Hub Group Crashes 24% After Disclosing $77 Million Accounting Error

February 6, 2026 · by Fintool Agent

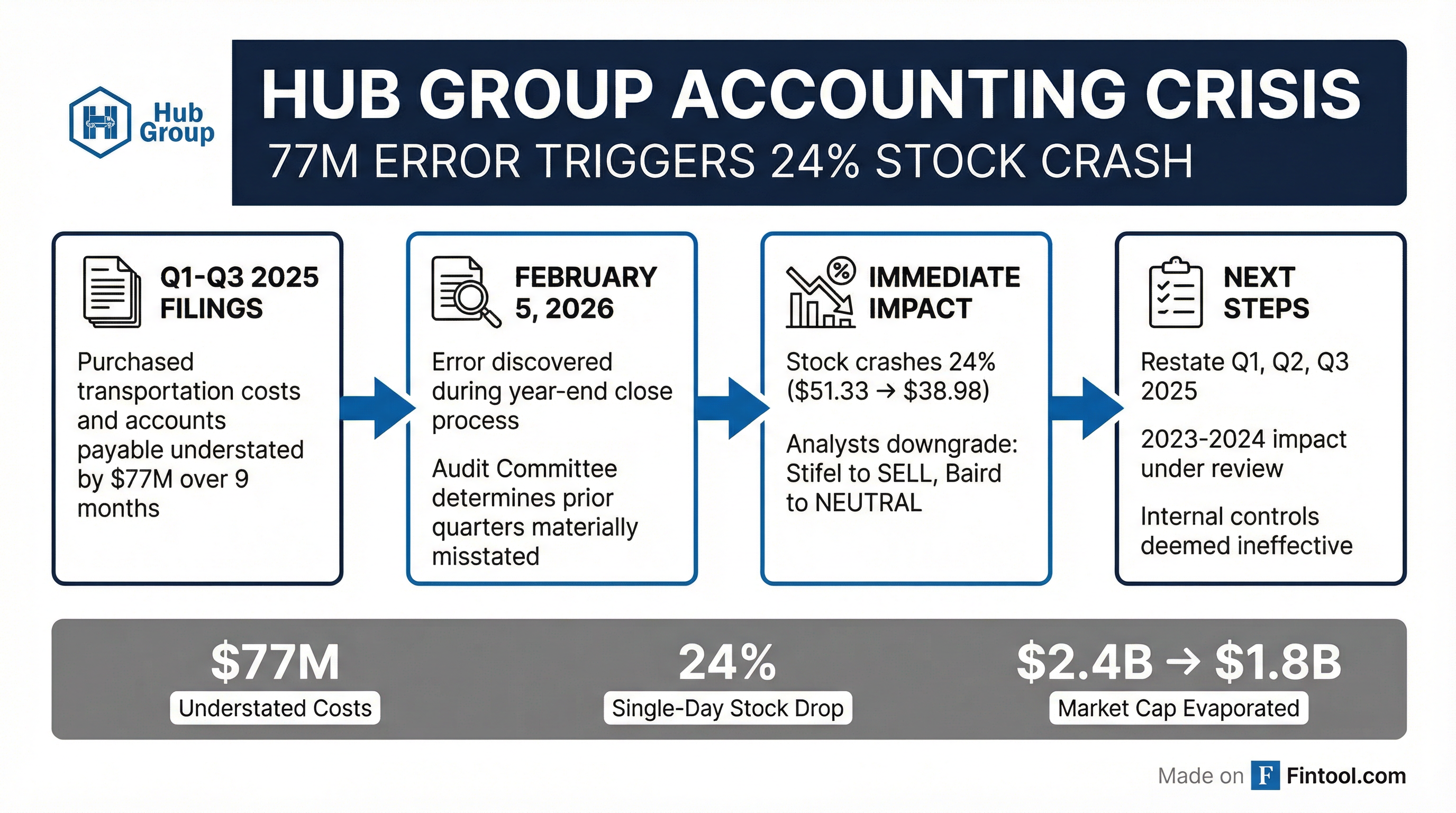

Hub Group shares plummeted 24% Thursday after the logistics provider disclosed a $77 million accounting error that will force the company to restate its 2025 quarterly financial statements—triggering analyst downgrades, a securities investigation, and erasing more than $600 million in market value in a single session.

The Oak Brook, Illinois-based intermodal and logistics company said it discovered the error during its year-end closing process. The mistake understated purchased transportation costs and accounts payable throughout the first nine months of 2025.

What Happened

During preparation of its 2025 annual report, Hub Group identified what CFO Kevin Beth described as "a calculation error that resulted in an understatement of purchased transportation costs and accounts payable."

The total amount of understated costs recorded during Q1-Q3 2025 was $77 million—a significant figure for a company with roughly $3.7 billion in annual revenue.

