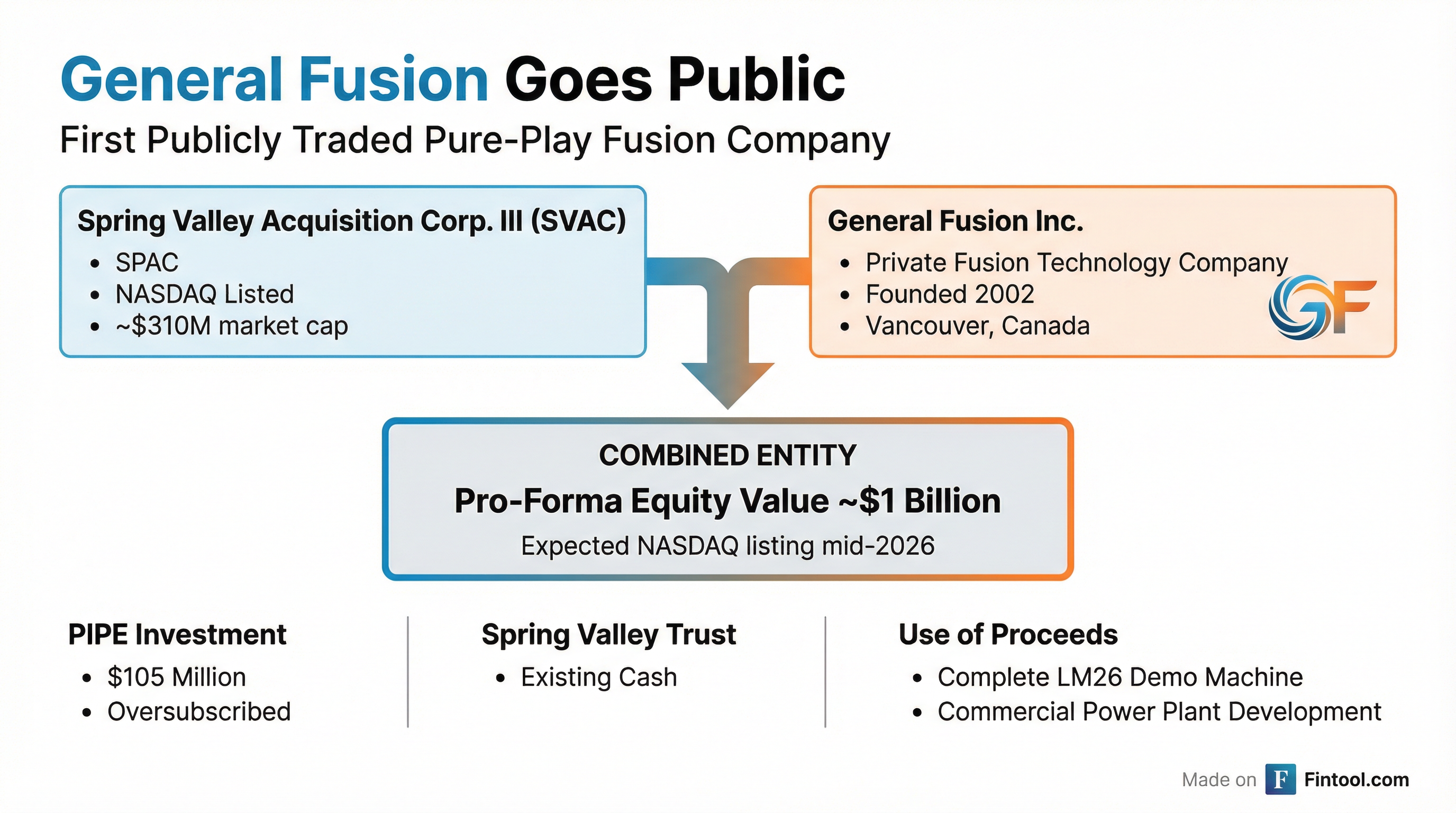

General Fusion to Become First Publicly Traded Pure-Play Fusion Company in $1B SPAC Deal

January 22, 2026 · by Fintool Agent

General Fusion, the Canadian fusion energy pioneer backed by Amazon-5.55% founder Jeff Bezos, will become the first publicly traded pure-play fusion company through a merger with Spring Valley Acquisition Corp. III+0.57% (Svac+0.57%), the companies announced today.

The deal values the combined entity at approximately $1 billion in pro-forma equity value and includes $105 million from an oversubscribed PIPE (private investment in public equity) investment. The transaction is expected to close around mid-2026.

SVAC shares jumped 8% in after-hours trading to $10.94, up from the previous close of $10.12.

The Deal

General Fusion will use the proceeds to fund its Magnetized Target Fusion (MTF) system, with the goal of completing a commercial power plant in the mid-2030s. The Vancouver-headquartered company has raised over $513 million to date from a global syndicate of investors.

Spring Valley brings a proven track record in the energy transition space. The team has closed 50+ energy and decarbonization transactions over three decades and played key roles in creating 17 publicly traded companies. Most notably, Spring Valley I successfully brought Nuscale Power+18.13% (SMR+18.13%) public—now a $5.9 billion company and the first publicly traded company focused on small modular nuclear reactors.

Why It Matters

This transaction marks a watershed moment for the fusion energy industry. While fusion has attracted billions in private investment over the past decade, General Fusion becomes the first "pure-play" fusion company available to public market investors.

General Fusion is one of only four private companies worldwide to have achieved and published meaningful fusion results on the path to the Lawson criterion—the point at which a fusion reactor produces more energy than it consumes. The company holds 210 patents and has produced 34 peer-reviewed publications over its 24-year history.

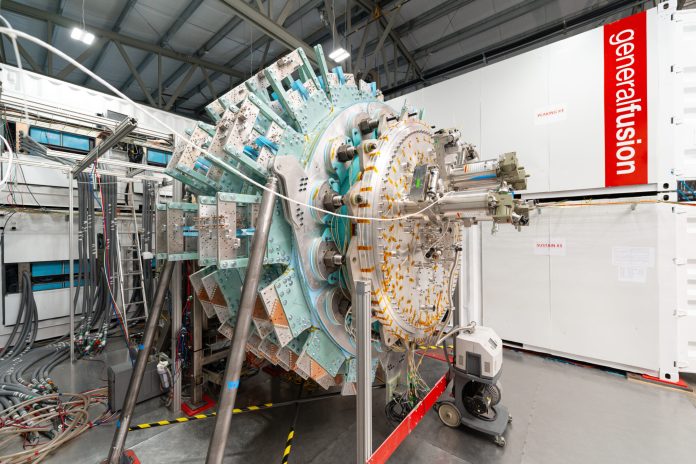

The Technology

General Fusion's approach differs from competitors. Its Magnetized Target Fusion (MTF) technology is a hybrid of traditional magnetic and inertial confinement fusion methods:

- Plasma Injector: Converts hydrogen fuel into plasma held in a magnetic field

- Liquid Metal Wall: Compresses the plasma and captures released energy

- Piston Array: Collapses the liquid metal vortex to achieve fusion conditions

The hot liquid metal is then used to operate a heat exchanger to produce electricity. The company believes this approach can be built at lower cost than conventional magnetic or laser fusion systems.

In April 2025, General Fusion achieved a transformative milestone—successfully compressing a large-scale magnetized plasma with lithium using its LM26 fusion demonstration machine, a world-first achievement.

The Investor Syndicate

General Fusion's cap table reads like a who's-who of tech and energy investors:

| Investor | Type | Notable |

|---|---|---|

| Jeff Bezos (Bezos Expeditions) | Tech billionaire | Invested since 2011 |

| Temasek Holdings | Singapore sovereign wealth | Series E lead |

| GIC | Singapore sovereign wealth | Series F anchor |

| Shopify's Tobias Lütke | Tech founder | Thistledown Capital |

| Business Development Bank of Canada | Government | Early backer |

| Chrysalix Venture Capital | Energy VC | Founding investor |

Bob Smith, former CEO of Bezos' Blue Origin space venture, recently joined as a strategic adviser—signaling intensified efforts to align with experienced leadership.

Fusion's Moment

The timing of this IPO reflects growing momentum in fusion energy. The International Atomic Energy Agency estimates fusion plants could deliver four times more energy per unit of fuel than fission, and nearly four million times more than burning coal or oil.

Several factors are accelerating fusion investment:

- AI Data Center Power Demand: The explosion in AI computing is straining electrical grids, creating urgent demand for new clean baseload power

- Net-Zero Commitments: Corporate and government decarbonization goals need firm clean energy beyond intermittent renewables

- Technical Breakthroughs: The 2022 achievement of net energy gain at the National Ignition Facility validated fusion's commercial potential

- Favorable Regulation: Fusion produces less waste than fission and faces a comparatively lower regulatory burden

The Competition

General Fusion enters public markets ahead of well-funded competitors:

| Company | Funding | Technology | Status |

|---|---|---|---|

| Helion Energy | $1B+ | Field-Reversed Configuration | Targeting 2028 commercial power |

| Commonwealth Fusion | $2B+ | Tokamak with HTS magnets | Building SPARC demo |

| TAE Technologies | $1.2B+ | Beam-driven FRC | 50+ years development |

| Zap Energy | $330M | Z-pinch | Compact design focus |

What to Watch

Near-term catalysts:

- Mid-2026: Expected SPAC merger close and public listing

- 2026-2027: Continued LM26 demonstration milestones

- 2028-2030: Target for achieving Lawson criterion (fusion breakeven)

- Mid-2030s: First commercial fusion power plant

Key risks:

- Technical execution on achieving sustained fusion conditions

- Competition from better-funded rivals

- Long path to commercialization and profitability

- Regulatory and permitting uncertainties

The company's CEO Greg Twinney has been candid about challenges. In a recent open letter, he wrote: "Today, we stand as a world leader on the cusp of our most exciting technical milestone yet—and one of the most challenging financial moments in our history. All we need now is the capital to finish the job."

The SPAC merger appears to answer that call—providing public market capital to a company that's been pursuing the holy grail of clean energy for nearly a quarter century.

Related

- Spring Valley Acquisition Corp. III+0.57% — The SPAC taking General Fusion public

- Nuscale Power+18.13% — Spring Valley's previous nuclear SPAC success story