Global Ship Lease CEO: Mid-Size Container Ships Profit from 'Age of Uncertainty'

January 27, 2026 · by Fintool Agent

Global Ship Lease CEO Thomas Lister delivered a bullish outlook for mid-sized container ship owners at today's Capital Link Virtual Company Presentation, arguing that geopolitical volatility, supply chain fragmentation, and a structural order book imbalance have created "precisely the type" of market conditions that favor the company's fleet.

The stock responded, gaining 2.6% to $37.47 during the session—within striking distance of its 52-week high of $37.79—extending a remarkable 65% rally over the past 12 months.

The Investment Case in Three Numbers

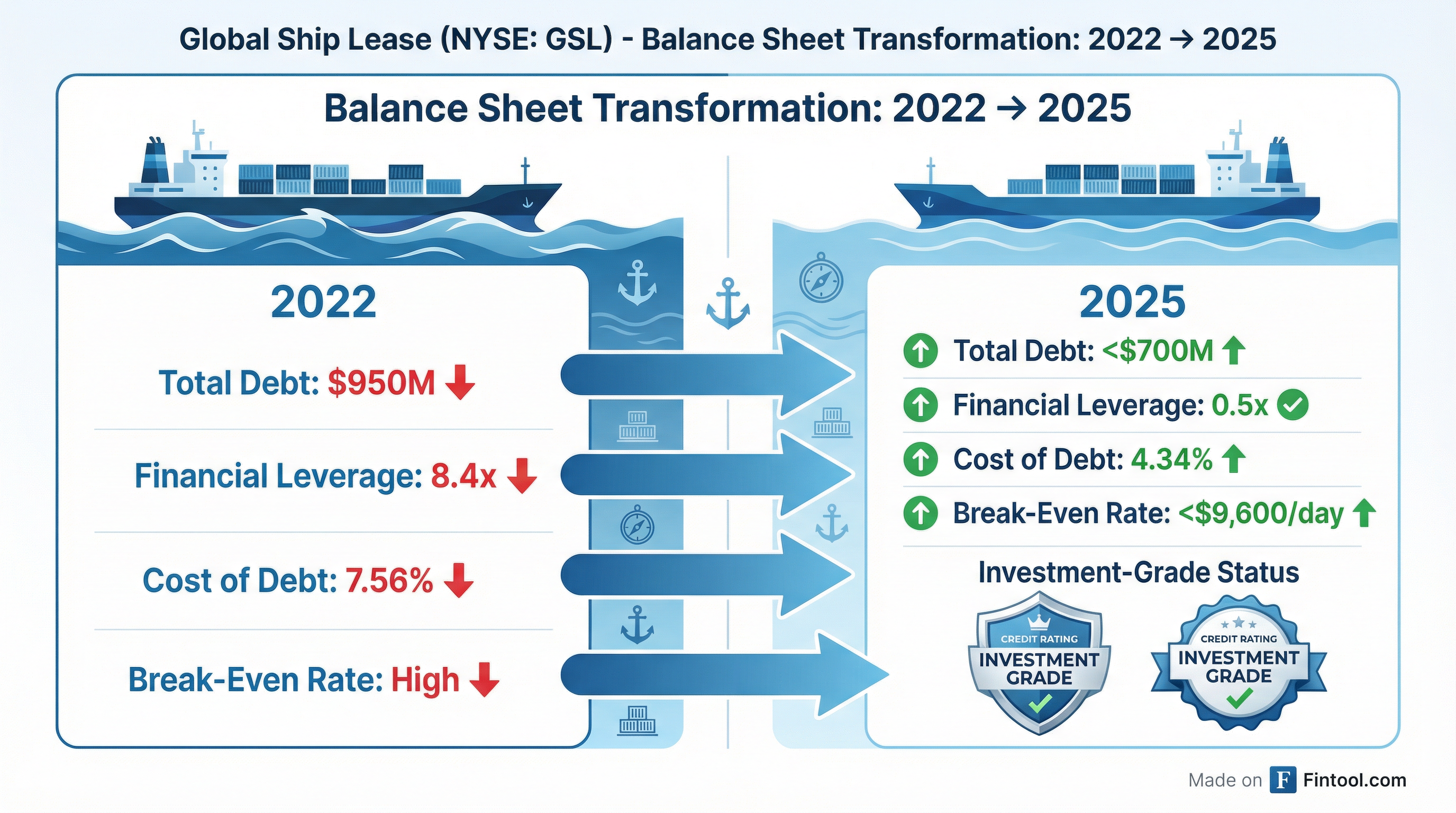

GSL's transformation is stark: financial leverage has collapsed from 8.4x to 0.5x, debt has fallen from $950 million to below $700 million, and the cost of borrowing has declined from 7.56% to 4.34%.

"We say what we do, and we do what we say," Lister told investors. "We're reassuringly boring in that respect."

