Earnings summaries and quarterly performance for GARTNER.

Executive leadership at GARTNER.

Eugene A. Hall

Chief Executive Officer

Akhil Jain

Executive Vice President, Consulting

Altaf Rupani

Chief Information Officer

Claire Herkes

Executive Vice President, Conferences

Craig W. Safian

Chief Financial Officer

Dick van Ham

Senior Vice President, Global Technology Sales

John J. Rinello

Senior Vice President, Global Business Sales

Kenneth Allard

Executive Vice President, Digital Markets

Robin Kranich

Chief Human Resources Officer

Scott C. Hensel

Executive Vice President, Global Services & Delivery

Thomas S. Kim

Chief Legal Officer & Corporate Secretary

William James Wartinbee

Executive Vice President, Global Sales Strategy & Operations

Yvonne Genovese

Executive Vice President, Research & Advisory

Board of directors at GARTNER.

Anne Sutherland Fuchs

Director

Diana S. Ferguson

Director

Eileen M. Serra

Director

José M. Gutiérrez

Director

Karen E. Dykstra

Lead Independent Director

Peter E. Bisson

Director

Raul E. Cesan

Director

Richard J. Bressler

Director

Stephen G. Pagliuca

Director

William O. Grabe

Director

Research analysts who have asked questions during GARTNER earnings calls.

Andrew Nicholas

William Blair & Company

8 questions for IT

Jason Haas

Wells Fargo

8 questions for IT

Jeffrey Silber

BMO Capital Markets

8 questions for IT

Joshua Chan

UBS Group AG

8 questions for IT

Toni Kaplan

Morgan Stanley

8 questions for IT

Faiza Alwy

Deutsche Bank

7 questions for IT

Surinder Thind

Jefferies Financial Group

7 questions for IT

George Tong

Goldman Sachs

6 questions for IT

Manav Patnaik

Barclays

5 questions for IT

Ashish Sabadra

RBC Capital Markets

4 questions for IT

Jeffrey Meuler

Robert W. Baird & Co. Incorporated

4 questions for IT

Scott Wurtzel

Wolfe Research

4 questions for IT

Jeff Meuler

Robert W. Baird & Co.

3 questions for IT

Jasper Bibb

Truist Securities

2 questions for IT

Brendan

Barclays

1 question for IT

Brendan Popson

Barclays

1 question for IT

Jeffrey Miller

Baird

1 question for IT

Keen Fai Tong

Goldman Sachs Group Inc.

1 question for IT

Sammy Yon

Goldman Sachs

1 question for IT

Recent press releases and 8-K filings for IT.

- Veracode closed 2025 with an 81% year-over-year increase in annual contract value (ACV) in Q4, underscoring strong market demand for application risk management.

- The company added over 130 new organizations in Q4 2025, driven by large-scale and multi-year agreements across diverse industries.

- In 2025, Veracode processed 420 trillion lines of code and helped remediate 131 million vulnerabilities, highlighting its impact on reducing security debt.

- Key product launches included Veracode Package Firewall and External Attack Surface Management, and Veracode was named a leader in the Forrester Wave, Gartner Magic Quadrant, and IDC MarketScape.

- Veracode recorded an 81% year-over-year increase in annual contract value (ACV) in Q4 2025, underpinned by rising demand for application risk management.

- The platform processed 420 trillion lines of code and enabled the remediation of 131 million security flaws in 2025, highlighting a proactive industry shift towards continuous security.

- Customer acquisition accelerated in Q4 with over 130 new enterprise clients, including multiple seven-figure, multi-year agreements across diverse sectors.

- Key 2025 product innovations included the Veracode Package Firewall, which blocks malicious open-source packages preemptively, and External Attack Surface Management.

- Achieved 30% new business growth and 107% customer net retention in 2025, driven by strong demand for its AI-powered network security solutions.

- Realized 2.5× growth in cloud, SASE, and microsegmentation offerings, underscoring expansion in key high-growth segments.

- Elevated Net Promoter Score by 57% year-over-year to 71, indicating heightened customer satisfaction and advocacy.

- Launched major product enhancements—including TOS R25-2 with advanced visibility and automation, TufinAI natural-language assistants, and TOS Discovery live topology onboarding—to simplify hybrid network management.

- Veracode’s new Annual Contract Value (ACV) grew 81% year-over-year in Q4 2025, underscoring robust market traction.

- Added 130+ new organizations in Q4 2025, including multiple seven-figure, multi-year contracts across diverse industries.

- In 2025, the platform processed 420 trillion lines of code and helped fix 131 million flaws, highlighting scale and impact.

- Introduced Package Firewall and External Attack Surface Management, and was named a Leader by Forrester, Gartner, and IDC, plus earned TrustRadius Top Rated and Buyers Choice awards.

- Boomi has surpassed 30,000 customers, including over one-quarter of the Fortune 500, with customer count up 50% over the past three years.

- 75,000+ intelligent agents are running in production on Boomi’s AI-driven automation platform, powering tens of billions of dollars in enterprise transactions.

- Boomi has been named a Leader in Gartner’s Magic Quadrant for iPaaS and API Management for 11 consecutive times.

- Boomi holds the highest SecurityScorecard rating among iPaaS providers, with an average score of 95+ over the past 18 months.

- Through acquisitions of Rivery and Thru, Inc., Boomi enhanced real-time data ingestion and enterprise-grade MFT capabilities on its core platform.

- Volante Technologies wurde im Gartner® Magic Quadrant™ 2026 for Banking Payment Hub Platforms als Leader ausgezeichnet, basierend auf der Umsetzungsfähigkeit und Vollständigkeit der Vision.

- Gartner hebt Volantes AI-gestützte, ISO 20022-kompatible Payments Platform hervor, die in verschiedenen Regionen, Bereitstellungsmodellen (adjunct, Full Hub, SaaS) und Umgebungen einsatzbar ist.

- Volante bietet modulare, stets verfügbare Zahlungsdienste, die neben bestehenden Systemen oder als vollständige End-to-End-Lösung implementiert werden können, um schrittweise Modernisierung zu ermöglichen.

- Die Plattform verarbeitet täglich Millionen geschäftskritischer Transaktionen in Echtzeit über eine Low-Code-, API-fähige Multi-Cloud-Architektur und bedient u. a. vier der fünf weltweit führenden Geschäftsbanken, sieben der zehn größten US-Banken und zwei der größten Kartennetzwerke.

- Gartner prognostiziert globale IT-Ausgaben von 6,08 Billionen USD für 2026, was Volante als Hinweis auf umfangreiche Modernisierungsinvestitionen in Kerninfrastrukturen sieht.

- Agile Ingeniería y Consultoría partnered with Regula to deploy a high-volume, high-compliance identity verification system for Chile’s telecom sector in response to 2025 regulatory updates.

- The platform now processes over 300,000 monthly ID checks with a 96% customer conversion rate and full compliance with Resolution No. 566/2024.

- Regula’s solution integrates deep authenticity and liveness checks across MRZs, barcodes, RFID chips, holograms, and optically variable elements to detect sophisticated forgeries without slowing onboarding.

- Since joining Solem Group in 2024, Agile has expanded its identity verification, KYC/KYB, and e-signature services across Latin America, supported by a dedicated biometric research center.

- Q4 revenue of $1.8 billion (+2% year-over-year, FX neutral) and EBITDA of $436 million (+5%); full-year revenue of $6.5 billion (+4%) with EBITDA of $1.6 billion, adjusted EPS of $13.17, and free cash flow of $1.2 billion.

- Generated strong cash flow and returned capital via $2 billion of share repurchases in 2025 (including $500 million in Q4), reducing shares outstanding by 8% to ~71 million and ending the year with $1.7 billion of cash and a 1.9× gross debt/EBITDA ratio.

- Entered into a definitive agreement to divest the digital markets business to focus on its core insights subscription platform.

- 2026 guidance calls for $6.45 billion in consolidated revenue (+2% FX neutral), $1.515 billion of EBITDA, adjusted EPS of $12.30, and free cash flow of $1.135 billion, with anticipated acceleration in contract value growth.

