Earnings summaries and quarterly performance for Hub Group.

Executive leadership at Hub Group.

Phillip Yeager

President and Chief Executive Officer

David Yeager

Executive Chairman

Dennis Mathews

Chief Accounting Officer

Eric Braun

Executive Vice President, Chief Legal Officer and Corporate Secretary

Kevin Beth

Executive Vice President, Chief Financial Officer and Treasurer

Thomas LaFrance

Executive Vice President, Chief Legal and Human Resources Officer and Corporate Secretary

Board of directors at Hub Group.

Research analysts who have asked questions during Hub Group earnings calls.

J. Bruce Chan

Stifel

4 questions for HUBG

Bascome Majors

Susquehanna Financial Group

3 questions for HUBG

David Zazula

Barclays

3 questions for HUBG

Jonathan Chappell

Evercore ISI

3 questions for HUBG

Scott Group

Wolfe Research

3 questions for HUBG

Brian Ossenbeck

JPMorgan Chase & Co.

2 questions for HUBG

Daniel Imbro

Stephens Inc.

2 questions for HUBG

Jason Seidl

TD Cowen

2 questions for HUBG

Brady Lierz

Stephens Inc.

1 question for HUBG

Christopher Kuhn

The Benchmark Company

1 question for HUBG

Christyne McGarvey

Morgan Stanley

1 question for HUBG

Dan Moore

B. Riley Securities

1 question for HUBG

Elliot Alper

TD Cowen

1 question for HUBG

Michael Triano

UBS

1 question for HUBG

Ravi Shanker

Morgan Stanley

1 question for HUBG

Thomas Wadewitz

UBS

1 question for HUBG

Tom Wadewitz

UBS Group

1 question for HUBG

Uday Khanapurkar

TD Cowen

1 question for HUBG

Recent press releases and 8-K filings for HUBG.

- Rosen Law Firm is investigating Hub Group, Inc. (NASDAQ: HUBG) for potential securities claims due to allegations of materially misleading business information.

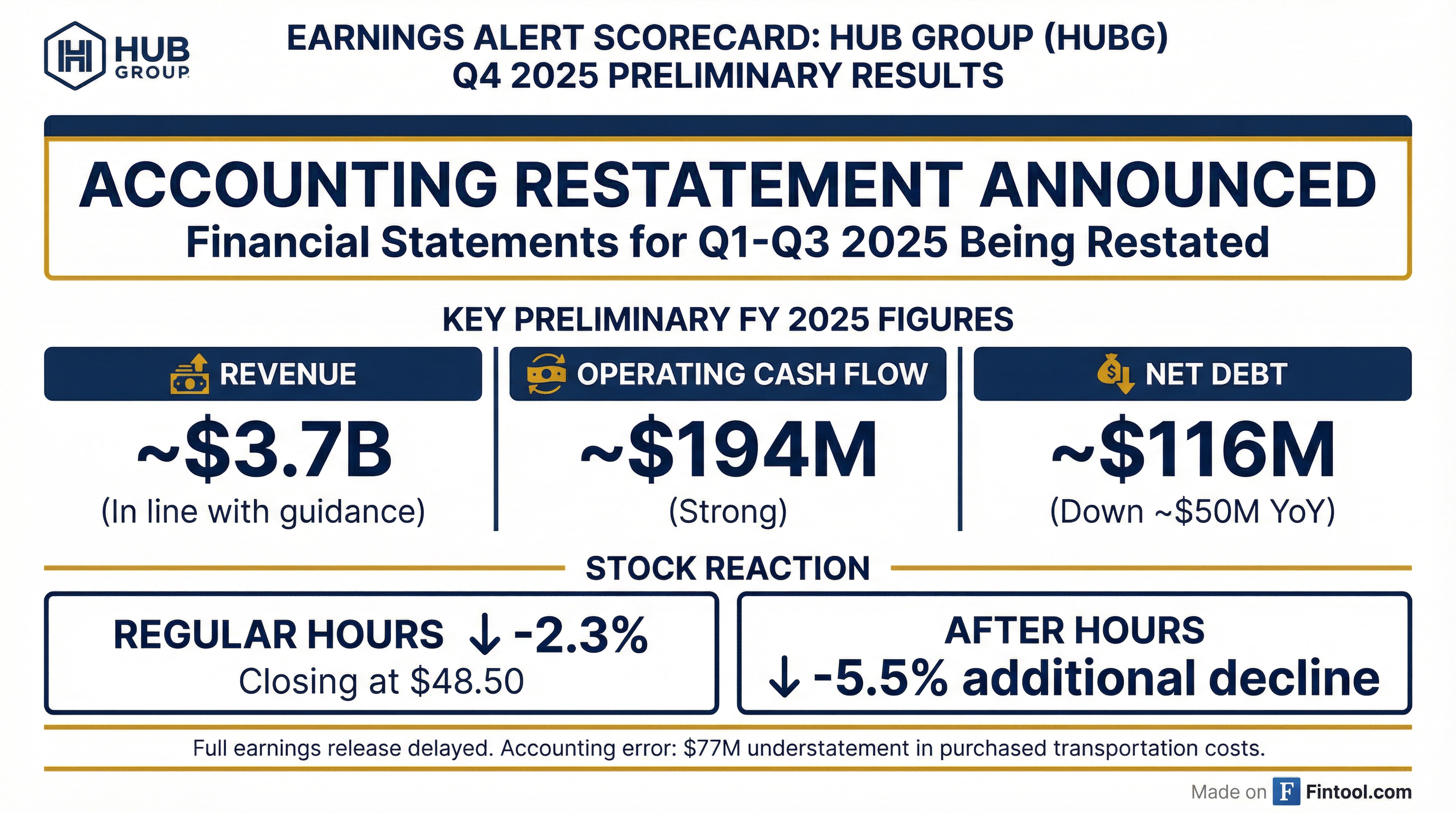

- This investigation follows Hub Group's February 5, 2026, announcement of an error in its financial statements for the first nine months of 2025, which understated purchased transportation costs and accounts payable.

- As a result, Hub Group plans to restatement its financial statements for the first, second, and third quarters of 2025.

- Following this news, Hub Group's stock price declined by $9.37 per share, or 18.3%, closing at $41.96 per share on February 6, 2026.

- Faruqi & Faruqi, LLP is investigating potential claims against Hub Group, Inc..

- The investigation follows Hub Group's disclosure on February 6, 2026, of a $77 million accounting error related to purchased transportation costs and accounts payable, which necessitates a restatement of prior financial results.

- This announcement led to a significant negative market reaction, with the company's stock falling by as much as 25% intraday.

- The company stated the error did not impact cash flow, but it coincided with the release of preliminary fourth-quarter and full-year 2025 results and a delay in filing updated financial statements.

- Hub Group, Inc. (HUBG) warned investors on February 5, 2026, not to rely on its quarterly reports for the periods ended March 31, June 30, and September 30, 2025, due to understated purchased transportation costs and accounts payable.

- The company expects to conclude that it did not maintain effective disclosure controls and internal control over financial reporting for the year ended December 31, 2025, and is assessing the potential impact on its consolidated financial statements for 2024 and 2023.

- Following this announcement, Hub Group's share price fell over 27% on February 6, 2026, resulting in a loss of over $800 million in market capitalization.

- Shareholder rights law firm Hagens Berman has opened an investigation into whether Hub Group may have intentionally misled investors regarding its financial statements and controls.

- Hub Group, Inc. (HUBG) has warned investors that its quarterly reports for March 31, June 30, and September 30, 2025, "should no longer be relied upon" due to understated purchased transportation costs and accounts payable.

- Following this announcement, Hub Group's share price fell over 27% on February 6, 2026, wiping out over $800 million of market capitalization.