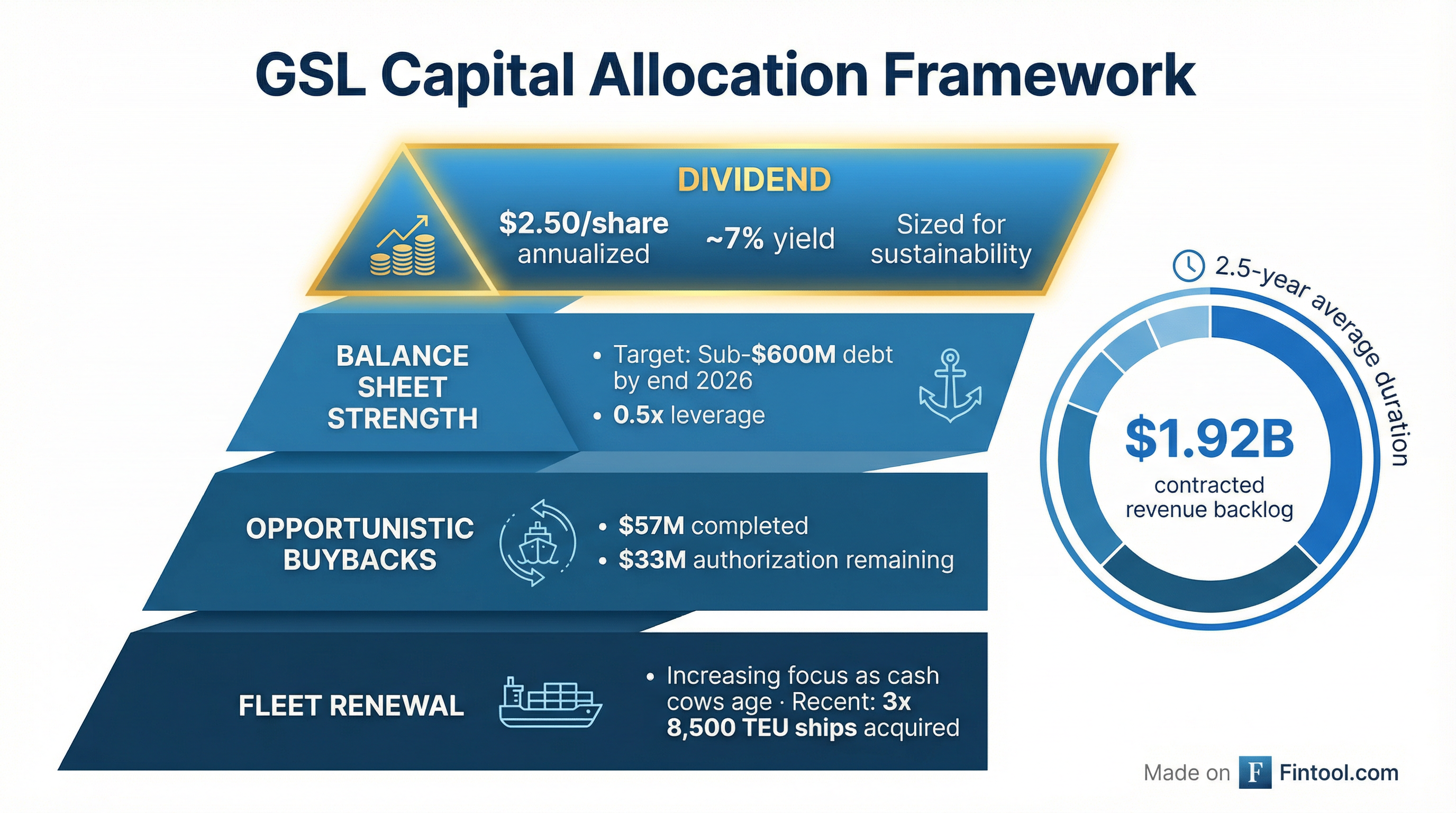

The payoff is visible in forward visibility: $1.92 billion in contracted revenues spread across a 2.5-year average duration, with 96% of 2026 positions already covered and 74% locked for 2027.

