical minerals executive orders and potential new support mechanisms for domestic production. The January 2025 "Unleashing American Energy" order specifically targeted rare earths, directing the Secretary of Defense to consider national stockpile needs.

The Investment Thesis

The transaction represents a bet that Western governments and manufacturers will pay a premium for supply chain security. With China controlling over 90% of rare earth processing and increasingly willing to use that leverage, Energy Fuels is positioning itself as a critical infrastructure provider for the energy transition and defense industrial base.

The key question is whether margins can reach levels justifying current valuations. Energy Fuels trades at roughly 100x trailing revenue with persistent operating losses, pricing in substantial future production growth and pricing power. The ASM deal accelerates the path to integrated production but also adds execution risk across multiple continents.

For investors tracking critical minerals, this deal marks another step in the reshoring trend that has accelerated since 2023. The question is no longer whether the West will build alternative rare earth supply chains—it's whether companies like Energy Fuels can execute fast enough to capture the opportunity before Chinese competitors respond.

Related: