Winklevoss Twins' Gemini Cuts 25% of Staff, Exits Europe and Australia as Crypto Winter Deepens

February 06, 2026 · by Fintool Agent

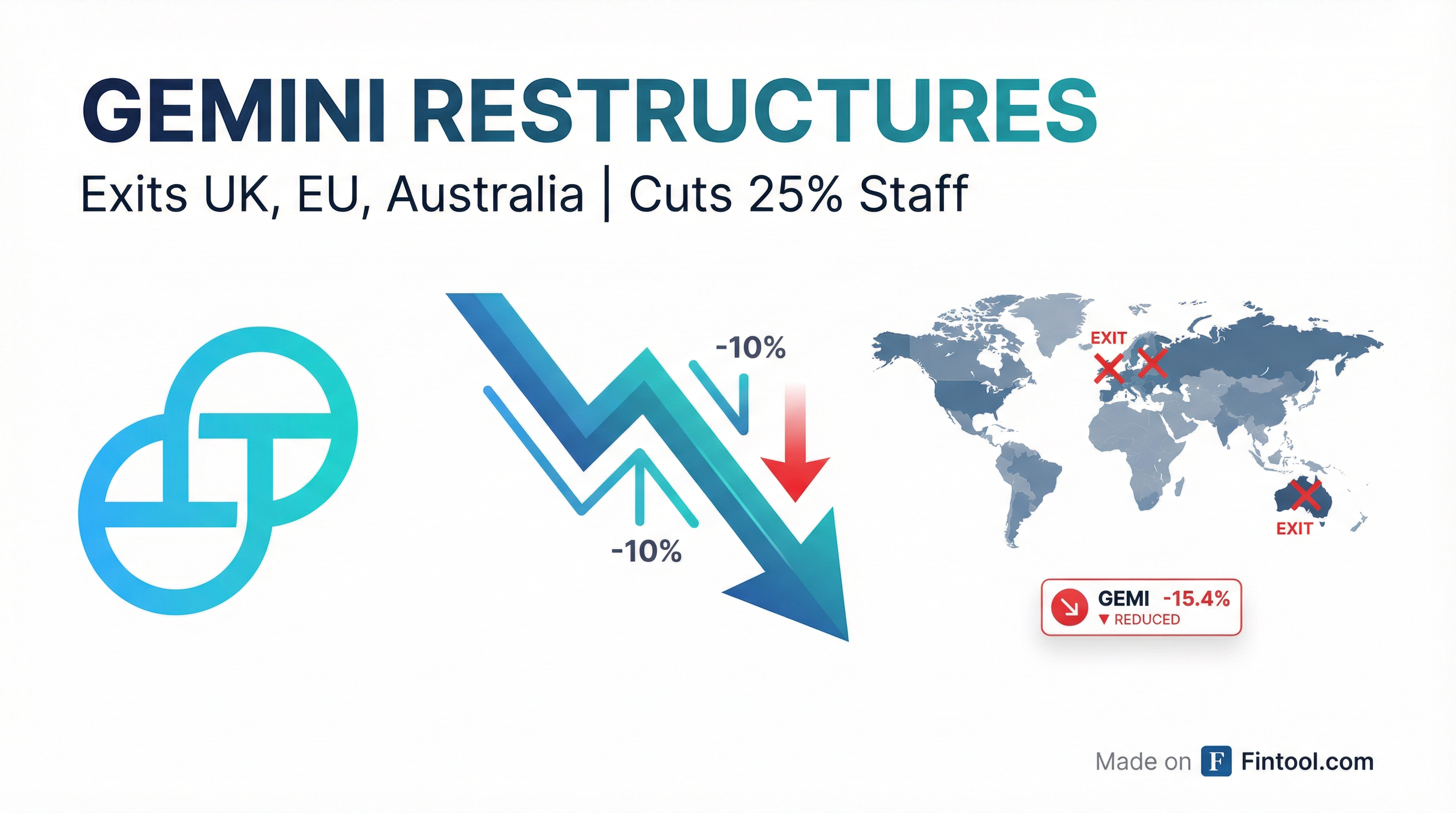

Gemini Space Station+14.63% (NASDAQ: GEMI), the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, announced a dramatic strategic retreat on Thursday—cutting up to 25% of its workforce and exiting the UK, European Union, and Australia—just three months after celebrating its global expansion at its inaugural earnings call.

The restructuring announcement sent shares tumbling to an all-time low of $6.66, marking a 73% decline from its $28 IPO price and an 85% crash from its first-day peak of $45.89. The stock recovered modestly on Friday, closing at $7.57, up 11.2%.

The move underscores the brutal toll that "crypto winter" is inflicting on the industry, with Bitcoin having plunged roughly 50% from its October peak of $126,000 to below $65,000.

The Numbers: A 90-Day Reversal

The whiplash between Gemini's Q3 2025 messaging and its February 2026 reality is striking:

| Metric | Q3 2025 (Nov) | Feb 2026 |

|---|---|---|

| Strategic Direction | Global expansion | Exit 3 major regions |

| Europe Status | MiCA license secured | Exiting by April 6 |

| Australia Status | Just launched | Exiting by April 6 |

| Global Footprint | 60+ countries | US + Singapore only |

| Stock Price | $15.50 | $6.70 (Feb 5 close) |

| Management Tone | "Expanding our reach" | "Double down on America" |

What the Winklevoss Twins Said

In a blog post titled "Gemini 2.0: A Bridge to the Future of Money and Markets," Cameron and Tyler Winklevoss framed the cuts as a strategic refocusing powered by AI and a bet on prediction markets:

"In 2022, our workforce peaked around approximately 1,100. Heading into the end of 2025, we were about 50% of that size. Today, we are reducing our size again by roughly 25%."

The twins attributed part of the cuts to AI-driven productivity gains:

"AI has completely changed the game, expanding this paradigm by another order of magnitude (at a minimum), making a 10xer now a 100xer. Critically, we are seeing that this step change holds true for every engineer who adopts AI into their workflows."

On the international retreat:

"These foreign markets have proven hard to win in for various reasons and we find ourselves stretched thin with a level of organizational and operational complexity that drives our cost structure up and slows us down. And we don't have the demand in these regions to justify them."

The Restructuring Details

According to the 8-K filing, Gemini approved the restructuring plan on February 4, 2026:

| Item | Details |

|---|---|

| Workforce Reduction | Up to 200 employees (25% of global headcount) |

| Affected Regions | Europe, United States, and Singapore |

| Markets Exiting | UK, European Union, other European jurisdictions, Australia |

| Remaining Operations | United States and Singapore only |

| Restructuring Charges | $11 million pre-tax (substantially cash) |

| Timeline | Substantially completed by H1 2026 |

Customer accounts in affected regions will enter withdrawal-only mode on March 5, 2026, with full closures on April 6, 2026. Gemini has partnered with brokerage platform eToro to help customers transfer their assets.

Stock Price: From IPO Hero to Crypto Winter Casualty

Gemini's stock tells the story of the broader crypto collapse:

| Milestone | Date | Price | Notes |

|---|---|---|---|

| IPO Pricing | Sept 12, 2025 | $28.00 | Priced at top of range |

| All-Time High | Sept 12, 2025 | $45.89 | Hit on first trading day |

| Year-End 2025 | Dec 31, 2025 | $11.50 | Down 59% from IPO |

| YTD 2026 Start | Jan 2, 2026 | $10.36 | Bitcoin still above $85K |

| All-Time Low | Feb 5, 2026 | $6.66 | Restructuring announced |

| Current Price | Feb 6, 2026 | $7.57 | +11.2% recovery |

Key Statistics:

- Decline from IPO price: -73%

- Decline from all-time high: -83.5%

- YTD 2026 performance: -26.9%

The Pivot to Prediction Markets

Despite the retrenchment, the Winklevoss twins expressed bullish conviction about prediction markets—a space that exploded in visibility during the 2024 U.S. presidential election:

"Our thesis is that prediction markets will be as big or bigger than today's capital markets. They offer a profound and boundless opportunity to leverage the wisdom of the crowds and power of markets to provide unique insights into the future."

Gemini launched its prediction markets platform, Gemini Predictions, in mid-December 2025. Early traction appears promising:

- 10,000+ users registered

- $24 million+ traded since launch

- Described as "the machine within our app to see the future. A truth machine."

The company is also pursuing a CFTC application to build a Designated Contract Market (DCM) in the United States.

The Broader Crypto Carnage

Gemini's retreat comes amid an industry-wide reckoning:

Bitcoin's Collapse:

- Peak: ~$126,000 (October 2025)

- Current: ~$65,000

- Decline: ~50%

Strategy (formerly MicroStrategy):

- Q4 2025 net loss: $12.4 billion

- Holds 713,502 Bitcoin at average cost of $76,052

- Holdings currently underwater by ~$8 billion

- Shares fell double digits Thursday alongside Bitcoin's crash

- Also expanding beyond crypto with stock trading services

Truist analyst Matthew Coad noted in a research note: "Management now must shift its strategy from investing to regain lost market share to staying afloat during a crypto downturn."

What Happened to the Global Expansion?

The speed of Gemini's reversal is remarkable. At its Q3 2025 earnings call—its first as a public company—management struck an expansive tone:

On Europe:

"We received our MiCA license from the Malta Financial Services Authority, enabling us to offer certain secure, reliable crypto services across all 30 European countries and jurisdictions."

On Australia:

"Following the close of Q3, we launched in Australia after obtaining AUSTRAC registration in August and completed key payments integrations to streamline onboarding in the region."

On the opportunity:

"We are proud of what we've accomplished in our first quarter as a public company and even more excited about what lies ahead."

Three months later, both regions are being abandoned.

What to Watch

Near-Term Catalysts:

- March 5, 2026: Customer accounts in UK/EU/Australia enter withdrawal-only mode

- April 6, 2026: Full account closures in affected regions

- H1 2026: Restructuring substantially complete

- Q4 2025 Earnings: Will provide first look at post-restructuring financials

Key Questions:

- Can Gemini's US business sustain profitability without international revenue?

- Will the prediction markets bet pay off, or is it a distraction?

- How will customers in affected regions respond—will they stay with eToro or move to competitors?

- Has the crypto winter found a bottom, or is more pain ahead?

The Bottom Line

The Winklevoss twins—who rose to prominence suing Mark Zuckerberg over Facebook and later became Bitcoin billionaires—are betting that a smaller, leaner, AI-powered organization focused solely on the US market can weather the crypto storm. Their $28-to-$7 stock collapse suggests the market remains skeptical.

The irony is thick: Just three months ago, Gemini was celebrating MiCA licenses and Australian launches. Now, it's retreating to its home market and hoping prediction markets—not crypto trading—become the next big thing.

For investors, the message is clear: In crypto winter, even the twins who once claimed to own 1% of all Bitcoin aren't immune to the deep freeze.