Gold Blasts Through $5,200 as Trump Shrugs Off Dollar's Four-Year Low

January 27, 2026 · by Fintool Agent

Gold vaulted past $5,200 an ounce on Wednesday to a fresh record high, extending a historic rally as the U.S. dollar cratered to its weakest level since February 2022—a decline President Trump called "great" when asked if the greenback had fallen too much .

The president's indifference triggered a flight from dollar-denominated assets and sent investors scrambling for gold, which has now gained 17% in January alone after surging 64% in 2025 . The Dollar Index suffered its worst one-day drop since April 2025's tariff chaos, plunging 1.3% after Trump's comments .

"FX market participants are always looking for a trend to jump on," said Steven Englander at Standard Chartered. "Often officials push back against abrupt currency moves, but when the president expresses indifference or even endorses the move, it emboldens USD sellers to keep pushing" .

The Numbers

| Metric | Current | YTD Gain | From Dec 23 | Context |

|---|---|---|---|---|

| Spot Gold | $5,179/oz | +17% | +15.5% | Record high |

| Gold Futures (Apr) | $5,215/oz | +18% | +16% | Fresh record |

| Spot Silver | $107.9/oz | +20% | +54% | $70 in December |

| Dollar Index | 95.57 | -10% | -5% | 4-year low |

The speed of the advance has stunned even veteran gold bulls. Just five weeks ago, gold was trading at $4,497—the "sky high" level celebrated in headlines then now looks like a launch pad .

Why Gold Is Surging

1. Dollar Destruction

The dollar's weakness is multi-factorial: expectations of continued Fed rate cuts, tariff uncertainty, threats to Fed independence, and rising fiscal deficits have eroded investor confidence in U.S. economic stability .

Trump's comments Tuesday accelerated the decline. When asked if the dollar had fallen too much, he told reporters in Iowa: "No, I think it's great. Look at the business we're doing. The dollar's doing great" .

The statement directly contradicts Treasury Secretary Scott Bessent, who has historically advocated for a stronger dollar. Some Trump advisers—including Fed Governor Stephen Miran—argue the dollar's strength has placed domestic businesses at a competitive disadvantage, but a weaker currency risks stoking inflation just as the administration touts economic victories .

2. Central Bank Buying Continues

Central banks remain aggressive accumulators. Goldman Sachs estimates purchases are averaging 60 tonnes monthly—far above the pre-2022 average of 17 tonnes—as emerging-market central banks continue shifting reserves into gold .

"The central banks are not dumb money," said Thomas Kaplan, Chairman of NOVAGOLD, on a recent earnings call. "They actually know better the lack of credibility of so much of the assets they own on their balance sheet. By buying gold as an act of choice, an act of volition, they are doing as much as anyone to show you that you should own it" .

3. Geopolitical Anxiety

From Greenland to Venezuela to the Middle East, flashpoints continue multiplying. The freezing of Russian assets after the 2022 Ukraine invasion "was a game changer for a lot of central banks," Kaplan noted. "When you own gold, it doesn't represent someone else's liability to repay you" .

4. ETF Inflows Accelerate

Western ETF holdings have climbed by about 500 tonnes since the start of 2025, while newer instruments—including physical purchases by high-net-worth families—have become an increasingly important demand source .

The World Gold Council reported physically-backed gold ETFs attracted $82 billion—equivalent to 749 tons—in 2025, the biggest inflow since 2020 .

Silver Goes Wild, CME Raises Margins

Silver has been even more volatile. The metal surged to $107.9 per ounce Monday—up 54% from December's $70 level—forcing CME Group to raise margins for the second time this month .

Starting Wednesday, silver futures margins will rise to 11% of notional from 9%, with heightened risk profile margins increasing to 12.1% from 9.9% . Platinum and palladium margins will also increase.

The margin hike follows CME's January 13 shift from fixed-dollar to percentage-based margin requirements—a structural change designed to automatically scale with price moves rather than require manual adjustments during volatile periods .

Despite the margin increases, trading volumes have exploded. CME's metals complex hit a single-day record of 3.34 million contracts on January 26, exceeding the previous record of 2.83 million set in October 2025—an 18% increase .