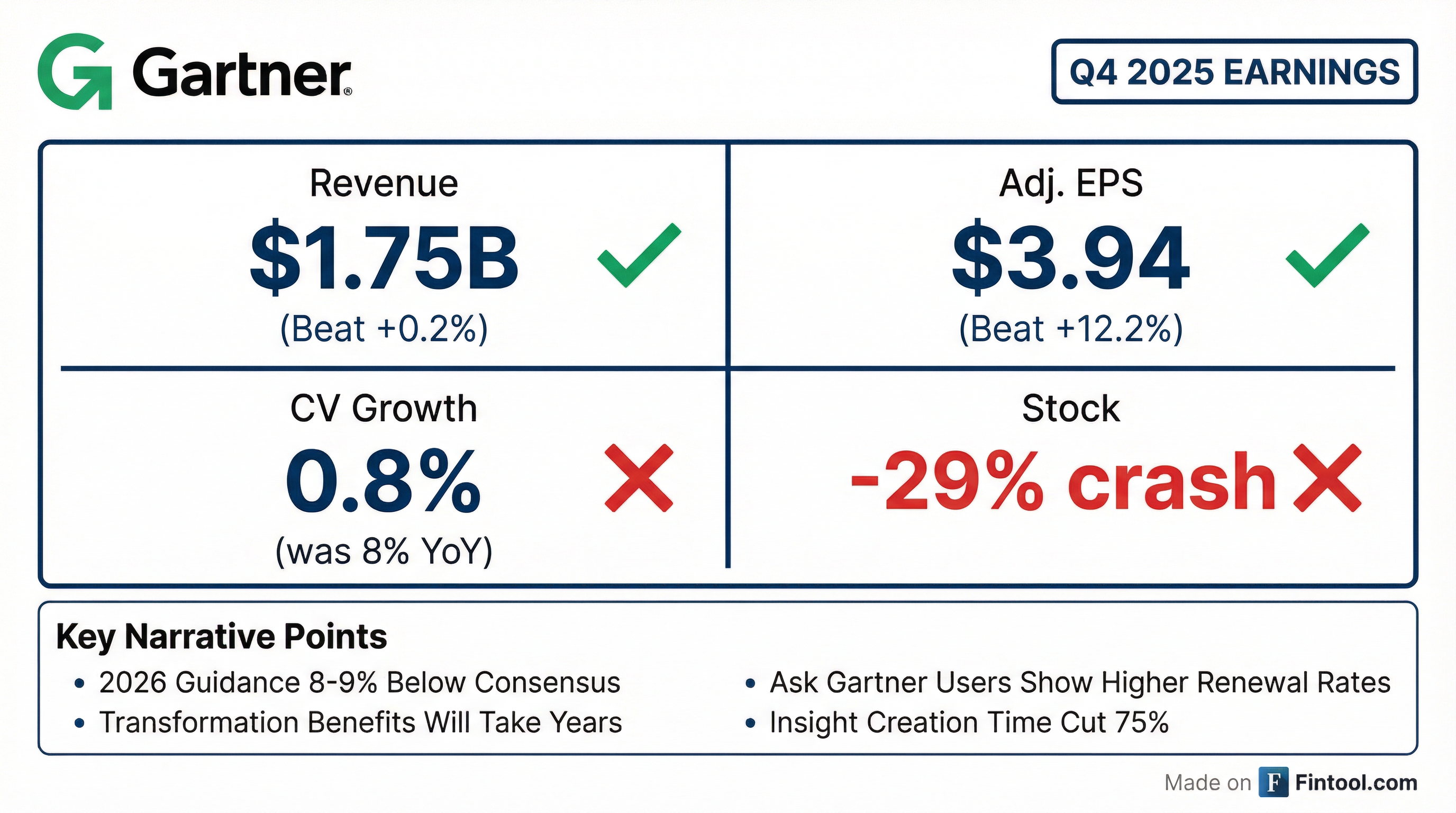

- Consolidated revenues of $1.753 B, up 2.2% Y/Y; Insights revenues of $1.283 B (+2.9%), and Consulting revenues down 12.8% to $134 M.

- Adjusted EBITDA of $436 M (+4.6%) with a margin of 24.9%, and Adjusted EPS of $3.94 (–27.8%).

- Free cash flow of $271 M in Q4 and $1.175 B LTM; Q4 share repurchases of $498 M, with ~$1.2 B authorization remaining.

- 2026 guidance: revenues > $6.455 B, Adj. EPS > $12.30, and Free Cash Flow > $1.135 B.

- Q4 revenue of $1.8 billion (+2% y/y); full-year revenue of $6.5 billion (+4% reported, +3% FX neutral).

- Full-year EBITDA of $1.6 billion (24.8% margin), free cash flow of $1.2 billion, ROIC ~24%; repurchased ~$2 billion of stock and issued inaugural investment-grade bonds to support buybacks.

- 2026 guidance: consolidated revenue ≥ $6.45 billion (+2% FX neutral); insights ≥ $5.19 billion (+1% FXN); conferences ≥ $695 million (+7% FXN); consulting ≥ $570 million (+3% FXN); EBITDA ≥ $1.515 billion (≥23.5% margin); adjusted EPS ≥ $12.30; free cash flow ≥ $1.135 billion.

- CEO Gene Hall outlined a transformation of business and technology insights across four dimensions—impact, volume, timeliness, user experience—to drive higher client engagement and accelerate contract value growth.

Fintool News

In-depth analysis and coverage of GARTNER.

Quarterly earnings call transcripts for GARTNER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more