The Structural Thesis: Order Book Disparity

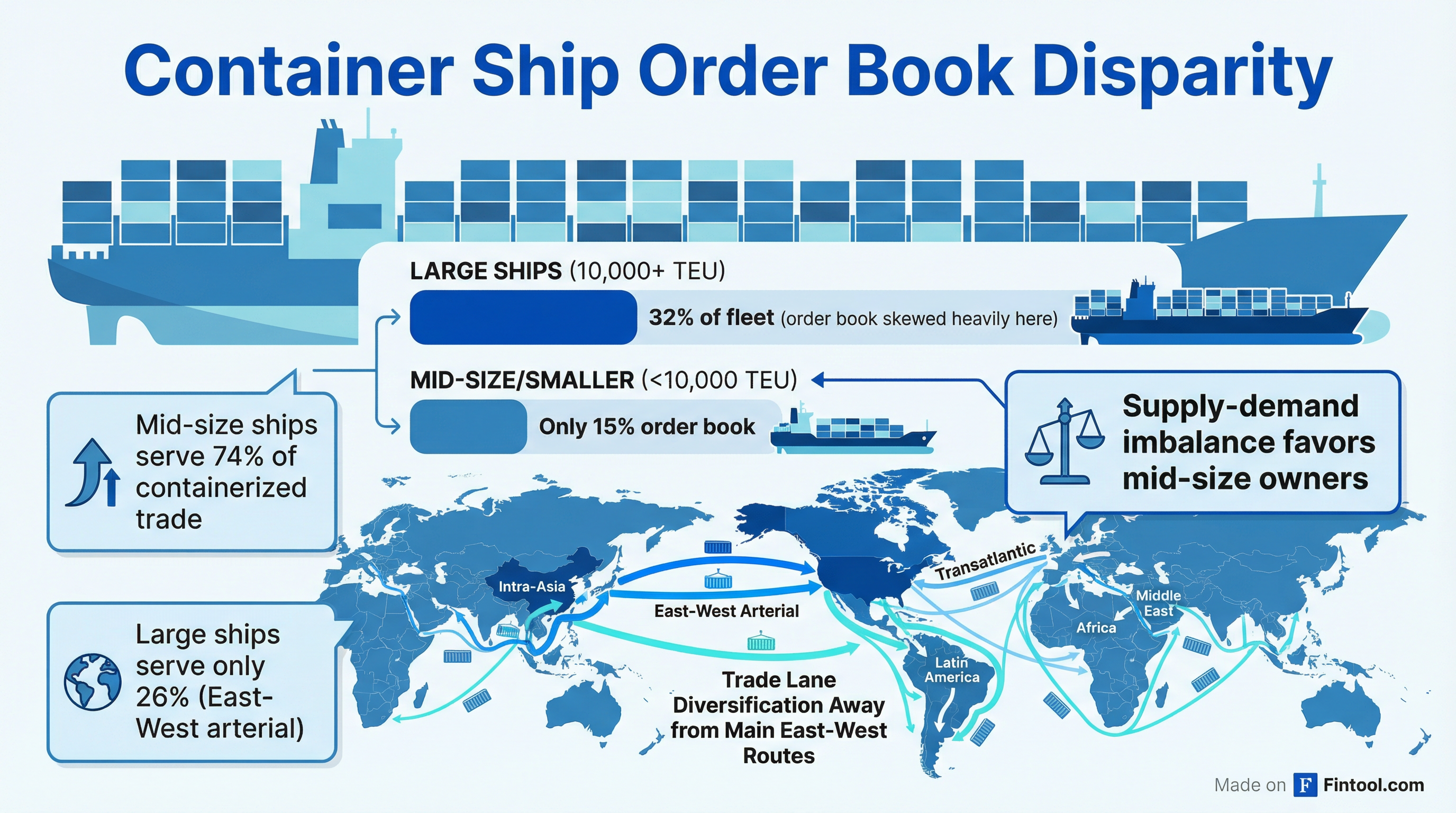

Lister's core argument rests on a fundamental supply/demand imbalance that shipyards cannot easily correct.

The global container ship order book stands at roughly 32% of the fleet on the water—but this figure is misleading. For vessels below 10,000 TEU, where GSL operates, the order book-to-fleet ratio is just 15%, with deliveries spread over several years.

Meanwhile, the ships being ordered are the wrong size. "Under a stable trading environment, it made tremendous sense for the lines to invest in really big ships, to drive for economies of scale in the big East-West arterial trades," Lister explained. "However, those big, stable trade lanes are no longer that stable. They're beginning to fragment."

The numbers support this thesis. Main-lane East-West trades—China to U.S., China to Northern Europe—represent only about 26% of global containerized volumes, yet the order book is heavily concentrated in jumbo ships designed for these routes. The remaining 74% of volumes flow on mid-sized and smaller ships through fragmented regional networks.

If all vessels 25 years and older were scrapped through 2029 while the current order book delivers, the fleet under 10,000 TEU would actually contract by more than 5%.

Red Sea: The Gift That Keeps Giving

The Houthi attacks that have effectively closed the Red Sea to commercial traffic since late 2023 continue to absorb roughly 10% of global container ship capacity as vessels reroute around the Cape of Good Hope.