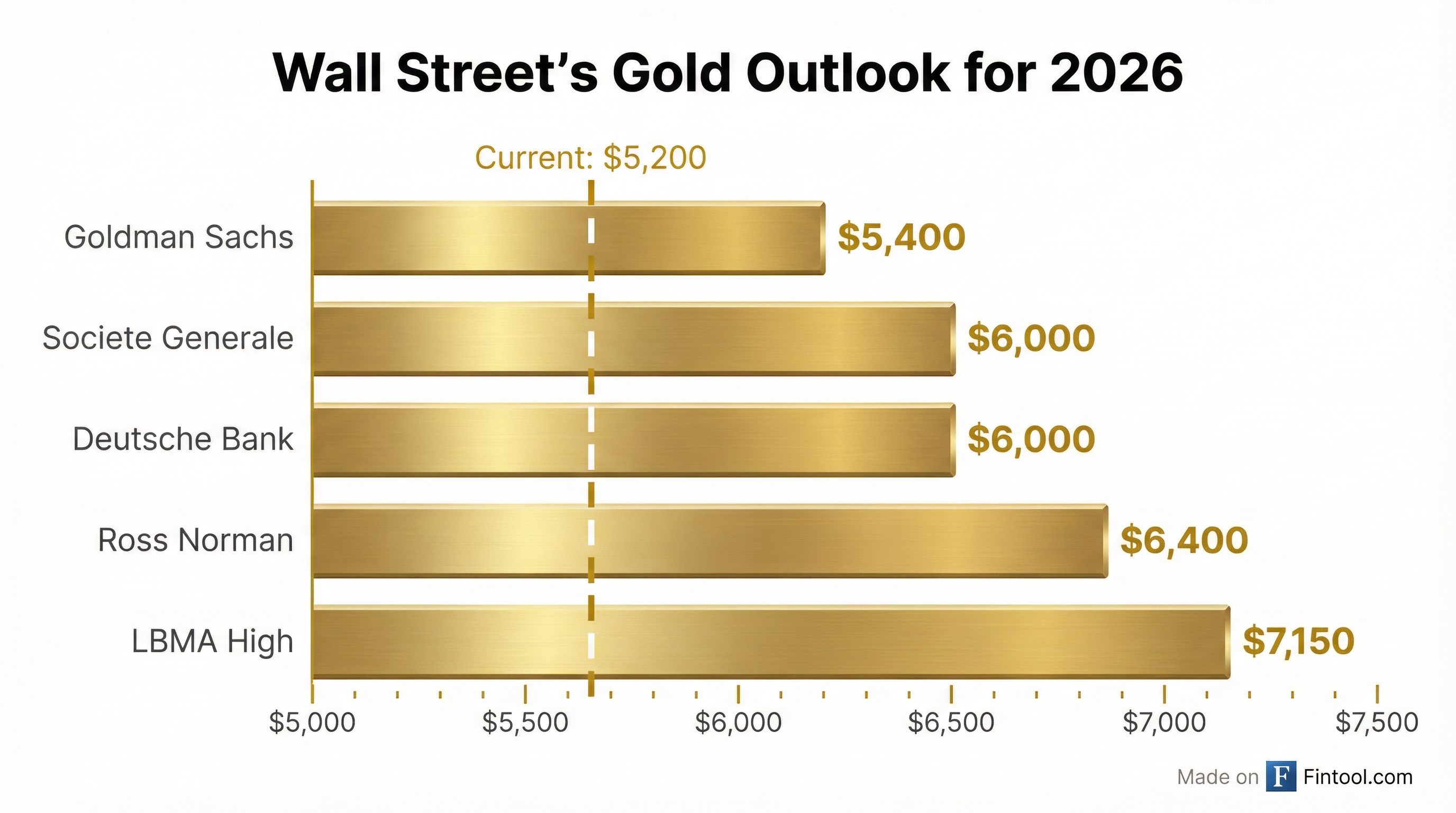

Where Wall Street Sees Gold Going

Analysts are ratcheting up targets as the rally accelerates:

| Firm | Target | Timeframe | Comment |

|---|---|---|---|

| Goldman Sachs | $5,400 | Dec 2026 | Raised from $4,900 |

| Societe Generale | $6,000 | Year-end | New forecast |

| Deutsche Bank | $6,000 | Year-end | New forecast |

| Ross Norman | $6,400 high | 2026 | Average $5,375 |

| LBMA Survey | $7,150 high | 2026 | Average $4,742 |

Goldman sees demand having "broadened beyond traditional channels," with hedges against macro and policy risks becoming "sticky" and effectively lifting the starting point for gold prices .

The most bullish voices see a fundamental revaluation underway. "I do believe this is the early stage of a complete revaluation," Kaplan told investors, comparing gold's breakout to the Dow Jones' escape from its 30-year trading range in the 1980s .

"The only certainty at the moment seems to be uncertainty, and that's playing very much into gold's hands," said analyst Ross Norman .

Mining Stocks Ride the Wave

Gold and silver miners have leveraged the rally to multi-year highs:

| Company | Ticker | Market Cap | Exposure |

|---|---|---|---|

| Newmont | NEM | $135B | World's largest gold miner |

| Agnico Eagle | AEM | $108B | Premium North American assets |

| Freeport-mcmoran | FCX | $87B | Gold/copper leverage |

| Barrick Mining | B | $86B | Major gold/copper producer |

| First Majestic Silver | AG | $12B | Primary silver producer |

Cohen & Steers noted on a recent call that "natural resource equities were a positive standout in the quarter, up more than 6%, driven by strength in metals and mining stocks" . For full-year 2025, natural resource equities led all real asset categories with nearly 30% gains, followed by commodities at 16% .

"Gold had a banner year, climbing 64% last year," the firm noted. "From mid-2020 to mid-2023, gold generally traded around $1,800 per ounce. 2.5 years later, gold is up 250% to $4,800 an ounce. Few people today argue that gold is obsolete versus Bitcoin" .

What to Watch

Near-term catalysts:

- Fed rate decision Wednesday—markets expect a hold but will parse Powell's comments for rate path signals

- Dollar intervention chatter—traders are bracing for possible coordinated U.S.-Japan action to prop up the yen

- CME margin changes—higher collateral requirements could trigger short-term volatility

Structural questions:

- Whether central bank buying maintains its 60+ tonne monthly pace

- How long Trump's tariff uncertainty persists

- Whether Fed independence concerns escalate

- Dollar trajectory as global investors reassess U.S. assets

For investors who missed the initial run from $3,000 to $5,000, the question is whether this rally has legs—or whether gold at $5,200 is the new $1,800 was in 2022: a plateau before the next leg higher.

The bulls would argue the factors driving gold—de-dollarization, geopolitical anxiety, fiscal deterioration, and central bank accumulation—are structural, not cyclical. As Kaplan put it: "We are in a completely different place."

Related: