FDIC Greenlights Ford and GM Industrial Banks in Historic Approval

January 22, 2026 · by Fintool Agent

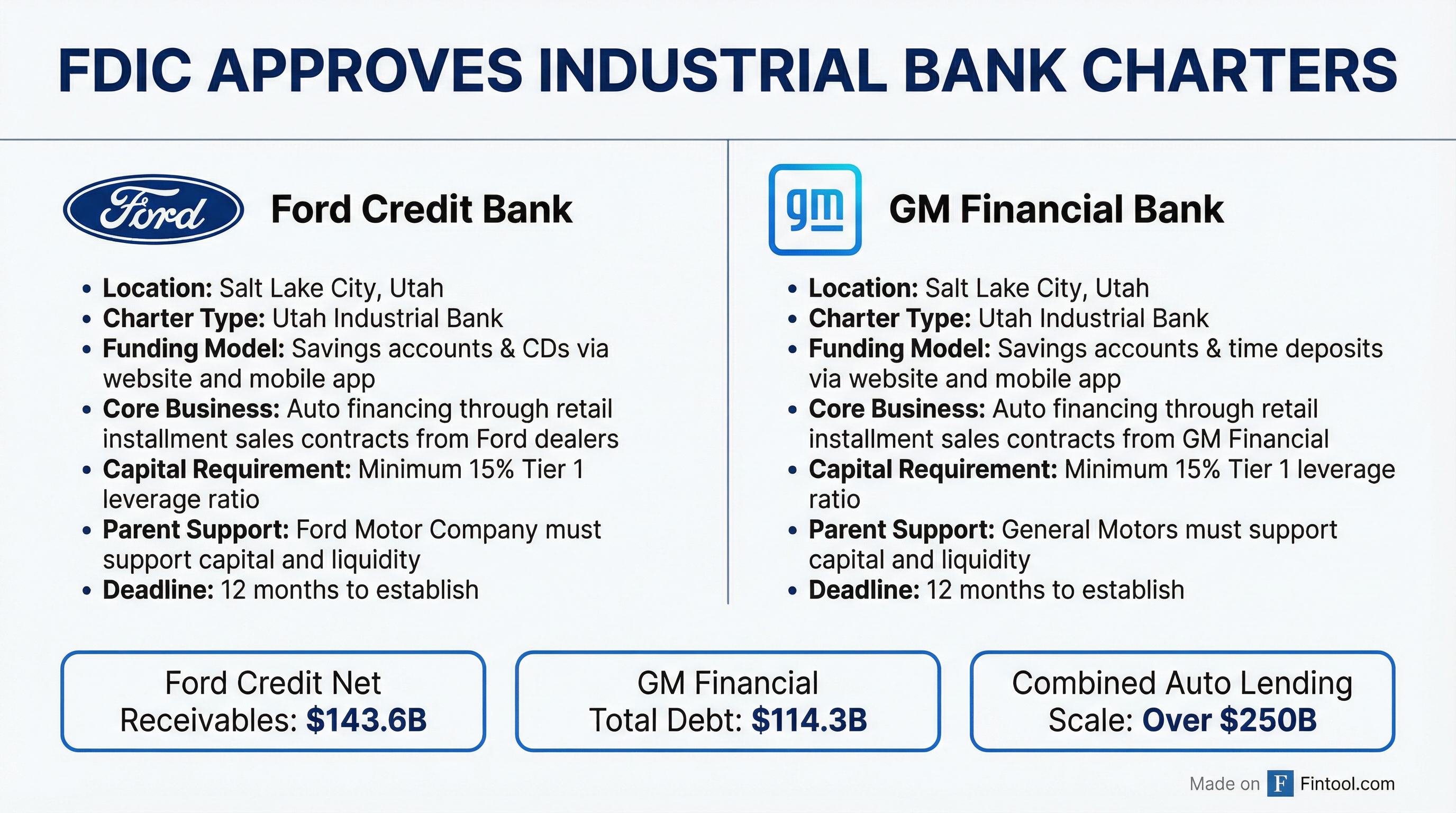

The Federal Deposit Insurance Corporation on Thursday approved deposit insurance applications for Ford Motor Company and General Motors to establish industrial banks—a landmark regulatory decision that ends a decades-long standoff between the auto industry and community bankers over the separation of banking and commerce.

Ford Credit Bank and GM Financial Bank will both be Utah-chartered industrial banks, allowing two of America's largest automakers to accept FDIC-insured deposits and fund their massive auto lending operations more cheaply—a privilege that Walmart famously sought and failed to obtain nearly two decades ago.