Industry data suggests the situation may persist well into 2026. While Maersk has announced test transits through the Suez Canal and some services are returning, a large-scale resumption remains uncertain. Monthly capacity through Suez on Asia-Europe services collapsed from 4.1 million TEU in 2023 to just 292,000 TEU in 2025.

"Liner operators are looking for a period of sustained safety before changing their networks, which is costly, and returning there in earnest," Lister said. "As far as we are concerned, the safety of our seafarers is and will always remain paramount."

The extended diversions have been unambiguously positive for GSL's charter rates. Container time charter indices surged 46% in early 2024 alone as lines scrambled for capacity.

Financial Performance: Stable and Climbing

GSL's recent quarters reflect the favorable operating environment:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $177.4* | $178.1* | $173.5* | $172.5* | $181.4* | $187.8* | $188.5* | $189.3* |

| Net Income ($M) | $67.0* | $91.9* | $88.0* | $81.1* | $92.6* | $123.4* | $95.4* | $95.0* |

| EBITDA ($M) | $101.3* | $119.9* | $116.9* | $115.6* | $96.9* | $126.6* | $128.9* | $126.6* |

| EBITDA Margin | 57.1%* | 67.3%* | 67.4%* | 67.0%* | 53.4%* | 67.4%* | 68.4%* | 66.9%* |

*Values retrieved from S&P Global

Revenue grew sequentially to $189.3 million in Q3 2025, with EBITDA margins consistently above 65%. GSL beat Q3 2025 estimates, posting EPS of $2.62 versus consensus expectations of $2.37.

The company's break-even rate—under $9,600 per vessel per day—sits well below current market charter rates, providing substantial margin of safety.

