Glacier Bancorp CFO Ron Copher to Retire After 20 Years, Korn Ferry Tapped to Find Successor

February 9, 2026 · by Fintool Agent

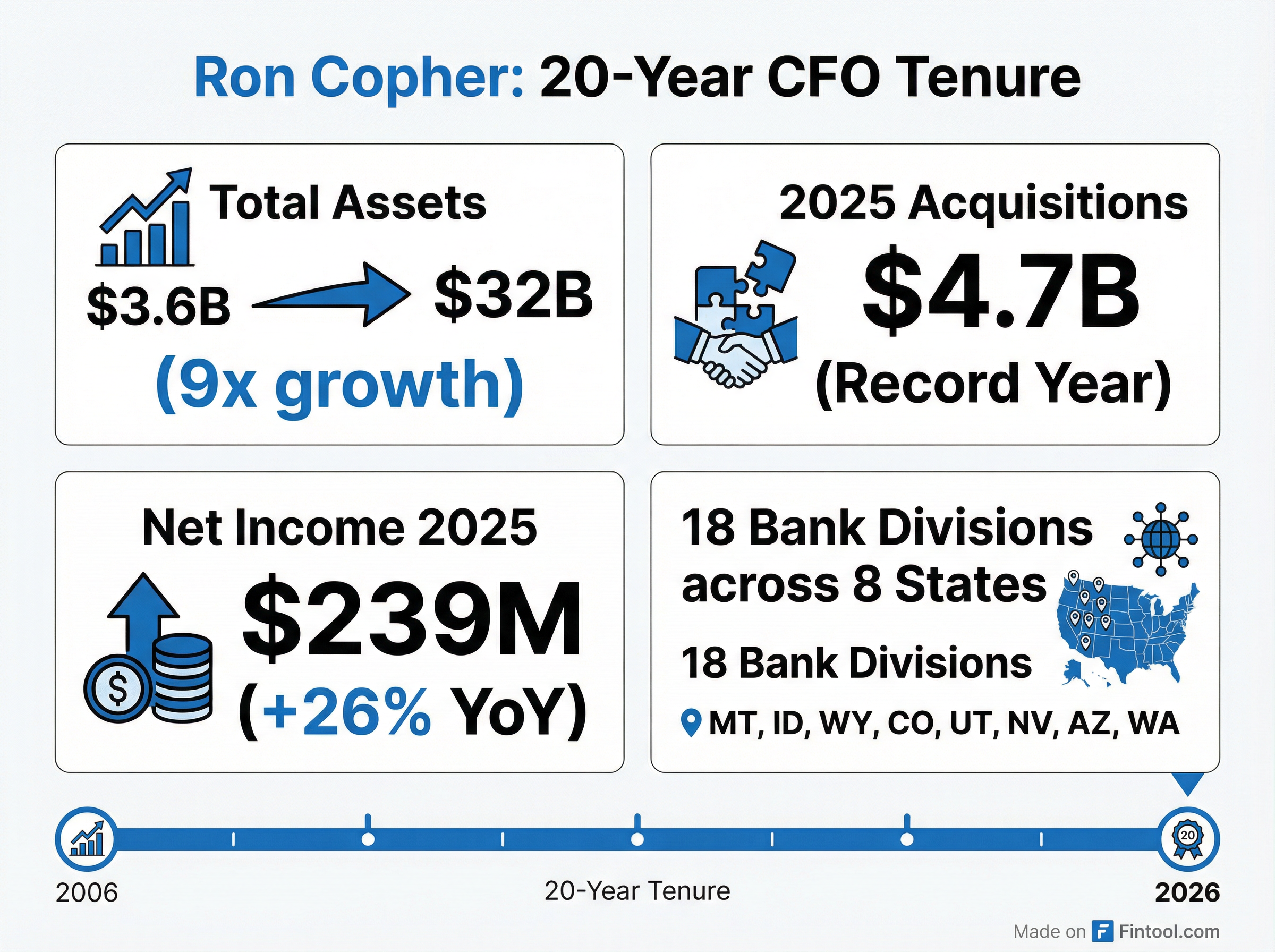

Glacier Bancorp CFO Ron Copher is retiring after a 20-year career that saw the Montana-based regional bank grow from a $3.6 billion community lender to a $32 billion financial institution spanning eight states. The company has engaged Korn Ferry to conduct an internal and external search for his successor.

