Earnings summaries and quarterly performance for GARTNER.

Executive leadership at GARTNER.

Eugene A. Hall

Chief Executive Officer

Akhil Jain

Executive Vice President, Consulting

Altaf Rupani

Chief Information Officer

Claire Herkes

Executive Vice President, Conferences

Craig W. Safian

Chief Financial Officer

Dick van Ham

Senior Vice President, Global Technology Sales

John J. Rinello

Senior Vice President, Global Business Sales

Kenneth Allard

Executive Vice President, Digital Markets

Robin Kranich

Chief Human Resources Officer

Scott C. Hensel

Executive Vice President, Global Services & Delivery

Thomas S. Kim

Chief Legal Officer & Corporate Secretary

William James Wartinbee

Executive Vice President, Global Sales Strategy & Operations

Yvonne Genovese

Executive Vice President, Research & Advisory

Board of directors at GARTNER.

Anne Sutherland Fuchs

Director

Diana S. Ferguson

Director

Eileen M. Serra

Director

José M. Gutiérrez

Director

Karen E. Dykstra

Lead Independent Director

Peter E. Bisson

Director

Raul E. Cesan

Director

Richard J. Bressler

Director

Stephen G. Pagliuca

Director

William O. Grabe

Director

Research analysts who have asked questions during GARTNER earnings calls.

Andrew Nicholas

William Blair & Company

8 questions for IT

Jason Haas

Wells Fargo

8 questions for IT

Jeffrey Silber

BMO Capital Markets

8 questions for IT

Joshua Chan

UBS Group AG

8 questions for IT

Toni Kaplan

Morgan Stanley

8 questions for IT

Faiza Alwy

Deutsche Bank

7 questions for IT

Surinder Thind

Jefferies Financial Group

7 questions for IT

George Tong

Goldman Sachs

6 questions for IT

Manav Patnaik

Barclays

5 questions for IT

Ashish Sabadra

RBC Capital Markets

4 questions for IT

Jeffrey Meuler

Robert W. Baird & Co. Incorporated

4 questions for IT

Scott Wurtzel

Wolfe Research

4 questions for IT

Jeff Meuler

Robert W. Baird & Co.

3 questions for IT

Jasper Bibb

Truist Securities

2 questions for IT

Brendan

Barclays

1 question for IT

Brendan Popson

Barclays

1 question for IT

Jeffrey Miller

Baird

1 question for IT

Keen Fai Tong

Goldman Sachs Group Inc.

1 question for IT

Sammy Yon

Goldman Sachs

1 question for IT

Recent press releases and 8-K filings for IT.

- Arctic Wolf has acquired Sevco Security, a cloud-native exposure assessment platform innovator, to integrate its technology into the Arctic Wolf Aurora Platform and enhance asset intelligence and vulnerability prioritization.

- Sevco Security was named a Visionary in the 2025 Gartner Magic Quadrant for Exposure Assessment Platforms, validating its approach to continuous exposure management.

- The acquisition unifies asset discovery, vulnerability context, and security control coverage to help organizations proactively identify and prioritize exposures across hybrid environments.

- Gartner predicts that by 2027, organizations integrating exposure assessment into business workflows will experience 30% less unplanned downtime from exploited vulnerabilities, underscoring the strategic importance of this capability.

- SUSE has acquired Losant, an Industrial IoT platform, completing its Edge vision by extending reach from the Near and Far Edge to the Tiny Edge.

- The acquisition positions SUSE as the first to offer a full-stack open process automation platform for IIoT, delivering real-time insights and actionable intelligence at the Edge.

- SUSE plans to open source Losant’s technology and collaborate with open source communities to accelerate interface standardization, interoperability, and process automation globally.

- Losant was recognized in the 2025 Gartner Magic Quadrant for Global Industrial IoT Platforms, underscoring its market leadership in IIoT solutions.

- AlgoSec achieved its best year ever in 2025, with 37% YoY new business growth, strong annual recurring revenue expansion and >90% gross dollar retention

- The company maintained positive cash flow and remained debt-free throughout 2025

- In 2025 over 100 enterprises implemented the newly launched AlgoSec Horizon platform, its first application-centric security management solution for hybrid networks

- AlgoSec earned a 4.5/5 customer satisfaction rating on both G2 and Gartner Peer Insights and received the 2025 SC Award for Best Security Company

- Independent validation from Latio Tech’s 2026 Application Security Market Report as Runtime Innovator and API Security Innovator.

- Recognized by Frost & Sullivan as 2025 CNADR Company of the Year for over 4,000% YoY revenue growth.

- Positioned as a Leader in GigaOm’s Container Security Radar, SPARK Matrix™ CNAPP Leader by QKS Group, and included in Gartner’s 2025 CNAPP Market Guide.

- Achieved 200% YoY customer logo growth, a 4.9/5 rating on Gartner Peer Insights, and secured $250 million Series B funding.

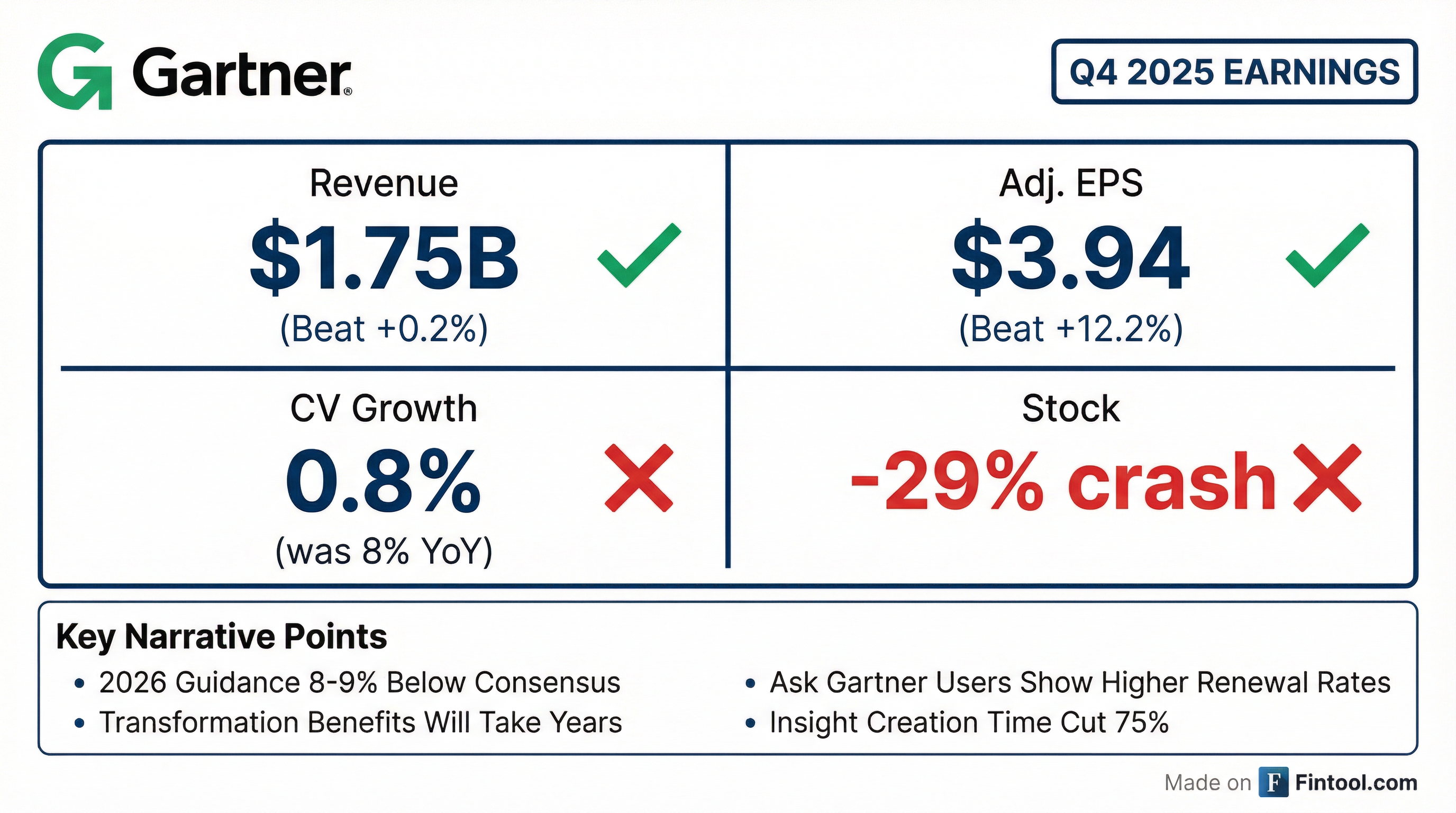

- Levi & Korsinsky is investigating Gartner over its presentation of non-GAAP vs GAAP metrics in earnings communications and SEC filings.

- In its Feb 3, 2026 Q4 release, Gartner highlighted an EPS beat while revenue missed consensus and issued a full-year 2026 outlook projecting year-over-year revenue decline.

- Gartner guided 2025 adjusted EPS to at least $12.65 based on 78 million shares, assuming repurchases; it repurchased over $1 billion in Q3 2025, cutting shares by 6% YoY.

- Following the release, shares plunged over 20% to a new 52-week low below $160, with trading volume spiking.

- Achieved 500% revenue growth, 300% increase in new customers, and 300% team growth in 2025, reflecting strong market demand for AI-driven security controls.

- Appointed Mike Baker as Chief Revenue Officer and Bharath Rangamannar as Senior VP of Engineering to bolster go-to-market and product execution capabilities.

- 80% of customers now add the Drift module, underscoring widespread adoption of continuous configuration validation.

- Earned recognition as a CRN Stellar Startup, joined Microsoft for Startups Pegasus Program, and featured in Gartner’s Innovation Insight and Emerging Tech reports.

- Veracode closed 2025 with an 81% year-over-year increase in annual contract value (ACV) in Q4, underscoring strong market demand for application risk management.

- The company added over 130 new organizations in Q4 2025, driven by large-scale and multi-year agreements across diverse industries.

- In 2025, Veracode processed 420 trillion lines of code and helped remediate 131 million vulnerabilities, highlighting its impact on reducing security debt.

- Key product launches included Veracode Package Firewall and External Attack Surface Management, and Veracode was named a leader in the Forrester Wave, Gartner Magic Quadrant, and IDC MarketScape.

- Veracode recorded an 81% year-over-year increase in annual contract value (ACV) in Q4 2025, underpinned by rising demand for application risk management.

- The platform processed 420 trillion lines of code and enabled the remediation of 131 million security flaws in 2025, highlighting a proactive industry shift towards continuous security.

- Customer acquisition accelerated in Q4 with over 130 new enterprise clients, including multiple seven-figure, multi-year agreements across diverse sectors.

- Key 2025 product innovations included the Veracode Package Firewall, which blocks malicious open-source packages preemptively, and External Attack Surface Management.

- Achieved 30% new business growth and 107% customer net retention in 2025, driven by strong demand for its AI-powered network security solutions.

- Realized 2.5× growth in cloud, SASE, and microsegmentation offerings, underscoring expansion in key high-growth segments.

- Elevated Net Promoter Score by 57% year-over-year to 71, indicating heightened customer satisfaction and advocacy.

- Launched major product enhancements—including TOS R25-2 with advanced visibility and automation, TufinAI natural-language assistants, and TOS Discovery live topology onboarding—to simplify hybrid network management.

- Veracode’s new Annual Contract Value (ACV) grew 81% year-over-year in Q4 2025, underscoring robust market traction.

- Added 130+ new organizations in Q4 2025, including multiple seven-figure, multi-year contracts across diverse industries.

- In 2025, the platform processed 420 trillion lines of code and helped fix 131 million flaws, highlighting scale and impact.

- Introduced Package Firewall and External Attack Surface Management, and was named a Leader by Forrester, Gartner, and IDC, plus earned TrustRadius Top Rated and Buyers Choice awards.

Fintool News

In-depth analysis and coverage of GARTNER.

Quarterly earnings call transcripts for GARTNER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more