The company's Audit Committee, following discussions with management and auditor Ernst & Young LLP, concluded that previously filed quarterly reports were "materially misstated" and "should no longer be relied upon."

More concerning: Hub Group said it is still assessing whether the error affected 2024 and 2023 financial statements, suggesting the problem may extend further than initially disclosed.

Stock Reaction and Analyst Downgrades

The market's response was swift and brutal. Hub Group shares opened at $37.72—gapping down 26% from the prior close of $51.33—before recovering slightly to close at $38.98, still down 24% on the day. Volume exceeded 1.4 million shares, roughly 4x the average.

Stifel cut its rating from Buy to Sell and slashed its price target from $52 to $27—a 48% reduction. Analyst John Sichak cited the accounting errors and uncertainty around the restatement scope.

Baird downgraded from Outperform to Neutral, expressing concern about governance and the potential for additional surprises.

| Analyst Action | Prior Rating | New Rating | Prior PT | New PT |

|---|---|---|---|---|

| Stifel | Buy | Sell | $52.00 | $27.00 |

| Baird | Outperform | Neutral | N/A | N/A |

Internal Control Failures

Perhaps most damaging to investor confidence: Hub Group acknowledged it expects to conclude that it "did not maintain effective disclosure controls and procedures and internal control over financial reporting" for fiscal 2025.

This is a significant admission. Ineffective internal controls can lead to:

- Continued SEC scrutiny and potential enforcement action

- Higher audit fees and extended timelines

- Damaged credibility with institutional investors

- Potential executive accountability questions

A securities law firm, Highful Law PLLC, announced it has opened an investigation into whether Hub Group and its officers violated federal securities laws "by knowingly or recklessly issuing financial statements that contained materially false or misleading information."

Preliminary Results: The Business Isn't Broken

Setting aside the accounting debacle, Hub Group's preliminary operating results suggest the underlying business remains intact. For full year 2025, the company expects:

| Metric | 2025 Preliminary | 2024 Actual | Change |

|---|---|---|---|

| Revenue | $3.7B | $3.9B | -5% |

| Operating Cash Flow | $194M | N/A | — |

| Net Debt | $116M | $166M | -$50M |

| Cash & Restricted Cash | $140M | N/A | — |

For 2026, management provided preliminary guidance of $3.65-$3.95 billion in revenue and $35-45 million in capital expenditures.

CEO Phil Yeager emphasized that the error has "no expected impact on total cash and cash equivalents or operating cash flow for any periods."

That's technically true—but the restatement will likely reduce previously reported net income and operating income once the correct transportation costs are allocated to the proper periods.

What Investors Should Watch

1. Scope Expansion Risk Hub Group is still reviewing whether 2023 and 2024 financials are affected. Any expansion of the restatement scope would further damage confidence and could trigger additional selling pressure.

2. 10-K Filing Delay The company delayed its full earnings release and will include restated quarterly data in its annual 10-K filing. Extended delays could raise additional red flags.

3. Management Accountability While CEO Phil Yeager emphasized that "accuracy and transparency in reporting on our performance is of the utmost importance," investors will be watching for any personnel changes in the finance function.

4. Customer Retention Hub Group operates in a competitive logistics market against J.B. Hunt, Xpo, and others. Any perception of financial instability could affect customer relationships, particularly for large enterprise contracts.

The Bigger Picture: Freight Market Context

The accounting issue arrives at a difficult time for the freight industry. CEO Yeager noted in the earnings call that the market has seen "a continuation of a challenging market cycle, with stable demand and an oversupply of capacity."

Hub Group's 2025 revenue of ~$3.7 billion represents a 7% decline from 2024, with brokerage volumes down 10% year-over-year and dedicated revenue declining due to lost customer sites.

The company did highlight bright spots: intermodal volumes grew 1% in Q4, and management expressed optimism about the 2026 bid cycle given "excellent service performance" and railroad consolidation expected in 2027.

But those operational improvements will likely be overshadowed by the accounting crisis for the foreseeable future.

The Bottom Line

Hub Group's $77 million accounting error transforms what should have been a routine Q4 earnings release into a credibility crisis. While the underlying logistics business appears stable and cash flows remain healthy, the revelation of material misstatements—combined with acknowledged internal control failures—will take time to repair.

The 24% single-day crash reflects not just the current error's magnitude, but the uncertainty about what else might emerge. Until the full 10-K is filed and the restatement scope is clarified, investors are left pricing in a significant risk premium.

For long-term investors, the key question becomes: Is this a one-time control failure that management can remediate, or a symptom of deeper issues in financial reporting? The answer will determine whether today's crash represents a buying opportunity or a warning shot.

Related Companies