Gartner Stock Plunges 23% Despite Q4 Beat as 2026 Guidance Falls Short, DOGE Cuts Weigh

February 3, 2026 · by Fintool Agent

Gartner shares collapsed 23% Tuesday after the research and advisory firm issued 2026 guidance that fell sharply below Wall Street expectations, overshadowing a solid Q4 2025 earnings beat. The stock opened at $147.94—down 27% from the prior close of $202.40—before recovering to close at $155.46 on volume of 4.6 million shares, nearly three times the daily average.

The culprit: revenue guidance of $6.45 billion for 2026, roughly 7% below the Street consensus of $6.91 billion, and an explicit margin reset that management characterized as "the new baseline."

The Numbers: Q4 Beat, 2026 Miss

Gartner's fourth quarter delivered on all key metrics. Adjusted EPS came in at $3.94, beating consensus of $3.51 by 12%. Revenue of $1.8 billion was essentially in-line. EBITDA margins expanded 60 basis points year-over-year to 24.9%, and the company repurchased $2 billion of stock during 2025, reducing shares outstanding by 8%.

But 2026 guidance told a different story.

| Metric | Q4 2025 Actual | FY 2026 Guidance | Street Estimate |

|---|---|---|---|

| Revenue | $1.8B | $6.45B | $6.91B |

| Adjusted EPS | $3.94 | $12.30+ | $13.00 |

| EBITDA Margin | 24.9% | 23.5% | 25% |

"We do believe that 23.5% is the new baseline, if you will, and we should be able to expand our margins going forward," CFO Craig Safian said on the call. "With faster CV growth... that certainly helps from a revenue growth perspective, EBITDA flow-through, free cash flow perspective."

DOGE Devastated Federal Business

The most striking headwind: the U.S. federal government. Department of Government Efficiency (DOGE) initiatives drove a dramatic collapse in Gartner's government contract value.

At December 31, federal CV stood at just $126 million—down sharply from prior levels. Excluding federal, CV grew 4% year-over-year. But total company CV grew only 1%, revealing just how much the government cuts dragged on the overall business.

"The vast majority of our U.S. federal contracts came up for renewal during 2025," Safian explained. "DOGE-related initiatives affected our U.S. federal clients... evolving trade policies created complexity for tariff-impacted enterprises."

CEO Gene Hall offered hope that the worst may be behind: "All of our federal government clients, U.S. Federal Government, contracts—virtually all of them are one-year contracts. And so any client that wanted to cancel because of DOGE after Q1 will have already had the chance to cancel."

The company expects federal to stabilize going forward, but Hall was clear-eyed: "We believe the ones that are gonna cancel will have gone through it once we get through Q1."

Transformation Underway—But Benefits Delayed

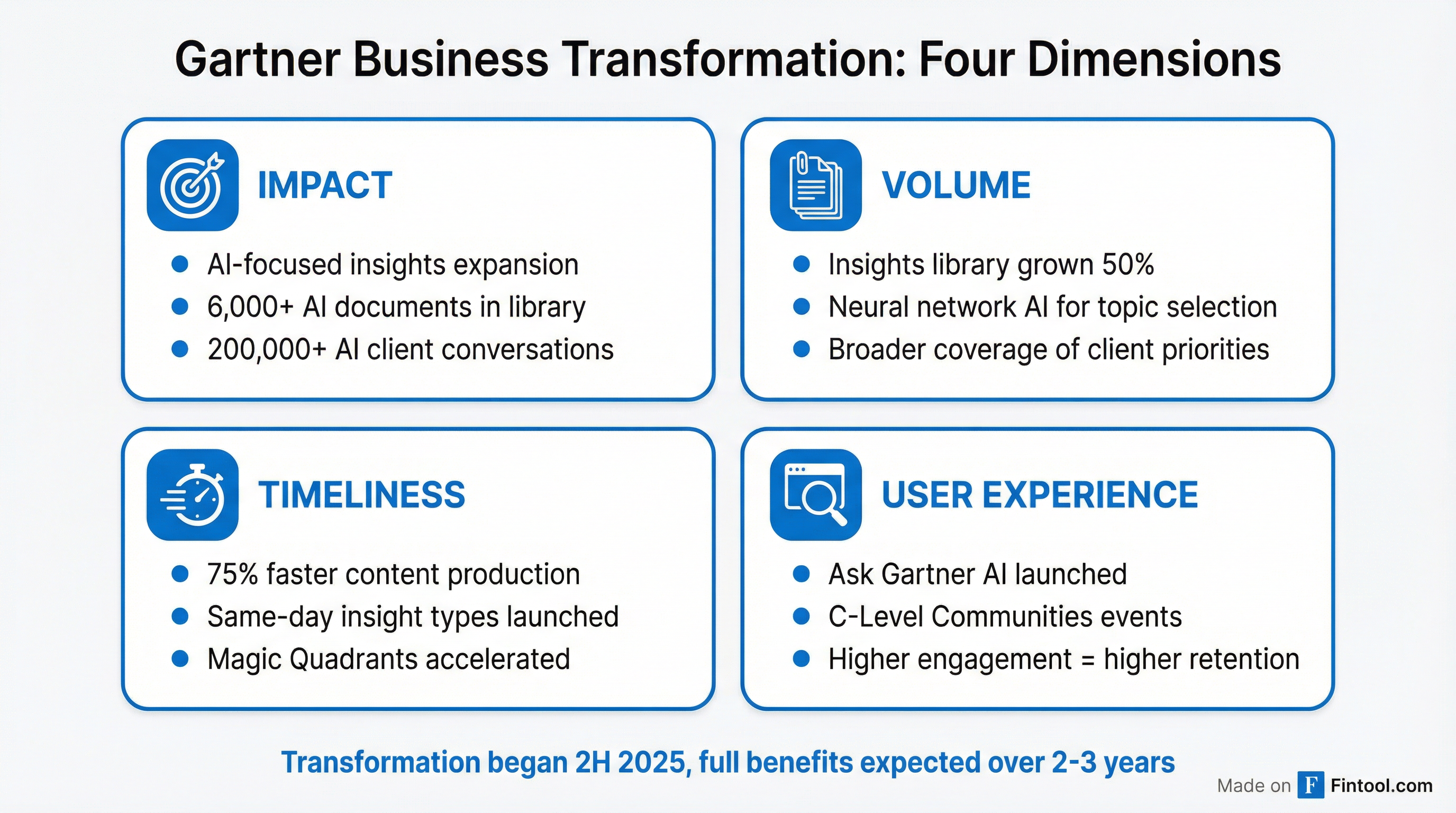

Management spent much of the call describing a sweeping business transformation launched in the second half of 2025. The changes span four dimensions: impact, volume, timeliness, and user experience.

Key initiatives include:

Impact: Expanded AI insights with more than 6,000 AI-related documents in the library, 200,000+ in-depth AI client conversations in 2025, and 500,000+ AI questions answered through Ask Gartner.

Volume: Active insights library grew approximately 50%, enabled by a neural network AI model to systematically determine the topics clients care about most.

Timeliness: Average production time for Magic Quadrants reduced by 75%. New "First Take" content type delivers same-day insights on breaking events.

User Experience: Ask Gartner, the AI-powered research assistant, fully rolled out in October. "Licensed users who used Ask Gartner had substantially higher renewal rates than those who did not, even with the same levels of engagement."

But Hall was explicit about timing: "It's gonna take a couple of years until you get the whole benefit of everything we're talking about."

Analysts Wanted Answers on Medium-Term Guidance

Several analysts pushed management on whether the company's medium-term financial targets remain achievable. Hall acknowledged the challenge: "The last year, there were a lot of changes—in fact, over the last two or three years, there's been a lot of changes between what's happened with AI, the U.S. federal government, tariffs."

Jefferies analyst Surinder Thind asked directly whether the company could still hit its targets given persistent disruption. Hall responded: "We're taking the view that the world is always going to be more challenging than it was prior to a couple of years ago. And so because of that, we needed to really up the value provided to clients a lot."

On AI competition, Hall was dismissive. The company tracks every instance where a salesperson reports a client considering AI as a substitute. "We have this help desk in case somebody has an AI question, and the help desk is like the Maytag repairman... We do not hear frequently that they're thinking about using AI in some way to substitute for Gartner."

Digital Markets Divested

Adding to the transformation, Gartner announced a definitive agreement to divest its Digital Markets business last week. The unit—which includes peer review platforms—will not be included in 2026 guidance.

"We came to the recognition that Digital Markets was not a core part of the business," Safian said. "We looked to drive value, sell it to a more natural owner, and then from a shareholder value perspective, that allows us to use those proceeds, but also to focus on the core."

The company also disclosed headcount reductions tied to the transformation. "As we assessed this BTI transformation, in any transformation, you often find that you have people that don't have the skills today that you need going forward," Hall explained. "It had nothing to do with cost. It had to do with making sure we had the skills to address the impact, volume, timeliness, and user experience that we need."

Historical Performance

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $1,473 | $1,595 | $1,413 | $1,715 | $1,534 | $1,686 | $1,469 | $1,703 |

| Net Income ($M) | $211 | $230 | $415 | $399 | $211 | $241 | $35 | $242 |

| Diluted EPS | $2.67 | $2.93 | $5.32 | $5.11 | $2.71 | $3.11 | $0.47 | $3.36 |

What to Watch

The key question for investors: Can Gartner's transformation drive the contract value acceleration management promises?

Near-term catalysts:

- Q1 2026 renewals: The seasonally important quarter will reveal whether federal headwinds have truly peaked

- CV acceleration trajectory: Management expects growth rates to improve throughout 2026, building toward 2027

- Ask Gartner adoption: Early data shows higher retention for users; broader adoption could bend the renewal curve

Risks:

- Margin reset permanence: The explicit 23.5% baseline suggests operating leverage is structurally lower

- Transformation execution: "More change than we've ever done at Gartner" in 20 years carries integration risk

- Macro uncertainty: Tariffs, government spending volatility, and enterprise budget scrutiny show no signs of abating

Despite the selloff, Gartner generated $1.2 billion in free cash flow in 2025 at a 161% conversion rate to GAAP net income. The company maintains a debt-free balance sheet with $2.7 billion in liquidity. The shareholder return machine remains intact—but investors will need to wait two to three years for the transformation payoff management has promised.