Copher, 67, will remain as CFO until a successor is appointed and will serve in an advisory capacity during the transition—a structure that gives Glacier ample runway to execute an orderly succession at a pivotal moment for the company.

A Planned Exit, Not a Crisis

The timing of Copher's announcement—just 17 days after the Q4 2025 earnings call where he provided detailed 2026 expense guidance—suggests this is a well-choreographed retirement rather than a sudden departure. On that January 23 call, Copher walked analysts through a $750-766 million full-year expense guide and projected the company would achieve a mid-50s efficiency ratio by H2 2026.

CEO Randy Chesler's statement was unequivocally positive: "Ron Copher has been an exceptional CFO and an invaluable partner whose steady leadership, integrity, and financial expertise have helped shape Glacier Bancorp into the strong organization it is today."

Perhaps most telling: Copher purchased $98,800 worth of GBCI stock at $41.17 per share in early November 2025—hardly the behavior of an executive fleeing a troubled situation.

The Copher Era: From $3.6 Billion to $32 Billion

When Copher joined Glacier in December 2006, the company operated primarily in Montana with total assets around $3.6 billion. Twenty years later, the franchise has grown nearly 9x and now operates 18 bank divisions across Montana, Idaho, Wyoming, Colorado, Utah, Nevada, Washington, and Texas.

The transformation accelerated in 2025, which Chesler called "the largest acquisition year in our history" with over $4.7 billion in acquired assets—topping the previous record of $4.1 billion set in 2021. The company closed two strategic deals: Bank of Idaho in April and Guaranty Bank & Trust in October, the latter marking Glacier's entry into Texas.

Financial Performance Under Copher (FY 2025)

| Metric | FY 2025 | FY 2024 | Change |

|---|---|---|---|

| Net Income | $239M | $190M | +26% |

| Diluted EPS | $1.99 | $1.68 | +18% |

| Total Assets | $32.0B | $27.9B | +15% |

| Net Interest Margin | 3.58% | 2.97% | +61 bps |

The net interest margin trajectory is particularly notable. At the Q4 call, Treasurer Byron Pollan confirmed Glacier expects to hit 4% NIM "at some point later this year, probably second half of 2026"—driven by structural repricing tailwinds that are "not in any way Fed-dependent."

Stock Performance: Resilience Through Regional Bank Turbulence

Glacier's stock has had a volatile five-year run, reflecting broader regional bank sector dynamics rather than company-specific issues. The shares peaked at $57.17 in March 2021, then plunged to $24.87 during the May 2023 regional bank crisis following the Silicon Valley Bank collapse.

The recovery has been steady: GBCI traded at $53.21 on February 9, 2026—up 114% from the crisis low and within 7% of all-time highs. The stock is up 21% year-to-date in 2026.

| Period | GBCI Performance |

|---|---|

| YTD 2026 | +21% |

| 1-Year | +7% |

| Since May 2023 Low | +114% |

| From All-Time High | -7% |

Succession Dynamics: What Investors Should Watch

The engagement of Korn Ferry signals a deliberate, institutional approach to succession. While the company is evaluating internal candidates alongside external options, several factors will shape investor sentiment:

Angela Dose, Chief Accounting Officer, is an obvious internal candidate. She appeared alongside Copher on the Q4 earnings call and has institutional knowledge of Glacier's complex multi-division structure.

The Guaranty Bank & Trust integration is the near-term operational priority. The core system conversion is scheduled for mid-February 2026, and management has emphasized executing it "exceedingly well." A new CFO will inherit a franchise still absorbing its largest-ever acquisition.

M&A pipeline visibility is another consideration. Chesler noted "increasing activity" in both the Mountain West and Southwest regions, with "a lot of conversations ongoing." A new CFO will need to be fluent in Glacier's disciplined, selective acquisition strategy that has driven the company's growth for two decades.

What This Means for Investors

Copher's departure is a non-event in the negative sense—this is textbook succession planning from a well-run regional bank. The timing actually suggests management confidence: announcing after the Guaranty deal closed, after Q4 earnings demonstrated continued margin expansion, and with explicit commitments to remain through the transition.

The incoming CFO will inherit:

- A NIM trajectory toward 4%+ with structural tailwinds

- $2+ billion in assets repricing annually at 75-100 bps gains

- A record loan pipeline entering 2026

- An efficiency ratio on track for mid-50s by H2 2026

The key risk is execution disruption during transition, particularly with the Guaranty conversion imminent. But Copher's commitment to stay through the search—and beyond as an advisor—mitigates this concern.