Capital Allocation: Dividends First, Fleet Renewal Rising

Lister outlined a four-pillar capital allocation framework, with the $2.50 annualized dividend (approximately 7% yield) as the foundation.

"The dividend is very important to our story, and returning capital that way is important to our story," he said. "We've sized that very carefully with a view to it being something that will remain in place."

Share buybacks ($57 million completed, $33 million authorization remaining) are treated as opportunistic, deployed when market dislocations create value disconnects.

The notable shift: fleet renewal is becoming an "increasing focus" as the company's cash cows begin to age.

"We only buy ships when we like the returns those acquisitions are going to make in relation to risk," Lister said. The company recently acquired three 8,500 TEU ships at the end of 2025. "Whether it's second-hand tonnage or new buildings, we're not dogmatic. It's wherever we can make money and make the best risk-adjusted returns."

GSL confirmed no intention to redeem its $109 million in 8.75% perpetual preferred shares, viewing the covenant-light, quasi-equity instrument as valuable despite its cost.

Supply Chain Fragmentation: The Structural Tailwind

Beyond the Red Sea, Lister pointed to deeper structural forces reshaping global trade patterns—all of which favor mid-sized vessel operators.

China is diversifying exports away from the U.S. and Europe toward Latin America, Africa, and the Middle East. Simultaneously, Western companies are nearshoring and "friendshoring" supply chains away from China to Vietnam, Indonesia, and Thailand.

"The whole thing is becoming much more fragmented, much more inefficient," Lister observed. "But because the order book stretches out to 2029, it's not easy for the industry to retool for this new fragmented environment."

The intra-Asia trade—often overlooked in Western coverage—represents roughly 35-40% of global containerized volume and is "growing somewhat rapidly" as supply chains diversify across the region.

Meanwhile, the charter market itself has contracted. Liner companies have been buying ships outright rather than leasing, reducing market liquidity. Counterintuitively, Lister views this positively: "If it's more lucrative for the lines to buy rather than chartering, it's more lucrative for us to hold on to the ships and precisely to milk them for cash flows."

Counterparty Quality: Strongest in History

Asked about credit risk, Lister noted that GSL's counterparties—the major liner companies—have generated "staggering sums of money" in recent years.

"The credit status of our counterparties is probably in the strongest place it's been historically for the industry," he said.

The customer base reads like a who's who of global container shipping, with charters spread across top-tier operators who have used recent windfalls to fortify their own balance sheets.

What Could Go Wrong?

While the outlook remains constructive, several risks bear monitoring:

Red Sea Normalization: A durable peace and large-scale return to Suez would release roughly 10% of global capacity, pressuring charter rates. Industry analysts suggest any transition could take months and initially cause port congestion in Europe.

Fleet Age: GSL's ships are cash cows now, but they're aging assets. The company acknowledges the need for renewal—but the timing and cost of acquisitions will matter.

Cycle Risk: Container shipping is cyclical. Charter rates well above break-even cannot persist forever, and the industry has a history of violent corrections.

Green Shipping Uncertainty: The regulatory environment for decarbonization remains unclear after the IMO's Net Zero Framework was pushed back in October 2025. "The industry is now in a little bit of a regulatory limbo," Lister admitted.

The Bottom Line

Global Ship Lease has executed a textbook balance sheet transformation while positioning its fleet in precisely the market segments benefiting from structural tailwinds. The 7% dividend yield, 0.5x leverage, and $1.9 billion backlog provide downside protection, while continued geopolitical uncertainty and supply chain fragmentation offer upside potential.

The stock's 65% rally over the past year suggests the market has noticed—but with shares still trading around the analyst consensus target of $37, the question becomes whether the structural thesis justifies further appreciation.

"We're poised to maximize value throughout the cycle," Lister concluded, "optimizing the durations of attractive charters amid charter market strength, while also being highly opportunistic and dynamic when countercyclical investment opportunities arise."

Related