ImmunityBio Stock Surges 83% as Cancer Drug Anktiva Posts 700% Revenue Growth

January 16, 2026 · by Fintool Agent

Immunitybio shares exploded 83% over two trading sessions this week, hitting new 52-week highs after reporting 700% year-over-year revenue growth for its breakthrough cancer immunotherapy Anktiva—and securing the world's first approval for the drug in lung cancer.

The stock closed at $5.52 on Friday, up from $3.02 just 48 hours earlier, on massive volume of 176 million shares—roughly 19 times the average daily trading volume. The rally propelled ImmunityBio's market cap to approximately $5.4 billion, nearly tripling from its May 2025 lows.

The Revenue Explosion

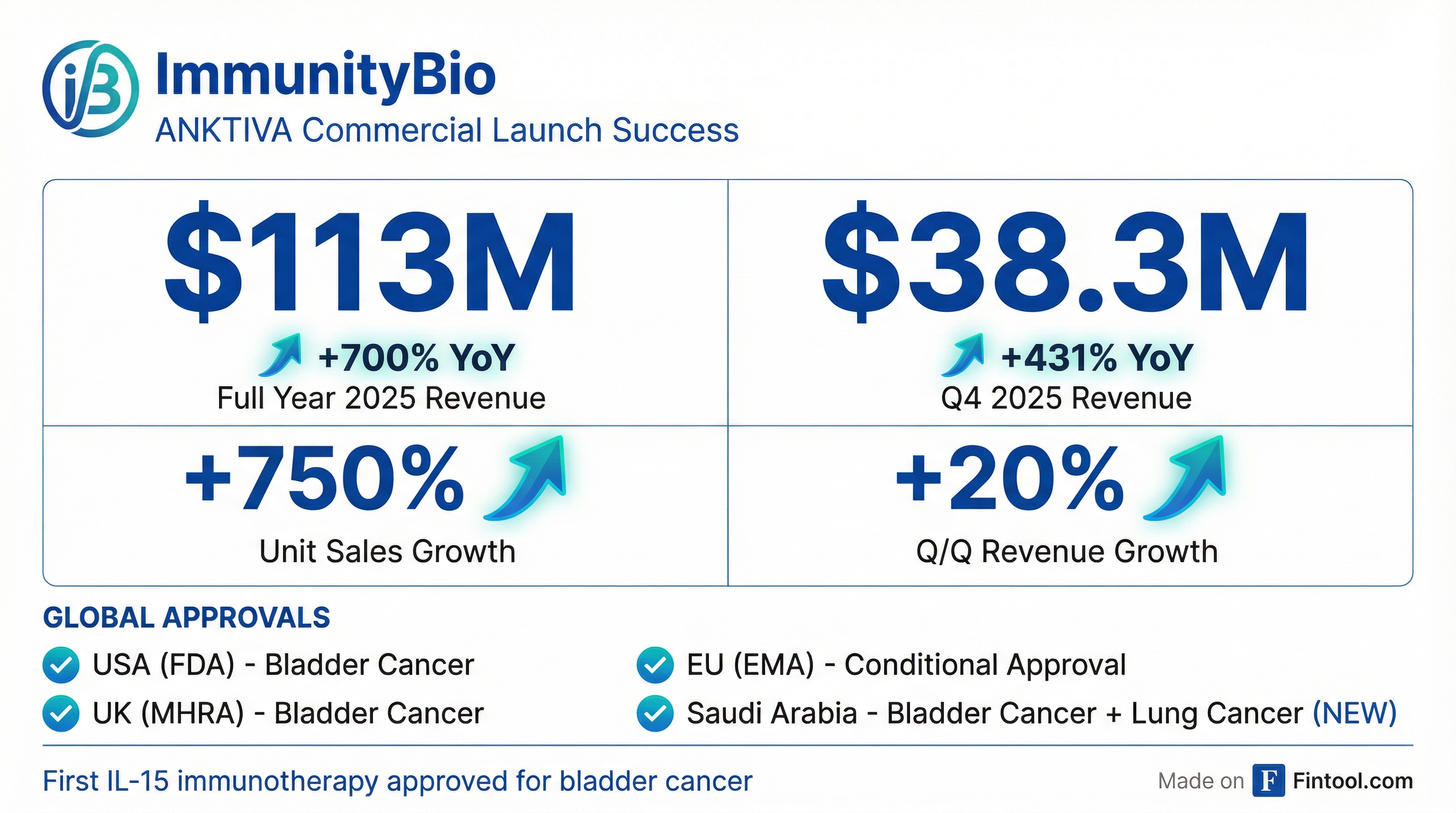

ImmunityBio's preliminary full-year 2025 net product revenue hit approximately $113 million, a staggering 700% increase from 2024. The acceleration continued through Q4, with $38.3 million in revenue representing a 431% year-over-year jump and 20% sequential growth from Q3's $31.8 million.

Unit sales tell an even more dramatic story: Anktiva volume surged 750% in 2025 compared to the prior year, with the company maintaining a 54% quarter-over-quarter unit growth rate throughout fiscal 2025.

"We delivered strong quarter-over-quarter revenue growth, reflecting accelerating adoption of ANKTIVA and the continued execution of our commercial strategy," said Richard Adcock, President and CEO of ImmunityBio.

First Global Approval for Lung Cancer

The catalyst cascade began January 14 when the Saudi Food and Drug Authority granted accelerated approval of Anktiva in combination with immune checkpoint inhibitors for metastatic non-small cell lung cancer (NSCLC)—the first approval anywhere in the world for this indication.

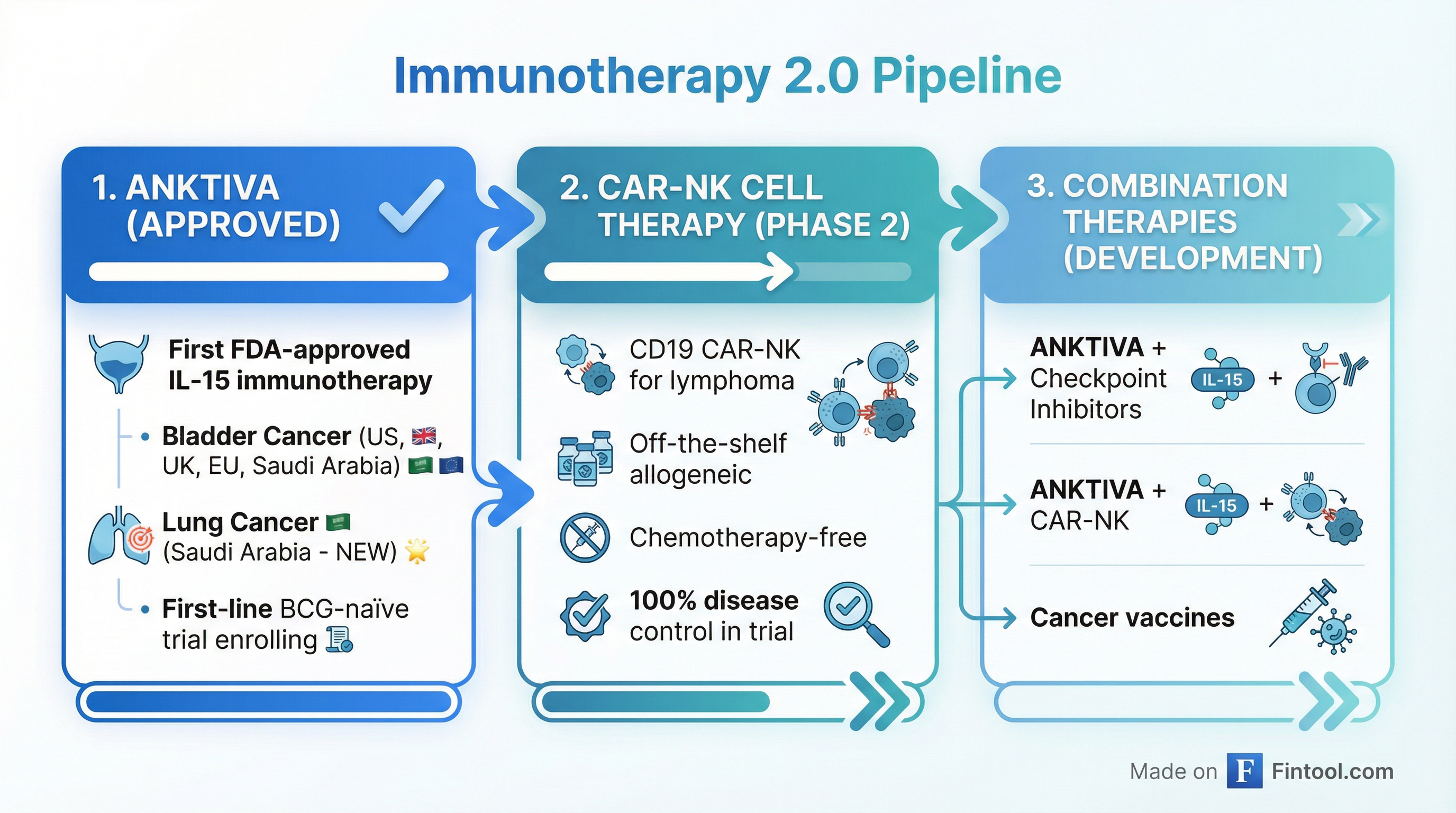

This marks two critical firsts: the first global approval of an IL-15 receptor superagonist in combination with checkpoint therapy, and the first approval of Anktiva for subcutaneous administration.

"This combination of ANKTIVA plus a checkpoint inhibitor serves as a foundational backbone to immunotherapy 2.0, enabling activation of the complex immune system through subcutaneous outpatient therapy," said founder Patrick Soon-Shiong, M.D.

The approval was based on clinical data from two trials—QUILT-3.055 and QUILT-2.023—involving 151 patients that demonstrated statistically significant immune restoration and improved survival outcomes. In second-line and later NSCLC patients, those who achieved restored lymphocyte counts experienced median overall survival of 16.2 months versus 11.8 months for non-responders—a 48% reduction in mortality risk.

Patients achieving higher immune competence saw even better outcomes: median overall survival of 21.1 months, well above the 7-9 months typically seen with standard chemotherapy.

Expanding the Addressable Market

The Saudi approval significantly expands Anktiva's commercial footprint beyond bladder cancer, where it already holds approvals in the U.S., U.K., and conditional approval in the European Union. Lung cancer represents a far larger market opportunity—it's the third most common cancer among males over 45 in Saudi Arabia alone.

ImmunityBio is moving quickly to capitalize on the opportunity, announcing plans to open a regional office in Saudi Arabia and partnering with Biopharma Cigalah for commercial distribution across the Middle East and North Africa.

The combination of Anktiva plus checkpoint inhibitor therapy is protected by multiple patents extending into 2032-2039, providing substantial runway for market exclusivity.

Pipeline Momentum: CAR-NK Shows 100% Disease Control

Adding fuel to the rally, ImmunityBio today released updated data from its QUILT-106 trial showing 100% disease control with its off-the-shelf CD19 CAR-NK cell therapy in Waldenstrom Non-Hodgkin lymphoma patients.

Two patients with extensive disease at baseline—one with multiple bone lesions and another with approximately 95% bone marrow infiltration—achieved complete responses that have now been sustained for 7 and 15 months respectively, with no additional treatment required after the initial eight doses.

What makes this particularly notable: the therapy is chemotherapy-free and lymphodepletion-free, administered entirely in an outpatient setting. This addresses major limitations of conventional CAR-T therapies, which typically require toxic conditioning regimens and hospitalization.

"Seeing complete responses persist beyond a year after treatment has stopped, in patients who had exhausted available options, represents a meaningful advance," said Dr. Soon-Shiong.

First-Line Bladder Cancer Trial Ahead of Schedule

The company's next major catalyst is the Phase 2b QUILT-2.005 trial evaluating Anktiva plus intravesical BCG in first-line, BCG-naïve non-muscle invasive bladder cancer—a significantly larger patient population than the BCG-unresponsive indication where Anktiva is currently approved.

Enrollment is progressing ahead of internal expectations, with full enrollment anticipated in the first half of 2026. Success here could dramatically expand Anktiva's commercial opportunity in bladder cancer.

Financial Position and Outlook

ImmunityBio ended Q4 2025 with an estimated $242.8 million in cash, cash equivalents, and marketable securities. While the company remains in investment mode, the trajectory toward commercial profitability has accelerated meaningfully—2025 revenue of $113 million is roughly equivalent to the entire 2024 revenue run rate achieved in a single quarter.

| Metric | Q3 2025 | Q4 2025 | Change |

|---|---|---|---|

| Net Product Revenue | $31.8M | $38.3M | +20% Q/Q |

| YoY Revenue Growth | +467% | +431% | — |

| Unit Volume Growth | +467% | +750% FY | — |

What to Watch

The investment thesis has evolved rapidly from speculative to execution-focused:

Near-Term Catalysts:

- First-line BCG-naïve NMIBC trial enrollment completion (H1 2026)

- Additional international regulatory approvals for lung cancer

- Commercial ramp in Middle East/North Africa markets

- Updated CAR-NK data as response durability matures

Key Risks:

- Competition from established checkpoint inhibitors in lung cancer

- Reimbursement challenges in international markets

- Execution risk on commercial scaling

- Preliminary financials subject to final adjustments

The stock has nearly tripled from its May 2025 lows, but bulls argue the revenue trajectory—and expanding pipeline—justify higher valuations. With full-year 2025 revenue at $113 million and momentum accelerating, ImmunityBio's transformation from clinical-stage to commercial-stage biotech appears to be taking hold.

Related: Immunitybio Company Profile