Enerpac Tool Group Shareholders Approve Leaner Board as Two Directors Exit After Combined 13 Years

February 4, 2026 · by Fintool Agent

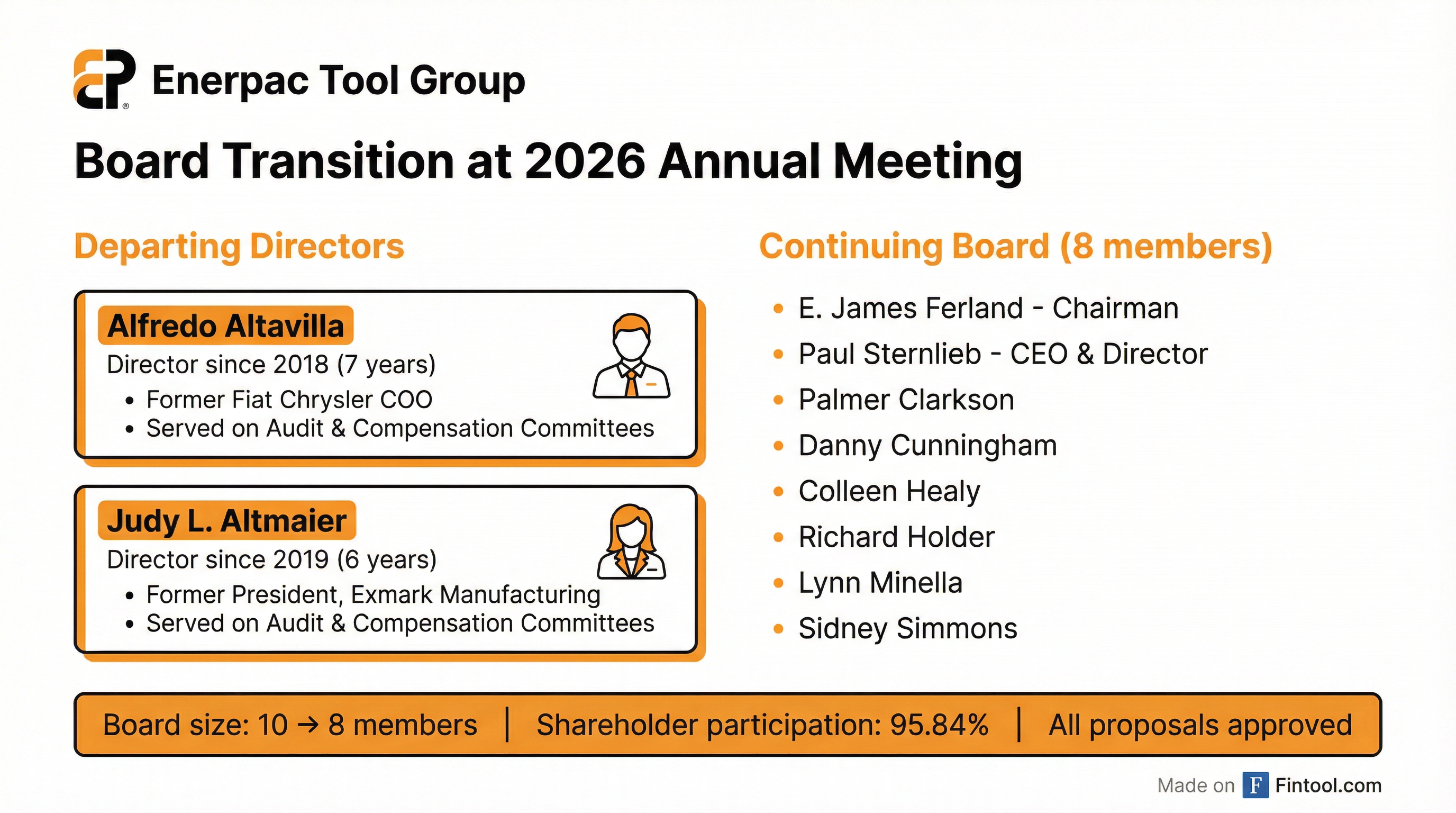

Enerpac Tool Group shareholders delivered a decisive vote of confidence at the company's 2026 Annual Meeting on Tuesday, approving all governance matters while bidding farewell to two veteran independent directors who together contributed 13 years of board service.

The $2.2 billion industrial tools maker saw 95.84% of outstanding shares represented at the virtual meeting—a remarkably high turnout that underscores investor engagement with the Milwaukee-based company. The clean sweep on all three proposals comes as Enerpac navigates a period of strategic investment while sitting on substantial M&A firepower.

Board Transition: Experience Departs

The most notable development from the meeting was the planned departure of Alfredo Altavilla and Judy L. Altmaier, shrinking the board from ten to eight members.

Altavilla, who joined in 2018, brought three decades of automotive industry expertise from his tenure as COO of Europe, Africa, and Middle East at Fiat Chrysler and CEO of Iveco. He also served as Senior Advisor to BYD Company and CVC Capital Partners.

Altmaier, a director since 2019, contributed deep manufacturing and operations experience from her career at The Toro Company (where she was President of Exmark Manufacturing) and 25+ years at Eaton Corporation. She continues to serve on the board of Allison Transmission (ALSN).

Both directors served on Enerpac's Audit and Compensation Committees, meaning the remaining board will need to redistribute these critical oversight responsibilities.

Chairman Jim Ferland thanked both departing directors for their "thoughtful and diligent service to Enerpac" during opening remarks. The eight continuing directors—including CEO Paul Sternlieb—were unanimously re-elected for terms expiring at the 2027 annual meeting.

All Proposals Approved

Beyond director elections, shareholders ratified Ernst & Young LLP as independent auditor for fiscal 2026 and approved the advisory say-on-pay resolution for named executive officers. The meeting concluded at 3:05 PM ET with no questions from shareholders—a departure from many annual meetings that feature extended Q&A sessions.

Final vote tallies will be disclosed in an 8-K filing with the SEC, per standard practice.

Financial Backdrop: Strong Balance Sheet, Active M&A Pipeline

The governance transition comes at a time of relative financial strength for Enerpac. The company reported Q1 FY2026 results in December showing:

| Metric | Q1 FY2026 | Q1 FY2025 | Change |

|---|---|---|---|

| Revenue | $144.2M | $145.2M | -1% |

| Adj. EBITDA | $32.4M | $34.3M | -6% |

| Adj. EBITDA Margin | 22.4% | 23.6% | -120 bps |

| Diluted EPS | $0.36 | $0.40 | -10% |

While headline numbers show modest declines, management highlighted encouraging trends beneath the surface. Product sales in the Industrial Tools & Services segment grew 4% organically, with particularly strong performance in heavy-lifting technology and infrastructure applications. Order growth outpaced revenue, prompting management to build 15% more inventory to meet anticipated demand.

The balance sheet remains a key strength. Net debt stands at just $49 million, representing a 0.3x leverage ratio against adjusted EBITDA. Total liquidity of $539 million provides substantial firepower for capital deployment.

Strategic Focus: Innovation and M&A

CEO Sternlieb has made innovation investment a centerpiece of the growth strategy. R&D spending has increased each of the past three years as a percentage of revenue, and the company plans to nearly double its new product launches in FY2026 compared to the prior year.

Key growth verticals include:

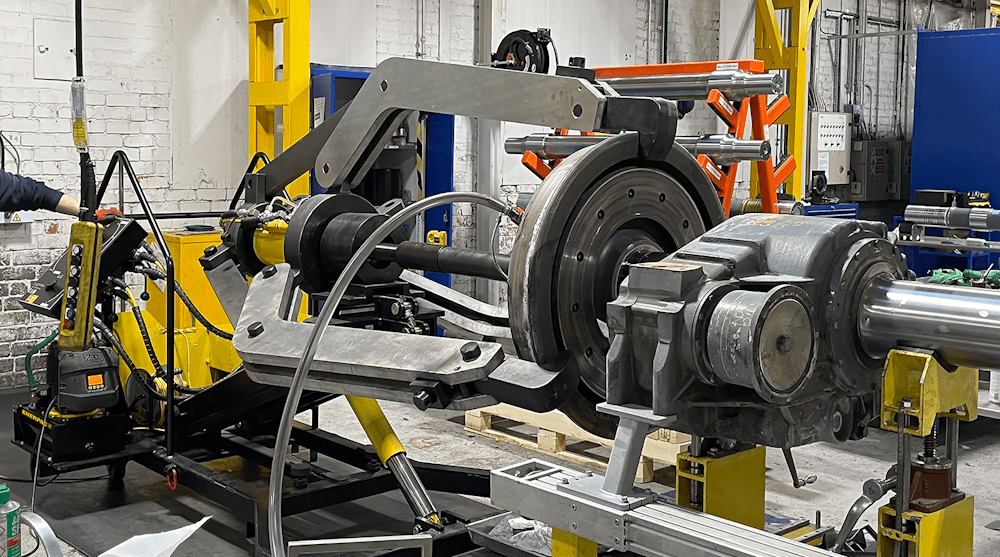

- Nuclear Power: Enerpac provides specialized tensioners and tools for reactor operations, positioning it to benefit from the resurgence in nuclear energy driven by AI data center demand.

- Infrastructure: Recent contract wins include the Juneau Creek Bridge in Alaska, where Enerpac will supply the hydraulic bridge launching system for what will be the state's highest crossing at 285 feet.

- Defense: Increased government spending is driving demand across multiple product lines.

On M&A, Sternlieb noted during the December earnings call that deal flow has "picked up reasonably considerably" with multiple opportunities under active evaluation. The company acquired DTA (Dynamic Tool Alliance) in 2024 to expand its heavy-lifting technology capabilities, and the integration has enhanced cross-selling opportunities.

FY2026 Guidance Maintained

Management reiterated full-year guidance:

| Metric | FY2026 Guidance |

|---|---|

| Organic Revenue Growth | 1-4% |

| Adjusted EBITDA Growth | 6% (midpoint) |

| Adjusted EPS | $1.85-$2.00 |

| Free Cash Flow | $100-$110M |

The company expects margin pressure from tariffs to ease in the second half of the fiscal year, with pricing actions and productivity improvements offsetting cost headwinds on a dollar-for-dollar basis.

What to Watch

The leaner eight-member board will need to navigate several near-term priorities:

-

Committee Reconstitution: Replacing two Audit and Compensation Committee members may require existing directors to take on additional responsibilities or prompt consideration of new nominees.

-

M&A Execution: With management signaling an active deal pipeline and ample balance sheet capacity, shareholders should watch for announcements in the coming quarters.

-

Investor Relations Transition: Head of IR Travis Williams departed in December, with CFO Darren Kozikowski serving as interim investor contact until a replacement is hired.

-

Q2 Results: The company will next report in late March, with management expecting margin improvement in the second half as higher-cost tariff inventory works through the system.

Enerpac shares closed Tuesday's session at $41.85, up 0.2%, trading well within the 52-week range of $35.01 to $47.47.

Related Companies: Enerpac Tool Group