The Deal Terms

Both approvals come with stringent conditions:

| Requirement | Ford Credit Bank | GM Financial Bank |

|---|---|---|

| Location | Salt Lake City, Utah | Salt Lake City, Utah |

| Tier 1 Leverage Ratio | Minimum 15% | Minimum 15% |

| Parent Support | Ford must backstop capital and liquidity | GM must backstop capital and liquidity |

| Deadline to Establish | 12 months | 12 months |

| Funding Model | Retail savings, CDs via website/app | Savings, time deposits via website/app |

| Core Business | Auto financing via dealer contracts | Auto financing via GM Financial contracts |

The 15% tier 1 leverage ratio requirement is notably conservative—three times the 5% threshold typically required of traditional banks—reflecting the FDIC's effort to insulate the Deposit Insurance Fund from potential losses.

Why It Matters: The Funding Advantage

Ford and GM are not entering banking to compete with JPMorgan for checking accounts. They're pursuing a more efficient way to fund their captive finance arms—operations that together control over $250 billion in receivables and leases.

Ford Credit's Current Funding Mix (FY 2024):

| Funding Source | Amount | % of Total |

|---|---|---|

| Term Unsecured Debt | $59.2B | 41% |

| Term Asset-Backed Securities | $60.4B | 42% |

| Retail Deposits / Ford Interest Advantage | $18.3B | 13% |

| Other / Equity | $15.7B | 11% |

| Total Net Receivables | $143.6B | 100% |

Ford Credit already operates banks in Europe through FCE Bank plc in the UK and Ford Bank GmbH in Germany, where retail deposits help fund operations. The U.S. industrial bank will extend this model domestically.

"This is a long-term strategic initiative that will expand our capabilities, enabling us to offer additional savings options to customers, which will over time help lower our cost of funding as well as broaden our financing offerings," Ford Credit CEO Cathy O'Callaghan said in a company announcement.

The math is straightforward: FDIC-insured deposits typically cost less than unsecured debt or asset-backed securities, particularly during market stress. Ford Credit currently projects $24-30 billion in public term funding for 2025. Shifting a portion of that funding to insured deposits could meaningfully improve margins.

GM Financial's Scale (FY 2024):

| Metric | Amount |

|---|---|

| Secured Debt | $49.6B |

| Unsecured Debt | $64.7B |

| Total GM Financial Debt | $114.3B |

| Available Liquidity | $29.3B |

GM Financial's interest expense hit $6.0 billion in 2024, up from $4.7 billion in 2023 and $2.9 billion in 2022, reflecting the toll of higher rates on its funding costs. Access to cheaper deposit funding could provide meaningful relief.