- The company expects to conclude that it did not maintain effective disclosure controls and procedures and internal control over financial reporting for the year ended December 31, 2025, and is assessing the potential impact on financial statements for FY 2023 and 2024.

- Shareholder rights law firm Hagens Berman has opened an investigation into whether Hub Group may have intentionally misled investors.

- Freight Technologies, Inc. (Fr8Tech) successfully completed its first annual ISO 9001:2015 surveillance audit on December 23, 2025.

- The audit confirmed the company's Quality Management System for Logistics Services and Transportation of Goods in North America, covering both its Mexico and US entities.

- This achievement marks the second consecutive year Fr8App (Fr8Tech's platform) has maintained the internationally recognized ISO 9001:2015 certification.

- CEO Javier Selgas stated that this audit reinforces Fr8Tech's commitment to service excellence and innovation in the freight technology marketplace.

- On February 6, 2026, Hub Group disclosed a $77 million accounting error related to purchased transportation costs and accounts payable, prompting a restatement of prior financial results.

- This disclosure led to a significant negative market reaction, with the company's stock falling by as much as roughly 25% intraday.

- The announcement coincided with the release of preliminary fourth-quarter and full-year 2025 results and a delay in filing updated financial statements.

- Faruqi & Faruqi, LLP is investigating potential claims against Hub Group on behalf of investors who suffered significant losses.

- Hub Group disclosed an accounting error, specifically an understatement of purchased transportation costs and accounts payable for the first nine months of 2025.

- The company will restatement Q1-Q3 2025 results and is assessing potential impacts to 2024 and 2023, with one firm citing a $77 million error.

- Following this disclosure, Hub Group's shares dropped approximately 18%, closing at $41.96 on February 6, 2026.

- Several plaintiff law firms have initiated investigations into potential securities-law violations, and analysts have downgraded the stock and significantly cut price targets.

- Hub Group (HUBG) shares fell over 27% on February 6, 2026, after the company stated that its quarterly reports for the periods ended March 31, June 30, and September 30, 2025, "should no longer be relied upon".

- The company revealed it understated "purchased transportation costs and accounts payable in the first nine months of 2025".

- Hub Group expects to conclude that it did not maintain effective disclosure controls and procedures and internal control over financial reporting for the year ended December 31, 2025, and is assessing the potential impact on its financial statements for the years ended December 31, 2024 and 2023.

- Shareholder rights law firm Hagens Berman has opened an investigation into whether Hub Group intentionally misled investors.

- On February 6, 2026, Hub Group, Inc. (HUBG) shares fell over 27%, wiping out over $800 million of market capitalization, after the company warned that its quarterly reports going back to March 31, 2025, "should no longer be relied upon".

- Hub Group filed a report with the SEC stating it understated "purchased transportation costs and accounts payable in the first nine months of 2025".

- The specific quarterly reports affected include those for the periods ended March 31, June 30, and September 30, 2025.

- The company also expects to conclude that it did not maintain effective disclosure controls and procedures and internal control over financial reporting for the year ended December 31, 2025, and is assessing the potential impact on its consolidated financial statements for 2023 and 2024.

- Shareholder rights law firm Hagens Berman has opened an investigation into whether Hub Group may have intentionally misled investors.

- Rosen Law Firm is investigating Hub Group, Inc. (HUBG) for potential securities claims on behalf of shareholders.

- This investigation follows Hub Group's announcement on February 5, 2026, that it identified an error resulting in the understatement of purchased transportation costs and accounts payable in its financial statements for the first nine months of 2025.

- As a consequence, Hub Group plans to restate its financial statements for the first, second, and third quarters of 2025.

- Following this news, Hub Group's stock price fell $9.37 per share, or 18.3%, to close at $41.96 per share on February 6, 2026.

Fintool News

In-depth analysis and coverage of Hub Group.

Quarterly earnings call transcripts for Hub Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more