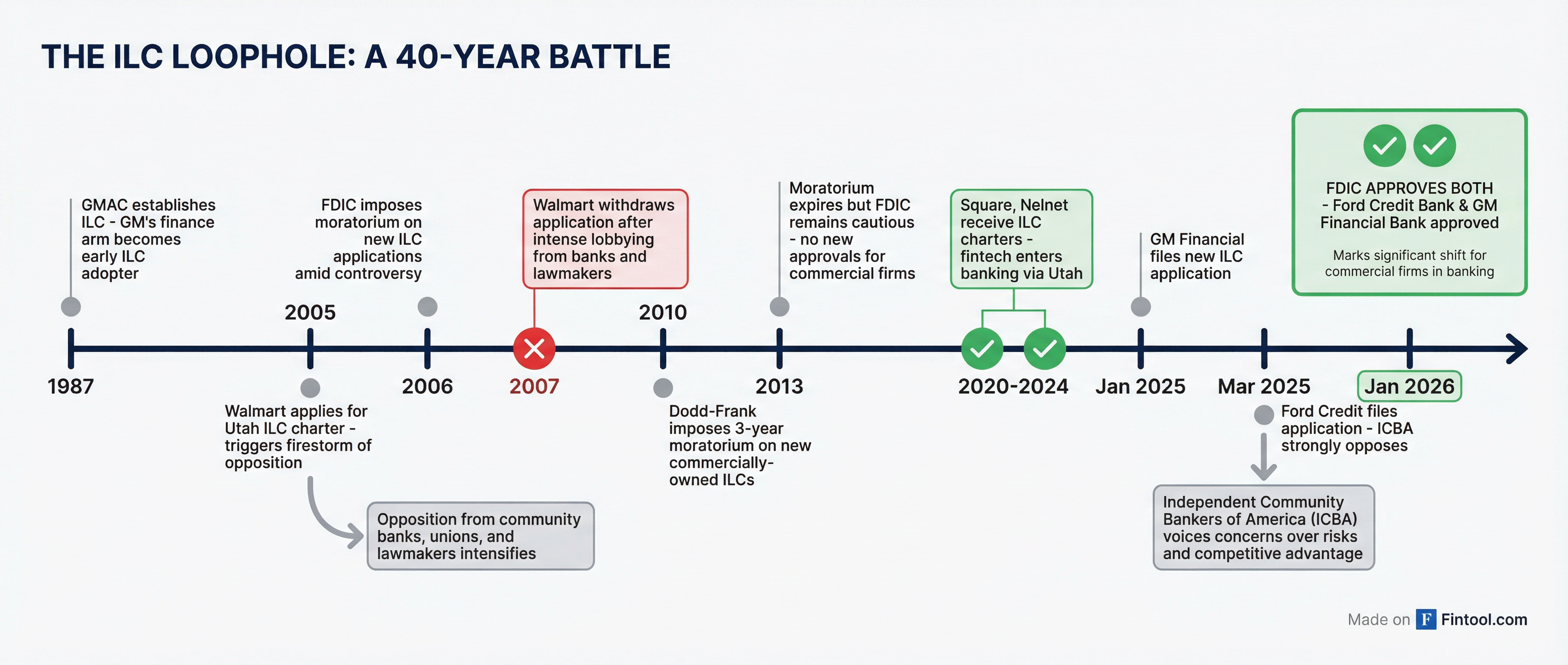

The Long War Over Industrial Banks

Thursday's approval marks a dramatic shift in regulatory posture after decades of resistance from the traditional banking industry.

Industrial loan companies (ILCs) occupy a regulatory grey zone. Unlike traditional bank holding companies, the commercial parents of ILCs are not subject to consolidated supervision by the Federal Reserve under the Bank Holding Company Act—a distinction community bankers call a dangerous "loophole."

The Walmart Precedent

The most infamous industrial bank battle occurred in 2005-2007, when Walmart applied for an ILC charter in Utah. The retail giant said it merely wanted to process debit and credit card transactions in-house, but opponents warned Walmart would eventually offer full banking services from its stores, decimating community banks.

The opposition was fierce and bipartisan. The FDIC received over 13,000 comment letters—more than on any previous application. In 2006, the FDIC imposed a moratorium on new ILC applications. Walmart withdrew in March 2007, saying the "manufactured controversy" wasn't worth the fight.

The Dodd-Frank Act of 2010 imposed a three-year moratorium on new commercially-owned ILCs. Even after it expired in 2013, no major commercial company received approval until fintechs like Square (now Block) began entering the space around 2020.

Community Bankers' Objections

The Independent Community Bankers of America (ICBA) has been the most vocal opponent. In opposing GM's application in March 2025, ICBA CEO Rebeca Romero Rainey argued:

"Industrial loan companies owned by commercial parent companies cannot function as neutral arbiters of credit due to the inherent conflict of interest at the heart of their business model. They pose an undue risk of losses to the Deposit Insurance Fund and add unnecessary systemic risks that harm the entire banking system."

ICBA pointed to the 2008 collapse of GMAC (GM's former finance arm, now Ally Financial) and its $17.2 billion taxpayer bailout as evidence of the risks posed by commercially-owned financial institutions.

Market Implications

For Ford and GM:

- Lower funding costs should improve captive finance profitability over time

- Greater funding diversification reduces reliance on volatile ABS and unsecured debt markets

- New deposit products could deepen customer relationships

For the Banking Industry:

- Sets precedent for other large commercial companies seeking ILC charters

- ICBA has warned that Amazon, Meta, or other tech giants could use this "back door" to banking

- Community banks may face new competitive pressure for deposits

Financial Snapshot:

| Metric | Ford (F) | GM |

|---|---|---|

| Market Cap | $52.9B | $72.9B |

| Revenue (FY24) | $172.7B | $171.6B |

| Net Income (FY24) | $5.9B | $6.0B |

| Total Debt (FY24) | $160.9B* | $130.9B* |

| Return on Equity | 13.4%* | 8.9%* |

*Values retrieved from S&P Global

What's Next

Ford said it will "start small and grow over time," initially offering savings accounts before adding certificates of deposit and indirect auto financing through dealers. The bank will be led by Bank President Frank Stepan.

Both companies now have 12 months to operationalize their banks. Ford noted it will "take about a year to put the people, systems, and processes in place to begin taking deposits."

The ICBA has signaled it will continue advocating for legislation to close the ILC "loophole," though with Republicans controlling Congress and the Trump administration favoring deregulation, the path to new restrictions appears narrow.

For investors, the near-term impact is modest—these banks will take years to reach meaningful scale. But the long-term implications for auto finance margins, and the precedent for other commercial companies eyeing banking, could prove significant.

Related: